Sensex Surges 1400 Points, Nifty Above 23800: Top 5 Reasons For Today's Market Rally

Table of Contents

Positive Global Cues Fuel Indian Market Growth

Positive global economic indicators played a significant role in boosting investor confidence and driving the Sensex and Nifty rally. Easing geopolitical tensions and improved macroeconomic data from key global economies instilled a sense of optimism that spilled over into the Indian markets. This positive global sentiment translated into increased buying activity, pushing indices higher.

- Improved US inflation figures: Lower-than-expected US inflation data signaled a potential slowdown in interest rate hikes by the Federal Reserve, easing concerns about a global recession.

- Easing global recession fears: Positive economic indicators from various parts of the world reduced fears of a widespread global economic downturn, bolstering investor confidence.

- Positive developments in the global trade environment: Improvements in global trade flows and reduced trade barriers created a more favorable environment for businesses, contributing to the positive market sentiment.

- Increased Foreign Institutional Investor (FII) inflow: Positive global cues led to a significant increase in FII investments in the Indian stock market, injecting substantial liquidity and further fueling the rally.

Robust Domestic Economic Data Boosts Confidence

Strong domestic economic data added further impetus to the market rally. Positive indicators showcasing the health of the Indian economy reassured investors and attracted further investment. The robust performance across various sectors highlighted the resilience of the Indian economy.

- Strong GDP growth figures exceeding expectations: India's GDP growth figures surpassed analysts' predictions, signaling a healthy and expanding economy.

- Increased industrial production: Positive industrial production numbers indicated strong manufacturing activity and overall economic strength.

- Positive consumer confidence index: A rising consumer confidence index pointed towards robust consumer spending, a key driver of economic growth.

- Growth in specific sectors: High-performing sectors like IT, banking, and FMCG contributed significantly to the overall market upswing, showcasing the breadth of the rally.

Increased FII and DII Investments

The significant contribution of both Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) cannot be overlooked. Their increased investments acted as a major catalyst for the market's upward trajectory.

- FII inflow figures: Large inflows of capital from FIIs demonstrated their renewed confidence in the Indian market's long-term growth potential.

- DII investment trends: Domestic investors also participated actively, further augmenting the buying pressure and supporting the market's ascent.

- Factors influencing their investment decisions: Attractive valuations, strong corporate earnings, and positive growth prospects played a key role in attracting both domestic and foreign investments.

Sector-Specific Performance and Key Gainers

The rally wasn't uniform across all sectors. Certain sectors outperformed others, significantly contributing to the overall Sensex and Nifty surge.

- Top performing sectors and their percentage gains: The IT, banking, and FMCG sectors witnessed particularly strong gains, driving a substantial portion of the market's upward movement.

- Key stocks that contributed significantly to the rally: Specific stocks within these high-performing sectors registered impressive gains, further fueling the market's momentum.

- Reasons for the outperformance of specific sectors: Strong earnings, positive industry outlook, and favorable government policies contributed to the outperformance of specific sectors.

Speculative Trading and Short Covering

While fundamental factors played a dominant role, it's important to acknowledge the potential influence of speculative trading and short covering. These activities can amplify market movements, both positive and negative.

- Explanation of short covering: Investors who had bet against the market (short selling) were likely forced to buy back shares to limit their losses, adding to the buying pressure.

- Impact of speculative trading on market volatility: Speculative trading can contribute to increased market volatility, amplifying both upward and downward movements.

- Potential risks associated with speculative trading: While speculative trading can lead to quick gains, it also carries significant risks and should be approached cautiously.

Sensex and Nifty's Impressive Rally – What's Next?

In summary, the remarkable 1400-point Sensex surge and Nifty's crossing of 23800 can be attributed to a confluence of factors: positive global cues, strong domestic economic data, increased FII and DII investments, sector-specific performance, and the potential impact of speculative trading and short covering. Understanding these market dynamics is crucial for navigating the Indian stock market effectively. While the current outlook appears positive, investors should remain cautious and aware of potential risks. Stay informed on future Sensex and Nifty market rallies by subscribing to our newsletter! Learn more about investing in the Indian stock market and understanding Sensex and Nifty's movements.

Featured Posts

-

Live Stock Market Updates Trumps China Tariffs And Uk Trade Deal

May 10, 2025

Live Stock Market Updates Trumps China Tariffs And Uk Trade Deal

May 10, 2025 -

Spike In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025

Spike In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025 -

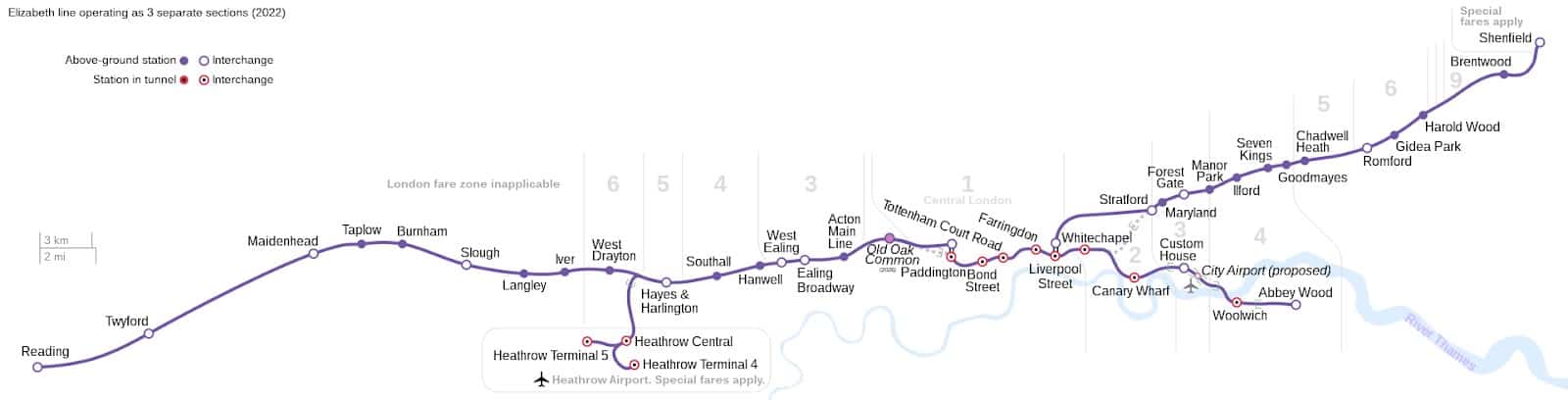

The Elizabeth Line And Wheelchair Users A Focus On Station Accessibility

May 10, 2025

The Elizabeth Line And Wheelchair Users A Focus On Station Accessibility

May 10, 2025 -

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025

Betting On The Oilers Kings Series Odds And Expert Analysis

May 10, 2025 -

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025

Elizabeth Line Ensuring Smooth Journeys For Wheelchair Users

May 10, 2025