S&P 500 Jumps Over 3% On US-China Trade Truce

Table of Contents

The US-China Trade Truce: A Detailed Look

The unexpected announcement of a trade truce between the US and China sent shockwaves through global financial markets. This agreement, while not a complete resolution of the trade war, marks a significant de-escalation of tensions.

Key Concessions Made by Both Sides

Both sides made concessions, although the exact details remain somewhat opaque. Key agreements reportedly include:

- Tariff Reductions/Suspensions: Specific details on the reduction or suspension of existing tariffs on various goods are still emerging, but reports suggest a significant scaling back of tariffs on certain products. [Link to credible news source 1] [Link to credible news source 2]

- Increased Purchases of US Goods by China: China reportedly committed to increasing purchases of US agricultural products and other goods, aiming to reduce the US trade deficit.

- Duration and Conditions: The truce is expected to last for a specific timeframe, though the exact length isn't definitively stated publicly. The agreement is contingent on continued good-faith negotiations and the fulfillment of certain conditions.

Market Reaction to the Truce

The market reacted with palpable relief and optimism. The S&P 500’s sharp increase reflects investor confidence that the worst of the trade war may be behind us. Specific sectors experienced disproportionately positive reactions:

- Technology: The technology sector, heavily impacted by previous tariffs, saw a particularly strong rebound. Reduced trade barriers on technology goods and increased consumer confidence boosted investor sentiment.

- Manufacturing: Manufacturing and industrial companies also saw significant gains, reflecting expectations of increased exports and reduced production costs. [Insert chart/graph showing S&P 500 performance].

Analyzing the Impact on Specific Sectors

The US-China trade truce had a varied impact across different sectors, highlighting the interconnectedness of global markets.

Technology Sector Performance

Tech giants like Apple, Microsoft, and Intel experienced notable gains following the truce announcement. The reduction or suspension of tariffs on technology goods directly benefited these companies, improving their profitability and bolstering investor confidence. This surge reflects the market's expectation of a less volatile and more predictable business environment for tech companies.

Manufacturing and Industrial Sector Performance

The manufacturing and industrial sectors also benefited significantly. Reduced tariffs on raw materials and finished goods could lead to lower production costs and increased export opportunities. Companies in this sector are likely to see improved profit margins and increased competitiveness in the global market.

Potential Risks and Future Outlook

While the truce provides temporary respite, several uncertainties remain.

Lingering Uncertainties

Despite the positive market reaction, significant uncertainties persist:

- Enforcement: The effectiveness of the truce hinges on both sides' commitment to its terms. Any failure to meet obligations could easily reignite tensions.

- Future Disputes: The underlying structural issues between the US and China remain unresolved. Future trade disputes remain a distinct possibility.

- Global Economic Slowdown: The broader global economic climate could still negatively impact the S&P 500's performance regardless of the trade truce.

Expert Opinions and Predictions

Financial analysts offer mixed perspectives. While many see the truce as a positive development, some caution against excessive optimism, emphasizing the need for sustained dialogue and tangible progress. [Include quotes from relevant financial experts]. The long-term impact on the S&P 500 remains subject to ongoing developments in the US-China relationship and broader global economic trends.

Investor Strategies Following the S&P 500 Jump

The S&P 500's jump presents both opportunities and challenges for investors.

Opportunities and Challenges for Investors

The truce may open up new investment opportunities, particularly in sectors directly benefiting from reduced trade barriers. However, investors should remain cautious, acknowledging that the market is still susceptible to significant volatility.

Suggested Investment Strategies

It's crucial to remember that past performance does not guarantee future results. This article does not offer financial advice. Investors should consult with a qualified financial advisor to create a personalized investment strategy aligned with their risk tolerance and financial goals.

Conclusion: Understanding the S&P 500's Reaction to the US-China Trade Truce

The S&P 500's 3%+ jump following the US-China trade truce underscores the significant impact of trade policy on market sentiment. The agreement, while imperfect, brought a much-needed reduction in uncertainty, leading to a surge in investor confidence. Key factors driving this positive reaction include the potential for tariff reductions, increased trade between the two countries, and reduced risks for specific sectors like technology and manufacturing. However, lingering uncertainties and potential future disputes remain. Staying informed about further developments in the US-China trade relationship and its impact on the S&P 500 is crucial for making informed investment decisions. Understanding the intricacies of this dynamic relationship is key for navigating the complexities of the market and maximizing investment potential.

Featured Posts

-

Exploring The Themes Of The Hobbit The Battle Of The Five Armies

May 13, 2025

Exploring The Themes Of The Hobbit The Battle Of The Five Armies

May 13, 2025 -

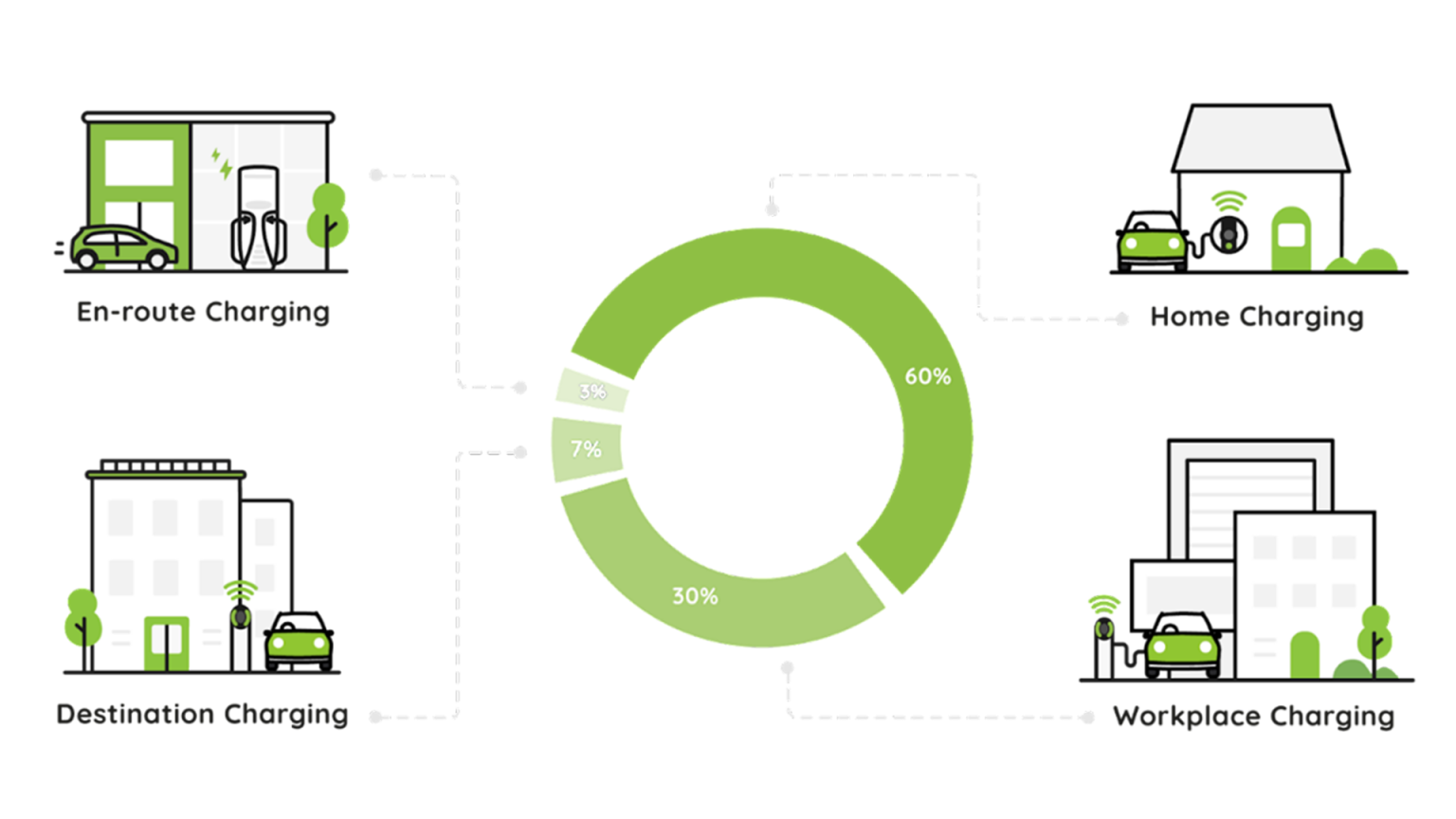

Byd 5 Minute Fast Charging Performance Challenges And The Future Of Evs

May 13, 2025

Byd 5 Minute Fast Charging Performance Challenges And The Future Of Evs

May 13, 2025 -

New Business Hotspots In Country Name A Regional Overview

May 13, 2025

New Business Hotspots In Country Name A Regional Overview

May 13, 2025 -

Apples Murderbot Diaries Goofy Sci Fi And Existential Dread

May 13, 2025

Apples Murderbot Diaries Goofy Sci Fi And Existential Dread

May 13, 2025 -

Is Byds 5 Minute Ev Charging Technology A Game Changer We Investigate

May 13, 2025

Is Byds 5 Minute Ev Charging Technology A Game Changer We Investigate

May 13, 2025