Sabic's Gas Business IPO: Details And Implications For Saudi Arabia

Table of Contents

Details of the SABIC Gas Business IPO

Assets Included in the IPO

The SABIC gas business IPO offering includes a substantial portfolio of gas-related assets and subsidiaries. These assets are crucial to Saudi Arabia's energy infrastructure and represent a significant portion of the country's gas production and processing capabilities. The precise composition of the IPO offering may vary based on the final regulatory approvals. However, key assets expected to be included are:

- Gas pipelines: A network of strategically located pipelines facilitating the transportation of natural gas across the kingdom.

- Gas processing plants: Facilities responsible for processing raw natural gas into marketable products, including ethane, propane, butane, and other valuable petrochemicals.

- Associated gas production facilities: Assets linked to oil production, capturing and processing associated gas to enhance efficiency and reduce flaring.

- Petrochemical feedstock production: Facilities producing essential feedstock for downstream petrochemical industries.

The estimated value of the assets being offered is substantial, expected to be in the billions of dollars, making this one of the largest IPOs in the region's history. Strategic partnerships and joint ventures related to these assets could also be part of the IPO package, potentially enhancing its attractiveness to investors. Further details regarding specific asset valuations and joint venture involvement will be made available closer to the listing date.

IPO Timeline and Process

The SABIC gas business IPO timeline involves several key stages. The process is subject to regulatory approvals and market conditions. While specific dates are subject to change, the general timeline typically includes:

- Pre-IPO Preparations: Including financial audits, legal due diligence, and preparation of the IPO prospectus.

- Regulatory Approvals: Securing all necessary approvals from the Saudi Capital Market Authority (CMA) and other relevant bodies.

- Marketing and Roadshows: Presentations to potential investors to gauge interest and determine pricing.

- Share Allocation: Determining the allocation of shares to institutional and retail investors.

- Listing Date: The official date when shares begin trading on the Saudi Tadawul exchange.

The share offering percentage, pricing strategy, and selection of underwriters and advisors will significantly influence the overall success of the IPO. Regular updates from SABIC and the CMA will provide clarity on the exact timing and details of these key phases.

Regulatory Approvals and Compliance

Securing the necessary regulatory approvals is paramount for the successful completion of the SABIC gas business IPO. The Saudi Capital Market Authority (CMA) plays a central role in overseeing this process, ensuring compliance with all relevant laws and regulations. This includes thorough due diligence, comprehensive disclosure requirements, and adherence to strict corporate governance standards.

- CMA Approval: The CMA's rigorous approval process involves a detailed review of the IPO prospectus, financial statements, and other relevant documents.

- Legal Compliance: Ensuring full compliance with Saudi Arabian laws and regulations related to public offerings and securities trading.

- Transparency: Maintaining transparency throughout the process is crucial to build investor confidence and attract both domestic and international investment.

The successful navigation of these regulatory hurdles underscores SABIC's commitment to transparency and accountability. The detailed compliance procedures ensure a fair and efficient IPO process.

Implications for Saudi Arabia's Economy

Impact on the Energy Sector

The SABIC gas business IPO has significant implications for Saudi Arabia's energy sector. It contributes directly to the kingdom's Vision 2030 goals, aiming for economic diversification and reduced reliance on oil revenue.

- Energy Diversification: The IPO helps diversify the energy sector, reducing dependence on oil and promoting the growth of the gas sector.

- Investment in Renewables: The infusion of capital from the IPO can facilitate investments in renewable energy sources, aligning with the kingdom's broader sustainability objectives.

- Market Competition: The increased involvement of private capital in the gas sector could promote healthy market competition and enhance efficiency.

Financial Market Impacts

The IPO is expected to have a considerable impact on the Tadawul, Saudi Arabia's stock exchange, and the broader Saudi capital markets.

- Increased Market Liquidity: The introduction of a large, well-regarded asset like SABIC's gas business can enhance market liquidity and attract more investors.

- Foreign Investment: A successful IPO can attract substantial foreign investment, boosting capital inflows into the Saudi economy.

- Market Capitalization: The IPO will likely increase the overall market capitalization of the Tadawul, further strengthening its position as a regional financial hub.

Broader Economic Implications

Beyond the energy and financial sectors, the Sabic Gas Business IPO holds broader implications for the Saudi Arabian economy:

- Job Creation: The increased activity in the gas sector and related industries can lead to significant job creation opportunities.

- Economic Growth: The inflow of capital and the enhanced efficiency of the energy sector can contribute to higher GDP growth.

- Economic Diversification: The success of this IPO further demonstrates the kingdom's commitment to economic diversification, reducing its reliance on oil revenues.

Conclusion

The Sabic Gas Business IPO is a landmark event for Saudi Arabia, signifying a crucial step in its economic diversification strategy and its commitment to Vision 2030. The successful execution of this IPO will not only have significant implications for the kingdom's energy sector and financial markets but also contribute to broader economic growth and job creation. Staying informed about the progress and outcomes of this Sabic Gas Business IPO is crucial for anyone interested in the Saudi Arabian economy and its future. Further research into the detailed financial reports and announcements surrounding the IPO will provide even deeper insights into the success and impact of this significant undertaking.

Featured Posts

-

Austrias Eurovision 2025 Win Resilience Against Protest

May 19, 2025

Austrias Eurovision 2025 Win Resilience Against Protest

May 19, 2025 -

Ufc 313 Star Concedes Opponent Deserved Victory After Robbery Claims

May 19, 2025

Ufc 313 Star Concedes Opponent Deserved Victory After Robbery Claims

May 19, 2025 -

Spring Budget Update Public Remains Wary Of Government Plans

May 19, 2025

Spring Budget Update Public Remains Wary Of Government Plans

May 19, 2025 -

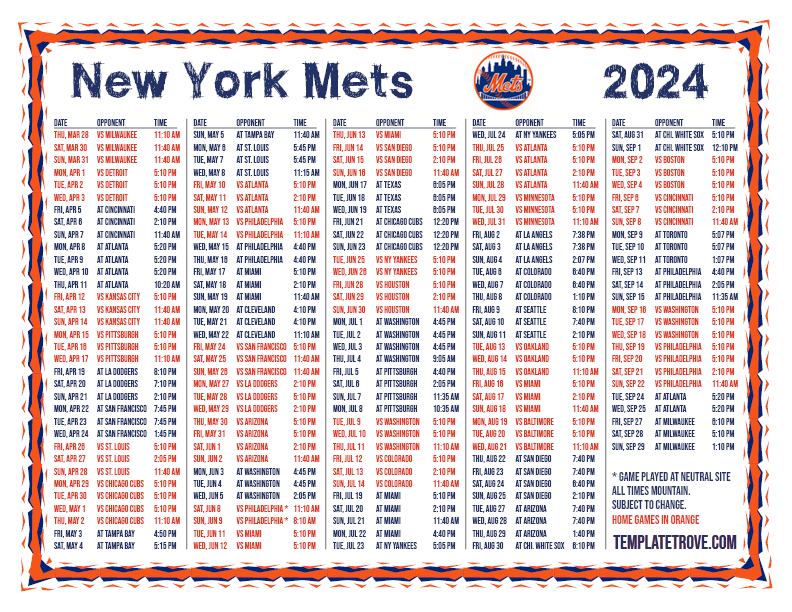

Ny Mets Schedule 3 Crucial May Series That Will Define Their Season

May 19, 2025

Ny Mets Schedule 3 Crucial May Series That Will Define Their Season

May 19, 2025 -

Star Wives And Financial Inequality A Look At The Hidden Costs

May 19, 2025

Star Wives And Financial Inequality A Look At The Hidden Costs

May 19, 2025