Saudi Wealth Fund Imposes One-Year Ban On PwC Advisory Services

Table of Contents

Details of the PIF's Ban on PwC Advisory Services

The Nature of the Ban

The PIF's ban encompasses a significant portion of PwC's advisory services within Saudi Arabia. While the exact details remain partially undisclosed, it's understood to include financial advisory, strategic consulting related to investments, and potentially aspects of auditing and accounting services linked to PIF projects. Currently, the ban appears geographically limited to Saudi Arabia; however, the potential for wider repercussions remains. It's not yet clear if the ban extends to all PwC entities or only specific subsidiaries operating within the Kingdom. While no publicly disclosed financial penalties accompany the ban, potential legal ramifications and reputational damage could result in significant indirect costs for PwC.

- Duration of the ban: One year.

- Specific services affected: Financial advisory, strategic consulting (investment-related), potentially aspects of audit and accounting.

- Geographical scope of the ban: Currently limited to Saudi Arabia.

- Other PwC entities affected: The exact extent of the impact on other PwC entities is yet to be determined.

- Financial penalties imposed: None publicly disclosed, but significant indirect costs are anticipated.

The ban follows an internal PIF investigation into PwC's conduct related to [mention the specific project or issue if publicly available; otherwise, use a general phrase like "a significant investment project"]. While the precise nature of the alleged breaches is confidential, the severity of the PIF's response underlines the seriousness of the situation and the importance of rigorous contractual adherence within Saudi Arabia's increasingly sophisticated financial landscape.

Impact on PwC's Business and Reputation

Financial Implications

The loss of PIF business represents a substantial financial blow to PwC. The PIF is a major player in global investment, and its patronage is highly sought after by leading consulting firms. The estimated revenue loss for PwC from this one-year ban could run into the tens of millions of dollars, potentially impacting its market share in Saudi Arabia and globally. The effect on PwC's stock price (if applicable) and investor confidence will likely be felt across financial markets.

- Estimated revenue loss for PwC: Significant, potentially tens of millions of dollars.

- Impact on PwC's market share: Negative impact, particularly in the Saudi Arabian market.

- Potential impact on PwC's stock price: Negative impact likely.

- Damage to PwC's reputation and brand image: Significant reputational damage, especially concerning trust and compliance.

This ban could also affect PwC’s ability to win future contracts, both within Saudi Arabia and internationally, as it challenges the firm's established reputation for reliability and adherence to best practices. Other sovereign wealth funds and government bodies worldwide will be keenly observing the situation and its implications for their own relationships with consulting firms.

Consequences for the Public Investment Fund (PIF)

Strategic Implications

The ban on PwC's advisory services presents strategic challenges for the PIF. Finding a suitable replacement advisor with equivalent expertise and understanding of the Saudi Arabian market within a short timeframe will be difficult. This could lead to delays in critical investment projects and increased costs associated with onboarding a new advisory team.

- Difficulty in finding suitable replacement advisors: High, due to the specialized expertise required.

- Potential delays in investment projects: A significant possibility, affecting timelines and ROI.

- Increased costs associated with finding a new advisor: Expected, adding to overall project expenditures.

- Potential impact on the PIF's overall investment performance: Could negatively impact returns if delays and increased costs are significant.

The loss of PwC's expertise and established relationship with the PIF could potentially impact the PIF's investment decisions, particularly in complex or sensitive transactions. The ability to swiftly and effectively leverage consulting expertise is crucial for a sovereign wealth fund managing vast assets and undertaking ambitious investment strategies.

Broader Implications for the Consulting Industry

Regulatory Scrutiny and Compliance

The PIF's decisive action against PwC underscores the increasing importance of regulatory compliance and ethical standards within the consulting industry, particularly in the volatile world of sovereign wealth fund management. This incident serves as a stark warning to all consulting firms operating in Saudi Arabia and globally.

- Increased pressure on consulting firms to maintain high ethical standards: Significantly heightened.

- Heightened regulatory scrutiny of consulting contracts: Anticipated across various jurisdictions.

- Potential for increased compliance costs for consulting firms: Likely, necessitating investment in enhanced compliance programs.

- Impact on competition within the consulting sector: Increased competition among firms with strong compliance records.

The event sets a precedent, potentially encouraging other sovereign wealth funds and governments to adopt stricter measures in evaluating and managing their relationships with consulting firms. This will likely lead to a more competitive environment in the consulting industry, with firms demonstrating strong ethical standards and impeccable compliance records enjoying a distinct advantage.

Conclusion

The Saudi Wealth Fund's one-year ban on PwC advisory services marks a significant development with far-reaching implications. The ban underscores the importance of robust compliance and ethical conduct within the consulting industry and highlights the significant consequences of non-compliance for both consulting firms and their clients. The impact extends beyond PwC, affecting the broader Saudi Arabian investment landscape and shaping future relationships between sovereign wealth funds and consulting firms globally. This event serves as a critical case study on risk management and regulatory compliance within the international financial sector. Stay updated on the latest news regarding the Saudi Wealth Fund and its impact on the global business landscape. Follow us for more in-depth analyses of the implications of this significant ban on PwC advisory services.

Featured Posts

-

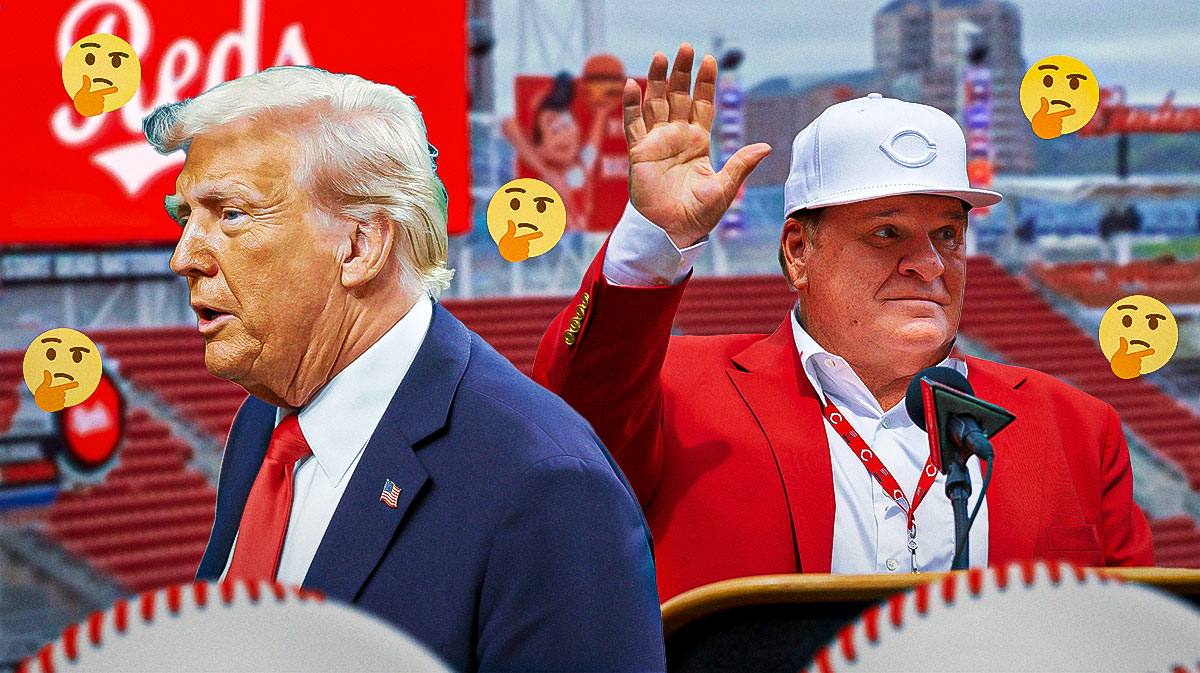

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Remembering The 2012 Louisville Tornado Impacts And Long Term Effects

Apr 29, 2025

Remembering The 2012 Louisville Tornado Impacts And Long Term Effects

Apr 29, 2025 -

Murder Conviction After Fatal Rock Throwing Incident Involving Teens

Apr 29, 2025

Murder Conviction After Fatal Rock Throwing Incident Involving Teens

Apr 29, 2025 -

Aiims Opd Reports A Surge In Young People Diagnosed With Adhd Uncovering The Reasons

Apr 29, 2025

Aiims Opd Reports A Surge In Young People Diagnosed With Adhd Uncovering The Reasons

Apr 29, 2025 -

Two Georgia Deputies Shot In Traffic Stop One Dies

Apr 29, 2025

Two Georgia Deputies Shot In Traffic Stop One Dies

Apr 29, 2025