Ripple (XRP) Soars: Is A $3.40 Price Possible?

Table of Contents

Factors Driving the Ripple (XRP) Price Increase

Several converging factors have contributed to the recent upswing in XRP's price. Understanding these elements is crucial to evaluating the potential for further growth.

Positive Legal Developments

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has significantly impacted XRP's price. Recent developments have been largely favorable for Ripple:

- Partial Summary Judgement Victory: The court's decision on certain aspects of the case has boosted investor confidence, leading to a price surge. This legal victory for Ripple XRP is a key driver of the current positive sentiment.

- Positive Judicial Interpretations: Favorable interpretations of existing laws and regulations concerning XRP have further fueled optimism among investors. This positive momentum is essential to consider when evaluating the potential for the XRP price to continue its upward trend.

- Expert Opinions: Market analysts and legal experts are increasingly voicing positive opinions on Ripple's chances of winning the case, further bolstering investor confidence in XRP's future. The SEC Ripple case has become a focal point for the broader cryptocurrency regulatory landscape, making each development significant.

Growing Adoption and Partnerships

Beyond the legal wins, increased adoption and strategic partnerships are fueling XRP's price appreciation.

- New Payment Solutions: Several new payment solutions are leveraging XRP's speed and efficiency for cross-border transactions, leading to increased demand for the cryptocurrency. These XRP use cases demonstrate the practical application of the technology.

- Collaborations with Financial Institutions: Ripple is actively forging partnerships with major financial institutions, signaling growing institutional acceptance and expanding XRP's reach. The growing number of Ripple partnerships is indicative of mainstream acceptance.

- Enhanced Liquidity: Increased adoption contributes to enhanced liquidity in the XRP market, making it more attractive to investors and traders alike. This improved liquidity makes XRP less volatile and more appealing for larger-scale investments.

Increased Institutional Interest

The growing interest from institutional investors is another significant factor pushing XRP's price higher.

- Large-Scale Purchases: Reports of substantial XRP purchases by institutional investors suggest increased confidence in the cryptocurrency's long-term potential. These large-scale XRP transactions demonstrate significant belief in the project's future.

- Increased Trading Volume: Higher trading volume from institutional players suggests increased liquidity and market depth, contributing to price stability and potential growth. The rise of institutional XRP investment has undoubtedly impacted the price movement.

- Whale Activity: The activity of "whales," or large cryptocurrency holders, can heavily influence XRP's price. Their buying and selling patterns often signal significant market trends and should be monitored closely.

Analyzing the $3.40 Price Target for XRP

Reaching $3.40 would represent a substantial increase from XRP's current price. To analyze its feasibility, we need to examine both technical and fundamental aspects.

Technical Analysis

Technical analysis of XRP's price charts offers clues about the potential for reaching $3.40.

- Moving Averages: Analysis of moving averages, such as the 50-day and 200-day moving averages, can indicate potential support and resistance levels. XRP chart analysis is a valuable tool for identifying trends and predicting future movements.

- Resistance Levels: Identifying and overcoming key resistance levels is crucial for XRP to reach $3.40. Breakouts above these levels could signal a significant price increase, while failures to do so could indicate a potential pullback. This XRP price prediction is heavily dependent on the ability to surpass these resistance levels.

- Volume Confirmation: Increases in trading volume alongside price increases provide strong confirmation of the upward trend. A lack of volume confirmation could suggest a weaker price movement.

Fundamental Analysis

Fundamental analysis focuses on the intrinsic value of Ripple and its underlying technology.

- Market Capitalization: Compared to other cryptocurrencies, XRP's market capitalization might suggest a potential for significant growth. The Ripple market cap needs to be considered within the context of overall market trends and adoption rates.

- Adoption Rate: The rate of XRP adoption in various sectors will directly influence its long-term price potential. This XRP valuation depends significantly on increasing adoption.

- Technological Advantages: Ripple's technology, particularly its focus on cross-border payments, provides a strong fundamental basis for potential growth. A comprehensive understanding of XRP fundamentals is critical for long-term investment decisions.

Risks and Challenges for XRP Reaching $3.40

While the outlook for XRP is positive, several challenges could hinder its price from reaching $3.40.

Regulatory Uncertainty

Regulatory uncertainty remains a major headwind for the entire cryptocurrency market, including XRP.

- Ongoing Legal Battles: The outcome of the SEC vs. Ripple lawsuit and potential future regulatory actions could significantly impact XRP's price. Understanding the intricacies of XRP regulation is critical for investors.

- Varying Regulatory Approaches: Different countries adopt different approaches to cryptocurrency regulation, creating a complex and uncertain environment. Navigating the nuances of cryptocurrency regulation globally is essential for long-term market success.

- Future Legal Challenges: Potential future legal challenges could further increase uncertainty and negatively affect XRP's price. These regulatory risks XRP faces must be acknowledged when making investment decisions.

Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Broader Market Conditions: A downturn in the overall cryptocurrency market could drag XRP's price down, regardless of its fundamental strength. Keeping abreast of broader cryptocurrency market volatility is crucial.

- External Factors: Geopolitical events, economic fluctuations, and other external factors can significantly influence cryptocurrency prices. These market risks XRP shares with all cryptocurrencies cannot be ignored.

- Sentiment Shifts: Sudden shifts in market sentiment can lead to dramatic price swings, making XRP a risky investment for some. Understanding and adapting to the changing dynamics of investor sentiment is essential for successful navigation of the XRP market.

Conclusion: Is a $3.40 XRP Price Realistic?

Whether XRP can reach $3.40 depends on a complex interplay of positive and negative factors. Positive legal developments, increased adoption, and institutional interest are strong tailwinds. However, regulatory uncertainty and market volatility remain significant challenges. A balanced perspective considers both the opportunities and risks. It's crucial to conduct thorough research and understand your risk tolerance before investing in XRP. Continue to monitor the Ripple (XRP) market and stay informed about its potential for further growth to make informed investment decisions.

Featured Posts

-

Thunders Williams Points To Exceptional Team Leadership

May 08, 2025

Thunders Williams Points To Exceptional Team Leadership

May 08, 2025 -

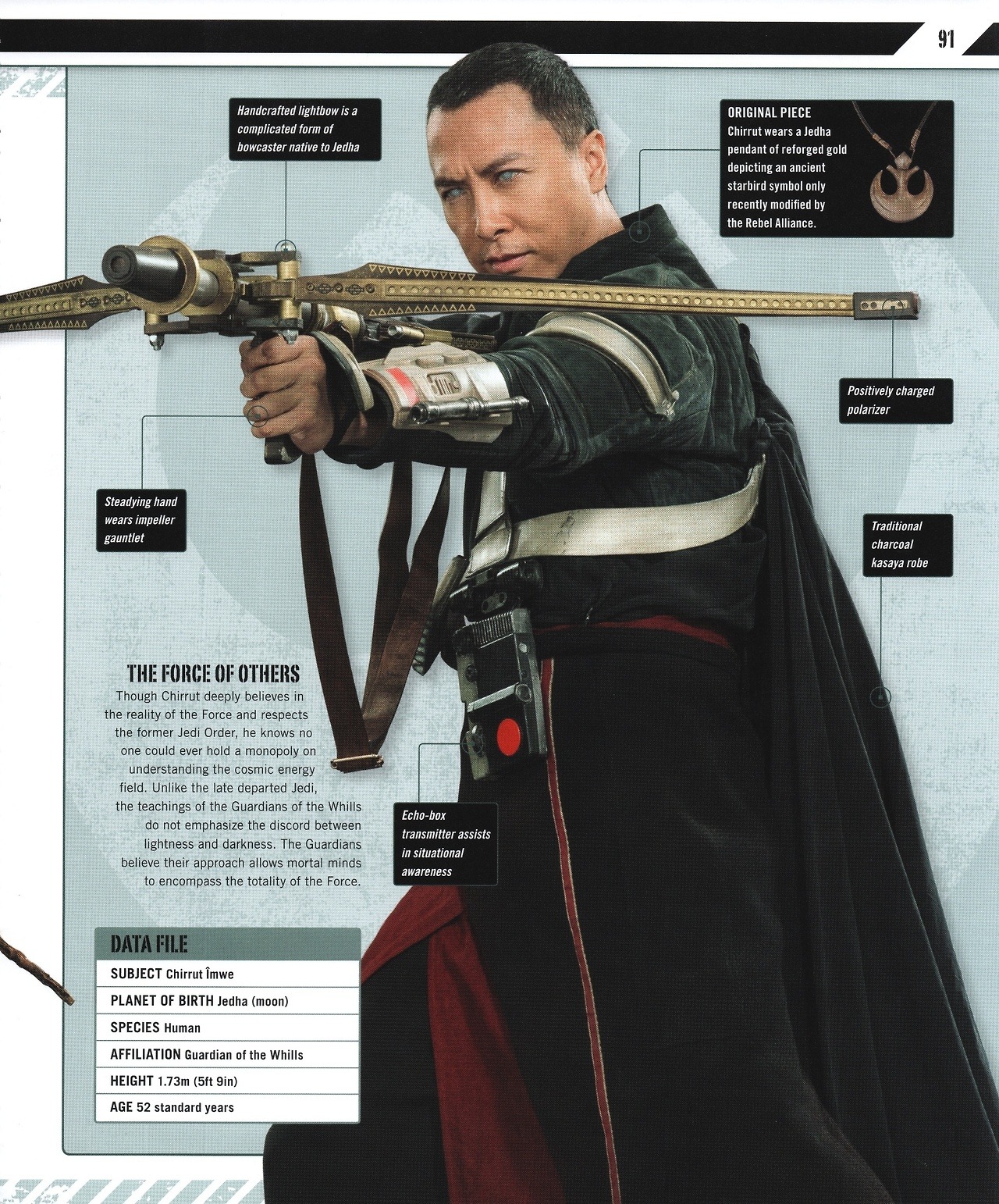

Rogue One Star Weighs In On Beloved Character

May 08, 2025

Rogue One Star Weighs In On Beloved Character

May 08, 2025 -

Star Wars Andor 3 Free Episodes Available On You Tube

May 08, 2025

Star Wars Andor 3 Free Episodes Available On You Tube

May 08, 2025 -

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025

Paris Walk Off Homer Secures Angels Win Against White Sox Despite Rain

May 08, 2025 -

Cemetery Corruption Fuels Ukraines War Profiteering

May 08, 2025

Cemetery Corruption Fuels Ukraines War Profiteering

May 08, 2025