Rupiah Pressure Triggers Significant Drop In Indonesia's Foreign Exchange Reserves

Table of Contents

Understanding the Rupiah's Recent Weakness

The recent weakening of the Rupiah is a complex issue stemming from both global and domestic economic factors.

Global Economic Headwinds

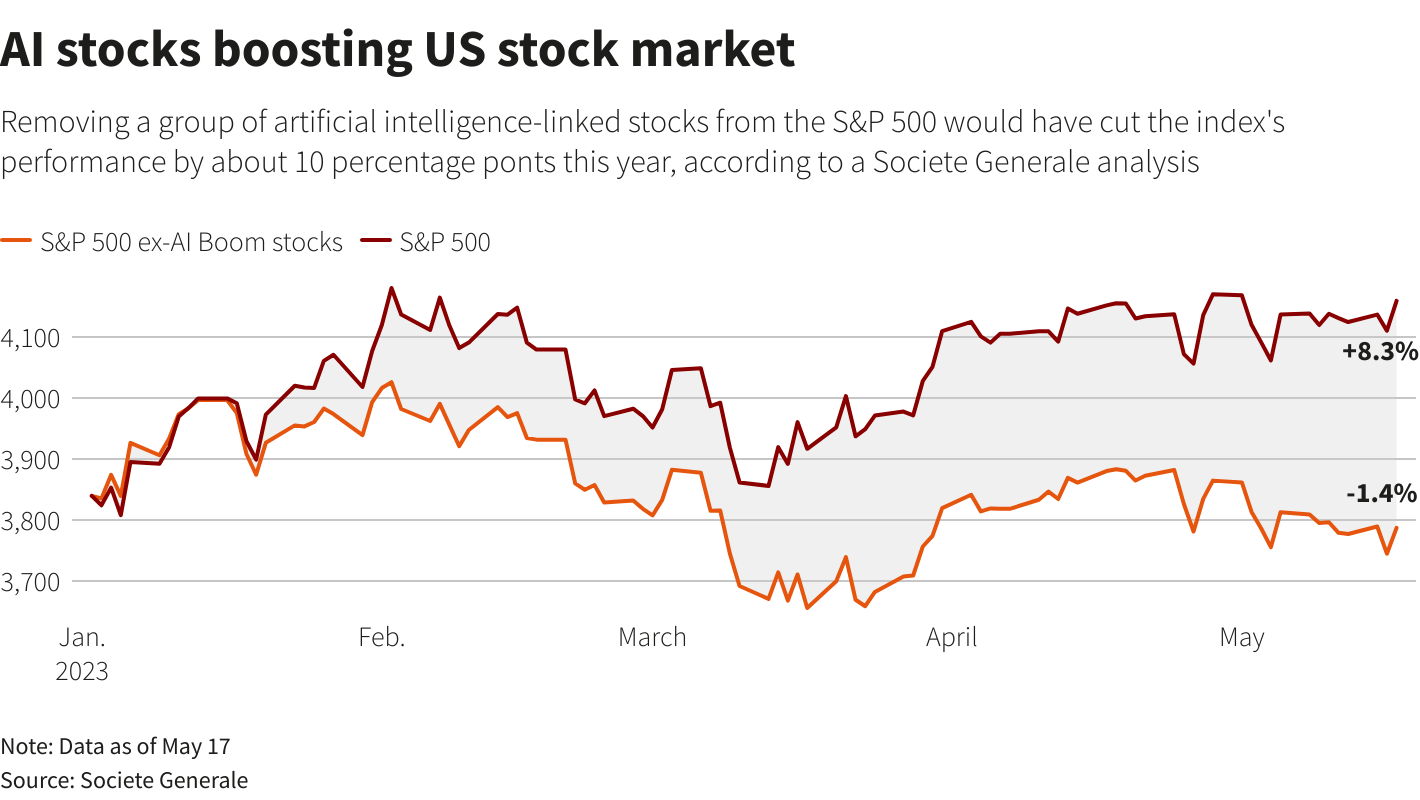

The global economic landscape has presented significant headwinds for emerging market currencies, including the Rupiah. The aggressive interest rate hikes by the US Federal Reserve, aimed at combating inflation in the US, have strengthened the US dollar significantly. This has drawn capital away from emerging markets like Indonesia, increasing the demand for US dollars and putting downward pressure on the Rupiah.

- Increased Capital Outflows: Investors are moving their funds from higher-risk emerging markets to the safer haven of US dollar-denominated assets. This capital flight weakens the Rupiah.

- Strengthening US Dollar: The US dollar's strength makes Indonesian exports more expensive and imports cheaper, widening the current account deficit and further weakening the Rupiah.

- Data: For instance, the Rupiah depreciated by approximately X% against the US dollar in the last [Time Period - e.g., quarter, month]. (Replace X% and [Time Period] with actual data.)

Domestic Economic Factors

Internal economic factors also contribute to the Rupiah's weakness. Indonesia's current account balance, inflation rates, and government spending all play a significant role.

- Widening Current Account Deficit: A persistent current account deficit, where imports exceed exports, increases the demand for foreign currency, putting downward pressure on the Rupiah.

- Inflationary Pressures: High inflation erodes the purchasing power of the Rupiah, potentially leading to capital flight and further weakening the currency.

- Government Spending: Excessive government spending can lead to increased inflation and a wider budget deficit, both of which can negatively impact the Rupiah.

- Data: Indonesia's inflation rate reached Y% in [Month, Year], while the current account deficit stood at Z% of GDP in [Quarter, Year]. (Replace Y%, Z%, [Month, Year], and [Quarter, Year] with actual data).

The Impact on Indonesia's Foreign Exchange Reserves

The pressure on the Rupiah has directly impacted Indonesia's foreign exchange reserves.

Reserve Levels and Their Significance

Foreign exchange reserves are crucial for a nation's economic stability. They act as a buffer against external shocks, allowing the central bank to intervene in the foreign exchange market to stabilize the currency and meet external debt obligations.

- Reduced Buffer: The recent decline in Indonesia's forex reserves reduces the country's ability to manage currency fluctuations effectively.

- Debt Servicing: A dwindling reserve level makes it more challenging for Indonesia to meet its foreign debt obligations, potentially leading to further economic instability.

- Data: Bank Indonesia reported a decrease of A% in foreign exchange reserves to B trillion IDR as of [Date]. (Replace A%, B trillion IDR, and [Date] with actual data from Bank Indonesia.)

Bank Indonesia's Response

Bank Indonesia (BI), Indonesia's central bank, has taken several measures to address the Rupiah's depreciation and manage the decline in reserves.

- Interest Rate Hikes: BI has increased interest rates to attract foreign investment and curb inflation, making the Rupiah more attractive to investors.

- Foreign Exchange Market Intervention: BI may intervene in the foreign exchange market by selling US dollars to increase the supply of Rupiah and support its value.

- Macroprudential Measures: BI may implement measures to manage capital flows and limit excessive foreign exchange volatility.

- Effectiveness: The effectiveness of these measures is subject to ongoing evaluation and depends on both domestic and global economic conditions.

Looking Ahead: Prospects for the Rupiah and Indonesia's Economy

The outlook for the Rupiah and Indonesia's economy requires careful consideration of both short-term and long-term factors.

Short-Term Outlook

The short-term outlook for the Rupiah remains uncertain. Continued global economic uncertainty and potential further interest rate hikes by the US Federal Reserve could continue to exert downward pressure. However, if inflation in Indonesia eases and the current account deficit narrows, the Rupiah may stabilize.

- Risk Factors: Persistently high global inflation, further US dollar appreciation, and geopolitical instability remain significant risk factors.

- Potential for Recovery: A decline in global inflation and improved domestic economic conditions could help strengthen the Rupiah.

Long-Term Strategies

To enhance its economic resilience and reduce vulnerability to external shocks, Indonesia needs to implement long-term structural reforms.

- Export Diversification: Reducing reliance on specific export markets and increasing the diversity of exports can improve the country's resilience to global economic fluctuations.

- Foreign Direct Investment (FDI) Attraction: Attracting more FDI can bolster the Rupiah and support economic growth.

- Domestic Industry Development: Strengthening domestic industries reduces reliance on imports, improving the current account balance.

- Fiscal Prudence: Implementing sound fiscal policies and managing government debt effectively are essential for long-term economic stability.

Conclusion

The recent significant drop in Indonesia's foreign exchange reserves underscores the challenges posed by the current global economic climate and domestic economic conditions. The pressure on the Rupiah stems from a combination of global headwinds, including the strengthening US dollar and rising US interest rates, and domestic factors such as the current account deficit and inflation. Bank Indonesia's response, though crucial, will require ongoing monitoring and potential adjustments depending on evolving conditions. To ensure long-term economic stability, Indonesia needs a multi-pronged approach, including export diversification, increased FDI, and responsible fiscal management. Stay informed about developments affecting the Indonesian Rupiah and the country's economy; understanding the ongoing Rupiah pressure and its potential effects is crucial for both investors and policymakers. Consider the implications for your investment and economic planning in light of these developments.

Featured Posts

-

Nyt Spelling Bee April 4 2025 Hints Answers And Pangram Help

May 10, 2025

Nyt Spelling Bee April 4 2025 Hints Answers And Pangram Help

May 10, 2025 -

Trumps Transgender Military Ban An Examination Of The Rhetoric

May 10, 2025

Trumps Transgender Military Ban An Examination Of The Rhetoric

May 10, 2025 -

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025

The Daily Fox News Briefings Analyzing The Us Attorney Generals Role

May 10, 2025 -

Unexpected Wall Street Rally Reversal Of Bear Market Trends

May 10, 2025

Unexpected Wall Street Rally Reversal Of Bear Market Trends

May 10, 2025 -

Chinese Goods And The Trade War How Bubble Blasters And More Are Affected

May 10, 2025

Chinese Goods And The Trade War How Bubble Blasters And More Are Affected

May 10, 2025