Rising Sea Levels, Falling Credit Scores: Assessing Climate Risk In Home Finance

Table of Contents

The Direct Impact of Rising Sea Levels on Property Value

Rising sea levels directly threaten property values through increased flood risk and decreased desirability of coastal properties.

Increased Flood Risk and Insurance Premiums

Increased flood risk due to rising sea levels translates to significantly higher insurance premiums and, in some cases, the inability to secure coverage altogether.

- Flood insurance mechanics: Flood insurance is separate from standard homeowner's insurance and often carries high deductibles and premiums, particularly in high-risk areas.

- FEMA flood maps and their limitations: While the Federal Emergency Management Agency (FEMA) provides flood maps, these maps can be outdated and may not accurately reflect the current and projected flood risks due to rising sea levels. Many areas are experiencing more frequent and severe flooding than indicated on these maps.

- Escalating costs: Coastal communities are witnessing dramatic increases in flood insurance premiums, making homeownership increasingly expensive and challenging. For example, in some parts of Florida, premiums have increased by hundreds of percent in recent years.

Decreased Property Values in Vulnerable Areas

Proximity to coastlines and flood zones significantly diminishes property values, making it more difficult to sell or refinance.

- Impact on appraisal values: Appraisers now factor in flood risk when assessing property values, often resulting in lower valuations for properties in high-risk areas.

- Mortgage challenges: Securing a mortgage in a high-risk area can be challenging, as lenders often require higher down payments or refuse to offer loans altogether due to the elevated risk.

- Real estate market data: Real estate market data consistently shows lower property appreciation rates, and in some cases, property devaluation in areas vulnerable to rising sea levels and increased flooding.

Indirect Financial Consequences of Climate Change

Beyond direct impacts, climate change creates indirect financial consequences that affect homeowners' financial stability.

Impact on Infrastructure and Local Economies

Climate-related damage to infrastructure – roads, bridges, utilities, etc. – can significantly affect property values and local economies, indirectly impacting credit scores.

- Repair and rebuilding costs: The cost of repairing or rebuilding damaged infrastructure is substantial, often borne by taxpayers, which can lead to increased taxes and reduced local investment.

- Ripple effect on businesses and employment: Damage to infrastructure disrupts local businesses, leading to job losses and reduced economic activity, which in turn, can negatively affect property values and homeowner financial health.

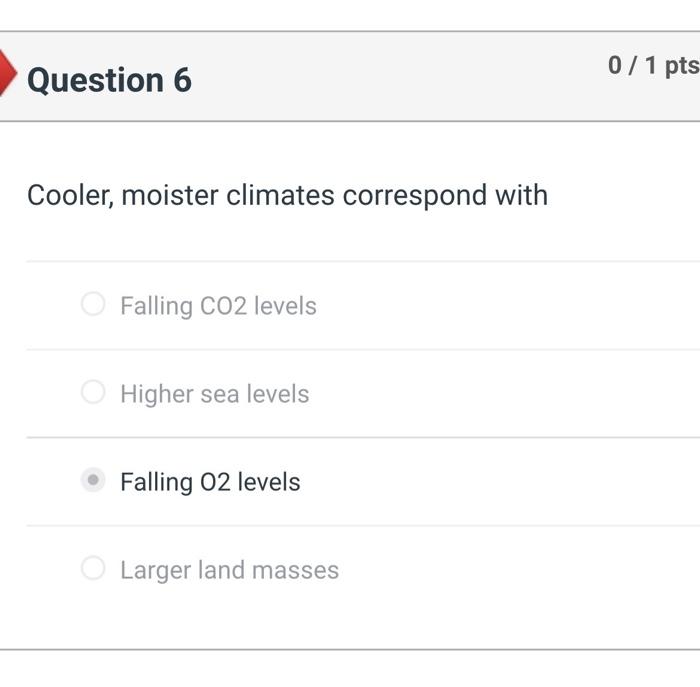

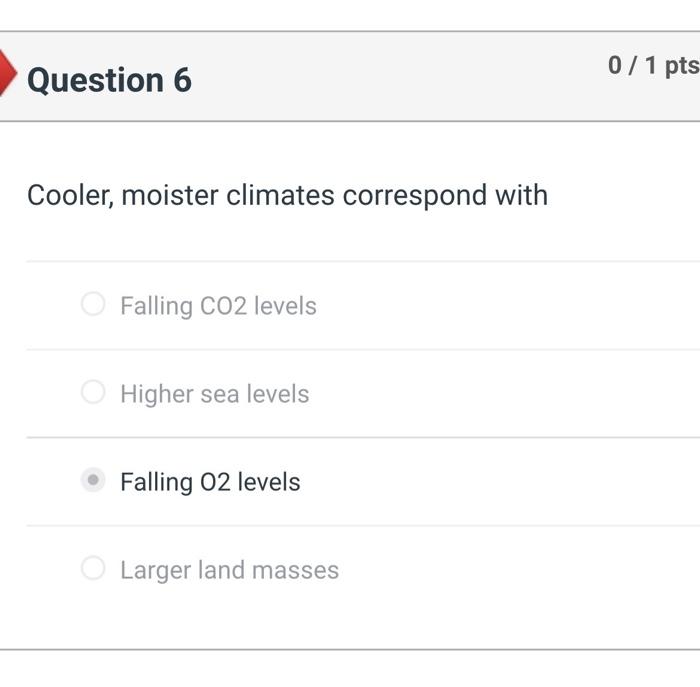

Increased Mortgage Delinquency and Foreclosure

Climate-related disasters can lead to higher mortgage delinquency rates and foreclosures, ultimately damaging credit scores.

- Financial hardship from disasters: The financial burden of repairing climate-related damage, coupled with potential job losses, can lead to missed mortgage payments.

- Government assistance programs: While government assistance programs exist, they are often insufficient to cover the full extent of losses, leaving homeowners financially vulnerable.

Assessing and Mitigating Climate Risk in Home Finance

Proactive steps are crucial to assess and mitigate climate risk in your home finance strategy.

Understanding Your Property's Vulnerability

Thorough research is paramount. Understanding your property's vulnerability to rising sea levels and flooding is crucial for making informed financial decisions.

- FEMA flood maps and other resources: Utilize resources like FEMA's flood maps, but be aware of their limitations and consider consulting with local experts for a more comprehensive assessment.

- Professional assessments: Consider engaging a professional surveyor or engineer to assess your property's vulnerability to flooding and other climate-related risks.

Financial Strategies for Climate Resilience

Implementing sound financial strategies can help protect your financial well-being in the face of climate risks.

- Flood insurance: Secure adequate flood insurance coverage, even if your property is not currently in a high-risk zone. Premiums are likely to increase in the future.

- Elevated home construction: For new builds, consider elevated construction techniques to mitigate flood risks.

- Emergency funds: Build a robust emergency fund to cover unexpected repairs or relocation costs.

- Investment diversification: Diversify your investments to mitigate the potential impact of climate-related losses on your overall financial portfolio.

Conclusion

Rising sea levels significantly impact home values, insurance costs, and credit scores. Climate risk in home finance is no longer a theoretical concern; it's a present-day reality that demands attention. Don't underestimate the impact of rising sea levels on your financial future. Assess climate risk in your home finance strategy today by exploring resources like FEMA flood maps and consulting with financial advisors who specialize in climate-related financial risks. Proactive planning and informed decisions are key to safeguarding your financial well-being in a changing climate.

Featured Posts

-

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025 -

March 13 Nyt Mini Crossword Solutions

May 20, 2025

March 13 Nyt Mini Crossword Solutions

May 20, 2025 -

Nyt Mini Crossword Answers March 15

May 20, 2025

Nyt Mini Crossword Answers March 15

May 20, 2025 -

Eurovision Song Contest 2025 The Artists Revealed

May 20, 2025

Eurovision Song Contest 2025 The Artists Revealed

May 20, 2025 -

Challenges To Clean Energys Expansion A Growing Threat

May 20, 2025

Challenges To Clean Energys Expansion A Growing Threat

May 20, 2025