Sharp Decline In Amsterdam Stock Exchange: AEX Index At 1-Year Low

Table of Contents

The Amsterdam Stock Exchange (Euronext Amsterdam) is facing a period of significant turbulence, with the AEX index recently hitting a one-year low. This sharp decline has sent ripples through the Dutch financial landscape and raised serious concerns among investors and economic analysts. This article will dissect the contributing factors behind this unexpected fall, exploring its potential implications for the Dutch economy and its position within the broader European market. We will also examine potential future scenarios and recovery strategies.

Key Factors Contributing to the AEX Index Decline

Several interconnected factors have converged to trigger this sharp decline in the AEX index. Understanding these elements is crucial for navigating the current market volatility.

Global Economic Uncertainty

The global economic climate is undeniably a major contributor to the AEX's downturn. Several key factors are at play:

- Rising Inflation Rates: Persistently high inflation rates in many countries are eroding purchasing power and dampening consumer and business spending, impacting global growth projections and investor sentiment.

- Geopolitical Tensions: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other regions, creates uncertainty and negatively impacts market confidence. This leads to risk aversion and capital flight from equities markets like the AEX.

- Increased Interest Rates: Central banks worldwide are aggressively raising interest rates to combat inflation. While this aims to curb price increases, it simultaneously increases borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability, thus affecting stock prices.

- Potential Recessionary Pressures: The combination of high inflation, rising interest rates, and geopolitical uncertainty has increased the likelihood of a global recession, further pressuring the AEX and other global stock markets.

Specific global events influencing the AEX include the ongoing energy crisis in Europe, supply chain disruptions caused by the pandemic and geopolitical tensions, and the volatility in the US and Chinese economies.

European Economic Slowdown

The European economy, and the Netherlands in particular, is facing significant headwinds.

- Weakness in the Eurozone Economy: The Eurozone is experiencing sluggish growth, partly fueled by the energy crisis and high inflation. This weakness directly impacts the performance of Dutch companies that are heavily integrated into the European market.

- Energy Crisis and its Impact on Dutch Businesses: The energy crisis, exacerbated by the war in Ukraine, has significantly increased energy costs for Dutch businesses, squeezing profit margins and impacting their competitiveness.

- Supply Chain Disruptions: Ongoing supply chain disruptions continue to hamper Dutch exports and production, further contributing to the economic slowdown.

- Decreased Consumer Spending in the Netherlands: High inflation and uncertainty have led to reduced consumer spending in the Netherlands, impacting domestic demand and the performance of consumer-related businesses.

Data from Eurostat and the Dutch Central Bank (De Nederlandsche Bank) show a significant slowdown in economic growth and increasing inflation in the Netherlands, corroborating this analysis.

Sector-Specific Challenges

The decline in the AEX is not uniform across all sectors. Certain sectors are experiencing more significant challenges than others.

- Underperformance of Energy and Financials: The energy sector, while initially benefiting from high energy prices, is now facing challenges from price volatility and regulatory changes. The financial sector is also experiencing headwinds due to increased interest rates and economic uncertainty.

- Technology Sector Slowdown: The technology sector, which experienced significant growth in previous years, is experiencing a slowdown due to reduced investor confidence and increased competition.

- Impact of Specific Regulations: New regulations and stricter compliance requirements in certain sectors are impacting profitability and investment.

Impact on Dutch Investors and the Economy

The sharp decline in the AEX has significant implications for both Dutch investors and the broader economy.

Investor Sentiment and Market Volatility

- Risk-Averse Behavior: Investors are exhibiting risk-averse behavior, leading to increased volatility and reduced trading activity.

- Impact on Pension Funds: Large institutional investors, such as pension funds, are significantly affected by the decline, impacting their long-term investment strategies.

- Increased Market Volatility: The market is experiencing heightened volatility, making investment planning and risk management more challenging.

Economic Consequences for the Netherlands

- Potential Impact on GDP Growth: The AEX decline is a strong indicator of potential slowing GDP growth in the Netherlands.

- Effects on Employment and Investment: Reduced economic activity may lead to job losses and reduced investment in new projects.

- Government Response: The Dutch government may need to implement further economic stimulus measures to mitigate the negative impacts.

Potential Future Scenarios and Recovery Strategies

Predicting the future of the AEX is challenging, but analyzing potential scenarios is crucial for investors.

Short-Term Outlook

- Continued Volatility: The short-term outlook suggests continued market volatility as investors grapple with uncertainty.

- Potential Catalysts for Recovery: Positive economic news, such as easing inflation or improved geopolitical stability, could trigger a market recovery.

- Assessment of Risks and Opportunities: Identifying specific risks and opportunities within different sectors is key for effective investment strategies.

Long-Term Prospects

- Resilience of the Dutch Economy: The Dutch economy has historically shown resilience, and this will be a key factor in its long-term recovery.

- Structural Reforms: Government-led structural reforms aimed at boosting productivity and competitiveness could support long-term growth.

- Opportunities for Investors: While the current situation is challenging, opportunities exist for long-term investors to identify undervalued assets.

Conclusion

The sharp decline in the AEX index reflects a confluence of global and European economic challenges, significantly impacting investor sentiment and the Dutch economy. While the short-term outlook remains uncertain, understanding the factors driving this decline is crucial for navigating the volatility and identifying potential opportunities. Analyzing these factors allows investors to make more informed decisions and prepare for various scenarios.

Call to Action: Stay informed on the latest developments impacting the AEX index and the Amsterdam Stock Exchange. Continue to monitor the AEX for further updates and insights into this evolving market situation. Understanding the factors driving the AEX decline is crucial for making informed investment decisions in the Amsterdam Stock Exchange.

Featured Posts

-

Elektromobiliu Ikrovimas Europoje Porsche Plecia Savo Tinkla

May 24, 2025

Elektromobiliu Ikrovimas Europoje Porsche Plecia Savo Tinkla

May 24, 2025 -

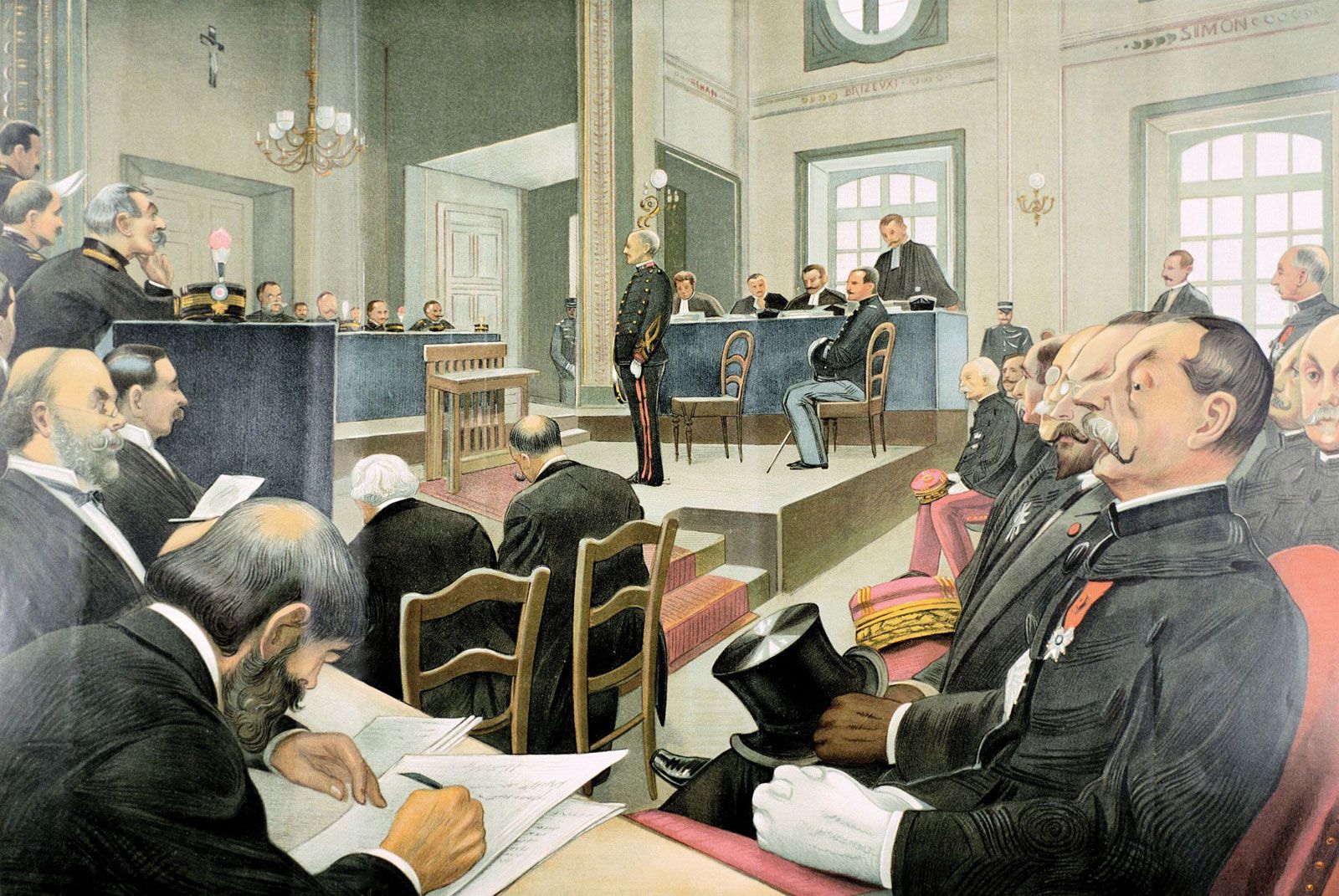

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025

French Lawmakers Push For Dreyfus Promotion A Century After The Scandal

May 24, 2025 -

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 24, 2025

Zhizn I Tvorchestvo Innokentiya Smoktunovskogo Yubileyniy Dokumentalniy Film

May 24, 2025 -

Trump Uitstel Positief Effect Op Aex Beurzen

May 24, 2025

Trump Uitstel Positief Effect Op Aex Beurzen

May 24, 2025 -

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025

Fedor Lavrov O Pavle I Pochemu Lyudi Lyubyat Schekotat Nervy

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025