Revised Palantir Predictions: Analyzing The Market Rally

Table of Contents

Palantir Technologies (PLTR) has recently experienced a significant market rally, surprising many who held more bearish views on its stock performance. This unexpected surge necessitates a reevaluation of previous Palantir predictions and a deeper analysis of the factors driving this positive momentum. This article revisits past forecasts, examines key performance indicators, assesses market sentiment, and explores emerging trends to offer a revised outlook on Palantir's trajectory and future stock price movements. We will dissect the contributing elements behind this rally and provide an informed perspective on potential future performance for the PLTR stock.

Re-evaluating Previous Palantir Predictions

Past predictions regarding Palantir's stock performance have been varied, ranging from extremely bullish to quite pessimistic. Some analysts, focusing on Palantir's innovative data analytics platform and growing government contracts, predicted substantial price increases, setting ambitious price targets. For example, some early predictions envisioned PLTR reaching $50 or even $100 per share within a few years, based on projected revenue growth and market capitalization compared to similar tech companies. Conversely, other analysts expressed skepticism, citing concerns about profitability, competition in the data analytics sector, and the inherent risks associated with reliance on government contracts. These bearish forecasts often predicted much lower price targets, or even further declines from already depressed levels.

- Specific Price Targets & Reasoning: Previous predictions varied widely, reflecting differing methodologies and assumptions regarding revenue growth rates, operating margins, and market penetration.

- Analysts' Differing Opinions: The divergence in opinions highlighted the inherent uncertainty in predicting stock prices, with analysts employing different valuation models and weighting various factors differently.

- Accuracy of Past Predictions: Many earlier predictions proved inaccurate, largely due to unforeseen market fluctuations, unexpected shifts in government spending, and the challenges associated with scaling a complex technology business.

The inaccuracy of previous predictions can be attributed to several factors: underestimation of Palantir's ability to secure new contracts, an overly cautious assessment of its AI capabilities, and perhaps a failure to fully appreciate the long-term growth potential in the data analytics and government services markets. These early analyses failed to adequately factor in the accelerating adoption of AI and cloud computing, which are proving to be major growth drivers for Palantir. We now turn to the current market situation to understand the recent rally.

Factors Contributing to the Recent Palantir Market Rally

Several factors have converged to fuel Palantir's recent market rally, transforming the outlook for PLTR stock.

Strong Q[Quarter] Earnings and Revenue Growth

Palantir's recent financial performance has been significantly stronger than many analysts predicted. The company reported robust revenue growth exceeding expectations, driven by increased demand for its data analytics and AI-powered solutions.

- Key Financial Metrics: The reported figures showed impressive growth in revenue, improved net income, and positive earnings per share (EPS), indicating progress toward sustained profitability.

- Profitability Improvements: The company has demonstrated improvements in operating margins, signifying a greater efficiency in delivering its products and services.

- Revenue Stream Diversification: While government contracts remain a significant revenue source, growth in the commercial sector highlights Palantir's increasing success in attracting private clients.

Increased Government Contracts and Strategic Partnerships

Palantir's success in securing significant new and expanded government contracts has played a pivotal role in the recent market rally. These contracts represent long-term revenue streams and demonstrate confidence in Palantir's technology from key governmental agencies.

- Implications for Future Revenue: The long-term nature of these contracts offers substantial revenue visibility and predictability, strengthening investor confidence.

- Strategic Partnerships: Strategic alliances with other technology firms have expanded Palantir's market reach and enhanced its ability to deliver comprehensive data analytics solutions.

- Geographical Distribution: A diversified portfolio of contracts, both domestically and internationally, reduces reliance on any single market, mitigating geographical risk.

Growing Adoption of AI and Data Analytics Solutions

Palantir is effectively capitalizing on the burgeoning demand for AI and data analytics solutions. The company's platform is well-positioned to help organizations manage, analyze and interpret large and complex datasets for improved decision making and operational efficiencies.

- AI-Powered Products/Services: Palantir offers a suite of advanced AI-powered tools for various sectors, including finance, healthcare, and defense.

- Market Demand: The increasing demand for advanced data analytics and AI solutions across various industries is fueling significant growth opportunities for Palantir.

- Competitive Advantages: Palantir's unique platform provides a competitive edge, offering unparalleled capabilities in data integration, analysis and visualization.

Improved Market Sentiment and Investor Confidence

A significant shift in market sentiment and investor confidence has contributed to Palantir's stock price increase. Positive news, strong earnings, and renewed belief in the company's long-term growth potential have all played a role.

- Analyst Ratings and Price Targets: Several analysts have upgraded their ratings and price targets for Palantir, reflecting a more positive outlook.

- Impact of News & Events: Positive press coverage, successful product launches, and strategic partnerships have boosted investor confidence.

- Overall Market Conditions: Favorable macroeconomic conditions and a renewed interest in technology stocks have provided a supportive environment for Palantir's stock price.

Revised Palantir Predictions and Future Outlook

Based on the analysis of the contributing factors above, we offer a revised, cautiously optimistic outlook for Palantir's stock price. While significant uncertainties remain, the recent performance suggests a stronger trajectory than previously anticipated.

- Potential Price Targets: While predicting exact figures remains inherently risky, the potential for further growth in the short-term and long-term appears significant. A range of potential price targets should be considered, reflecting various scenarios and risk tolerances.

- Potential Risks & Uncertainties: The technology sector is dynamic; competition, economic downturns, and shifts in government policy pose potential challenges.

- Reasoning Behind Revised Predictions: The combination of improved financials, strategic partnerships, and the increasing adoption of its AI-driven solutions suggests a sustained period of growth.

Disclaimer: Investing in the stock market involves inherent risk. The information provided here is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Conclusion

The recent Palantir market rally can be attributed to a confluence of factors: stronger-than-expected financial performance, increased government contracts, the rising adoption of its AI-powered solutions, and improved market sentiment. This positive momentum suggests a more optimistic outlook for Palantir than previous predictions had indicated. However, investors should remain mindful of potential risks and uncertainties inherent in the stock market. Understanding the dynamics behind Palantir predictions is crucial for informed investment strategies concerning Palantir stock and the broader technology sector. Stay informed on the latest developments in the Palantir stock market by regularly checking reputable financial news sources and conducting your own in-depth analysis. Making informed decisions about Palantir stock requires diligent research and careful consideration of various factors influencing its price.

Featured Posts

-

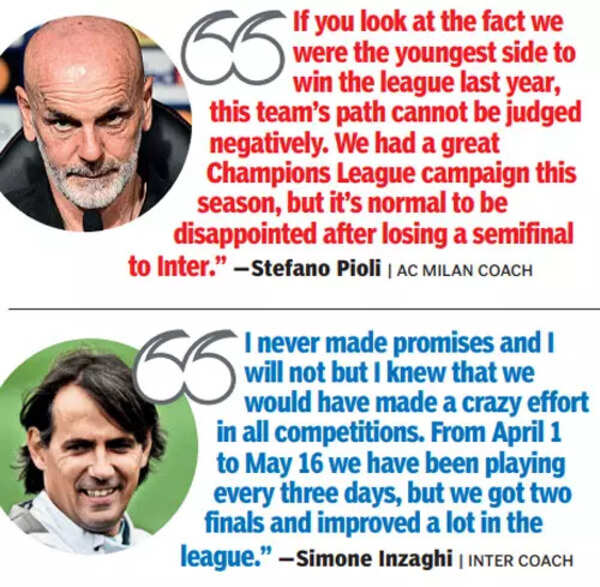

Inter Milans Tactical Masterclass Secures Champions League Advantage

May 09, 2025

Inter Milans Tactical Masterclass Secures Champions League Advantage

May 09, 2025 -

Nova Kniga Stivena Kinga Ta Yogo Pozitsiya Schodo Trampa Ta Maska

May 09, 2025

Nova Kniga Stivena Kinga Ta Yogo Pozitsiya Schodo Trampa Ta Maska

May 09, 2025 -

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 09, 2025

Golden Knights Clinch Playoff Spot Despite Oilers 3 2 Victory

May 09, 2025 -

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025 -

Doohans F1 Future Palmers Insights Following Alpines Reserve Driver Choice

May 09, 2025

Doohans F1 Future Palmers Insights Following Alpines Reserve Driver Choice

May 09, 2025