Secure The Best Personal Loan Interest Rate Today

Table of Contents

Understanding Personal Loan Interest Rates

Understanding the factors that influence your personal loan interest rate is the first step toward securing a low rate. Several key elements determine how much you'll pay in interest.

Factors Affecting Your Interest Rate

-

Credit Score: Your credit score is the single most important factor determining your personal loan interest rate. Lenders use your FICO score (a widely used credit scoring model) to assess your creditworthiness. A higher credit score (generally above 700) signifies lower risk to the lender, resulting in lower interest rates. Conversely, a lower credit score indicates higher risk and will likely lead to higher interest rates. Check your credit score for free using services like [insert link to reputable credit score checking service].

-

Debt-to-Income Ratio (DTI): Your DTI is the ratio of your monthly debt payments to your gross monthly income. A high DTI suggests you're already carrying a significant debt load, making you a riskier borrower. Lenders prefer lower DTIs, as it indicates a greater ability to repay the loan. For example, a DTI of 36% or lower is generally considered good.

-

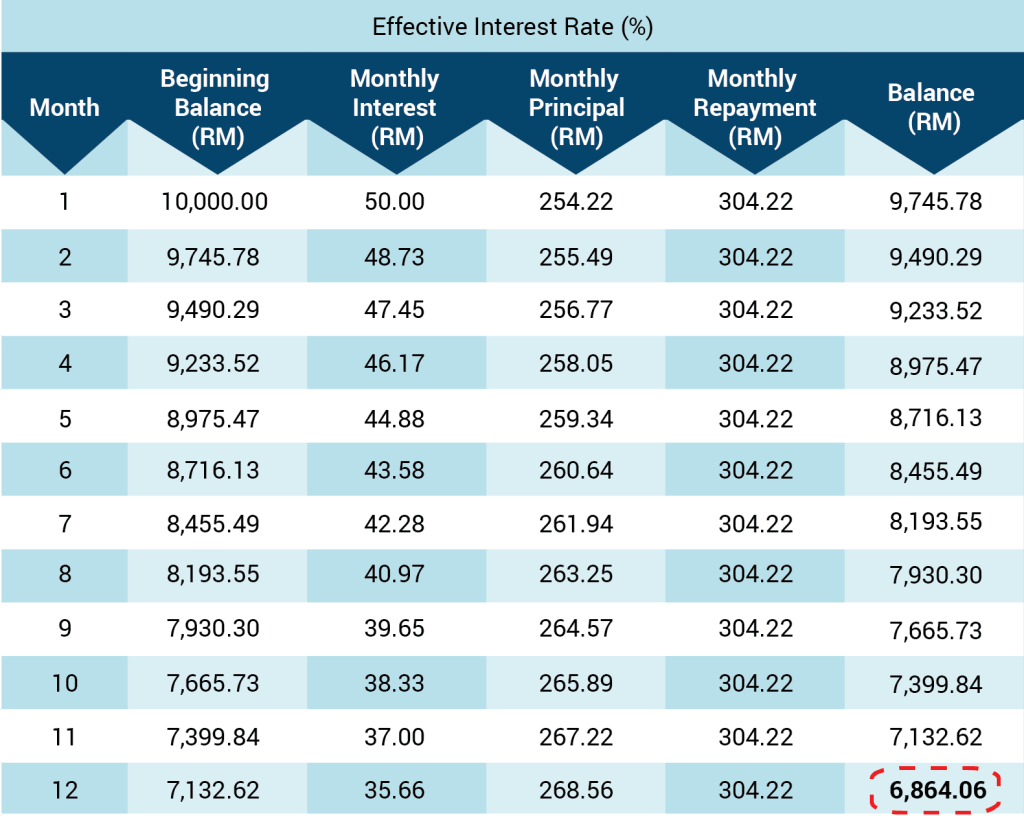

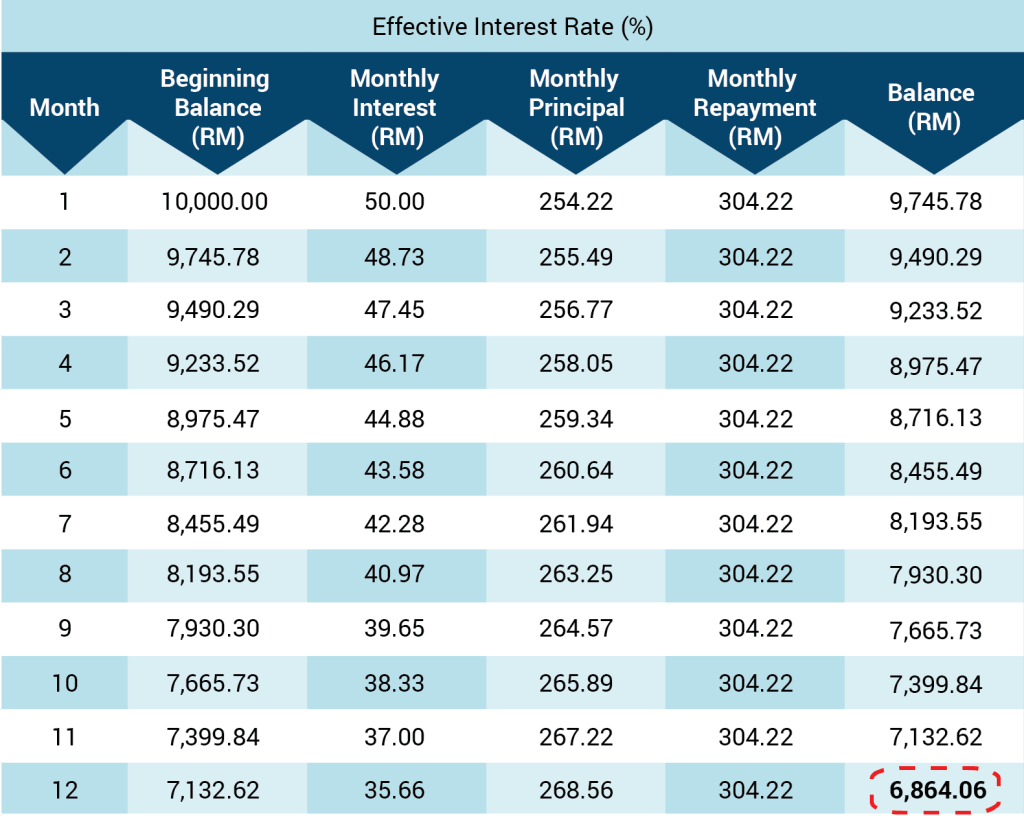

Loan Amount and Term: The amount you borrow and the repayment period both impact your interest rate. Larger loan amounts often come with higher interest rates, while longer loan terms can also result in higher overall interest payments, even if the monthly payments are lower.

-

Loan Type: Personal loans are broadly classified as secured or unsecured. Secured loans require collateral (like a car or savings account), reducing risk for the lender and often resulting in lower interest rates. Unsecured loans don't require collateral, making them riskier for lenders and therefore typically carrying higher interest rates.

-

Lender Type: Different lenders offer varying interest rates. Banks, credit unions, and online lenders each have their own lending criteria and interest rate structures. Banks often offer competitive rates but may have stricter eligibility requirements. Credit unions, typically member-owned, may offer more favorable rates to their members. Online lenders provide convenience but often have higher rates or fees.

Shopping Around for the Best Rates

Finding the best personal loan interest rate requires diligent comparison shopping.

-

Compare Multiple Lenders: Don't settle for the first offer you receive. Compare offers from several banks, credit unions, and online lenders to identify the most competitive rates.

-

Use Online Comparison Tools: Several reputable websites offer personal loan comparison tools that allow you to easily compare rates from different lenders based on your specific needs and financial profile. [insert link to reputable comparison website].

-

Negotiate with Lenders: Once you've found a few lenders with attractive rates, don't hesitate to negotiate. Highlight your strong credit history and financial stability to potentially secure a lower rate.

-

Check for Hidden Fees: Be wary of hidden fees such as prepayment penalties (fees charged for paying off the loan early), origination fees, or late payment fees. Carefully review all loan documents before signing.

Improving Your Chances of Getting a Lower Interest Rate

Proactive steps to improve your creditworthiness can significantly enhance your chances of securing a lower personal loan interest rate.

Boosting Your Credit Score

-

Pay Bills on Time: Consistent on-time payments are crucial for building a positive credit history. Even one missed payment can negatively impact your score.

-

Reduce Credit Utilization: Keep your credit utilization ratio (the amount of credit you're using compared to your total available credit) low. Aim for under 30% for optimal results.

-

Monitor Your Credit Report: Regularly check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for any errors that could be affecting your score. You can obtain free credit reports annually at [insert link to annualcreditreport.com].

Managing Your Debt

-

Consolidate High-Interest Debt: If you have high-interest debt (credit card debt, for example), consider consolidating it into a lower-interest personal loan. This can simplify your payments and potentially reduce your overall interest costs.

-

Create a Budget: A well-structured budget helps you track your income and expenses, allowing you to manage your finances effectively and improve your creditworthiness.

-

Pay Down Existing Debt: Reducing your existing debt lowers your DTI, making you a more attractive borrower and improving your chances of getting a lower interest rate on a new loan.

Securing Your Personal Loan

The final steps involve the actual application and loan process.

Pre-qualification vs. Application

Pre-qualification provides a preliminary estimate of your potential interest rate without impacting your credit score. A full application involves a hard credit check, which will affect your credit score, but is necessary to finalize the loan.

Document Preparation

Gather all necessary documents before applying. This typically includes proof of income, identification, and bank statements.

Reviewing Loan Terms Carefully

Before signing any loan agreement, thoroughly review all terms and conditions, including the interest rate, fees, repayment schedule, and any other stipulations.

Conclusion

Securing the best personal loan interest rate requires careful planning and proactive steps. By improving your credit score, managing your debt effectively, comparing offers from multiple lenders, and negotiating favorable terms, you can significantly reduce the overall cost of your loan. Remember to use online comparison tools to simplify the process and carefully review all loan documents before signing. Start comparing rates today and find the best personal loan interest rate to meet your financial needs! [insert link to a relevant resource].

Featured Posts

-

Column Analyzing The New Baseball Book Released For Opening Day

May 28, 2025

Column Analyzing The New Baseball Book Released For Opening Day

May 28, 2025 -

Mc Kennas Back Cajustes Progress Ipswich Town Injury Update

May 28, 2025

Mc Kennas Back Cajustes Progress Ipswich Town Injury Update

May 28, 2025 -

Aprils Rain Examining The Monthly Precipitation Totals

May 28, 2025

Aprils Rain Examining The Monthly Precipitation Totals

May 28, 2025 -

Canadian Tires Acquisition Of Hudsons Bay A Complete Analysis

May 28, 2025

Canadian Tires Acquisition Of Hudsons Bay A Complete Analysis

May 28, 2025 -

Jannik Sinners Road To The French Open Final Top Half Draw Advantage

May 28, 2025

Jannik Sinners Road To The French Open Final Top Half Draw Advantage

May 28, 2025