Revised Palantir Predictions: Analyzing The Factors Behind The Stock Rally

Table of Contents

Improved Financial Performance and Revenue Growth

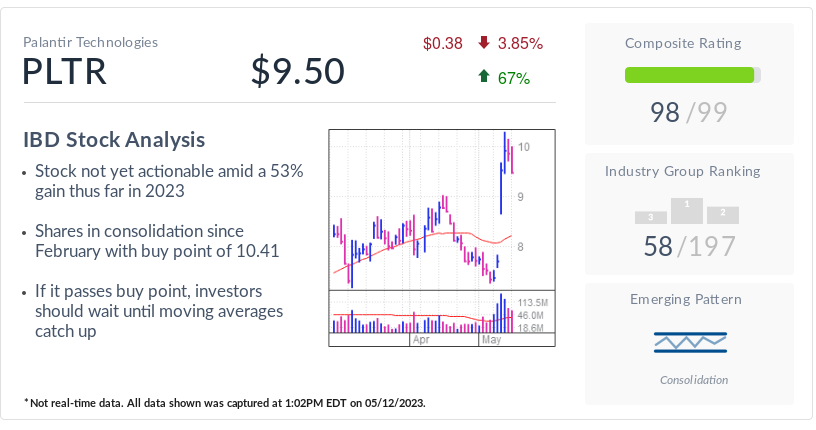

Palantir's recent financial performance has been a significant catalyst for its stock rally. The company has demonstrated substantial improvements in revenue, profitability, and customer acquisition, significantly exceeding some initial expectations. This positive trajectory offers a compelling narrative for investors.

-

Stronger-than-expected Q3 2023 earnings: Palantir's latest quarterly earnings report showcased impressive revenue growth and improved margins, exceeding analyst expectations and boosting investor confidence. Detailed financial data and specific figures from the report should be included here (replace bracketed information with actual data). [Insert chart/graph showing revenue growth].

-

Increased government contracts and expansion into commercial sectors: Palantir's success isn't solely reliant on government contracts. The company has successfully expanded its commercial footprint, securing significant deals across various industries, demonstrating the versatility of its platform. This diversification reduces reliance on a single revenue stream.

-

Successful implementation of cost-cutting measures: Improved operational efficiency through cost-cutting initiatives has contributed to enhanced profitability and strengthened Palantir's bottom line. This demonstrates a commitment to long-term sustainability.

-

Data illustrating revenue growth and improved margins: [Insert chart/graph showing margin improvement]. Key performance indicators (KPIs) such as revenue growth rate, operating margin, and customer acquisition cost should be analyzed to demonstrate the strength of Palantir's financial health and its positive impact on the stock price.

The significance of these improvements cannot be overstated. They demonstrate a clear path towards long-term sustainability and are key factors in bolstering investor confidence in Palantir's future. These positive financial trends directly contribute to a more optimistic outlook regarding Palantir's stock predictions.

Government Contracts and Geopolitical Factors

The geopolitical landscape plays a significant role in Palantir's success. Increased government spending on defense and intelligence, particularly fueled by global instability, has created a substantial demand for Palantir's advanced data analytics and AI capabilities.

-

Increased demand for Palantir's data analytics and AI capabilities: Various government agencies worldwide are increasingly relying on Palantir's platform for crucial intelligence gathering, cybersecurity, and operational efficiency.

-

Impact of global events (e.g., the war in Ukraine): The ongoing conflict in Ukraine, along with other geopolitical tensions, has highlighted the critical need for sophisticated data analytics and intelligence platforms, significantly boosting demand for Palantir's services. This increased demand translates into higher revenue and strengthens the company's position in the market.

-

Analysis of the long-term potential of government contracts: Government contracts provide a stable, long-term revenue stream for Palantir, mitigating some of the risks associated with relying heavily on commercial contracts. The long-term implications of these contracts are substantial and contribute to positive revised Palantir predictions.

-

Mention specific contracts or partnerships (if publicly available): [Insert details of any publicly available significant government contracts or partnerships].

The sustained demand from government agencies, coupled with the increasing importance of data analytics in national security and defense, positions Palantir for continued growth in this sector. This contributes significantly to a positive outlook for Palantir stock.

Expansion into the Commercial Sector and New Product Launches

While government contracts form a substantial part of Palantir's business, its expansion into the commercial sector is equally crucial for its long-term growth. Palantir's Foundry platform has gained traction across various industries.

-

Successful adoption of Palantir's Foundry platform: [Insert examples of successful commercial implementations across different industries].

-

New product launches and features that cater to commercial needs: Palantir's continuous innovation and development of new features tailored to the specific needs of commercial clients demonstrate its commitment to staying ahead of the curve.

-

Case studies showcasing successful commercial implementations: Highlighting successful case studies showcasing the positive impact of Palantir's solutions on commercial clients builds confidence in its ability to generate significant revenue beyond the government sector.

-

Discuss the potential for disruptive innovation within the commercial sector: Palantir has the potential to revolutionize several commercial sectors by providing them with advanced data analysis capabilities. This potential contributes to the positive revised Palantir predictions.

The successful penetration into the commercial market diversifies Palantir's revenue streams, creating a more robust and resilient business model, and contributing greatly to a more positive view on future stock performance.

Addressing Concerns: Valuation and Competition

While the recent stock rally is encouraging, concerns regarding Palantir's valuation and the competitive landscape in the data analytics market persist.

-

Analysis of Palantir's valuation compared to competitors: [Compare Palantir's valuation metrics (P/E ratio, etc.) to competitors like Databricks, Snowflake, etc.].

-

Discussion of competitive threats and Palantir's strategies to maintain a competitive edge: Palantir's strategies for innovation, strategic partnerships, and unique platform capabilities are crucial for maintaining a competitive edge in this rapidly evolving market. Specific examples of these strategies should be provided.

-

Mention specific competitors and their strengths and weaknesses: [Discuss specific competitors and their relative strengths and weaknesses compared to Palantir].

Addressing these concerns openly and transparently is essential for maintaining investor confidence. However, Palantir's demonstrated progress in revenue growth, operational efficiency, and market expansion suggests that these concerns may be gradually mitigating.

Conclusion

The recent Palantir stock rally is driven by a confluence of factors: significantly improved financial performance, increased government contracts fueled by geopolitical events, successful expansion into the commercial sector, and demonstrable progress in addressing previous investor concerns. These positive developments suggest a more optimistic outlook than some initial predictions indicated.

Revised Predictions: While inherent risks remain in the market, the data suggests a positive outlook for Palantir's short-to-medium-term performance. [Insert potential price targets or ranges, justifying the prediction with specific data and analysis. Clearly state any assumptions made]. This projection is based on the continued strong performance in key areas, including government contracts and commercial expansion.

Call to Action: Stay updated on Revised Palantir Predictions by following financial news and company reports. Deepen your understanding of Palantir's Stock Performance through independent research and analysis. Explore the potential of investing in Palantir's Future, but remember to conduct thorough due diligence before making any investment decisions. The information provided here is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025 -

Technical Training Program Empowers Transgender Individuals In Punjab

May 10, 2025

Technical Training Program Empowers Transgender Individuals In Punjab

May 10, 2025 -

Justice Roberts On Mistaken Identity A Cnn Politics Interview

May 10, 2025

Justice Roberts On Mistaken Identity A Cnn Politics Interview

May 10, 2025 -

Ras Barakas Arrest A Closer Look At The Ice Detention Center Protest

May 10, 2025

Ras Barakas Arrest A Closer Look At The Ice Detention Center Protest

May 10, 2025 -

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025