Scandal-Hit PwC Shrinks Global Footprint: A Detailed Analysis

Table of Contents

The Impact of Major Scandals on PwC's Reputation and Client Base

Several high-profile scandals have severely damaged PwC's reputation and eroded client trust. These accounting scandals range from accusations of facilitating tax evasion for multinational corporations to significant audit failures that have led to regulatory investigations and hefty fines. The reputational damage has been substantial, leading to significant client loss and a decline in new business.

- Tax Evasion Allegations: PwC has faced intense scrutiny regarding its role in assisting corporations in tax avoidance schemes, leading to accusations of aiding and abetting illegal activities. These tax evasion scandals have resulted in substantial fines and reputational damage.

- Audit Failures: Instances of PwC failing to adequately detect and report financial irregularities in audits have led to significant audit failures, costing clients millions and damaging public trust. This has triggered regulatory investigations and eroded confidence in the firm's auditing capabilities.

- Loss of Key Clients: The combination of reputational damage and regulatory pressure has resulted in several high-profile clients severing ties with PwC. This client churn has directly impacted revenue and profitability. Specific examples of lost contracts, though often confidential, further highlight the severity of the situation.

PwC's Response: Restructuring and Downsizing Initiatives

In response to the cascading fallout, PwC has undertaken significant restructuring and cost-cutting measures. This has included widespread PwC layoffs, office closures in certain geographical regions, and a reassessment of its global operational strategy.

- Layoffs and Workforce Reduction: Significant PwC layoffs have been announced across various departments and geographical locations, impacting thousands of employees. These workforce reductions reflect the firm's attempt to reduce costs and streamline operations.

- Office Closures: Numerous office closures, particularly in areas where the impact of scandals was most keenly felt, have further shrunk PwC's physical global footprint. This consolidation aims to optimize resource allocation and reduce overhead.

- Leadership Changes: To signal a commitment to reform, PwC has also seen some changes in leadership, with new executives tasked with restoring trust and implementing improved internal controls.

Financial Implications and Long-Term Strategic Adjustments

The scandals and subsequent restructuring have had a profound financial impact on PwC. The firm has experienced a decline in profitability and a decrease in its market share, facing increased competition from other Big Four accounting firms.

- Reduced Profitability: The loss of clients and the cost of restructuring have directly affected PwC's profitability, impacting financial results and investor confidence.

- Market Share Decline: The reputational damage has made it more difficult for PwC to compete for new business, leading to a decrease in its market share relative to other major accounting and consulting firms.

- Long-Term Strategic Review: PwC is undertaking a comprehensive review of its long-term strategic goals and growth plans, acknowledging the need for significant adaptation in light of the recent events. This includes a reevaluation of its global presence and its service offerings.

The Future of PwC: Recovery and Adaptation Strategies

PwC's future hinges on its ability to rebuild trust and implement effective recovery strategies. This requires a multifaceted approach focusing on reputation management, improved risk management, and enhanced corporate governance.

- Reputation Management Initiatives: PwC is investing heavily in initiatives to regain public trust, emphasizing its commitment to ethical standards and improved internal controls.

- Strengthening Internal Controls: The firm is implementing more robust internal controls to prevent future scandals and ensure compliance with regulations. This includes enhanced auditing procedures and stricter ethical guidelines.

- Focus on Ethical Standards: A renewed emphasis on ethical conduct and corporate social responsibility is central to PwC's recovery strategy. This commitment needs to be demonstrably visible to clients and stakeholders alike.

Conclusion: Analyzing the Shrinking Global Footprint of Scandal-Hit PwC

The scandals affecting PwC have undeniably had a profound and lasting impact, shrinking its global footprint through significant restructuring, layoffs, and a decline in market share. The financial impact has been considerable, requiring a substantial reassessment of the firm’s long-term strategic direction. The path to recovery demands a sustained commitment to ethical practices, robust internal controls, and a demonstrable effort to regain the trust of clients and the public. What are your thoughts on PwC's future and the broader implications for the accounting industry? Share your perspective in the comments below and join the discussion on the future of PwC's global footprint. For further reading on similar cases and industry trends, explore [link to related article 1] and [link to related article 2].

Featured Posts

-

Where To Invest A Geographic Analysis Of New Business Hot Spots

Apr 29, 2025

Where To Invest A Geographic Analysis Of New Business Hot Spots

Apr 29, 2025 -

Nyt Spelling Bee February 10 2025 Solutions And Pangram

Apr 29, 2025

Nyt Spelling Bee February 10 2025 Solutions And Pangram

Apr 29, 2025 -

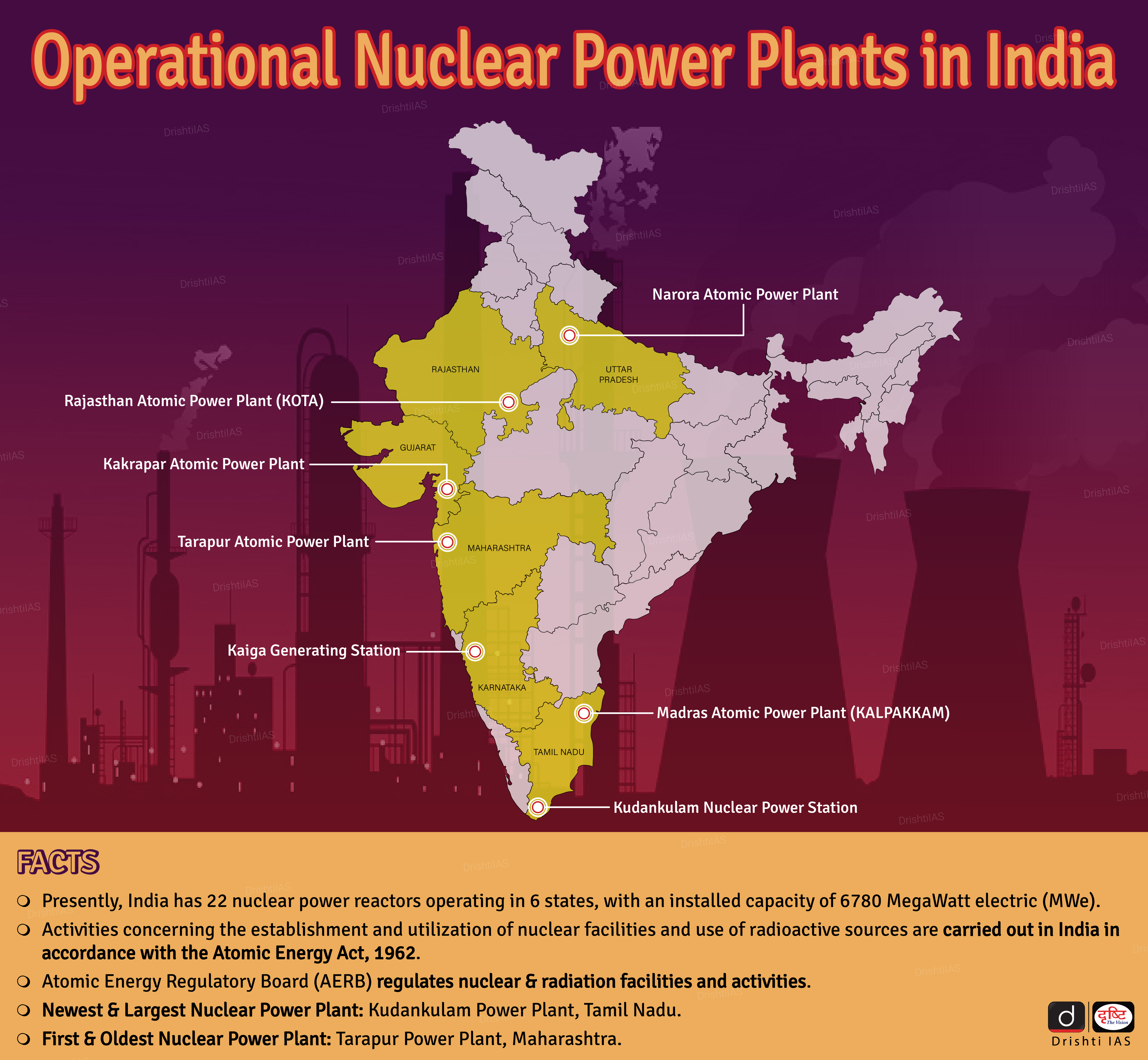

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025 -

Willie Nelsons Health Balancing Legacy With The Demands Of Touring

Apr 29, 2025

Willie Nelsons Health Balancing Legacy With The Demands Of Touring

Apr 29, 2025 -

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

Apr 29, 2025

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

Apr 29, 2025