Revised Trump Tax Bill Clears The House

Table of Contents

Key Provisions of the Revised Trump Tax Bill

The revised Trump Tax Bill introduces several key changes to the existing tax system. Understanding these provisions is critical to assessing their impact on your personal finances and business operations. Keywords relevant to this section include: Tax Brackets, Standard Deduction, Corporate Tax Rate, Individual Tax Rates, Tax Credits.

-

Changes to Individual Income Tax Brackets and Rates: The bill proposes adjustments to individual income tax brackets and the corresponding rates. For example, the highest tax bracket might be lowered, while lower brackets may see minor adjustments. This could lead to substantial tax savings for high-income earners, while the impact on lower and middle-income individuals may vary. Specific examples will be crucial once the final version of the bill is released, allowing for precise calculations of the impact across various income levels.

-

Modifications to the Standard Deduction: The bill increases the standard deduction for both single filers and married couples filing jointly. This change aims to simplify tax preparation for many Americans and potentially reduce their tax liability. The increased standard deduction amount will impact the number of individuals who itemize their deductions, potentially leading to a less complex tax filing process for a significant portion of the population.

-

Revised Corporate Tax Rate: A key feature of the revised Trump Tax Bill is a reduction in the corporate tax rate. Lowering this rate is intended to stimulate business investment, encourage economic growth, and potentially lead to job creation. The projected effects on business investment and subsequent economic growth will be closely monitored. Analysis of the potential for increased competitiveness of American businesses in the global marketplace will also be crucial.

-

Changes to Tax Credits and Deductions: The bill may include modifications or eliminations of certain tax credits and deductions. Some existing tax breaks could be phased out, while others might be modified. A careful examination of these changes will be necessary to determine the "winners" and "losers" under the new tax regime. This analysis requires a detailed review of the specific changes and their impact on different demographic groups and industries.

-

Economic Growth Incentives: The legislation might incorporate provisions designed to spur economic growth. These could include incentives for business investment, research and development, or job creation. These provisions are designed to stimulate specific sectors of the economy and encourage domestic production and competitiveness.

Political Ramifications and Future of the Bill

The passage of the revised Trump Tax Bill through the House is just one step in a complex legislative process. Its future trajectory depends heavily on its reception in the Senate and ultimately, the President's signature. Keywords relevant to this section include: Senate Approval, Presidential Signature, Congressional Debate, Political Opposition, Bipartisan Support.

-

Senate Approval: The bill faces significant hurdles in the Senate, where it requires a majority vote for passage. Potential amendments and negotiations will likely occur, potentially altering the final form of the legislation. The level of bipartisan support in the Senate will be a critical factor in determining its fate.

-

Presidential Signature: Even with Senate approval, the President's signature is necessary to make the bill law. While the President has expressed strong support for the tax reform efforts, the final version of the bill could influence his decision.

-

Congressional Debate and Political Opposition: The bill's passage through the House was not without its challenges, and the Senate is expected to see similar levels of debate and opposition. Analysis of the major arguments for and against the bill, from both Republican and Democratic perspectives, is essential to understanding the political landscape.

-

Long-Term Economic and Social Consequences: Economists and social scientists will closely analyze the potential long-term economic and social consequences of the tax legislation. These consequences could include effects on income inequality, the national debt, and the overall health of the American economy.

Impact on Different Income Groups and Industries

The revised Trump Tax Bill’s impact will vary significantly across different income groups and industries. This section aims to analyze these diverse effects. Keywords relevant to this section include: Middle Class, High-Income Earners, Low-Income Families, Small Businesses, Large Corporations.

-

Impact on Income Levels: The bill’s impact on different income levels requires a careful assessment. While some argue it will disproportionately benefit high-income earners, others contend it will provide relief to the middle class through increased standard deductions. The distribution of tax benefits and burdens across different income strata is a crucial area of analysis.

-

Impact on Industries: The effects on specific industries, such as manufacturing, technology, or healthcare, will vary based on the bill's provisions. Some industries may experience a boost in investment and growth, while others may face challenges due to the changed tax landscape. Detailed analysis is needed to assess the impact on each sector.

-

Small Businesses vs. Large Corporations: The tax bill’s impact on small businesses will differ from its effects on large corporations. Small businesses may benefit from simplified tax codes and deductions, while large corporations might see the biggest impact from changes in the corporate tax rate. This disparity is a critical factor to consider in assessing overall fairness and effectiveness.

-

Investment and Unintended Consequences: The bill's provisions aimed at stimulating investment in certain sectors should be examined for their effectiveness. Additionally, potential unintended consequences, loopholes, or unforeseen effects on the economy need careful consideration.

Conclusion

The revised Trump Tax Bill's passage through the House represents a significant shift in American tax policy. Its key provisions, encompassing changes to individual and corporate tax rates and deductions, will exert profound effects on the American economy and its citizens. Understanding the nuances of this legislation is critical for both individuals and businesses.

Call to Action: Stay informed about the progress of the Trump Tax Bill as it progresses through the Senate and beyond. Continue to follow our updates for the latest developments and in-depth analysis on how this revised legislation will impact your finances. Learn more about how the Trump Tax Bill changes may affect you by [link to further resources or detailed analysis].

Featured Posts

-

The Karate Kids Continued Story A Deep Dive Into Cobra Kais Continuity

May 23, 2025

The Karate Kids Continued Story A Deep Dive Into Cobra Kais Continuity

May 23, 2025 -

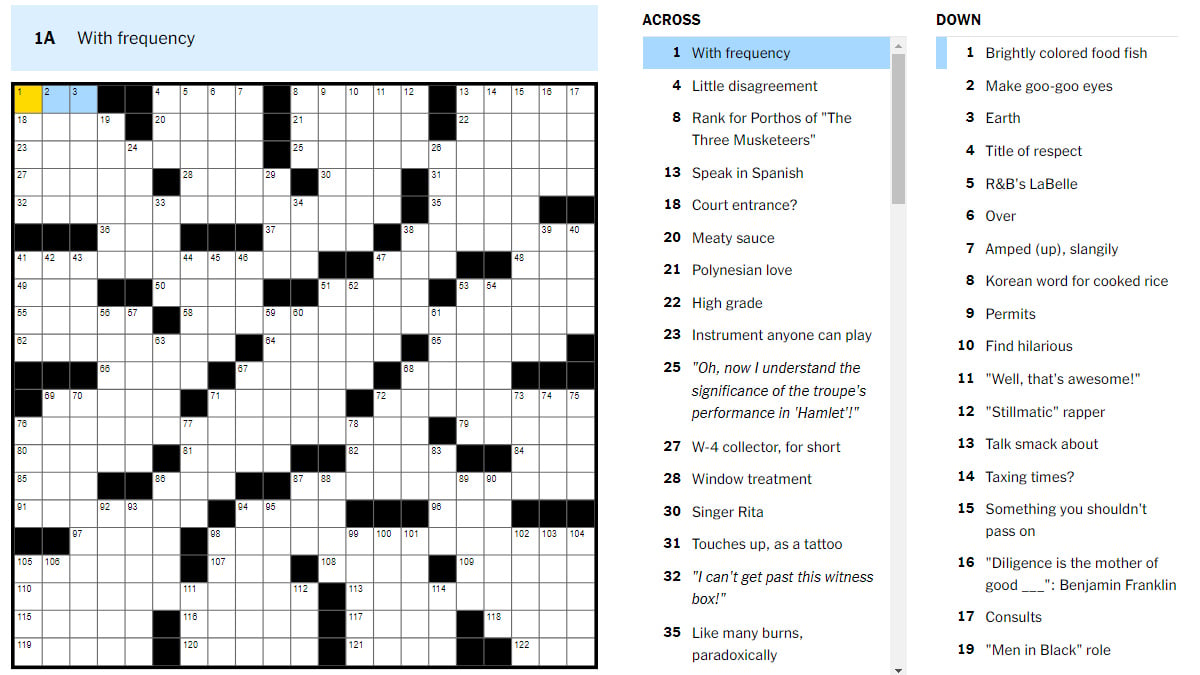

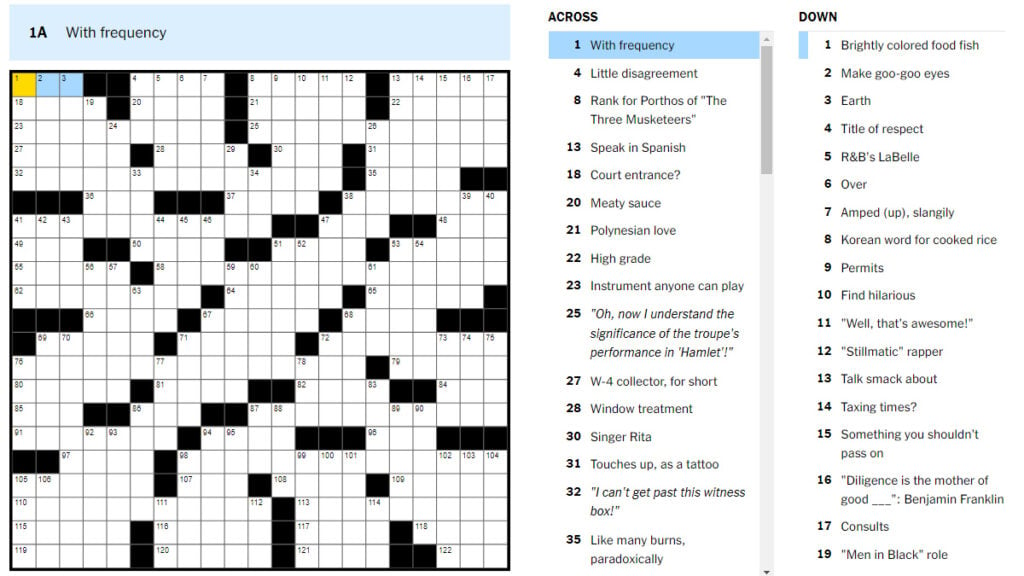

Solve The Nyt Mini Crossword Sunday May 11 Hints And Answers

May 23, 2025

Solve The Nyt Mini Crossword Sunday May 11 Hints And Answers

May 23, 2025 -

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 23, 2025

Dylan Dreyer And Brian Ficheras Marriage Everything We Know

May 23, 2025 -

Mc Larens Persistent Problem Lewis Hamiltons Telling Revelation

May 23, 2025

Mc Larens Persistent Problem Lewis Hamiltons Telling Revelation

May 23, 2025 -

Big Rig Rock Report 3 12 Big 100 Key Trends And Analysis

May 23, 2025

Big Rig Rock Report 3 12 Big 100 Key Trends And Analysis

May 23, 2025

Latest Posts

-

Bestechung An Der Uni Duisburg Essen Umfang Des Skandals Und Gestaendnis Einer Mitarbeiterin

May 23, 2025

Bestechung An Der Uni Duisburg Essen Umfang Des Skandals Und Gestaendnis Einer Mitarbeiterin

May 23, 2025 -

Solve The Nyt Mini Crossword April 8th 2025 Hints And Answers

May 23, 2025

Solve The Nyt Mini Crossword April 8th 2025 Hints And Answers

May 23, 2025 -

Nyt Mini Crossword March 6 2025 Clues And Answers

May 23, 2025

Nyt Mini Crossword March 6 2025 Clues And Answers

May 23, 2025 -

Nyt Mini Crossword Clues And Solutions April 8 2025

May 23, 2025

Nyt Mini Crossword Clues And Solutions April 8 2025

May 23, 2025 -

Sunday May 11 Nyt Mini Crossword Clues Hints And Solutions

May 23, 2025

Sunday May 11 Nyt Mini Crossword Clues Hints And Solutions

May 23, 2025