Rockwell Automation's Strong Earnings Drive Stock Surge: Market Movers & Analysis

Table of Contents

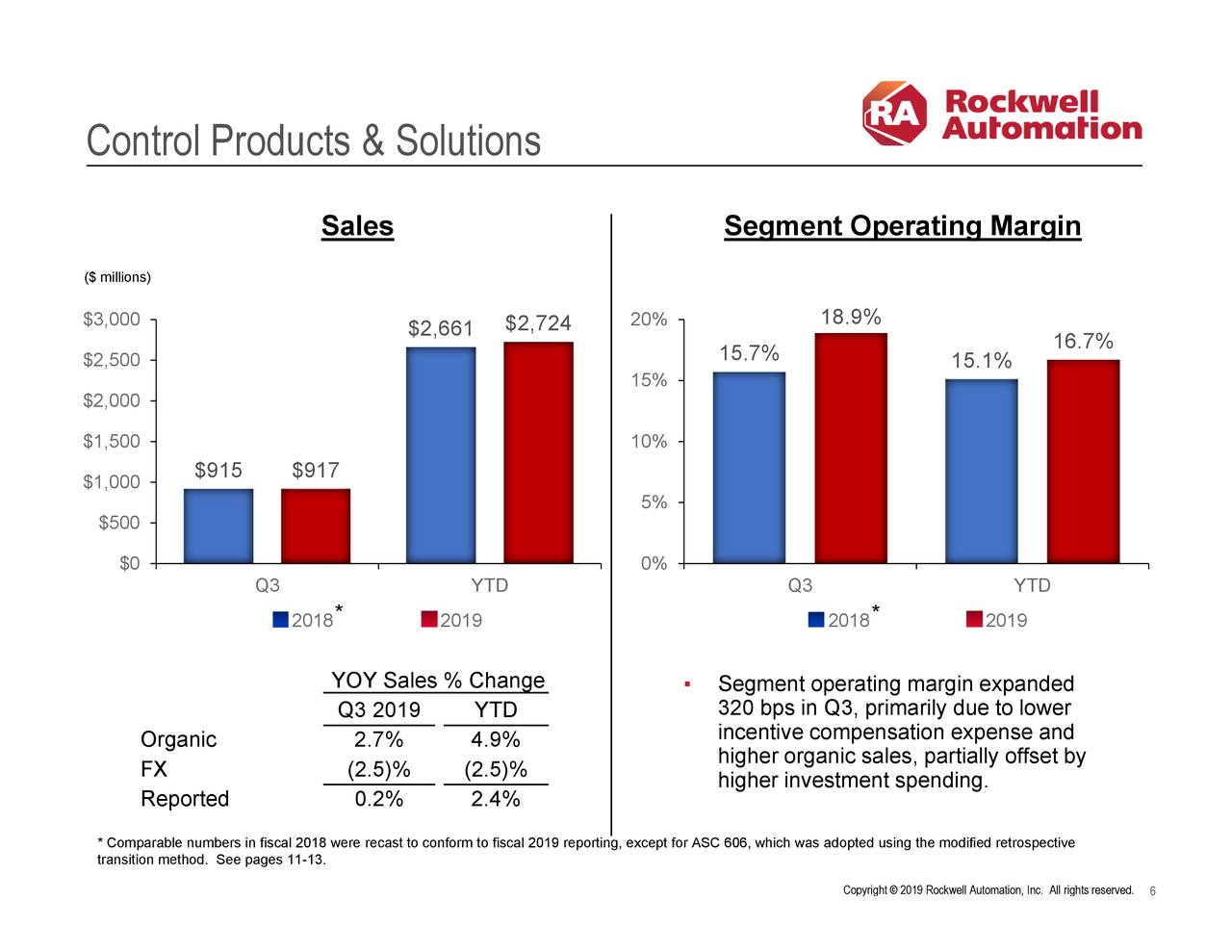

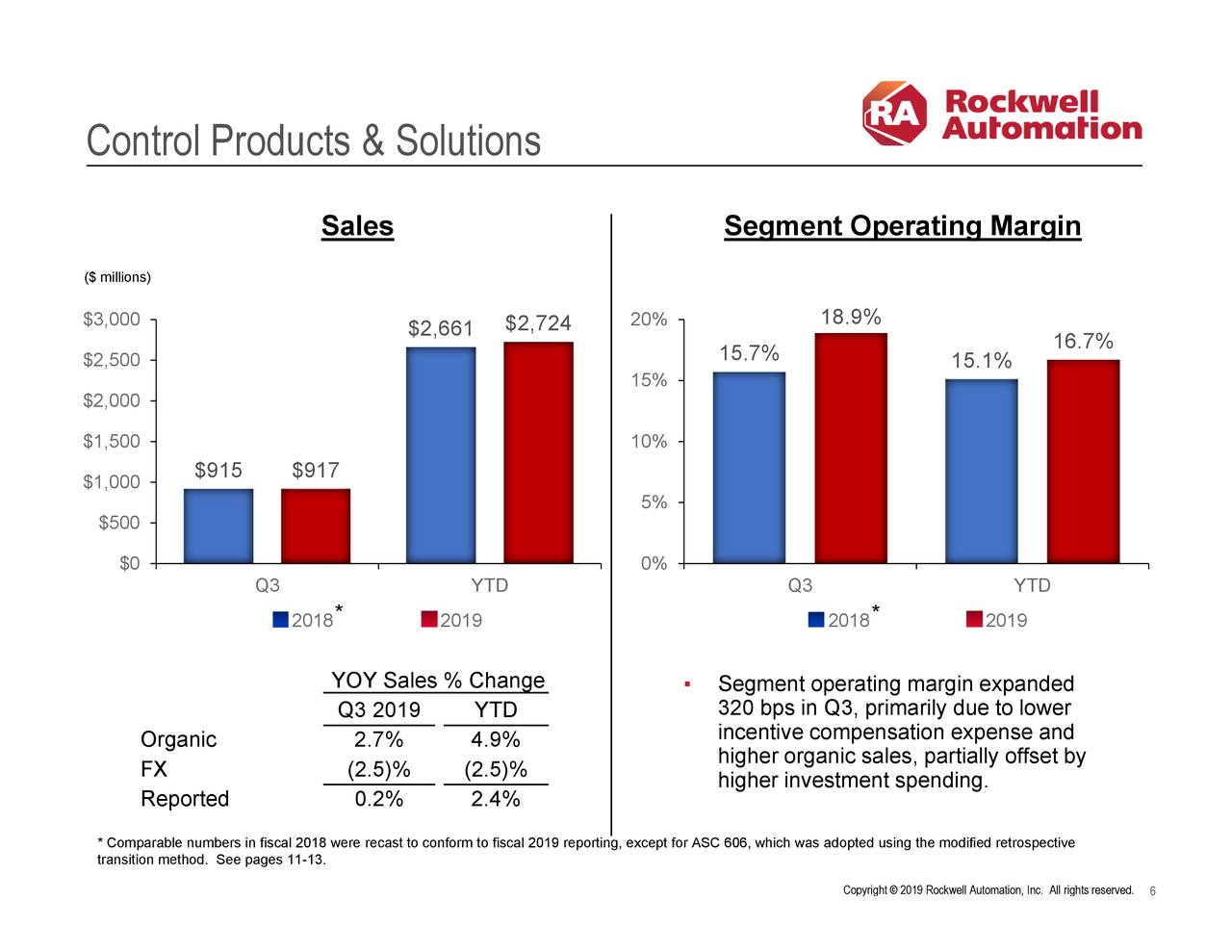

Rockwell Automation's Q[Quarter] Earnings: A Deep Dive

Rockwell Automation's Q[Quarter] earnings report showcased remarkable growth across various key performance indicators (KPIs), solidifying its leading role in industrial automation.

Revenue Growth and Key Performance Indicators (KPIs)

Rockwell Automation reported a [Insert Percentage]% increase in revenue compared to the same quarter last year and a [Insert Percentage]% increase compared to the previous year. This impressive growth was driven by strong performance across its segments, particularly in industrial automation and process automation. The detailed KPIs illustrate this success:

- Revenue Growth: [Insert Percentage]% year-over-year

- Gross Margin: [Insert Percentage]% (up [Insert Percentage]% YoY)

- Operating Income: [Insert Percentage]% (up [Insert Percentage]% YoY)

- Earnings Per Share (EPS): $[Insert EPS] (up [Insert Percentage]% YoY)

This exceptional financial performance can be attributed to several factors, including increased demand driven by the ongoing recovery in manufacturing, successful new product launches catering to the growing needs of Industry 4.0, and effective cost-cutting measures implemented in recent years.

Market Share and Competitive Landscape

Rockwell Automation maintains a significant market share within the industrial automation sector, estimated at [Insert Percentage]%. The company's competitive advantage stems from its comprehensive portfolio of automation solutions, strong brand reputation, and a vast global customer base. Recent strategic partnerships and acquisitions have further bolstered its market position, allowing it to gain market share against key competitors such as [mention key competitors, e.g., Siemens, Schneider Electric]. This strategic approach contributed significantly to the overall success reported in the Q[Quarter] earnings.

Guidance for Future Quarters

Rockwell Automation's management provided positive guidance for the remainder of the year, projecting [Insert projected growth percentage]% revenue growth. The outlook reflects the company's confidence in its ability to capitalize on the continued growth in industrial automation and its ongoing investments in research and development. However, the company acknowledged potential risks, including supply chain disruptions and global economic uncertainties, which could impact future performance.

Impact on the Stock Market: Analysis of the Surge

The release of Rockwell Automation's Q[Quarter] earnings report triggered a significant surge in its stock price.

Stock Price Performance and Trading Volume

Following the earnings announcement, Rockwell Automation's stock price increased by [Insert Percentage]%, reflecting strong investor confidence. Trading volume also surged, indicating significant investor activity and enthusiasm. This heightened trading volume suggests a positive market sentiment and a strong belief in the company's future growth potential. The price movements before and after the announcement show a clear upward trend, confirming the positive impact of the earnings release.

Investor Reactions and Analyst Ratings

The market reacted positively to the strong earnings, with investors and analysts praising Rockwell Automation's robust financial performance and positive outlook. Several major investment firms upgraded their rating for Rockwell Automation stock, reflecting increased confidence in the company's future. A number of analysts issued buy recommendations, further contributing to the stock's surge.

Long-Term Implications for Investors

The strong Q[Quarter] earnings suggest a positive long-term outlook for Rockwell Automation's stock price. The company's continued investment in innovation, coupled with the growing demand for industrial automation solutions, positions it well for sustained growth. However, potential risks such as geopolitical instability and economic downturns should be considered when assessing long-term investment potential.

Industry Trends and Their Influence on Rockwell Automation

The robust performance of Rockwell Automation is closely linked to the broader trends shaping the industrial automation industry.

Growth in Industrial Automation

The industrial automation industry is experiencing significant growth, driven by factors such as the increasing adoption of digital transformation strategies, the expansion of Industry 4.0 initiatives across various sectors, and the e-commerce boom fueling the need for efficient logistics and supply chain management. Rockwell Automation is a direct beneficiary of this growth, leveraging its expertise to provide cutting-edge solutions to meet the evolving needs of manufacturers and other industrial players.

Technological Advancements and Innovation

Rockwell Automation's success is also linked to its commitment to technological innovation. The company continues to invest heavily in research and development, integrating advancements in artificial intelligence (AI), the Internet of Things (IoT), and robotics into its products and services. The launch of new products incorporating these technologies has played a significant role in the company's strong performance and contributed to its market leadership.

Conclusion: Rockwell Automation's Stock Surge: A Positive Outlook

Rockwell Automation's Q[Quarter] earnings report underscores the company's robust financial performance and strong position within the industrial automation sector. The significant stock surge reflects investor confidence in the company's ability to capitalize on industry growth and its commitment to technological innovation. Factors like increased revenue, improved KPIs, a strengthened market position, and positive future guidance all contribute to a positive outlook.

For investors seeking exposure to the growing industrial automation market, Rockwell Automation presents a compelling opportunity. We encourage you to conduct thorough research and consider a Rockwell Automation investment as part of a diversified portfolio. Further analysis of Rockwell Automation stock and its market performance is highly recommended before making any investment decisions.

Featured Posts

-

10 Best Sherlock Holmes Quotes Ranked

May 17, 2025

10 Best Sherlock Holmes Quotes Ranked

May 17, 2025 -

Boston Celtics Vs Detroit Pistons Expert Prediction And Analysis

May 17, 2025

Boston Celtics Vs Detroit Pistons Expert Prediction And Analysis

May 17, 2025 -

Uber And Heads Up For Tails Expand Pet Friendly Rides In Delhi And Mumbai

May 17, 2025

Uber And Heads Up For Tails Expand Pet Friendly Rides In Delhi And Mumbai

May 17, 2025 -

Hailey Van Liths Rookie Season Guidance From Angel Reese

May 17, 2025

Hailey Van Liths Rookie Season Guidance From Angel Reese

May 17, 2025 -

Reddit Offline Current Status And Solutions

May 17, 2025

Reddit Offline Current Status And Solutions

May 17, 2025