Ripple (XRP) And The $3.40 Target: A Realistic Assessment

Table of Contents

XRP's Current Market Position and Price Action

Understanding XRP's current market position is crucial to assessing its potential. We need to consider its price, market capitalization, recent price movements, trading volume, and liquidity. Let's analyze these key indicators:

-

Market Capitalization Comparison: Compared to Bitcoin (BTC) and Ethereum (ETH), XRP's market cap is significantly smaller. This means it has greater potential for percentage growth, but also greater volatility. A substantial influx of investment would be needed to reach a price of $3.40.

-

Recent Price Movements: Examining XRP's recent price charts reveals periods of both significant gains and losses. Identifying key support and resistance levels helps predict future price action. Sustained trading above crucial resistance levels would be a positive sign for those aiming for the $3.40 target.

-

Trading Volume and Liquidity: High trading volume generally indicates strong market interest. However, low liquidity can lead to significant price swings. Analyzing XRP's trading volume across different exchanges is essential to understand its susceptibility to price manipulation. Increased liquidity is vital for achieving and sustaining a higher price point.

-

Key Indicators:

- Comparison to BTC and ETH: XRP's market cap is currently significantly smaller than BTC and ETH.

- Recent Highs and Lows: Analyzing these helps establish price trends and potential support/resistance zones.

- Trading Volume Fluctuations: High volume during price increases suggests strong buying pressure.

- Market Liquidity Assessment: Deep liquidity is crucial for large price movements without significant volatility.

Technological Advancements and Adoption of RippleNet

Ripple's technology, primarily its RippleNet platform, underpins its potential for growth. RippleNet facilitates faster and cheaper cross-border payments, a crucial service for financial institutions. The wider adoption of this technology could significantly impact XRP's price.

-

RippleNet Functionality: RippleNet utilizes XRP to streamline international transactions, reducing costs and processing times compared to traditional methods.

-

Successful Implementations: Numerous financial institutions globally utilize RippleNet, demonstrating its practical application and market acceptance. These case studies showcase Ripple's capabilities and contribute to positive market sentiment.

-

Future Partnerships: Potential future partnerships with major banks and financial institutions could drive widespread RippleNet adoption and increase demand for XRP.

-

Technological Upgrades: Continuous improvements to RippleNet's technology enhance its efficiency and attractiveness to potential users, impacting XRP's value positively.

Regulatory Landscape and Legal Challenges

The regulatory environment significantly impacts cryptocurrency prices. Ripple faces an ongoing lawsuit from the Securities and Exchange Commission (SEC) in the US, which casts a shadow over XRP's future.

-

The SEC Lawsuit: The SEC alleges that XRP is an unregistered security. The outcome of this lawsuit will dramatically influence XRP's price and adoption.

-

Potential Outcomes: A favorable ruling could unlock significant price appreciation, while an unfavorable ruling could severely depress the price.

-

Global Regulatory Frameworks: Regulations vary globally. Regulatory clarity in major markets would boost investor confidence and potentially drive price increases. Uncertainty, however, fosters hesitancy and price volatility.

-

Investor Sentiment Impact: Regulatory clarity fosters investor confidence, reducing risk perception. Conversely, regulatory uncertainty increases volatility and discourages investment.

Market Sentiment and Investor Confidence

Market sentiment, encompassing investor confidence, social media trends, news coverage, and expert opinions, significantly influences XRP's price. Speculation and Fear Of Missing Out (FOMO) further contribute to price fluctuations.

-

Social Media Sentiment: Analyzing social media discussions surrounding XRP provides valuable insights into public perception and potential market trends. Positive sentiment can fuel price appreciation.

-

News Coverage Impact: Significant news events—positive or negative—affect XRP's price immediately. Monitoring news sources is essential for informed decision-making.

-

Expert Predictions and Market Analyses: Expert opinions and market analyses contribute to investor sentiment. Positive predictions can foster optimism and potentially drive price increases.

-

Speculative Trading Influence: Speculative trading can create significant price volatility, both upwards and downwards. This volatility needs careful consideration when evaluating potential price targets.

Conclusion

This analysis of Ripple (XRP) and its potential to reach the $3.40 price target reveals a complex interplay of factors. While technological advancements and expanding RippleNet adoption offer significant growth potential, the ongoing legal challenges and inherent market volatility pose substantial hurdles. Regulatory developments and investor sentiment are key determinants of XRP's future price trajectory. Reaching $3.40 necessitates a convergence of favorable conditions and overcoming considerable obstacles.

Call to Action: Continue researching Ripple (XRP) and its potential, but always remember to conduct thorough due diligence before investing in any cryptocurrency. Understanding the risks associated with XRP and the $3.40 price target is paramount for making informed investment decisions. Learn more about Ripple (XRP) and its future prospects by exploring reliable sources and staying updated on market developments.

Featured Posts

-

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025 -

Lotto 6aus49 Gewinnzahlen Und Quoten Vom 12 April 2025

May 08, 2025

Lotto 6aus49 Gewinnzahlen Und Quoten Vom 12 April 2025

May 08, 2025 -

Increased Dwp Home Visits Impact On Benefit Recipients

May 08, 2025

Increased Dwp Home Visits Impact On Benefit Recipients

May 08, 2025 -

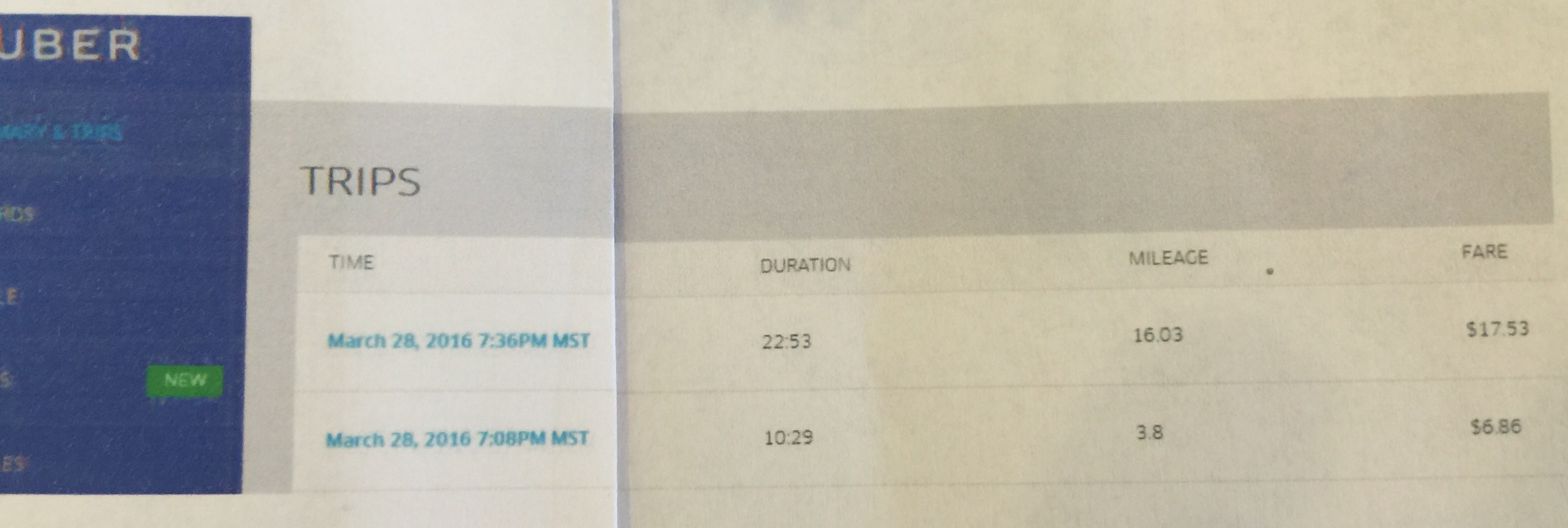

Uber Ditches Commission Model Introduces Subscription Plans For Drivers

May 08, 2025

Uber Ditches Commission Model Introduces Subscription Plans For Drivers

May 08, 2025 -

From Scatological Data To Podcast Gold An Ai Powered Solution

May 08, 2025

From Scatological Data To Podcast Gold An Ai Powered Solution

May 08, 2025