Ripple's XRP: After A 400% Increase, Where Could The Price Go?

Table of Contents

Analyzing the 400% XRP Price Increase

Factors Contributing to the Surge

Several factors likely contributed to XRP's remarkable price increase. Understanding these catalysts is crucial for predicting its future trajectory:

-

Increased Institutional Interest: Several large financial institutions have shown increased interest in blockchain technology and cross-border payments, potentially boosting demand for XRP, a key asset in Ripple's payment system. This growing institutional adoption is a significant factor driving the XRP price prediction upwards.

-

Positive Legal Developments in the Ripple vs. SEC Case: Positive developments, or even perceived positive movement, in the ongoing legal battle between Ripple and the SEC have significantly influenced investor sentiment, leading to increased XRP trading volume and price appreciation. You can find updates on the case on [link to reputable news source covering the lawsuit].

-

Broader Crypto Market Recovery: The recent recovery in the broader cryptocurrency market has undoubtedly contributed to XRP's surge. A positive overall market sentiment often lifts the prices of most digital assets, including XRP.

-

Increased Trading Volume: The surge in XRP's price has been accompanied by a significant increase in trading volume, indicating heightened investor activity and confidence in the asset. This increased volume signifies strong market participation and can sustain price growth.

Technical Analysis of XRP Price Charts

Analyzing XRP price charts using technical indicators can provide valuable insights into potential future price movements. [Insert chart/graph here if possible]. Key indicators such as moving averages (e.g., 50-day and 200-day MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify support and resistance levels, potential breakout points, and overall market sentiment. Currently, the technical outlook suggests [insert your technical analysis based on the chart data – e.g., a potential upward trend, consolidation phase, etc.].

The Ripple vs. SEC Lawsuit: Impact on XRP's Future

Current Status of the Lawsuit

The Ripple vs. SEC lawsuit remains a significant factor influencing XRP's price. The case centers around whether XRP is a security, a determination that could have far-reaching implications for its future. [Link to official court documents or reputable news sources covering the lawsuit]. The ongoing legal battle creates uncertainty, and the outcome will significantly impact investor sentiment and, consequently, the XRP price prediction.

Potential Scenarios and Their Price Implications

Several scenarios could unfold, each with different implications for XRP's price:

-

Favorable Ruling: A favorable ruling for Ripple could lead to a significant surge in XRP's price, potentially exceeding current levels considerably.

-

Unfavorable Ruling: An unfavorable ruling could result in a substantial price correction, potentially impacting investor confidence and leading to significant sell-offs.

-

Settlement: A settlement between Ripple and the SEC could lead to a moderate price movement, depending on the terms of the agreement. The outcome could be positive or negative, so careful observation is required for accurate XRP price prediction.

Future Developments and Potential Price Drivers

Adoption of XRP by Financial Institutions

Ripple's ongoing efforts to secure wider adoption of XRP among financial institutions are crucial for its long-term success. Increased institutional adoption could significantly boost XRP's price and market capitalization. Their expansion into new markets and partnerships could be vital for XRP price prediction.

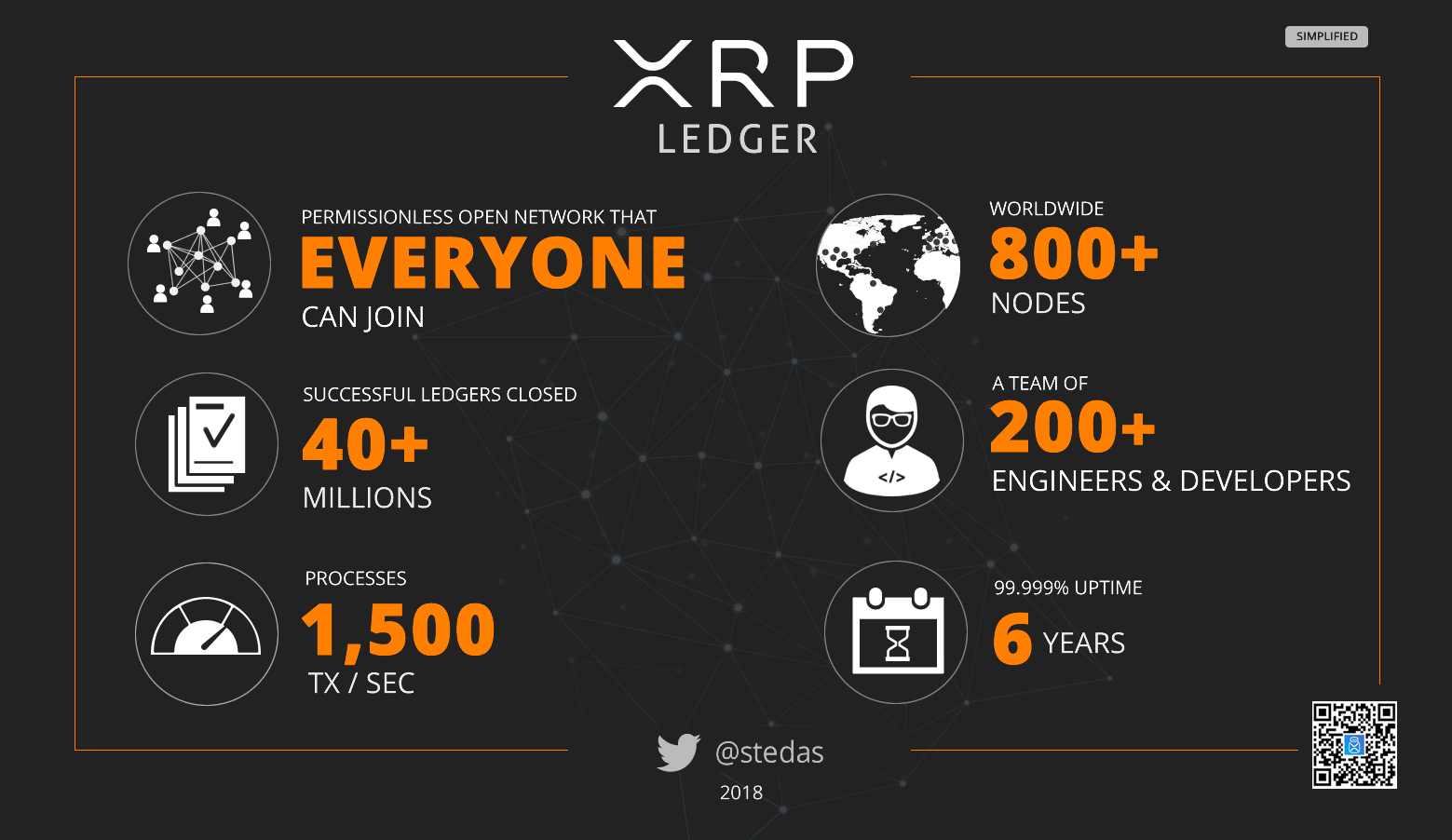

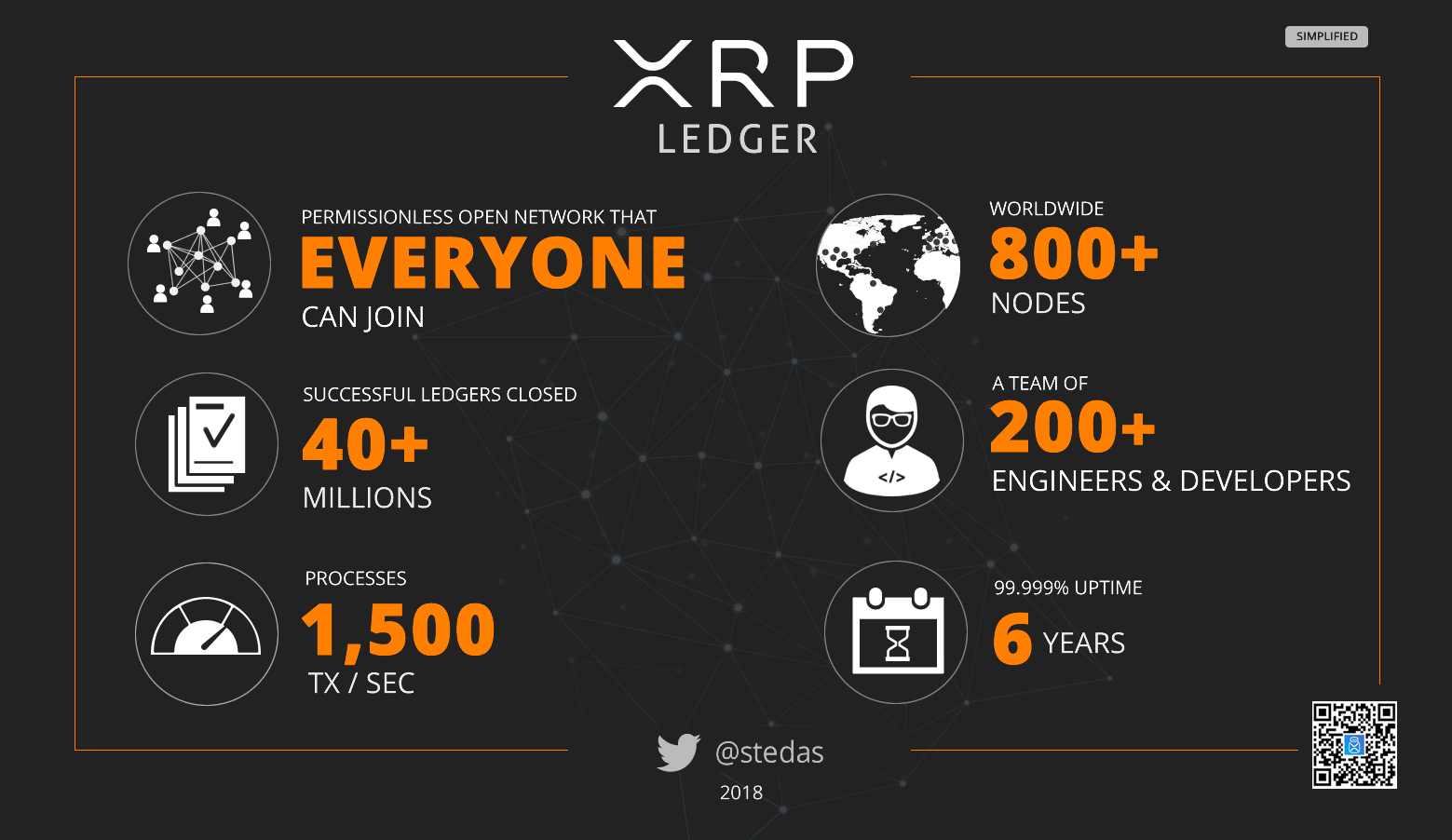

Technological Advancements and RippleNet Expansion

Ripple's continuous development and expansion of its RippleNet network, including technological advancements, are critical factors in its future growth. These improvements enhance the network's efficiency and attract more users, ultimately influencing XRP demand and price.

Overall Market Sentiment and Crypto Regulations

The overall sentiment within the cryptocurrency market and regulatory developments globally will significantly influence XRP's price. Positive regulatory changes or a generally bullish market sentiment are likely to support XRP's price, while negative developments could lead to corrections. Broader macroeconomic factors also play a role, impacting the XRP price prediction.

Conclusion

XRP's recent 400% price surge highlights its volatility and potential for significant gains or corrections. The Ripple vs. SEC lawsuit, institutional adoption, technological advancements, and overall market sentiment all play crucial roles in shaping XRP's future. While the potential for further price increases is real, investors must understand the inherent risks involved. This analysis is not financial advice. Conduct thorough research, consider your risk tolerance, and make informed decisions before investing in XRP. Stay informed about the latest developments in the XRP market and make informed decisions about your XRP investments.

Featured Posts

-

Could You Be Due A Universal Credit Refund From The Dwp

May 08, 2025

Could You Be Due A Universal Credit Refund From The Dwp

May 08, 2025 -

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers

May 08, 2025

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers

May 08, 2025 -

Star Wars Andor Companion Book Scrapped Over Ai Controversy

May 08, 2025

Star Wars Andor Companion Book Scrapped Over Ai Controversy

May 08, 2025 -

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025

U S China Trade Talks Officials To Meet Amid Ongoing Tensions

May 08, 2025 -

Kripto Piyasa Coekuesue Yatirimcilar Neden Satiyor

May 08, 2025

Kripto Piyasa Coekuesue Yatirimcilar Neden Satiyor

May 08, 2025