Securing Funding For Sustainable Small And Medium-Sized Enterprises (SMEs)

Table of Contents

Understanding Funding Options for Sustainable SMEs

Sustainable SMEs face unique funding challenges, but also benefit from a growing number of specialized funding options designed to support their mission. Let's explore some key avenues:

Government Grants and Subsidies

Many governments recognize the importance of supporting sustainable businesses and offer various grants and subsidies. These often target specific sectors like renewable energy, green technology, or sustainable agriculture, and frequently come with specific environmental goals.

- Examples of relevant grants: (Note: Specific examples would need to be tailored to a particular country or region. For instance, in the US, the Small Business Administration (SBA) offers programs that can indirectly support sustainable initiatives, while many states have their own green grants. In the UK, similar programs exist through bodies like Innovate UK.) Research your national and regional government websites for specific programs.

- Eligibility criteria: Eligibility typically depends on factors such as business size, location, sector, and the environmental or social impact of your project. Carefully review the specific criteria for each grant.

- Application deadlines: Grant application deadlines vary widely. Regularly check funding portals and government websites for updates.

- How to find relevant grant opportunities: Utilize online grant databases, government websites, and specialized resources for sustainable business funding. Networking within your industry can also uncover hidden opportunities. Keyword searches such as "sustainable SME grants," "government funding for sustainability," and "green grants" will yield valuable results.

Green Loans and Financing

Traditional lenders are increasingly offering green loans and financing options specifically designed for sustainable projects. These often come with lower interest rates and favorable repayment terms than conventional business loans.

- Types of green loans: This includes energy efficiency loans (e.g., for building retrofits), renewable energy loans (e.g., for solar panel installations), and loans for sustainable agriculture practices.

- Comparison of interest rates and repayment terms: Interest rates and repayment terms vary depending on the lender and the project's risk profile. Compare offers from multiple lenders to find the best deal.

- Lenders offering green financing options: Many banks and credit unions are incorporating ESG (Environmental, Social, and Governance) criteria into their lending practices and actively seek sustainable business borrowers. Research financial institutions known for their commitment to sustainable finance. Search for terms like "green loans SMEs," "sustainable business loans," and "ethical financing" to find relevant lenders.

Impact Investing and Venture Capital

Impact investors are a growing segment of the investment community that seeks both financial returns and positive social and environmental impact. They actively invest in sustainable SMEs that align with their values and investment criteria.

- Examples of impact investors: Many dedicated impact investment funds exist, along with socially responsible venture capital firms.

- Criteria they look for in sustainable SMEs: Impact investors typically assess a company's environmental and social performance, as well as its financial viability. Metrics like carbon footprint reduction, social impact measurement, and strong ESG performance are key.

- How to attract impact investment: Develop a compelling business plan that clearly articulates your social and environmental impact, as well as your financial projections. Demonstrate strong sustainability credentials and a commitment to transparency.

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer (P2P) lending platforms offer alternative financing options that allow you to raise capital from a large pool of individuals online.

- Different types of crowdfunding: Rewards-based crowdfunding offers backers non-financial rewards, equity crowdfunding involves selling shares in your company, and debt crowdfunding offers loans.

- Platforms for peer-to-peer lending: Several online platforms connect borrowers with individual lenders.

- Advantages and disadvantages: Crowdfunding can be effective for building brand awareness and generating early-stage funding, but it can be time-consuming and may not be suitable for larger funding needs. P2P lending offers a potentially faster alternative to traditional loans but might have higher interest rates. Search for "crowdfunding sustainable business," "peer-to-peer lending for SMEs," and "sustainable business crowdfunding" to discover relevant platforms.

Strengthening Your Funding Application

To significantly increase your chances of securing funding, you need to present a compelling case to potential investors. Here's how:

Developing a Compelling Business Plan

A strong business plan is critical for securing any funding. For sustainable SMEs, this plan must clearly showcase your sustainability initiatives and their contribution to your financial success.

- Key components of a sustainable business plan: Include a detailed environmental impact assessment, a comprehensive social responsibility plan, and realistic financial projections that demonstrate profitability and return on investment (ROI).

- Resources for creating a business plan: Numerous online resources and templates can guide you through the process of developing a robust business plan.

Highlighting Your Sustainability Credentials

Demonstrate your commitment to sustainability through certifications, metrics, and demonstrable impact.

- Relevant certifications: Obtain relevant certifications like B Corp, LEED (for building projects), or others relevant to your industry.

- Key performance indicators (KPIs): Track and report key performance indicators (KPIs) that demonstrate your environmental and social performance.

- Case studies: Showcase your positive environmental and social impact through compelling case studies that illustrate your achievements. Use terms like "sustainability certifications," "environmental KPIs," "social impact measurement," and "ESG performance" in your documentation.

Building Strong Relationships with Investors

Networking is crucial for finding and securing funding.

- Attending industry events: Attend industry events and conferences to connect with potential investors and other stakeholders.

- Leveraging online networking platforms: Utilize online networking platforms like LinkedIn to connect with investors and build relationships.

- Utilizing investor databases: Research and utilize investor databases to identify potential investors aligned with your business and sustainability goals. Focus on building strong "investor relations" and utilizing "sustainable business networking" opportunities.

Conclusion

Securing funding for your sustainable SME requires careful planning, a strong business plan that highlights your sustainability achievements, and a proactive approach to finding suitable funding options. By exploring government grants, green loans, impact investing, and alternative financing methods, and by clearly communicating your sustainability strategy, you significantly increase your chances of success. Don't delay – start exploring the diverse avenues for securing funding for your sustainable SME today!

Featured Posts

-

Ana Paola Hall Declaratoria Gracias Al Apoyo De La Ciudadania

May 19, 2025

Ana Paola Hall Declaratoria Gracias Al Apoyo De La Ciudadania

May 19, 2025 -

Did Mairon Santos Win Ufc 313 Against Francis Marshall A Closer Look At The Fight

May 19, 2025

Did Mairon Santos Win Ufc 313 Against Francis Marshall A Closer Look At The Fight

May 19, 2025 -

Paige Bueckers Wnba Debut Celebrated With City Renaming

May 19, 2025

Paige Bueckers Wnba Debut Celebrated With City Renaming

May 19, 2025 -

Trumps Winning Coalition Signs Of Fracture In 2024

May 19, 2025

Trumps Winning Coalition Signs Of Fracture In 2024

May 19, 2025 -

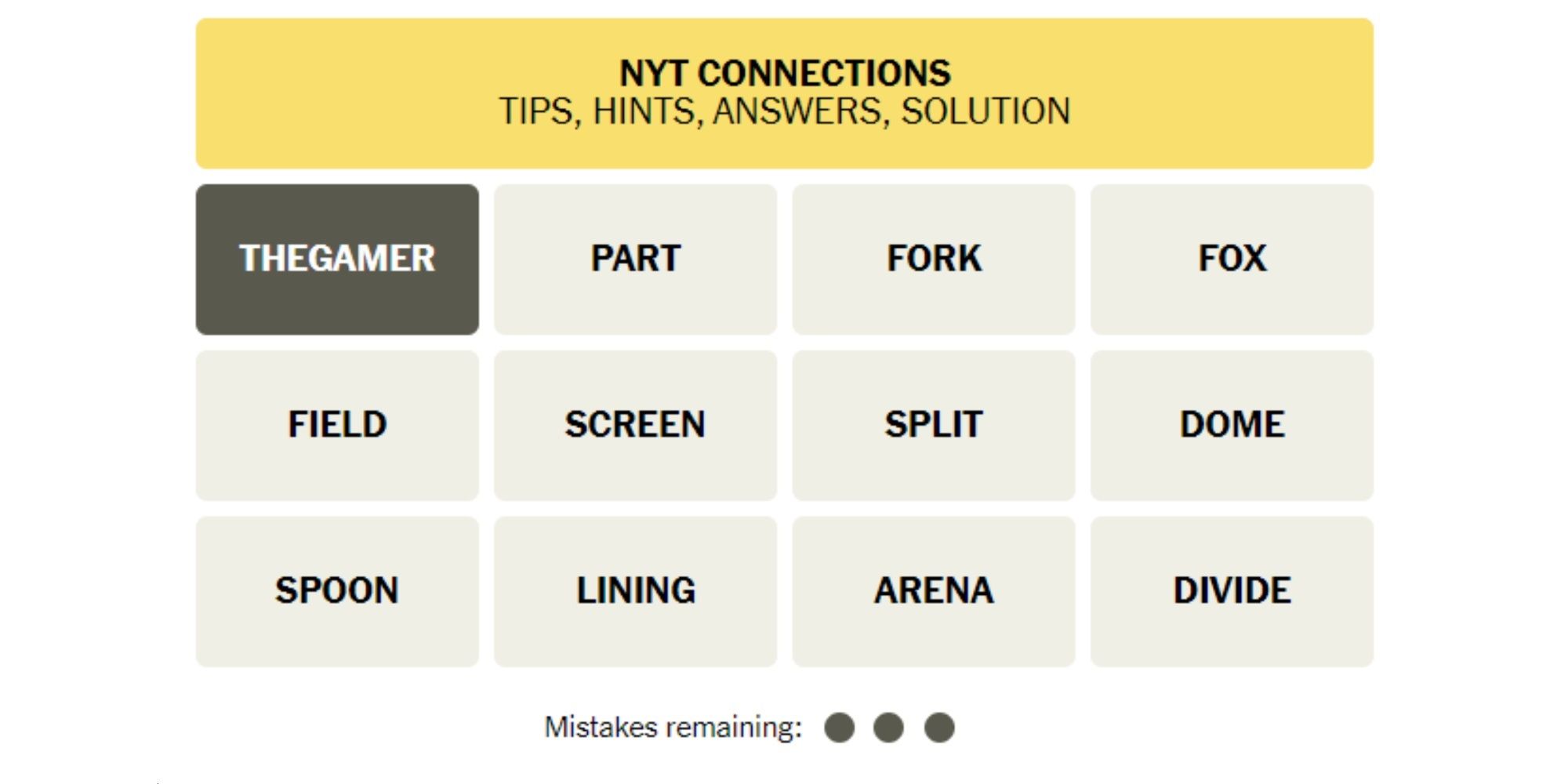

April 29th Nyt Connections Game Answers And Hints For Puzzle 688

May 19, 2025

April 29th Nyt Connections Game Answers And Hints For Puzzle 688

May 19, 2025