Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Sasol, a global integrated chemicals and energy company, recently released its 2023 strategy update. This update provides crucial insights into the company's future direction, financial performance, and strategic initiatives. This article will delve into the key takeaways from Sasol's 2023 strategy update, providing essential information for investors looking to understand the company's prospects and potential impact on their portfolios. This analysis will cover Sasol's financial performance, strategic growth plans, risk assessment, and the overall market outlook, offering a comprehensive view for informed investment decisions.

Financial Performance and Outlook

Sasol Revenue and Profitability

Sasol's 2023 financial results revealed [insert actual data from Sasol's report, e.g., a specific revenue figure and profit margin]. These figures reflect [insert analysis of performance, e.g., strong growth driven by increased demand for certain chemical products or a decline due to specific market conditions]. Key factors influencing Sasol's financial performance include:

- Commodity Prices: Fluctuations in the prices of oil, gas, and other raw materials significantly impact Sasol's profitability. [Discuss the impact of specific commodity price movements in 2023 on Sasol's financials].

- Operational Efficiency: Sasol's ongoing efforts to improve operational efficiency, including [mention specific examples from the report, e.g., streamlining production processes or optimizing energy consumption], have played a crucial role in [explain the positive or negative impact on the bottom line].

[Insert a relevant chart or graph illustrating Sasol's revenue and profitability trends over time. Clearly label the axes and provide a concise caption.]

Sasol Debt Reduction and Capital Allocation

Sasol's strategy for debt reduction focuses on [mention specific strategies outlined in the report, e.g., reducing capital expenditure, improving cash flow generation, or asset disposals]. The company aims to [state the target debt levels or debt reduction percentage]. Regarding capital allocation, Sasol's plans include:

- Dividend Payouts: [State the dividend policy, including any changes from the previous year]. This reflects [explain the rationale behind the dividend decision, e.g., commitment to shareholder returns or a need to conserve cash].

- Share Buyback Programs: [Detail any share buyback programs announced, including the scale and timing]. This signifies [explain the strategic implications of the buyback, e.g., increasing shareholder value or signaling confidence in the company's future].

The effectiveness of these strategies will be key in determining Sasol's future share price and overall shareholder value.

Strategic Initiatives and Growth Plans

Energy Transition and Sustainability

Sasol's 2023 strategy update highlighted its commitment to the energy transition and sustainability. The company plans to [mention specific targets and initiatives outlined in the report related to carbon emission reductions, renewable energy investments, or sustainable technologies]. Key initiatives include:

- Investment in Renewable Energy: Sasol is investing in [mention specific renewable energy projects or technologies, e.g., solar, wind, or biofuels].

- Carbon Emission Reduction Targets: Sasol has set ambitious targets to reduce its carbon emissions by [state the percentage or absolute reduction target]. This includes [mention specific strategies for achieving these goals].

- ESG (Environmental, Social, and Governance) Initiatives: Sasol is focusing on improving its ESG performance across various aspects, including [mention specific ESG initiatives].

These initiatives will be crucial for positioning Sasol in the evolving landscape of the chemical and energy industries.

Operational Efficiency and Cost Optimization

Sasol is actively pursuing operational efficiency and cost optimization to enhance profitability and competitiveness. Key initiatives include:

- Process Optimization: Implementing [mention specific process improvements] to enhance productivity and reduce waste.

- Technology Upgrades: Investing in [mention specific technologies or upgrades] to improve operational efficiency.

- Supply Chain Management: Optimizing the supply chain to reduce costs and improve delivery times.

The success of these initiatives will have a direct impact on Sasol's bottom line and its ability to compete effectively in a challenging market.

Risk Assessment and Market Outlook

Geopolitical and Economic Risks

Sasol faces several geopolitical and economic risks, including:

- Global Economic Slowdown: A potential global economic slowdown could reduce demand for Sasol's products, impacting revenue and profitability.

- Geopolitical Instability: Political instability in key regions could disrupt operations or affect supply chains.

- Commodity Price Volatility: Continued volatility in commodity prices poses a significant risk to Sasol's financial performance.

Sasol's strategies for mitigating these risks include [mention specific strategies from the report, e.g., hedging strategies or diversification].

Competitive Landscape

Sasol operates in a competitive landscape with key players such as [mention key competitors]. Sasol's competitive advantages include [mention specific advantages, e.g., technological expertise, integrated operations, or established market presence]. However, challenges include [mention specific challenges, e.g., competition from lower-cost producers or the need to adapt to changing market demands]. Maintaining a strong competitive position requires ongoing innovation, cost optimization, and a focus on sustainability.

Conclusion

Sasol's 2023 strategy update reveals a company focused on navigating a dynamic energy landscape while delivering value to shareholders. Key takeaways include the company's financial performance, strategic initiatives toward sustainability and operational efficiency, and an assessment of risks and market opportunities. Understanding these aspects is crucial for investors considering Sasol investments.

Call to Action: Stay informed about Sasol's ongoing progress and future strategic developments by regularly reviewing company announcements and analyses. Understanding the details of Sasol's 2023 strategy update is essential for making informed investment decisions in this crucial sector. Learn more about Sasol's investor relations resources to stay ahead of the curve on Sasol stock and future strategy updates.

Featured Posts

-

Pro D2 Colomiers Oyonnax Et Montauban Brive Apercu Des Rencontres

May 20, 2025

Pro D2 Colomiers Oyonnax Et Montauban Brive Apercu Des Rencontres

May 20, 2025 -

Tampoy Pos O Erotas I Fygi Kai I Syllipsi Sximatizoyn Tin Istoria Mas

May 20, 2025

Tampoy Pos O Erotas I Fygi Kai I Syllipsi Sximatizoyn Tin Istoria Mas

May 20, 2025 -

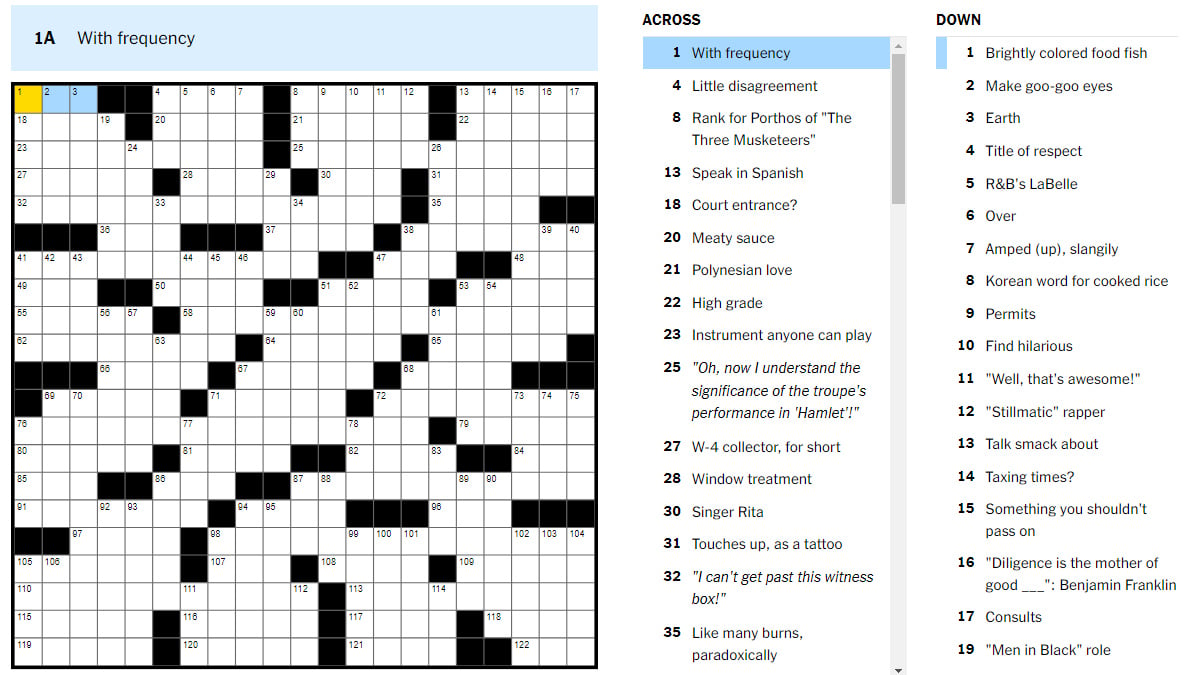

Marvel Avengers Crossword Clue Full Solution And Solving Tips For May 1st Nyt Mini

May 20, 2025

Marvel Avengers Crossword Clue Full Solution And Solving Tips For May 1st Nyt Mini

May 20, 2025 -

Balikatan Military Exercises Philippines And Us Pledge Increased Joint Training

May 20, 2025

Balikatan Military Exercises Philippines And Us Pledge Increased Joint Training

May 20, 2025 -

Hmrc Tax Refunds Are You One Of The Millions Due A Repayment

May 20, 2025

Hmrc Tax Refunds Are You One Of The Millions Due A Repayment

May 20, 2025