Securing Funding For A 270MWh BESS Project In The Belgian Merchant Market

Table of Contents

Understanding the Belgian Energy Market and its BESS Opportunities

Belgium's ambitious renewable energy targets necessitate robust energy storage solutions to manage the intermittency of solar and wind power. A 270MWh BESS project offers a significant contribution to grid stability, frequency regulation, and peak demand management, unlocking substantial revenue streams in the merchant market. The Belgian government actively supports the deployment of energy storage through various incentives and regulatory frameworks.

- Government Incentives and Regulations: The Belgian government offers various tax benefits, feed-in tariffs, and potential subsidies specifically designed to encourage investments in renewable energy projects, including BESS. Specific programs to watch include [mention specific Belgian government programs and initiatives related to energy storage and renewable energy].

- Market Demand and Revenue Streams: The Belgian merchant market presents lucrative opportunities for BESS operators. Revenue can be generated through:

- Frequency Regulation: Providing ancillary services to maintain grid stability.

- Arbitrage: Buying energy at low prices and selling it at peak demand times.

- Capacity Market Participation: Securing payments for providing grid capacity.

- Peak Shaving: Reducing peak demand charges by supplying energy during peak hours.

Identifying Potential Funding Sources for your 270MWh BESS Project

Securing funding for a project of this scale requires a multifaceted approach, leveraging diverse financial instruments.

- Private Equity and Venture Capital: Several specialized private equity and venture capital firms are actively investing in large-scale energy storage projects. These investors seek high-growth potential and are often willing to take on higher risk in exchange for significant returns. [Mention specific examples of relevant firms active in the Belgian or European energy market].

- Bank Financing and Debt Financing: Traditional banks and financial institutions provide project financing through loans and other debt instruments. These loans often require strong collateral and a detailed financial model demonstrating project viability. The loan structure might involve a combination of senior and subordinated debt to manage risk.

- Public Funding and Grants: The Belgian government and the European Union offer various grant programs and subsidies to support renewable energy projects. These grants often require a competitive application process and align with specific environmental and energy policy objectives. [Mention specific examples of public funding opportunities for renewable energy projects in Belgium].

- Green Bonds and Sustainable Finance: The growing market for green bonds and sustainable finance provides attractive funding options for environmentally friendly projects like BESS. Green bonds offer lower borrowing costs and attract environmentally conscious investors.

Developing a Compelling Project Finance Strategy for a 270MWh BESS Project

A successful financing strategy necessitates a robust and persuasive proposal.

- Business Plan and Financial Projections: A detailed business plan outlining the project's technical feasibility, market analysis, revenue projections, and operational strategy is crucial. Accurate and conservative financial projections are critical to securing funding.

- Management Team and Expertise: Investors assess the credibility and experience of the project's management team. Demonstrating a strong team with proven expertise in energy storage, project development, and finance significantly enhances the proposal's attractiveness.

- Risk Mitigation Strategies: Thorough risk assessment and mitigation strategies are vital. This includes addressing potential technical issues, regulatory hurdles, and market price fluctuations. Insurance policies and hedging strategies are effective risk management tools.

- Regulatory Compliance and Permitting: Navigating the permitting process smoothly is critical. A clear understanding of Belgian regulations and a proactive approach to obtaining necessary permits significantly reduce project timelines and risks.

Navigating the Regulatory Landscape for BESS in Belgium

Understanding and complying with Belgium's regulatory framework for energy storage is paramount.

- Regulatory Bodies: Key regulatory bodies involved in the permitting and operation of BESS projects in Belgium include [mention specific Belgian regulatory bodies and their responsibilities related to energy and grid connections].

- Interconnection Agreements and Grid Connection: Securing grid connection is a critical step. This involves negotiating interconnection agreements with Elia (the Belgian transmission system operator) outlining technical requirements and connection charges.

- Permitting Requirements and Timelines: The permitting process for a 270MWh BESS project requires careful planning and adherence to specific timelines. [List specific permitting requirements and typical timelines].

Securing Funding for Your Belgian 270MWh BESS Project – A Roadmap to Success

Securing funding for a large-scale BESS project in Belgium requires a well-structured financing strategy, a thorough understanding of the regulatory environment, and a compelling project proposal. By leveraging the diverse funding sources available, mitigating potential risks, and adhering to regulatory requirements, developers can successfully secure funding and contribute to Belgium's renewable energy transition. Begin your journey to securing funding for your Belgian BESS project today! Learn more about maximizing your BESS project financing in Belgium’s evolving energy market.

Featured Posts

-

Berlangas Next Targets Plant Munguia And Charlo

May 04, 2025

Berlangas Next Targets Plant Munguia And Charlo

May 04, 2025 -

Bianca Censori And Kanye West Working On Their Marriage

May 04, 2025

Bianca Censori And Kanye West Working On Their Marriage

May 04, 2025 -

Desperate Measures Migrants Eight Hour Ordeal In A Tree To Avoid Ice

May 04, 2025

Desperate Measures Migrants Eight Hour Ordeal In A Tree To Avoid Ice

May 04, 2025 -

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

May 04, 2025

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

May 04, 2025 -

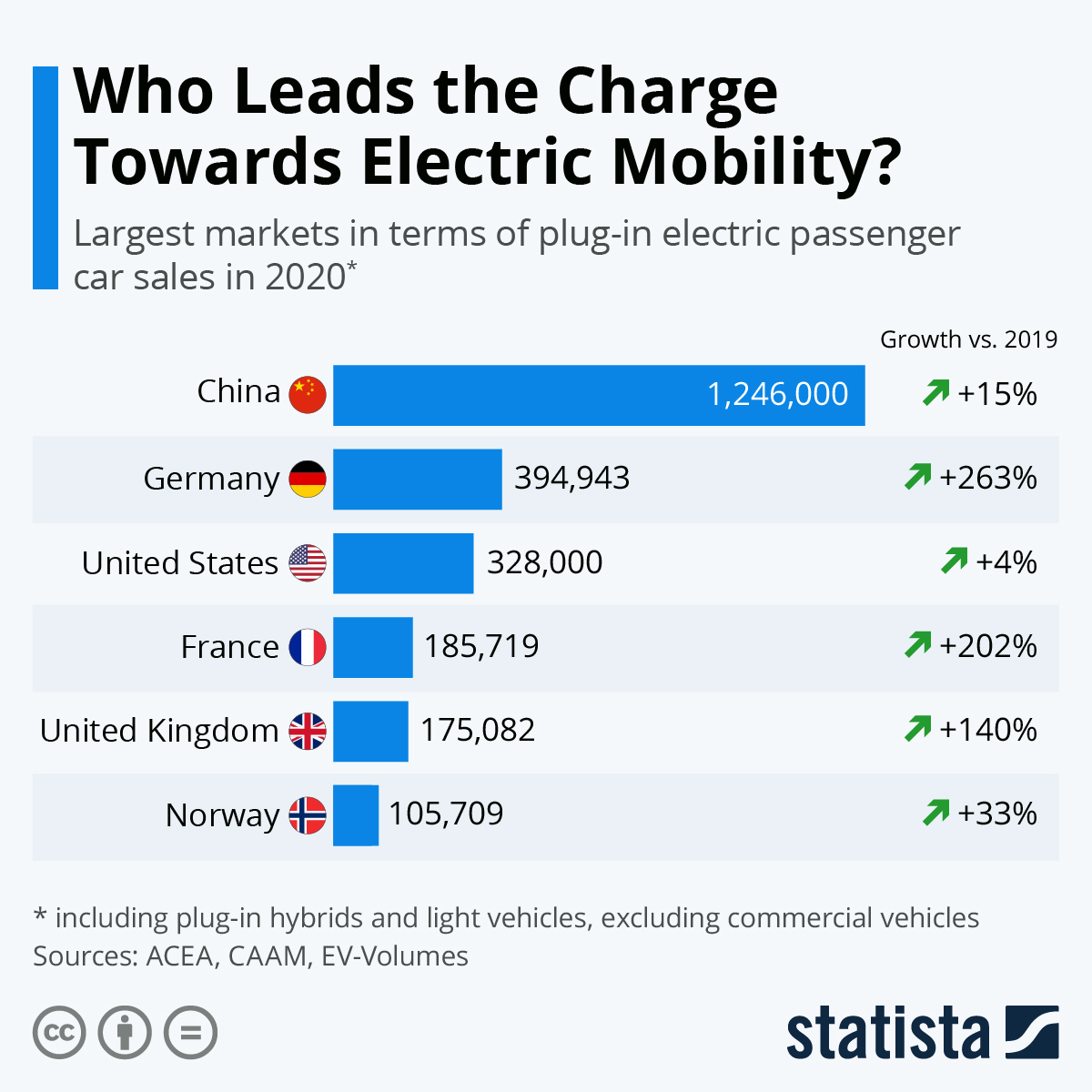

Chinas Electric Vehicle Rise Is America Prepared For Global Competition

May 04, 2025

Chinas Electric Vehicle Rise Is America Prepared For Global Competition

May 04, 2025