Seven Tech Titans Suffer $2.5 Trillion Market Value Plunge This Year

Table of Contents

The Magnitude of the Tech Stock Market Crash

The sheer scale of losses in this tech industry downturn is breathtaking. This 2023 tech slump represents a significant shift from the sustained growth seen in previous years. Let's examine the losses suffered by some of the biggest players:

Trillion-Dollar Losses Detailed

While precise figures fluctuate daily, a snapshot reveals the severity of the tech titan valuation drop. (Note: Actual figures should be inserted here, obtained from reliable financial sources like the NYSE, NASDAQ, or reputable financial news outlets. Include a visually appealing chart or graph illustrating the percentage decline for each company). For example, the data might look something like this:

- Apple: Lost $X Billion (Y% decrease)

- Microsoft: Lost $Z Billion (W% decrease)

- Amazon: Lost $A Billion (B% decrease)

- Google (Alphabet): Lost $C Billion (D% decrease)

- Meta (Facebook): Lost $E Billion (F% decrease)

- Tesla: Lost $G Billion (H% decrease)

- Nvidia: Lost $I Billion (J% decrease)

(Insert Chart/Graph Here)

- Comparison to previous market crashes: This tech bubble burst compares to [insert comparable historical market crashes and their impact].

- Impact on investor confidence: The significant losses have severely eroded investor confidence, leading to increased volatility and risk aversion in the tech sector.

Key Factors Contributing to the Tech Industry Downturn

Several interconnected factors have contributed to this severe tech stock market crash and the broader tech industry downturn.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes to combat persistent inflation have significantly impacted tech valuations.

- Higher interest rates: These make borrowing more expensive for tech companies, hindering expansion and slowing down growth. Higher rates also make riskier assets like tech stocks less attractive to investors, who seek safer, higher-yield investments.

- Impact of inflation: Increased inflation reduces consumer spending power, impacting demand for tech products and services. This is particularly true for discretionary tech purchases.

- Effect on borrowing costs: Higher borrowing costs impact everything from research and development to acquisitions, putting pressure on profitability.

The Post-Pandemic Reality Check

The post-pandemic period revealed a reality check for the tech sector. The rapid growth fueled by pandemic-related circumstances proved unsustainable.

- Reduced demand for remote work technologies: As offices reopened, demand for certain remote work technologies declined, impacting companies heavily invested in this sector.

- Supply chain disruptions: Ongoing supply chain disruptions continued to impact production, leading to increased costs and reduced profits.

- Increased competition and market saturation: Increased competition and market saturation in many tech segments further intensified the pressure on prices and profitability.

Concerns Over Future Growth and Profitability

Concerns about the future growth and profitability of tech companies are contributing to the ongoing tech stock market crash.

- Reduced earnings forecasts: Several key tech companies have issued reduced earnings forecasts, fueling investor anxieties.

- Slowing economic growth: Global economic slowdown further dampens growth expectations for the tech sector, which is highly sensitive to economic cycles.

- Potential for further price corrections: Many analysts predict further price corrections in the tech market, anticipating a period of consolidation and adjustment.

Impact on Investors and the Broader Economy

The tech stock market crash has significant ramifications for investors and the global economy.

Investor Losses and Portfolio Diversification

Individual and institutional investors have suffered substantial losses due to the tech industry downturn.

- Diversification strategies: To minimize risk, investors need to diversify their portfolios beyond the tech sector. A well-diversified strategy is key.

- Retirement portfolios: The decline in tech stock values has significant implications for retirement portfolios reliant on tech investments.

- Government regulation and intervention: The extent of government intervention and its impact on the market remains to be seen.

Ripple Effects on the Global Economy

The tech sector downturn has widespread global economic consequences.

- Job market: Job losses in the tech sector are anticipated, impacting employment figures and potentially triggering broader economic slowdown.

- Innovation: A prolonged downturn could hinder innovation and technological advancement, given reduced funding and slower growth.

- Global economic consequences: The performance of the tech sector has a cascading effect on global economic growth, given its significance in the global economy.

Conclusion

The $2.5 trillion loss in market value across seven major tech companies represents a significant tech stock market crash, driven by a confluence of factors including rising interest rates, a post-pandemic economic adjustment, and concerns about future growth and profitability. Understanding the complexities of this tech industry downturn and its impact is crucial for investors and businesses alike. Stay informed about the latest developments in the tech sector and carefully analyze potential risks before making investment decisions in the volatile world of tech titans. Continuously monitor the market for further updates on this significant tech stock market crash and its ongoing evolution.

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 29, 2025

Ftc Appeals Activision Blizzard Acquisition Ruling Whats Next

Apr 29, 2025 -

2024 Metais Porsche Pardavimai Lietuvoje Isaugo Trecdaliu

Apr 29, 2025

2024 Metais Porsche Pardavimai Lietuvoje Isaugo Trecdaliu

Apr 29, 2025 -

Adidas Anthony Edwards 2 Release Date Specs And First Impressions

Apr 29, 2025

Adidas Anthony Edwards 2 Release Date Specs And First Impressions

Apr 29, 2025 -

Aiims Opd Sees Rise In Young Adults With Adhd Whats The Cause

Apr 29, 2025

Aiims Opd Sees Rise In Young Adults With Adhd Whats The Cause

Apr 29, 2025 -

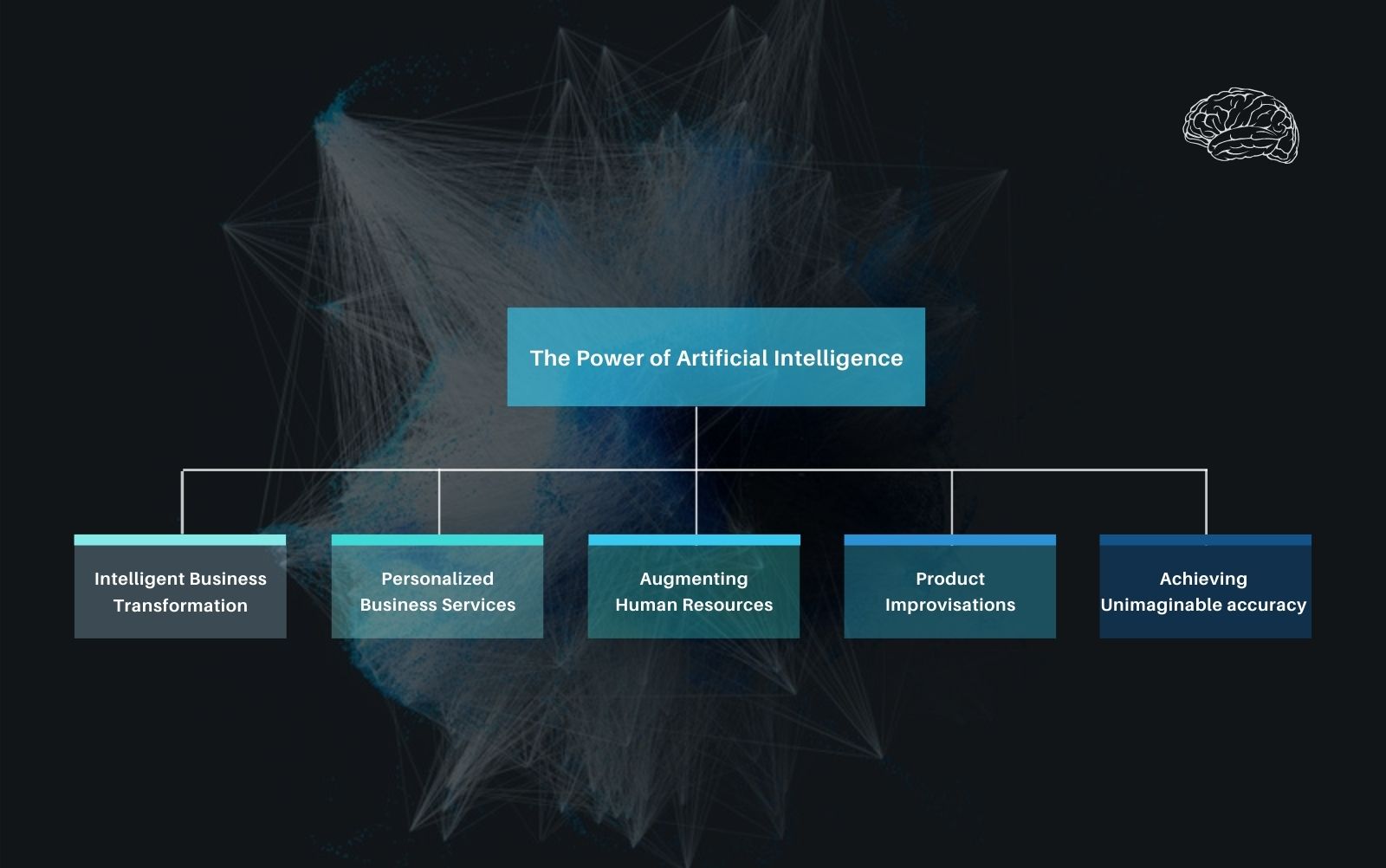

Is Ai Truly Thinking A Critical Analysis Of Artificial Intelligence

Apr 29, 2025

Is Ai Truly Thinking A Critical Analysis Of Artificial Intelligence

Apr 29, 2025