Sabadell And Unicaja: A Look At The Proposed Investment Deal

Table of Contents

The Proposed Deal Structure

The proposed merger between Banco Sabadell and Unicaja Banco involves a stock swap, aiming to create a stronger, more competitive entity in the Spanish banking sector. This isn't a simple acquisition; it's a significant restructuring designed to leverage the strengths of both institutions.

-

Specifics of the exchange ratio: The precise exchange ratio of Sabadell and Unicaja shares will be determined based on valuations and negotiations between the two banks, subject to regulatory approvals. This ratio dictates how many shares of the new combined entity each existing shareholder will receive.

-

Timeline for completion of the deal: The merger is anticipated to be finalized within a specific timeframe, contingent upon fulfilling regulatory requirements and completing necessary due diligence processes. Delays are possible, given the intricate nature of such large-scale financial transactions.

-

Regulatory approvals required: Securing approval from the relevant Spanish and European regulatory bodies, such as the Bank of Spain (Banco de España) and the European Central Bank (ECB), is crucial for the deal's success. These approvals involve rigorous assessments of the merger's impact on competition, financial stability, and customer protection.

-

Potential synergies and cost savings: The primary driver behind the merger is the potential for significant cost savings through streamlining operations, eliminating redundancies, and leveraging shared resources. This includes consolidating IT infrastructure, back-office functions, and branch networks, which should result in enhanced efficiency and profitability.

Benefits for Sabadell and Unicaja

The merger offers significant benefits for both Banco Sabadell and Unicaja Banco, leading to a stronger combined entity.

Benefits for Banco Sabadell:

-

Increased market share and competitive advantage: The combined entity will achieve a larger market share in Spain, enhancing its competitiveness against larger rivals. This increased scale provides bargaining power with suppliers and clients.

-

Improved profitability through economies of scale: Consolidation of operations will create significant cost savings, leading to improved profitability and higher returns for shareholders.

-

Expansion into new geographic markets: The merger could lead to expansion into new regions where either bank currently has a weaker presence, optimizing network reach and customer access.

-

Diversification of revenue streams: Combining the customer bases and product offerings of both banks leads to a more diversified revenue stream, reducing reliance on any single segment and strengthening resilience against market fluctuations.

-

Strengthened capital position: The combined entity will benefit from a stronger capital base, improving its financial stability and risk profile. This enhanced capital position allows for increased lending capacity and investment opportunities.

Benefits for Unicaja Banco:

-

Access to greater resources and technology: Unicaja will gain access to Sabadell's resources, potentially including advanced technology platforms, improved infrastructure, and broader expertise.

-

Enhanced brand recognition and customer base: The merger will combine the customer base of both banks, expanding the overall customer reach. Furthermore, Sabadell's broader brand recognition may positively influence Unicaja's market position.

-

Opportunities for career advancement for employees: While job losses are a potential concern (discussed later), the enlarged entity may also create new career opportunities and advancement paths for employees of both banks.

-

Improved financial stability and resilience: By joining forces with Sabadell, Unicaja will attain improved financial stability and resilience against economic downturns and market volatility.

Challenges and Potential Risks

While the Sabadell and Unicaja merger offers significant potential, several challenges and risks must be addressed.

-

Integration challenges following the merger: Combining two large banking institutions is a complex process. Integrating different IT systems, operational processes, and corporate cultures can be challenging and time-consuming.

-

Potential job losses due to redundancies: Overlapping roles and functions within the merged entity will likely lead to redundancies, resulting in potential job losses. This aspect will require careful management to minimize social impact and maintain employee morale.

-

Regulatory hurdles and antitrust concerns: Obtaining regulatory approvals requires navigating a complex regulatory landscape, including antitrust concerns related to potential market concentration. This process can be lengthy and uncertain.

-

Impact on customer service and branch network: The merger may impact customer service levels, particularly during the integration period. Decisions on branch closures or consolidations could also affect customer access and convenience.

-

Market reaction and investor sentiment: The market's reaction to the proposed merger is crucial. Negative investor sentiment could impact the deal's success and the value of the combined entity.

Impact on the Spanish Banking Sector

The Sabadell and Unicaja merger will have a significant impact on the Spanish banking sector.

-

Increased concentration in the market: The merger will result in increased concentration within the Spanish banking market, leading to a reduction in the number of major players.

-

Potential impact on competition and pricing: Reduced competition could lead to less price competition and potentially higher fees for customers. Regulatory bodies will carefully monitor this aspect.

-

Implications for smaller banks and credit unions: The merger could put pressure on smaller banks and credit unions, increasing competition and potentially forcing consolidation within this segment of the market.

-

Government response and regulatory oversight: The Spanish government and regulatory authorities will closely monitor the merger, ensuring it adheres to competition rules and protects the interests of customers and financial stability.

Analysis of the Investment Deal's Success

The success of the Sabadell and Unicaja investment deal hinges on several key factors.

-

Effective integration strategies: A well-planned and effectively executed integration process is paramount for minimizing disruption and maximizing synergies.

-

Customer retention and satisfaction: Maintaining high levels of customer satisfaction during and after the merger is vital for preventing customer churn and preserving the combined entity's reputation.

-

Management capabilities and execution: The leadership team's ability to manage the complex integration process and effectively lead the combined entity will be critical for success.

-

Market conditions and economic outlook: The overall economic climate and market conditions will significantly influence the merger's outcome. A strong economy will favor success, while an economic downturn could present additional challenges.

Conclusion

This article analyzed the proposed investment deal between Banco Sabadell and Unicaja Banco, highlighting the potential benefits and challenges. The success of this merger will depend on effective integration, addressing regulatory concerns, and maintaining customer satisfaction. Understanding the complexities of this Sabadell and Unicaja merger is crucial for investors and stakeholders in the Spanish banking sector.

Call to Action: Stay informed about the latest developments in this significant Sabadell and Unicaja investment deal by following our future updates and analyses of the Spanish banking sector. Continue to explore this crucial merger and its impact on the Spanish financial landscape. Learn more about the Sabadell and Unicaja merger and its future implications.

Featured Posts

-

Evreyskaya Avtonomnaya Oblast I Programma Gazifikatsii Ot Gazproma

May 13, 2025

Evreyskaya Avtonomnaya Oblast I Programma Gazifikatsii Ot Gazproma

May 13, 2025 -

Prediksi Akurat Skor Ac Milan Vs Atalanta Head To Head And Lineup Pemain

May 13, 2025

Prediksi Akurat Skor Ac Milan Vs Atalanta Head To Head And Lineup Pemain

May 13, 2025 -

Summer Adventures Chris And Megs Wild Journey

May 13, 2025

Summer Adventures Chris And Megs Wild Journey

May 13, 2025 -

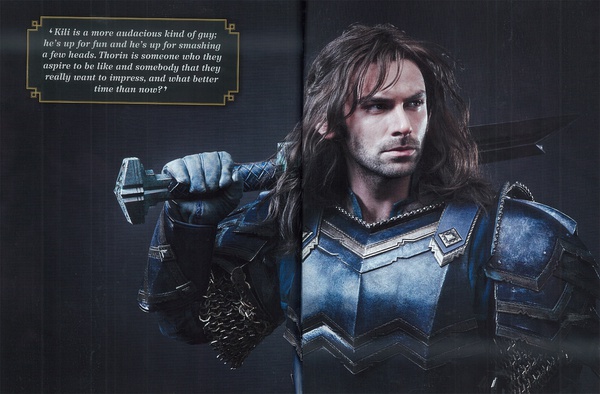

The Hobbit The Battle Of The Five Armies A Comprehensive Guide

May 13, 2025

The Hobbit The Battle Of The Five Armies A Comprehensive Guide

May 13, 2025 -

Leonardo Di Caprios Near Miss The Romeo Juliet Rollerblading Incident

May 13, 2025

Leonardo Di Caprios Near Miss The Romeo Juliet Rollerblading Incident

May 13, 2025