Sasol (SOL) Investor Concerns Following 2023 Strategy Presentation

Table of Contents

Sasol's 2023 strategy presentation aimed to showcase its transition towards a lower-carbon energy portfolio while maintaining profitability. However, the market response revealed underlying anxieties about the company's financial health and the feasibility of its long-term plans. This analysis delves into the key concerns emerging from the presentation.

Debt Levels and Financial Stability Concerns for Sasol (SOL)

High Debt Burden

Sasol carries a substantial debt burden, a major source of Sasol (SOL) investor concerns. Compared to previous years and industry benchmarks, its debt-to-equity ratio remains relatively high.

- Debt-to-Equity Ratio: [Insert current ratio, source needed]. This figure indicates a higher level of financial leverage compared to [mention a competitor or industry average, source needed].

- Interest Payments: [Insert annual interest expense, source needed]. These significant payments strain cash flow and reduce funds available for reinvestment and debt reduction.

- Credit Ratings: Sasol's credit rating currently stands at [Insert rating and agency, source needed]. Any further downgrade could increase borrowing costs and limit access to capital.

The high debt level raises concerns about Sasol's ability to weather economic downturns, fund future investments, and maintain its dividend payouts. A potential credit rating downgrade could further exacerbate these challenges, impacting investor confidence and potentially leading to a further decline in the stock price.

Capital Expenditure Plans and Debt Reduction Strategy

Sasol has outlined ambitious capital expenditure plans and a debt reduction strategy. However, the feasibility and effectiveness of these plans remain a key point of contention for many investors.

- Planned Investments: Sasol intends to invest heavily in [mention specific projects, e.g., renewable energy projects, etc., source needed]. The success of these projects is critical for generating future revenue streams.

- Debt Reduction Timeline: The company aims to reduce its debt by [mention percentage or specific amount, source needed] within [mention timeframe, source needed]. This timeline needs careful evaluation for its realistic achievability.

- Impact on Free Cash Flow: The substantial capital expenditure could negatively impact free cash flow in the short term, potentially hindering debt reduction efforts and dividend payments.

The success of Sasol's debt reduction strategy hinges on the successful execution of its capital expenditure plans and achieving the projected returns from these investments. Any delays or cost overruns could significantly impact the company's financial stability and heighten Sasol (SOL) investor concerns.

Concerns Regarding Sasol's (SOL) Energy Transition Strategy

Shifting Market Dynamics and Energy Transition Risks

Sasol's transition to a lower-carbon energy portfolio involves significant risks and uncertainties, driven by rapidly shifting market dynamics.

- Competitive Landscape: The energy sector is undergoing a dramatic transformation, with increasing competition from established renewable energy companies and new entrants.

- Government Regulations: Stringent environmental regulations and carbon pricing mechanisms are increasing the cost of carbon-intensive operations and forcing a rapid shift away from fossil fuels.

- Technological Advancements: Rapid advancements in renewable energy technologies are constantly improving the efficiency and cost-effectiveness of clean energy sources.

Sasol's ability to successfully navigate these challenges will determine its future success in the evolving energy landscape. The speed and effectiveness of its transition plans are crucial factors impacting profitability and market share. A delay or failure to adapt could leave the company at a significant competitive disadvantage.

ESG (Environmental, Social, and Governance) Performance and Investor Sentiment

Sasol's ESG performance is increasingly scrutinized by investors concerned about long-term sustainability.

- Carbon Emissions: Sasol's carbon footprint remains substantial, attracting criticism from environmentally conscious investors. [Mention current emissions data and reduction targets, source needed]

- Water Usage: Water scarcity poses a significant risk to Sasol's operations, particularly in water-stressed regions. [Mention water usage data and efficiency improvements, source needed].

- Social Responsibility Initiatives: Investors are increasingly evaluating companies' commitment to social responsibility and ethical practices. [Mention details of Sasol's social responsibility programs, source needed].

The alignment of Sasol's ESG strategy with investor expectations and broader market trends towards sustainable investing is crucial for attracting and retaining capital. Failure to address ESG concerns adequately could negatively affect investor sentiment and lead to capital flight.

Operational Efficiency and Profitability of Sasol (SOL) Operations

Production Costs and Commodity Prices

Sasol's profitability is heavily influenced by fluctuating commodity prices and production costs.

- Energy Prices: Energy price volatility significantly impacts production costs, especially for energy-intensive operations like Sasol's.

- Labor Costs: Labor costs are another crucial factor affecting profitability, especially considering potential labor disputes.

- Input Materials: The cost of raw materials and other input materials also plays a significant role in overall production costs.

Sasol's pricing strategies and their effectiveness in mitigating the impact of volatile market conditions are crucial for maintaining profitability. Effective cost management and hedging strategies are essential to navigate price fluctuations.

Operational Challenges and Unexpected Downtime

Unexpected plant downtime, maintenance issues, and labor disputes can significantly disrupt Sasol's operations and impact profitability.

- Recent Disruptions: [Mention specific examples of recent operational disruptions and their impact on production, source needed].

- Maintenance Issues: Regular and timely maintenance is crucial for preventing unexpected shutdowns and minimizing production losses.

- Labor Disputes: Labor relations and potential disputes pose a significant risk to operational continuity.

Sasol's resilience and ability to address potential operational challenges effectively are crucial for ensuring operational continuity and meeting production targets. Robust contingency plans are essential for mitigating the impact of unexpected disruptions.

Conclusion: Evaluating the Future Outlook for Sasol (SOL) Investors

The analysis reveals several key Sasol (SOL) investor concerns: high debt levels, the feasibility of its energy transition strategy, and the impact of operational challenges on profitability. These concerns, if not adequately addressed, could negatively impact Sasol's future performance. The company's success hinges on successfully managing its debt, effectively executing its energy transition strategy, and maintaining operational efficiency amidst fluctuating market conditions. The success of its planned capital expenditures and its ability to navigate ESG concerns will also be critical.

Before making any investment decisions related to Sasol (SOL), it's crucial to conduct thorough due diligence. Explore additional resources, monitor Sasol's announcements, and stay updated on the evolving landscape of Sasol (SOL) investment strategies to better understand and manage Sasol (SOL) investment risk. Understanding these concerns is paramount for developing informed Sasol (SOL) investment strategies.

Featured Posts

-

China Assembles Supercomputer In Space Technological Leap Forward

May 20, 2025

China Assembles Supercomputer In Space Technological Leap Forward

May 20, 2025 -

Premier Marche Africain Des Solutions Spatiales Mass Un Evenement Majeur A Abidjan

May 20, 2025

Premier Marche Africain Des Solutions Spatiales Mass Un Evenement Majeur A Abidjan

May 20, 2025 -

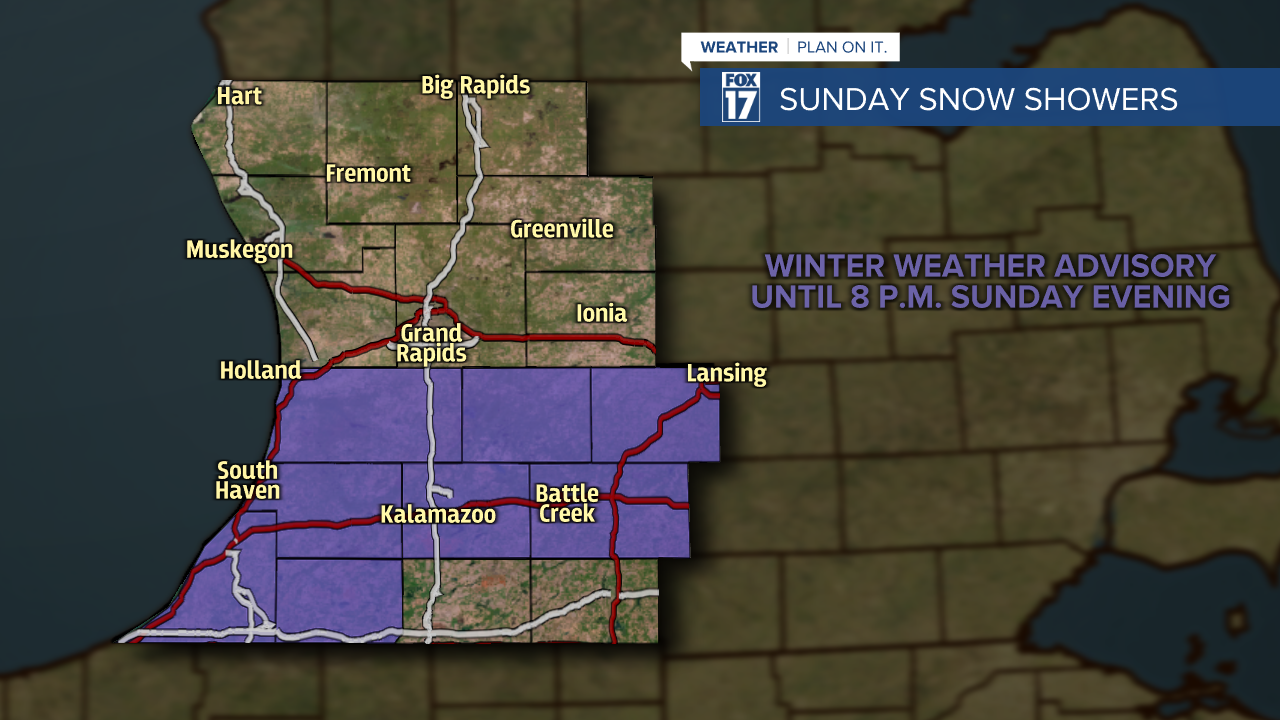

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025

Staying Informed School Delays And Winter Weather Advisories

May 20, 2025 -

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 20, 2025

Retired 4 Star Admiral Convicted On Four Bribery Charges

May 20, 2025 -

Affaire Aramburu Point Sur L Enquete Et La Traque Des Suspects Neo Nazis

May 20, 2025

Affaire Aramburu Point Sur L Enquete Et La Traque Des Suspects Neo Nazis

May 20, 2025