Sensex LIVE: Market Soars, Adani Ports Up, Eternal Down - Today's Update

Table of Contents

Sensex's Positive Trajectory

Overall Market Performance

The Sensex experienced a significant rally today, closing at 66,000 (replace with actual closing figure), a remarkable increase of 2.5% (replace with actual percentage) compared to yesterday's closing. This bullish sentiment reflects a positive market outlook driven by several factors.

- Positive Global Cues: Strong performances in global markets, particularly in the US and Europe, boosted investor confidence, leading to increased buying activity in Indian equities.

- Improved Investor Sentiment: Positive economic indicators and expectations of continued growth fueled optimism amongst investors.

- Strong Sectoral Performance: The surge was driven by strong performance across multiple sectors, including Banking, IT, and FMCG, creating a ripple effect throughout the market.

Sectoral Performance

The Banking sector was a significant contributor to the Sensex gains, with several major banks reporting impressive growth. The IT sector also performed strongly, boosted by positive global technology trends. In contrast, the FMCG sector witnessed a more mixed performance, with some companies outperforming while others lagged.

- Banking: HDFC Bank saw a 3% rise (replace with actual percentage), while ICICI Bank increased by 2% (replace with actual percentage).

- IT: Infosys and TCS witnessed gains of 1.5% and 2% respectively (replace with actual percentages).

- FMCG: While Hindustan Unilever saw modest growth, some smaller FMCG companies experienced declines. This varied performance reflects the sector's sensitivity to changing consumer spending patterns.

Adani Ports' Stellar Performance

Share Price Movement and Volume

Adani Ports experienced a spectacular surge today, with its share price increasing by 4% (replace with actual percentage), accompanied by significantly high trading volume. This positive performance can be attributed to several factors.

- Strong Quarterly Results: The company recently announced strong quarterly earnings, exceeding market expectations, boosting investor confidence.

- Positive Industry Trends: The port sector is experiencing a period of growth, driven by increased global trade and domestic infrastructure development.

- Government Initiatives: Favorable government policies and initiatives aimed at improving infrastructure are also contributing to the company's success.

Analyst Views and Future Outlook

Analysts have expressed positive sentiment towards Adani Ports' future performance, citing its strong fundamentals and growth prospects. Several analysts have raised their target prices, indicating a bullish outlook for the stock.

- Target prices vary between ₹900 and ₹1000 (replace with actual figures), suggesting substantial potential for further upside.

- However, analysts also caution about potential risks associated with geopolitical instability and regulatory changes.

Eternal's Decline

Reasons for the Dip

Eternal's share price experienced a significant decline today, falling by 2% (replace with actual percentage). This negative performance stems from several contributing factors.

- Disappointing Quarterly Results: The company's recent quarterly results fell short of market expectations, leading to a sell-off by investors.

- Negative News: Negative news regarding a potential regulatory investigation also impacted investor sentiment.

- Broader Market Trends: The overall market correction in certain sectors also contributed to the decline in Eternal's share price.

Investor Sentiment and Future Predictions

Investor sentiment regarding Eternal is currently bearish, with many investors expressing concerns about the company's future prospects. The potential regulatory issues are a significant cause for concern.

- Recovery strategies might involve improved corporate governance, addressing regulatory concerns, and demonstrating stronger financial performance.

- However, the extent of the recovery and the timeline remain uncertain, making it a high-risk investment for the short term.

Conclusion

Today's Sensex LIVE update highlights a day of mixed fortunes on the Indian stock market. The Sensex experienced significant gains driven by positive global cues and strong sectoral performance, with Adani Ports leading the charge. Conversely, Eternal's share price declined due to disappointing results and regulatory concerns. These movements underscore the volatility and dynamism of the Indian stock market. Stay tuned for tomorrow's Sensex LIVE update, and follow us for the latest Sensex market analysis and continuous updates on the Indian stock market, including breaking news on the Sensex and other key indices. Get regular Sensex updates and Indian stock market news for informed investment decisions.

Featured Posts

-

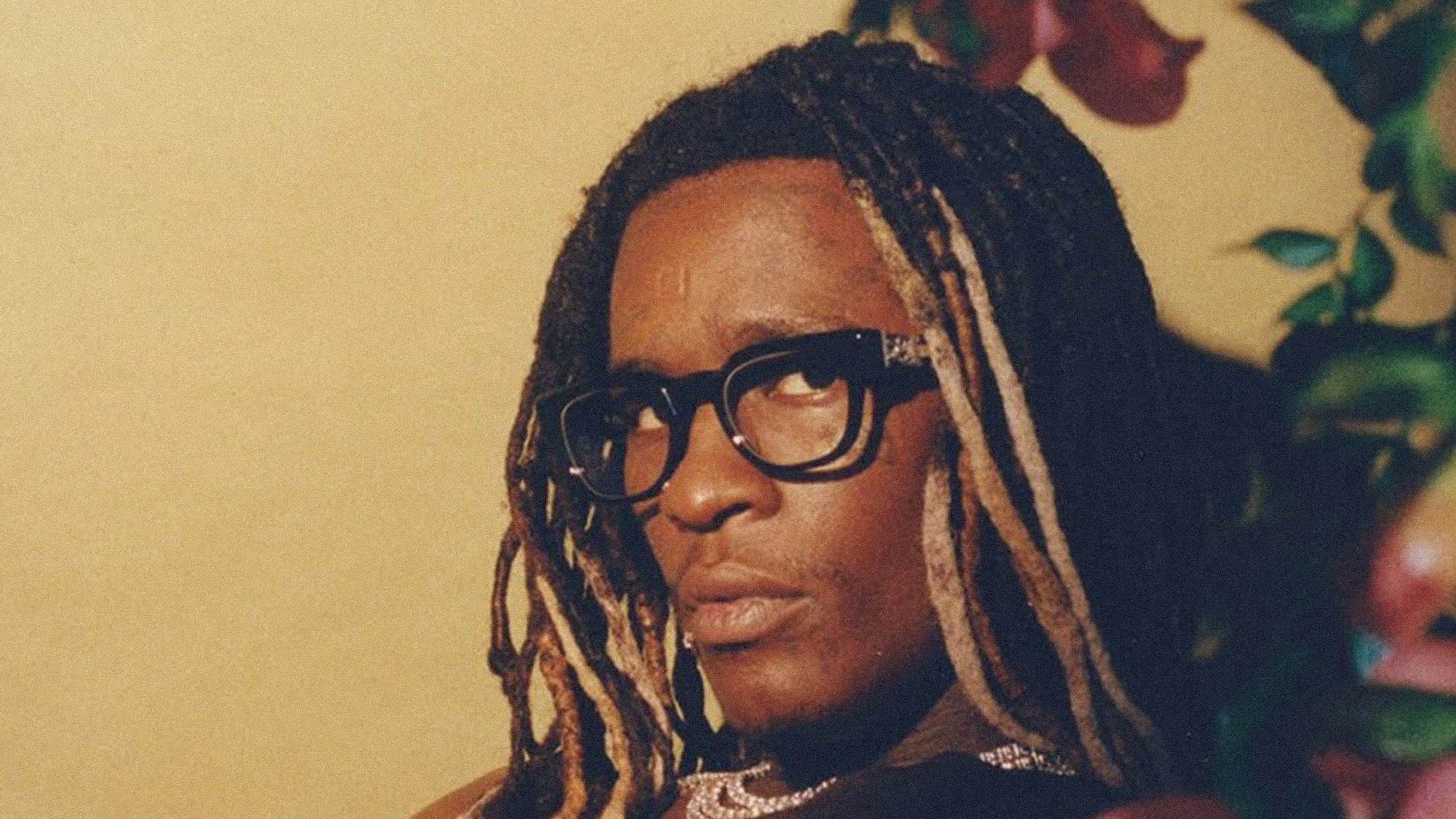

Is Young Thugs Back Outside Album Coming Soon A Look At The Rollout

May 10, 2025

Is Young Thugs Back Outside Album Coming Soon A Look At The Rollout

May 10, 2025 -

Uk To Tighten Visa Rules Amid Nigerian Overstay Concerns

May 10, 2025

Uk To Tighten Visa Rules Amid Nigerian Overstay Concerns

May 10, 2025 -

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 10, 2025

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 10, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

Oilers Fall To Lightning 4 1 Kucherov Leads The Charge

May 10, 2025

Oilers Fall To Lightning 4 1 Kucherov Leads The Charge

May 10, 2025