Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Sasol (SOL), a global integrated chemicals and energy company, is currently navigating a challenging period marked by declining share prices and increasing investor pressure for a clearer strategic direction. Recent financial performance, coupled with the accelerating global energy transition, has raised significant concerns, prompting demands for greater transparency and a robust roadmap for the future. This article examines the key issues driving investor anxieties and explores the potential pathways for Sasol to regain confidence and navigate its strategic challenges.

Declining Share Price and Investor Sentiment

Performance Under Scrutiny

Sasol's stock performance has been a major source of concern for investors. Recent months have witnessed significant drops in the SOL share price, underperforming many of its industry competitors. This decline reflects a broader erosion of investor confidence.

- Share Price Fluctuations: Over the past [insert time period], Sasol's share price has decreased by [insert percentage], significantly lagging behind the performance of [mention relevant industry indices or competitors].

- Investor Confidence Ratings: Several key investor sentiment indicators, such as [mention specific ratings or indices], have shown a marked downturn in confidence in Sasol's prospects.

- Analyst Downgrades: Numerous financial analysts have downgraded their ratings for Sasol stock, citing concerns about [mention specific concerns raised by analysts, e.g., debt levels, operational inefficiencies].

This negative sentiment stems from a confluence of factors, including high debt levels, operational challenges at some of its facilities, and broader market volatility exacerbated by global economic uncertainty.

Investor Concerns Regarding Debt and Capital Allocation

Sasol's substantial debt burden is a primary source of investor apprehension. The company's ability to effectively manage its debt while simultaneously investing in future growth projects and maintaining a sustainable dividend policy is under intense scrutiny.

- Debt Levels: Sasol currently carries a debt load of [insert figure], representing a significant portion of its balance sheet.

- Debt Restructuring: While Sasol has undertaken some debt restructuring initiatives [mention specifics if available], investors remain concerned about its long-term debt sustainability.

- Capital Expenditure Plans: Investor concerns center on whether Sasol's capital expenditure plans are appropriately balanced between maintaining existing operations, investing in new growth opportunities, and addressing its debt burden. A perceived lack of efficient capital allocation further fuels investor skepticism.

- Dividend Cuts: The possibility of future dividend cuts to conserve capital and improve its debt position is a major factor influencing investor sentiment.

The Energy Transition and Sasol's Response

Adapting to a Low-Carbon Future

The global energy transition presents both a challenge and an opportunity for Sasol. The company is facing increasing pressure to reduce its carbon footprint and transition towards more sustainable energy sources.

- Renewable Energy Investments: Sasol has announced investments in various renewable energy projects, including [mention specific examples, if any]. However, the scale and pace of these investments are subject to investor scrutiny.

- Carbon Emission Reduction Plans: Sasol's plans for reducing carbon emissions need to be more ambitious and demonstrably effective to satisfy investors concerned about long-term sustainability.

- ESG Initiatives: While Sasol has outlined ESG (Environmental, Social, and Governance) initiatives, their effectiveness and transparency remain areas of concern for investors.

Balancing Traditional Energy with Sustainability

Balancing its existing fossil fuel-based operations with its commitment to a sustainable future represents a significant strategic challenge for Sasol.

- Transitioning Away from Existing Assets: The challenge of transitioning away from existing, high-carbon assets without incurring substantial losses requires careful planning and communication.

- Short-Term Profitability vs. Long-Term Sustainability: Finding a balance between short-term profitability and achieving long-term sustainability goals is critical. Investors are looking for a clear and credible pathway that addresses both concerns.

- Clear Communication: Open and honest communication with investors regarding the company’s transition strategy is crucial to build trust and address concerns.

Sasol's Strategic Priorities and Communication Gaps

Lack of Transparency and Communication Failures

Several instances of perceived communication failures have contributed to negative investor sentiment. A lack of transparency and proactive engagement with investors has eroded confidence.

- Missed Communication Opportunities: Sasol has been criticized for missed opportunities to proactively communicate its strategy and address investor concerns.

- Delayed or Insufficient Information: Instances of delayed or insufficient information provided to investors have further fueled skepticism and uncertainty.

- Impact on Investor Confidence: Poor communication has directly impacted investor confidence, leading to a sell-off and further pressure on the share price.

The Need for a Clearer Long-Term Vision

To regain investor trust, Sasol needs a clear, detailed, and well-communicated long-term strategy that addresses the challenges it faces.

- Improved Transparency and Communication: Sasol needs to enhance transparency by providing more frequent and detailed updates on its performance, strategic initiatives, and ESG progress.

- Achievable and Measurable Goals: Setting clear, achievable, and measurable goals, along with a transparent reporting framework, is crucial.

- Stakeholder Engagement: Strengthened engagement with investors, analysts, and other stakeholders is essential for building confidence and trust.

Conclusion

Sasol (SOL) is at a crossroads. Addressing investor concerns regarding its financial performance, debt levels, and its approach to the energy transition is paramount for its future success. A transparent and well-communicated long-term strategy, coupled with decisive action on debt management and a demonstrable commitment to sustainability, are crucial for regaining investor confidence and charting a course towards sustainable growth. Stay informed on further developments in Sasol's strategy and the investor response by continuing to follow our updates on Sasol (SOL) and related keywords.

Featured Posts

-

Rain Forecast Update Precise Timing Of Showers And Downpours

May 20, 2025

Rain Forecast Update Precise Timing Of Showers And Downpours

May 20, 2025 -

Croissance Du Trafic Au Port Autonome D Abidjan Chiffres 2021 2022

May 20, 2025

Croissance Du Trafic Au Port Autonome D Abidjan Chiffres 2021 2022

May 20, 2025 -

Technologies Spatiales En Afrique Debut Du Marche Africain Des Solutions Spatiales Mass A Abidjan

May 20, 2025

Technologies Spatiales En Afrique Debut Du Marche Africain Des Solutions Spatiales Mass A Abidjan

May 20, 2025 -

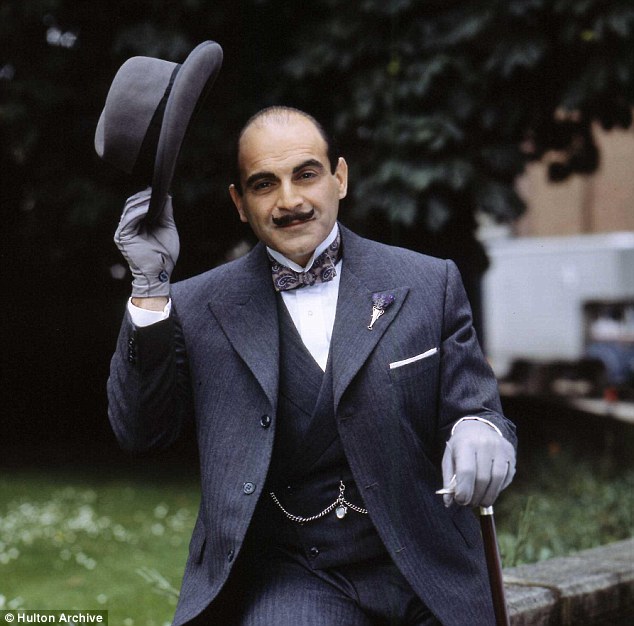

The Genius Of Agatha Christies Poirot Detective Skills And Character Analysis

May 20, 2025

The Genius Of Agatha Christies Poirot Detective Skills And Character Analysis

May 20, 2025 -

Mirra Andreeva Biografiya Statistika I Znachimye Matchi

May 20, 2025

Mirra Andreeva Biografiya Statistika I Znachimye Matchi

May 20, 2025