Ripple's XRP: A Pivotal Moment? Examining ETF Prospects And SEC Impact

Table of Contents

The SEC Lawsuit and its Ripple Effects

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. The core argument hinges on whether XRP sales constituted investment contracts, meaning investors reasonably anticipated profits based on Ripple's efforts.

-

Summary of the SEC's claims regarding XRP as an unregistered security: The SEC contends that Ripple's distribution of XRP involved the sale of securities, requiring registration with the SEC. They point to Ripple's control over XRP distribution and the expectation of profit by investors as key factors.

-

Key arguments presented by Ripple's defense: Ripple argues that XRP is a decentralized digital asset, akin to Bitcoin or Ether, and not a security. They emphasize the operational independence of XRP and its widespread use on various exchanges.

-

The potential implications of a ruling in favor of Ripple or the SEC: A victory for Ripple could significantly boost XRP's price and potentially set a precedent for other cryptocurrencies, clarifying the regulatory landscape. An SEC win, however, could severely impact XRP's value and further tighten regulations on the crypto industry.

-

Analysis of the judge's previous statements and potential outcomes: Judge Analisa Torres' previous statements and rulings offer clues, though the final decision remains uncertain. The judge’s attention to the various distribution methods of XRP may be crucial in the final verdict.

-

Impact on other cryptocurrencies facing similar regulatory scrutiny: The outcome of the Ripple case will undoubtedly influence the regulatory scrutiny facing other cryptocurrencies, particularly those with centralized distribution models or similar tokenomics.

XRP ETF Prospects: A Game Changer?

The possibility of XRP ETFs (Exchange-Traded Funds) is a significant factor in the current market speculation. An XRP ETF would revolutionize access and liquidity for the token.

-

Explanation of Exchange-Traded Funds (ETFs) and their benefits: ETFs are investment funds traded on stock exchanges, offering investors diversified exposure to assets like stocks or, potentially, cryptocurrencies. They provide regulated, convenient, and liquid access to the underlying assets.

-

How an XRP ETF would increase accessibility and liquidity: An XRP ETF would make investing in XRP far simpler and more accessible to institutional and retail investors, potentially driving up demand and liquidity.

-

Potential impact on XRP's price and market capitalization: Increased demand and accessibility fueled by an ETF launch could dramatically increase XRP's price and market capitalization, positioning it as a major player in the crypto space.

-

Challenges and regulatory hurdles to overcome for XRP ETF approval: Regulatory approval is a major hurdle. The SEC's stance on cryptocurrencies and concerns about market manipulation are obstacles that must be addressed before approval is granted.

-

Comparison to other crypto ETFs already available: The success of existing Bitcoin and Ether ETFs, if any, will serve as a benchmark, informing the potential trajectory of an XRP ETF.

Increased Institutional Investment and Adoption

A positive ruling in the SEC lawsuit could unlock a flood of institutional investment into XRP.

-

The role of institutional investors in driving crypto market growth: Institutional investment is a powerful catalyst for market growth, bringing increased capital, sophisticated trading strategies, and enhanced credibility.

-

How an SEC victory could attract large-scale institutional investment in XRP: Regulatory clarity following a favorable ruling for Ripple would significantly reduce the risk associated with investing in XRP, making it attractive to institutional investors.

-

Potential impact on XRP's price and trading volume: A surge in institutional investment would likely drive up both XRP's price and trading volume, further strengthening its market position.

-

The importance of regulatory clarity for institutional adoption of cryptocurrencies: Clear and consistent regulatory frameworks are crucial to attract institutional investors, who are generally risk-averse and demand legal certainty.

The Ripple Effect on the Crypto Landscape

The SEC's decision will have far-reaching consequences across the crypto landscape.

-

Potential for increased regulatory clarity regarding cryptocurrencies: The outcome could establish clearer guidelines for classifying and regulating other digital assets, potentially creating a more stable and predictable environment.

-

Impact on the development of other crypto projects: The decision will influence how developers design and market their cryptocurrencies, potentially impacting innovation and adoption.

-

The influence on investor confidence in the crypto market: A positive ruling could boost investor confidence, while a negative one could trigger a market downturn.

-

A potential shift in the regulatory landscape and its long-term consequences: The case could significantly reshape the global regulatory landscape for cryptocurrencies, potentially influencing international regulatory standards.

Conclusion

The SEC's decision regarding Ripple's XRP stands as a pivotal moment for the cryptocurrency market. A positive outcome could unlock significant growth potential for XRP, paving the way for ETF approvals, increased institutional investment, and greater market clarity. The ripple effects could extend beyond XRP, shaping the future of cryptocurrency regulation and adoption globally. Staying informed about the ongoing developments surrounding XRP and the SEC lawsuit is crucial for anyone invested in or interested in the future of cryptocurrencies. Continue to research and monitor the situation surrounding XRP to make informed decisions about your investment strategy.

Featured Posts

-

Dwp Universal Credit Overpayments Reclaiming Your Money

May 08, 2025

Dwp Universal Credit Overpayments Reclaiming Your Money

May 08, 2025 -

Why Reliability And Trust In Crypto News Are Crucial In 2024

May 08, 2025

Why Reliability And Trust In Crypto News Are Crucial In 2024

May 08, 2025 -

Efficient Podcast Production Ais Role In Digesting Repetitive Scatological Data

May 08, 2025

Efficient Podcast Production Ais Role In Digesting Repetitive Scatological Data

May 08, 2025 -

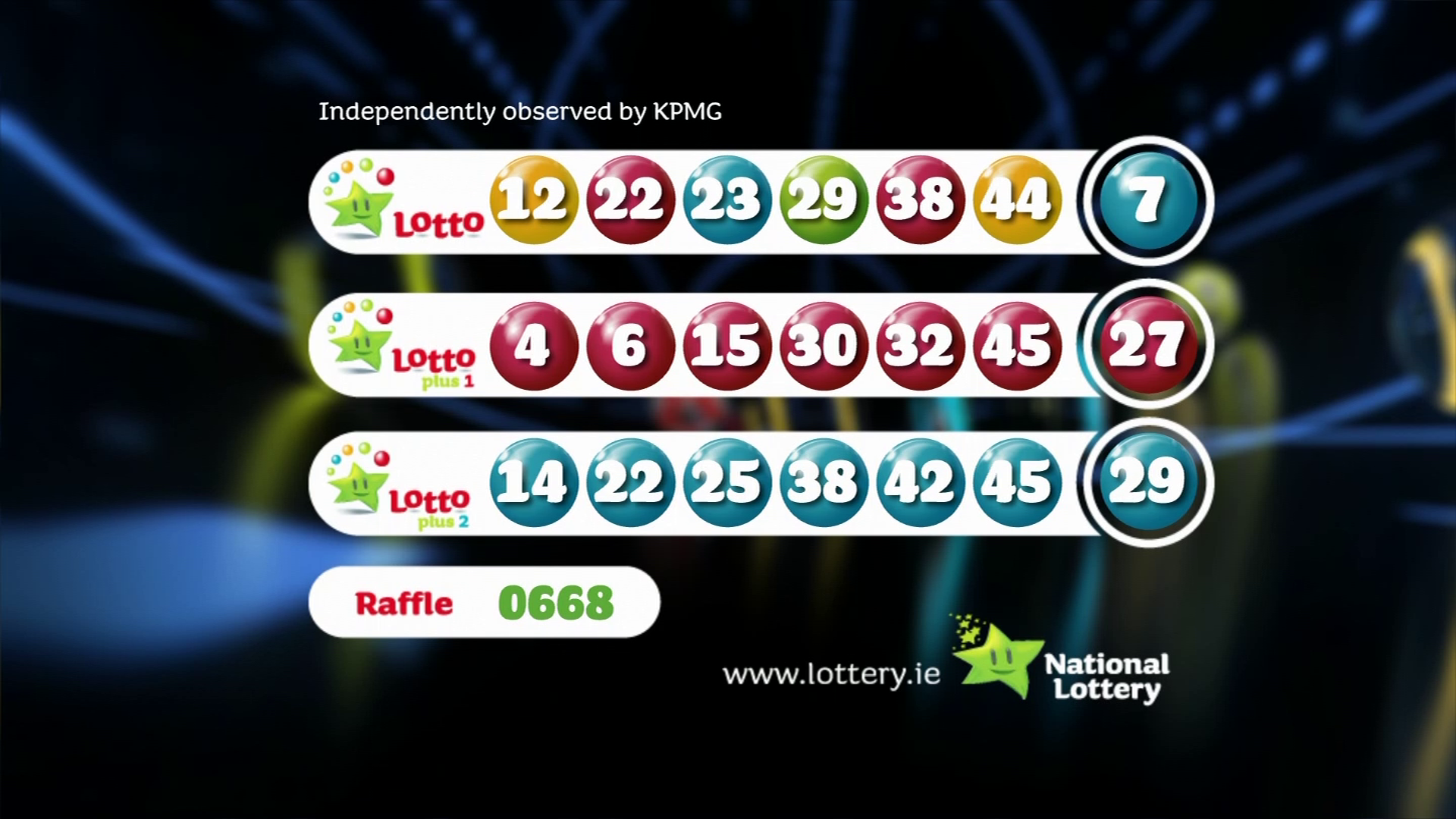

Lotto Results Saturday April 12th Check The Winning Numbers Now

May 08, 2025

Lotto Results Saturday April 12th Check The Winning Numbers Now

May 08, 2025 -

Ubers Self Driving Future A Critical Analysis Of Its Stock Performance

May 08, 2025

Ubers Self Driving Future A Critical Analysis Of Its Stock Performance

May 08, 2025