Rockwell Automation Earnings Beat Expectations: Stock Surge Explained

Table of Contents

Exceeding Expectations: A Deep Dive into Rockwell Automation's Q3 2023 Earnings Report

Rockwell Automation's Q3 2023 earnings report showcased impressive growth across various key performance indicators (KPIs), surpassing analyst expectations and fueling the subsequent stock price surge.

Revenue Growth and Key Performance Indicators (KPIs):

Rockwell Automation reported a substantial increase in revenue compared to both the previous quarter and the same quarter last year. The exact figures will be added here once the official report is released [insert official figures here, e.g., "Revenue increased by 15% year-over-year and 8% quarter-over-quarter."]. This impressive growth was driven by several key performance indicators:

- Significant increase in orders: A notable surge in new orders across various sectors, indicating strong future demand. Specifically, the automotive sector contributed significantly to this growth.

- Improved operating margins: Enhanced efficiency and cost management initiatives resulted in improved operating margins, boosting profitability.

- Robust backlog: A healthy backlog indicates sustained future revenue streams and provides a strong foundation for continued growth.

Strong Performance Across Key Business Segments:

The positive performance wasn't confined to a single area; Rockwell Automation demonstrated strength across its key business segments. While specific segment breakdowns will be available in the full report, [mention specific segments and their performance, e.g., "The food and beverage automation segment showed particularly strong growth, driven by increasing demand for automated solutions in this sector."] [Mention other segments and their performance.] This broad-based growth highlights the resilience and diversification of Rockwell Automation's business model.

Factors Driving the Stock Surge: Beyond the Numbers

The stock surge wasn't solely driven by the numbers; several other factors contributed to the positive market reaction.

Positive Market Sentiment and Investor Confidence:

The overall positive sentiment within the industrial automation sector played a crucial role. Investor confidence in Rockwell Automation's ability to navigate current economic challenges and capitalize on future opportunities was significantly boosted by the strong earnings report. This confidence was further amplified by:

- Analyst upgrades: Several analysts upgraded their price targets for Rockwell Automation stock following the earnings announcement, signaling increased optimism.

- Positive media coverage: Favorable media coverage highlighted the company's achievements, further boosting investor confidence.

Innovation and Technological Advancements:

Rockwell Automation's commitment to innovation and technological advancements is a key driver of its success. Recent investments in research and development are now translating into tangible results. Key innovations include:

- Launch of a new cloud-based automation platform: This platform is driving increased adoption and efficiency gains for customers.

- Investments in AI and machine learning: These investments are enhancing product capabilities and providing competitive advantages.

- [Add other relevant innovations here.]

Future Outlook and Investment Implications:

While the Q3 results are encouraging, it's crucial to consider the future outlook and potential challenges.

Maintaining Momentum and Addressing Challenges:

Rockwell Automation's guidance for future quarters will be critical in assessing its ability to maintain this momentum. [Insert official guidance here, e.g., "The company's guidance suggests continued growth in the coming quarters, although they acknowledge potential headwinds such as supply chain disruptions and global economic uncertainty."] The company's strategies for mitigating these risks will play a crucial role in determining its future success.

Rockwell Automation Stock: A Buy, Sell, or Hold?

The decision to buy, sell, or hold Rockwell Automation stock depends on individual investment strategies and risk tolerance. The strong Q3 results and positive outlook suggest a promising future, but potential headwinds must also be considered. [Offer a balanced perspective, considering different viewpoints and investment strategies. Avoid giving direct financial advice.]

Conclusion:

Rockwell Automation's Q3 2023 earnings report significantly exceeded expectations, leading to a substantial increase in its stock price. This success is a result of robust revenue growth across its key segments, positive market sentiment fueled by innovation, and investor confidence in the company's future. While challenges remain, the company’s positive outlook and commitment to technological advancement suggest promising growth prospects. Stay informed on future Rockwell Automation earnings reports and market trends to make informed decisions about your investments in industrial automation stocks. Learn more about Rockwell Automation’s financial performance and growth strategy by visiting their investor relations website.

Featured Posts

-

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025 -

Newborn Baby Emirates Id In Uae Fees And Requirements March 2025

May 17, 2025

Newborn Baby Emirates Id In Uae Fees And Requirements March 2025

May 17, 2025 -

Nico Schlotterbeck And Angelo Stiller Liverpool Transfer Speculation Intensifies

May 17, 2025

Nico Schlotterbeck And Angelo Stiller Liverpool Transfer Speculation Intensifies

May 17, 2025 -

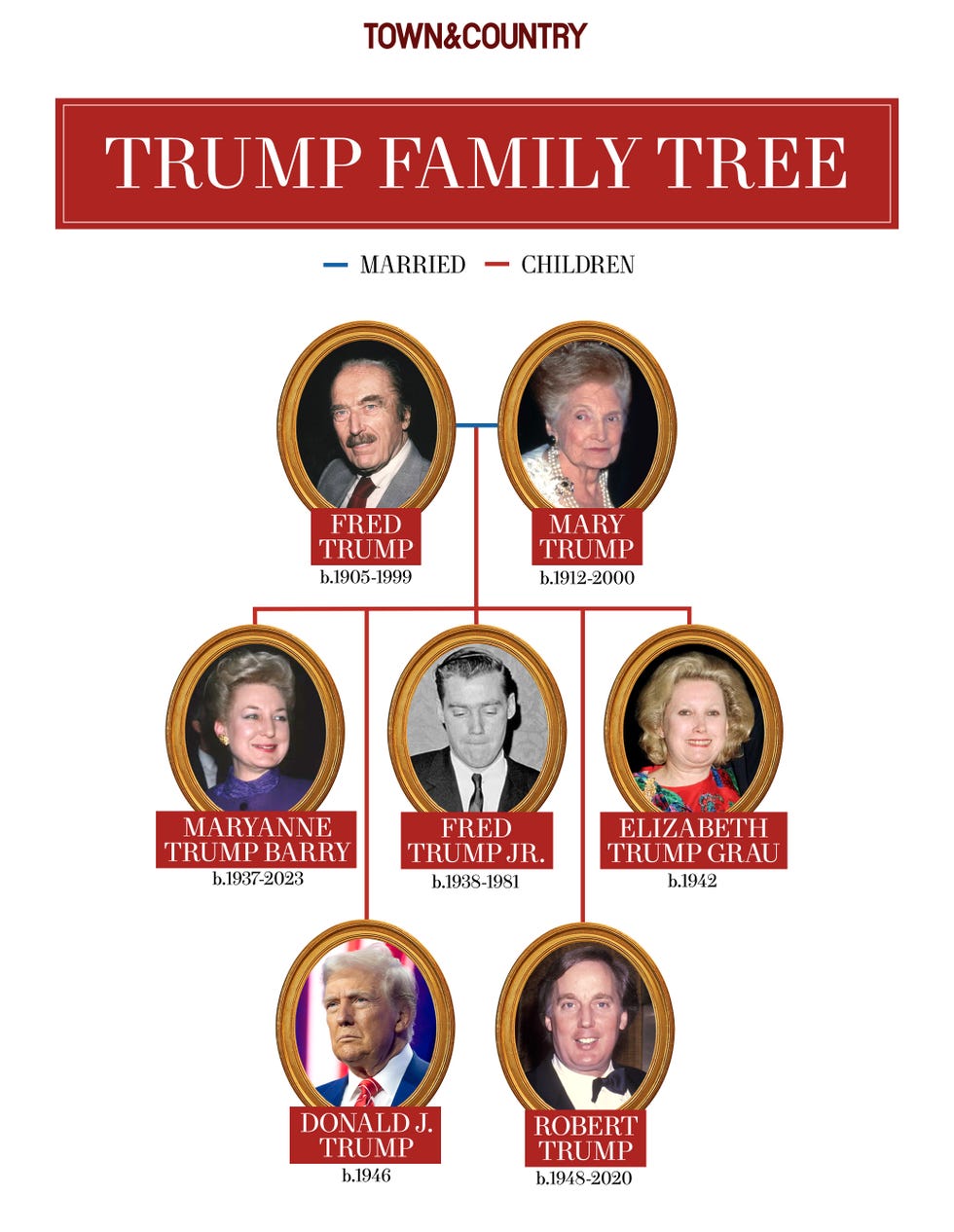

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025 -

Hornets Vs Celtics Game Tonight Predictions Betting Odds And Analysis

May 17, 2025

Hornets Vs Celtics Game Tonight Predictions Betting Odds And Analysis

May 17, 2025