Sasol (SOL) Investor Concerns After Two-Year Strategy Silence

Table of Contents

Declining Profitability and Weakening Financial Performance

Recent financial reports paint a concerning picture for Sasol. Declining profitability and weakening financial performance are central to the escalating Sasol (SOL) investor concerns. Key performance indicators demonstrate a worrying trend. Fluctuating energy prices and global economic headwinds have significantly impacted the company's bottom line, exacerbating existing challenges.

- EPS Decline Year-over-Year: A consistent decline in earnings per share indicates a shrinking profit margin and reduced returns for shareholders, directly impacting investor confidence and contributing to Sasol investor uncertainty.

- Decreased Operating Margins: Falling operating margins demonstrate a decline in efficiency and profitability, raising concerns about Sasol's ability to compete effectively in a challenging market environment. This adds fuel to existing Sasol stock concerns.

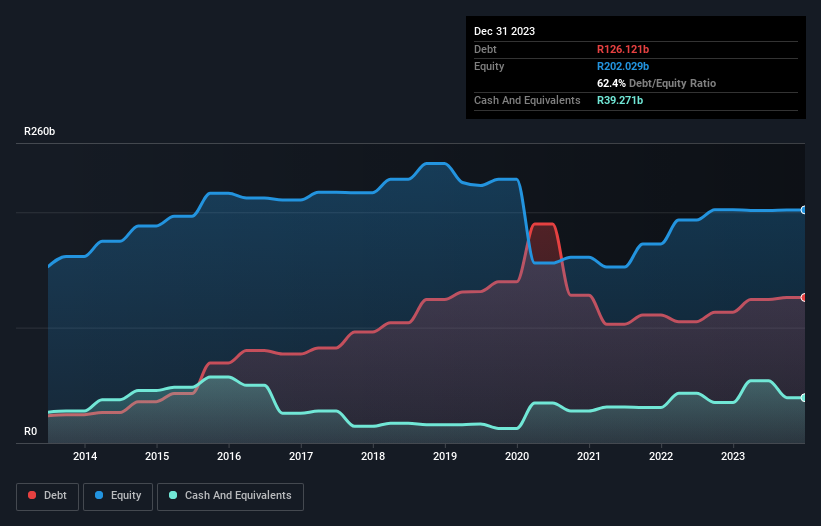

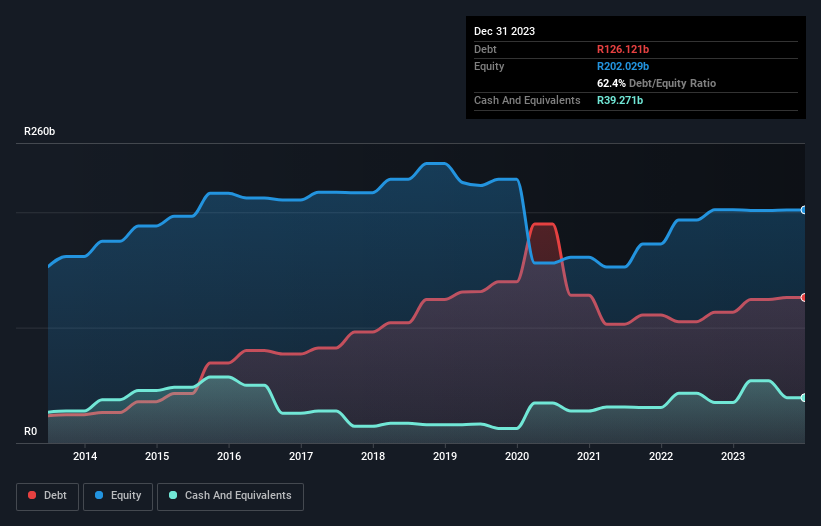

- Rising Debt-to-Equity Ratio: An increase in the debt-to-equity ratio signals a growing reliance on debt financing, increasing financial risk and further contributing to SOL share price volatility. This is a significant factor in overall Sasol (SOL) investor concerns.

- Impact of Commodity Price Volatility: Sasol's performance is heavily influenced by fluctuating commodity prices. The inability to effectively manage this volatility has directly impacted profitability and fueled Sasol investor uncertainty.

Lack of Clear Strategic Direction and Communication

The absence of a comprehensive strategic update for two years is a major source of Sasol (SOL) investor concerns. Transparency and clear communication are crucial for maintaining investor trust, and the lack thereof has fueled significant uncertainty. This silence contributes to anxieties about future growth prospects and profitability.

- Delayed Strategic Review Announcements: The prolonged delay in announcing strategic reviews suggests a lack of clear direction and planning, contributing to Sasol stock concerns and eroding investor confidence.

- Lack of Specific, Measurable Targets for Growth: The absence of concrete, measurable growth targets makes it difficult for investors to assess Sasol's future performance and potential returns, adding to Sasol investor uncertainty.

- Uncertainty Regarding Long-Term Sustainability Initiatives: In today's climate, investors increasingly prioritize ESG factors. Uncertainty surrounding Sasol's long-term sustainability initiatives contributes to investor hesitancy and negatively impacts SOL share price volatility.

- Limited Investor Engagement and Communication: Limited interaction with investors further compounds the issue, leaving shareholders feeling uninformed and fueling existing Sasol (SOL) investor concerns.

Growing Competition and Market Challenges

Sasol faces a highly competitive landscape and significant market challenges. The company's ability to adapt to changing energy markets and the rise of renewable energy sources is crucial, yet concerns persist. Furthermore, increasing ESG scrutiny adds another layer of complexity.

- Intense Competition in the Chemical Industry: Sasol operates in a fiercely competitive chemical industry, requiring continuous innovation and strategic adaptation to maintain market share. This intensifies Sasol stock concerns.

- Shifting Energy Landscape and Growing Pressure from Renewable Sources: The transition towards renewable energy sources poses a substantial challenge to Sasol's traditional business model, contributing to SOL share price volatility.

- Increasing ESG Scrutiny and its Impact on Investment Decisions: Growing environmental, social, and governance concerns are influencing investor decisions, and Sasol needs to effectively address these concerns to regain investor trust and alleviate Sasol (SOL) investor concerns.

- Geopolitical Risks and Their Influence on the Company's Operations: Geopolitical instability and unforeseen events can significantly impact Sasol's operations and profitability, adding another layer of uncertainty for investors.

Conclusion: Addressing Sasol (SOL) Investor Concerns and Looking Ahead

The growing Sasol (SOL) investor concerns stem from a combination of factors: declining profitability, a lack of strategic direction and communication, and significant market challenges. Regaining investor trust requires clear communication, a well-defined strategic roadmap, and proactive management of financial performance and ESG concerns. Sasol needs to address these issues decisively to stabilize SOL share price volatility. Investors should carefully monitor Sasol's upcoming announcements, conduct thorough due diligence, and remain informed about developments to effectively manage their Sasol (SOL) investment and address their Sasol stock concerns. Further research into Sasol's future strategy is crucial for navigating the uncertainty surrounding this investment.

Featured Posts

-

Remont Pivdennogo Mostu Khto Skilki Ta Koli Zvit Pro Proekt

May 21, 2025

Remont Pivdennogo Mostu Khto Skilki Ta Koli Zvit Pro Proekt

May 21, 2025 -

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025 -

Pelatih Mana Yang Akan Bawa Liverpool Juara Liga Inggris 2024 2025

May 21, 2025

Pelatih Mana Yang Akan Bawa Liverpool Juara Liga Inggris 2024 2025

May 21, 2025 -

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025 -

Die Finale Bauform Entscheidungen Der Architektin Vor Ort

May 21, 2025

Die Finale Bauform Entscheidungen Der Architektin Vor Ort

May 21, 2025