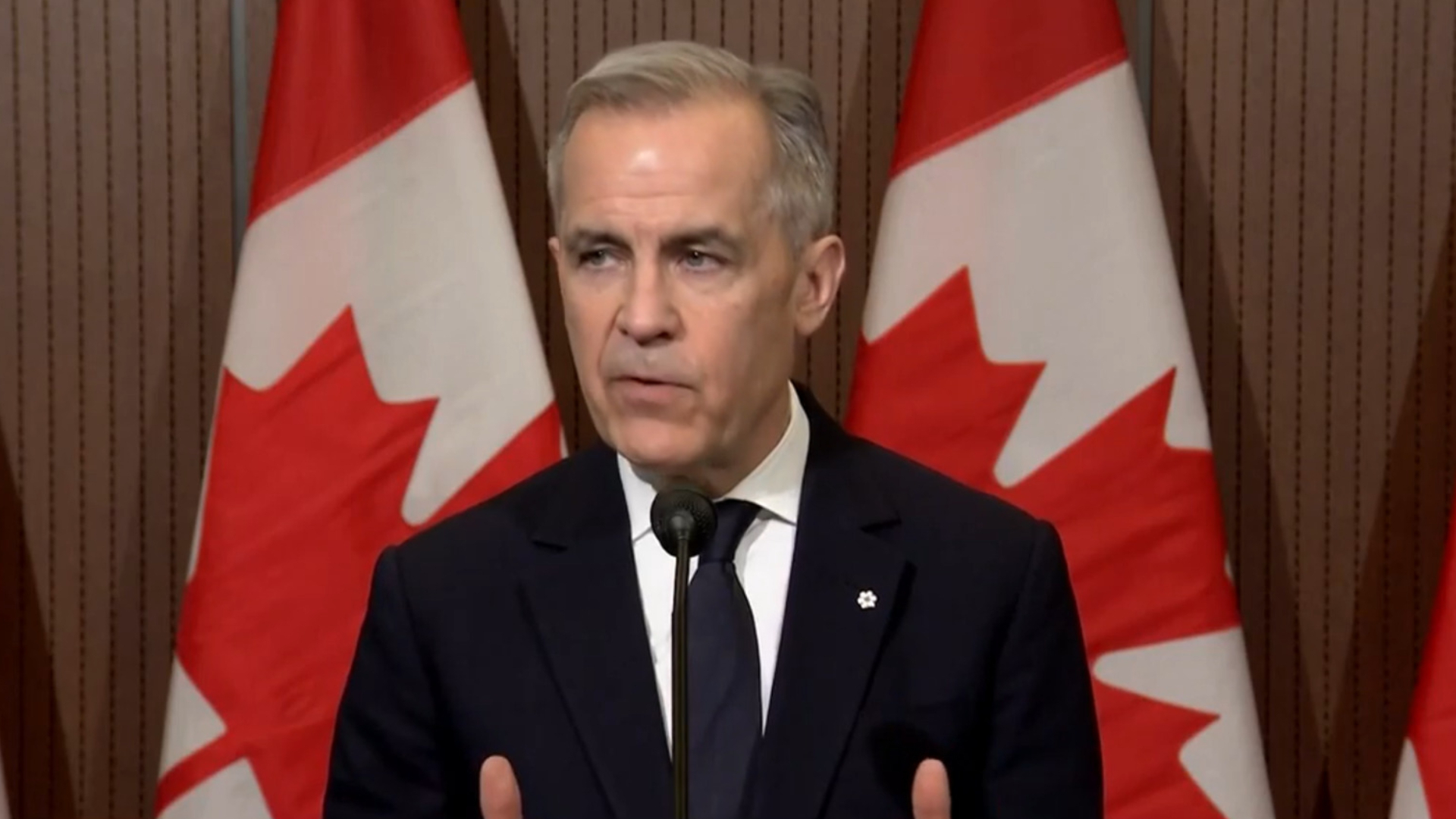

Retail Sector Strength Challenges Case For Another Bank Of Canada Rate Cut

Table of Contents

Strong Retail Sales Figures Defy Expectations

Recent data on Canadian retail sales has defied expectations, showing unexpected growth in [insert recent period, e.g., Q3 2023]. This surge in Canadian retail sales suggests robust consumer spending, despite rising interest rates and concerns about a potential economic downturn. Several factors contribute to this strength:

- Pent-up demand: After years of pandemic restrictions, consumers are still spending accumulated savings.

- Government support programs: While phased out, lingering effects of previous government support measures continue to impact spending.

- Resilient labor market (to be expanded in section 2.3): A strong labor market, with relatively low unemployment, allows many Canadians to maintain their spending power.

This robust consumer spending, reflected in strong economic indicators, paints a picture at odds with the narrative of a weakening economy, making the case for a Bank of Canada rate cut more complex. Specific examples, such as a [percentage]% increase in sales of [specific retail sector, e.g., durable goods] in [month/quarter], further bolster this argument.

Inflationary Pressures Remain Persistent

Despite the positive news from the retail sector, inflation rate Canada remains stubbornly high. The current inflation rate stands at [insert current inflation rate]%, significantly above the Bank of Canada's target of [insert Bank of Canada inflation target]%. This persistent inflationary pressure significantly complicates the decision-making process for the Bank of Canada. Their primary mandate is to control inflation, and a Bank of Canada rate cut risks exacerbating this issue.

- The persistence of inflation necessitates a cautious approach to monetary policy.

- High inflation erodes purchasing power and could potentially dampen consumer spending in the long run, offsetting the positive impacts of strong retail sales.

- The Bank of Canada inflation target remains a crucial benchmark, guiding their policy decisions.

The Labor Market: A Mixed Signal

The Canadian labor market strength presents a mixed signal. While unemployment remains relatively low at [insert current unemployment rate]%, wage growth has not kept pace with inflation in many sectors. This means that although many Canadians are employed, their real income is declining, potentially impacting future consumer spending.

- High employment levels suggest economic robustness, which could support continued strong retail sales.

- However, stagnant real wages could lead to a decline in consumer confidence and spending in the future.

- The balance between a strong Canadian unemployment rate and lagging wage growth needs careful consideration by the Bank of Canada.

Arguments Against a Further Rate Cut

Given the unexpected strength of the retail sector and persistent inflationary pressures, the case against another interest rate cuts is strong. Further reductions could:

- Fuel inflation: Lower interest rates could stimulate further spending, potentially worsening inflationary pressures.

- Lead to an inflationary spiral: A rapid increase in prices could trigger a cycle of wage increases and further price hikes.

- Devalue the Canadian dollar: Lower interest rates can make the Canadian dollar less attractive to foreign investors, weakening its value.

Alternative policy options, such as targeted fiscal measures to address specific inflationary pressures, might be more appropriate than a blanket Bank of Canada rate cut.

Arguments For a Further Rate Cut (Counterarguments)

Despite the compelling arguments against a rate cut, several counterarguments exist. The current economic strength might mask underlying vulnerabilities:

- Global economic uncertainty: A global recession could severely impact the Canadian economy, necessitating a rate cut to stimulate growth.

- Potential retail sector slowdown: The current strength in retail sales might be unsustainable, with a potential slowdown looming.

- Housing market correction: A significant correction in the housing market could negatively impact consumer confidence and spending.

These economic recession risks necessitate careful consideration of the global economic outlook and proactive risk management by the Bank of Canada.

Conclusion: The Retail Sector's Influence on Bank of Canada Rate Decisions

The resilience of the Canadian retail sector, despite broader economic headwinds, presents a complex challenge for the Bank of Canada. While strong retail sales suggest economic strength, persistent inflationary pressures argue against further Bank of Canada rate cuts. The conflicting signals necessitate a nuanced approach, carefully weighing the risks and benefits of any monetary policy decision. The Bank of Canada must consider the potential for a future slowdown and the impact of global economic uncertainty. To stay informed, follow future developments in Canadian retail sales, inflation data, and the Bank of Canada's announcements regarding future Bank of Canada rate cuts or increases. Consult the Bank of Canada website and reputable economic news sources for updates on key economic indicators.

Featured Posts

-

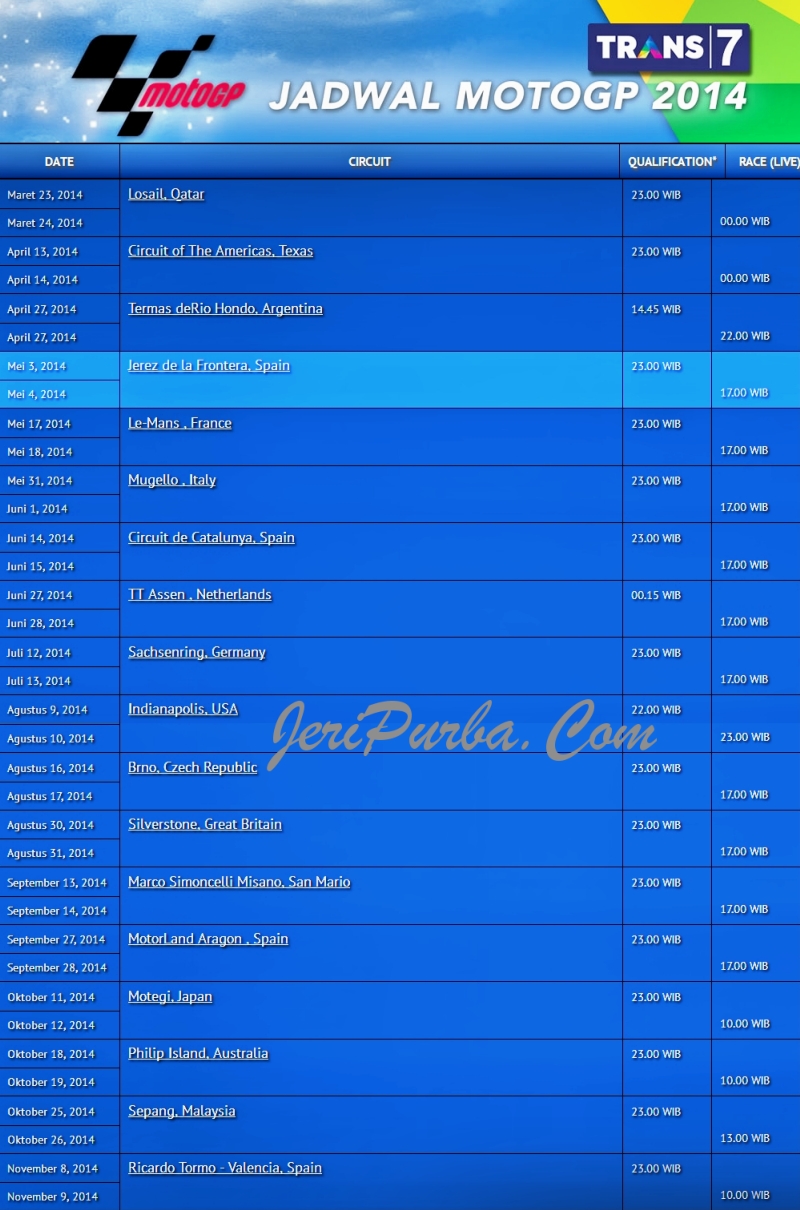

Moto Gp Argentina 2025 Di Trans7 Jadwal Tayang Lengkap And Panduan Nonton

May 26, 2025

Moto Gp Argentina 2025 Di Trans7 Jadwal Tayang Lengkap And Panduan Nonton

May 26, 2025 -

Louisiana Inmates Ingenious Escape Attempt The Hair Trimmer Strategy

May 26, 2025

Louisiana Inmates Ingenious Escape Attempt The Hair Trimmer Strategy

May 26, 2025 -

Unnoticed Escape 10 New Orleans Inmates Jailbreak Explained

May 26, 2025

Unnoticed Escape 10 New Orleans Inmates Jailbreak Explained

May 26, 2025 -

The Queen Wen Paris Show Highlights And Impressions

May 26, 2025

The Queen Wen Paris Show Highlights And Impressions

May 26, 2025 -

Florentino Perez Y El Futuro Del Real Madrid

May 26, 2025

Florentino Perez Y El Futuro Del Real Madrid

May 26, 2025