Ryanair's Growth Prospects Under Threat From Tariff Wars; Buyback Plan Unveiled

Table of Contents

Tariff Wars: A Major Headwind for Ryanair's Expansion

Tariff wars pose a significant challenge to Ryanair's growth prospects. The imposition of tariffs on various goods, particularly impacting fuel prices, directly affects the airline's operational costs and profitability.

Fuel Costs and Increased Operational Expenses

- Increased Fuel Prices: Tariffs on imported oil and refined fuel products directly translate into higher fuel costs for Ryanair. This increase can significantly impact profitability, as fuel is a major operational expense for any airline.

- Impact on Ticket Prices: To offset increased fuel costs, Ryanair may be forced to increase ticket prices, potentially impacting passenger demand, especially in a price-sensitive market like budget air travel.

- Fuel Hedging Strategies: Ryanair, like other airlines, employs fuel hedging strategies to mitigate some of the risk associated with fluctuating fuel prices. However, the scale and unpredictability of tariff-induced price hikes may still negatively impact their effectiveness.

- Route Optimization and Expansion: Higher operational costs may force Ryanair to reassess its route network, potentially delaying or canceling expansion plans into new, less profitable markets.

Impact on Tourism and Passenger Numbers

Tariff wars can create economic uncertainty, impacting overall tourism and reducing passenger demand.

- Reduced Travel Due to Economic Uncertainty: Consumers may postpone travel plans due to concerns about economic instability stemming from tariff disputes. This directly affects Ryanair's passenger numbers and revenue streams.

- Shifts in Travel Patterns: Tariffs can lead to shifts in travel patterns, with consumers opting for closer destinations or alternative transportation methods. Ryanair needs to adapt its route optimization strategies to account for these changes.

Geopolitical Uncertainty and its Influence on Ryanair's Strategic Decisions

The broader geopolitical context of tariff wars introduces significant uncertainty for Ryanair's strategic decision-making.

- Route Planning and Expansion: Political instability in certain regions may make expansion into new markets riskier, necessitating careful evaluation and potentially delaying expansion plans.

- Operational Risks: Operating in politically unstable regions can expose Ryanair to increased operational risks, potentially including disruptions to flights and heightened security concerns.

Ryanair's Buyback Plan: A Sign of Confidence or a Defensive Move?

Ryanair's recent share buyback plan adds another layer of complexity to the analysis of its growth prospects. Let's examine the details and implications.

Details of the Buyback Program

The buyback program involves [insert specific details of the buyback plan here, including amount, timeline, etc.]. The rationale behind the buyback, as stated by Ryanair, is [insert Ryanair's official statement on the reasoning].

- Benefits for Shareholders: A share buyback can increase earnings per share and potentially boost the stock price, benefiting existing shareholders.

- Implications for Future Investment: The buyback may reduce funds available for future investments in fleet expansion, new routes, or technological upgrades.

Interpretation of the Buyback in the Context of Tariff Wars

The buyback's interpretation is multifaceted and open to various interpretations.

- Sign of Confidence: It could signal Ryanair's confidence in its long-term prospects, suggesting that management believes the current challenges are temporary and that the company will remain profitable.

- Defensive Strategy: Conversely, it could be a defensive move to return capital to shareholders in a challenging market environment, potentially boosting shareholder value in the face of headwinds.

Impact on Ryanair's Financial Position

The buyback program will impact Ryanair's financial position.

- Reduced Cash Reserves: The buyback will reduce Ryanair's cash reserves, which could limit its ability to weather unforeseen economic downturns or invest in future growth opportunities.

- Debt Levels: The buyback may increase Ryanair's debt levels if it is financed through borrowing.

Outlook for Ryanair's Growth Prospects: Navigating Uncertain Waters

Analyzing Ryanair's future growth necessitates a balanced assessment of the challenges and opportunities.

Analysis of Long-Term Growth Potential

Despite the challenges, Ryanair retains significant long-term growth potential.

- New Markets: Expansion into untapped markets, both within Europe and beyond, remains a significant opportunity.

- Ancillary Revenue: Increasing focus on ancillary revenue streams (e.g., baggage fees, seat selection) could enhance profitability.

- Technological Advancements: Investing in technological advancements can improve operational efficiency and reduce costs.

Comparison to Competitors

Ryanair's competitive position relative to other low-cost carriers (e.g., EasyJet, Wizz Air) is crucial in assessing its growth prospects. [Insert comparison of market share, competitive advantages, and strategies].

Recommendations for Investors

Based on the analysis, investors should [insert concise investment recommendations, e.g., hold, buy, sell, etc.]. The risks associated with tariff wars and the implications of the buyback plan should be carefully considered.

Conclusion: The Future of Ryanair's Growth Prospects

Ryanair's growth prospects are undeniably intertwined with the ongoing impact of tariff wars and its strategic response, exemplified by the share buyback. While the buyback presents a potential short-term benefit for shareholders, the long-term implications of escalating tariffs on operational costs and passenger demand remain a considerable concern. Navigating this uncertain environment requires adaptability, strategic resource allocation, and a keen eye on geopolitical developments. Stay tuned for further updates on Ryanair’s performance and how it continues to navigate these challenges to its growth prospects. Keep an eye on the evolving global economic landscape to understand how tariff wars will shape the future of Ryanair and other airlines.

Featured Posts

-

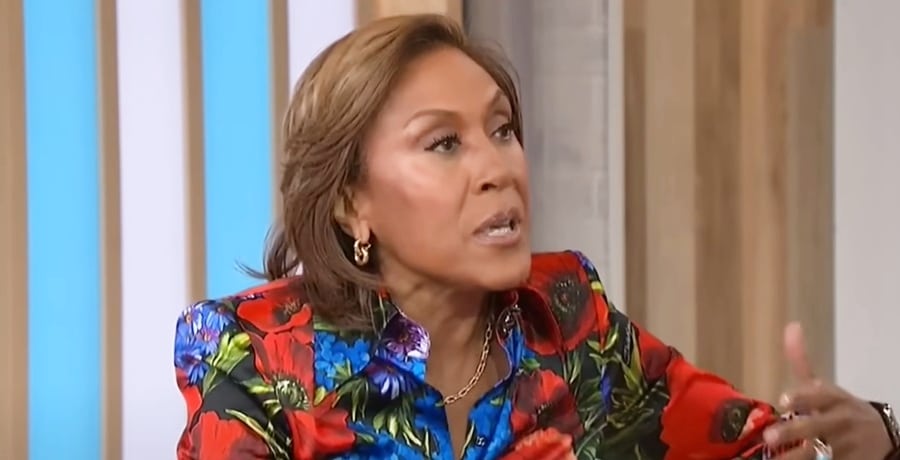

Family Grows Robin Roberts Emotional Announcement On Good Morning America

May 21, 2025

Family Grows Robin Roberts Emotional Announcement On Good Morning America

May 21, 2025 -

Wwe Raw Tyler Bate Returns Brings Back The Bruiserweight

May 21, 2025

Wwe Raw Tyler Bate Returns Brings Back The Bruiserweight

May 21, 2025 -

Self Guided Walking Holiday In Provence Mountains To Mediterranean Coast

May 21, 2025

Self Guided Walking Holiday In Provence Mountains To Mediterranean Coast

May 21, 2025 -

Paulina Gretzky Topless Selfie And Other Unseen Photos

May 21, 2025

Paulina Gretzky Topless Selfie And Other Unseen Photos

May 21, 2025 -

Juergen Klopp Nereye Gidecek Transfer Spekuelasyonlari Ve Analizi

May 21, 2025

Juergen Klopp Nereye Gidecek Transfer Spekuelasyonlari Ve Analizi

May 21, 2025