Sharp Decline In Amsterdam Stock Market: AEX Index Hits 1-Year Low

Table of Contents

Factors Contributing to the AEX Index Decline

Several interconnected factors have contributed to the recent sharp decline in the AEX Index, creating a challenging environment for investors in the Amsterdam Stock Market.

Global Economic Uncertainty

Global economic uncertainty is a primary driver of the AEX Index's downturn. The current climate is characterized by persistent inflation, growing recession fears in major economies, and significant geopolitical instability, particularly the ongoing war in Ukraine. This uncertainty significantly impacts investor sentiment, leading to risk aversion and a sell-off in stock markets worldwide, including the AEX.

- Increased Interest Rates: Central banks globally are raising interest rates to combat inflation, increasing borrowing costs for businesses and dampening economic growth. This negatively affects corporate profits and investor confidence.

- Energy Crisis: The ongoing energy crisis, exacerbated by the war in Ukraine, has driven up energy prices, impacting businesses across various sectors and fueling inflation.

- Supply Chain Disruptions: Lingering supply chain disruptions continue to hamper production and contribute to inflationary pressures, further eroding investor confidence.

- Decreased Consumer Confidence: Concerns about inflation and a potential recession are leading to decreased consumer spending, impacting businesses' revenue and profitability.

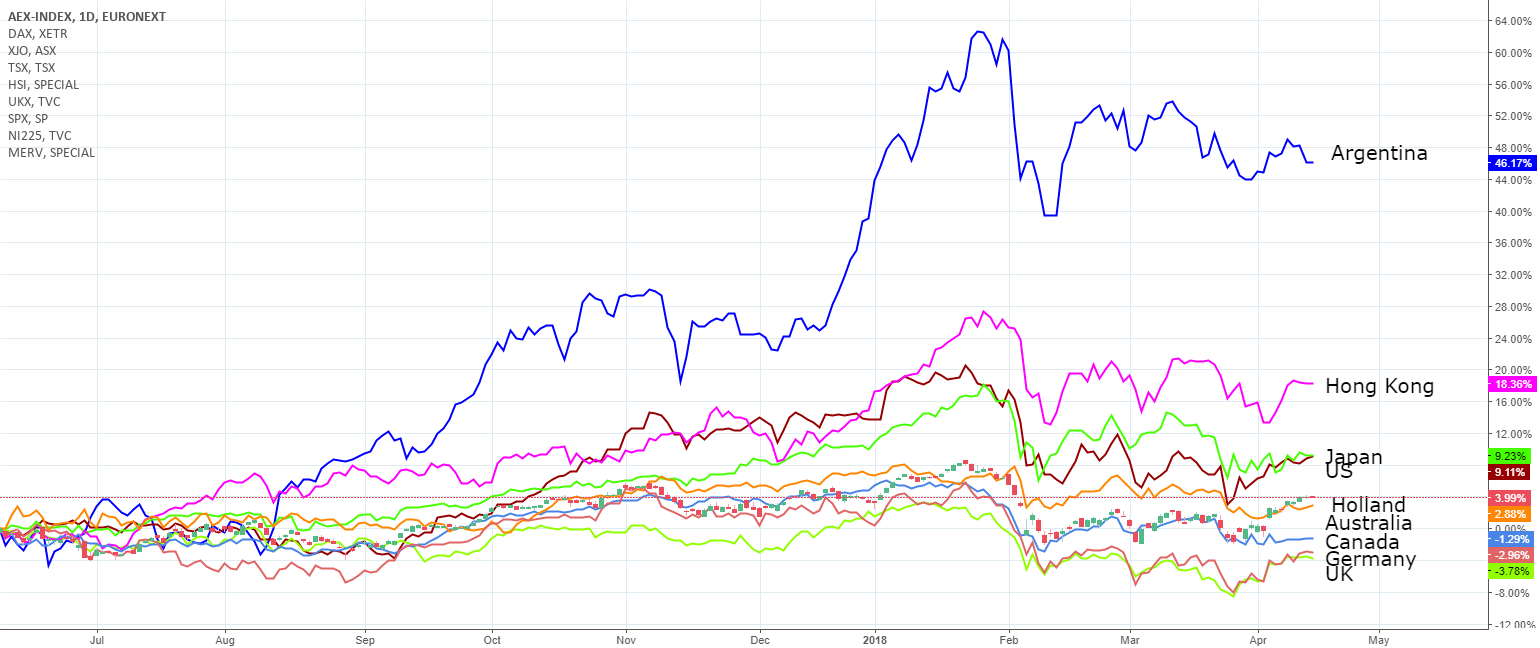

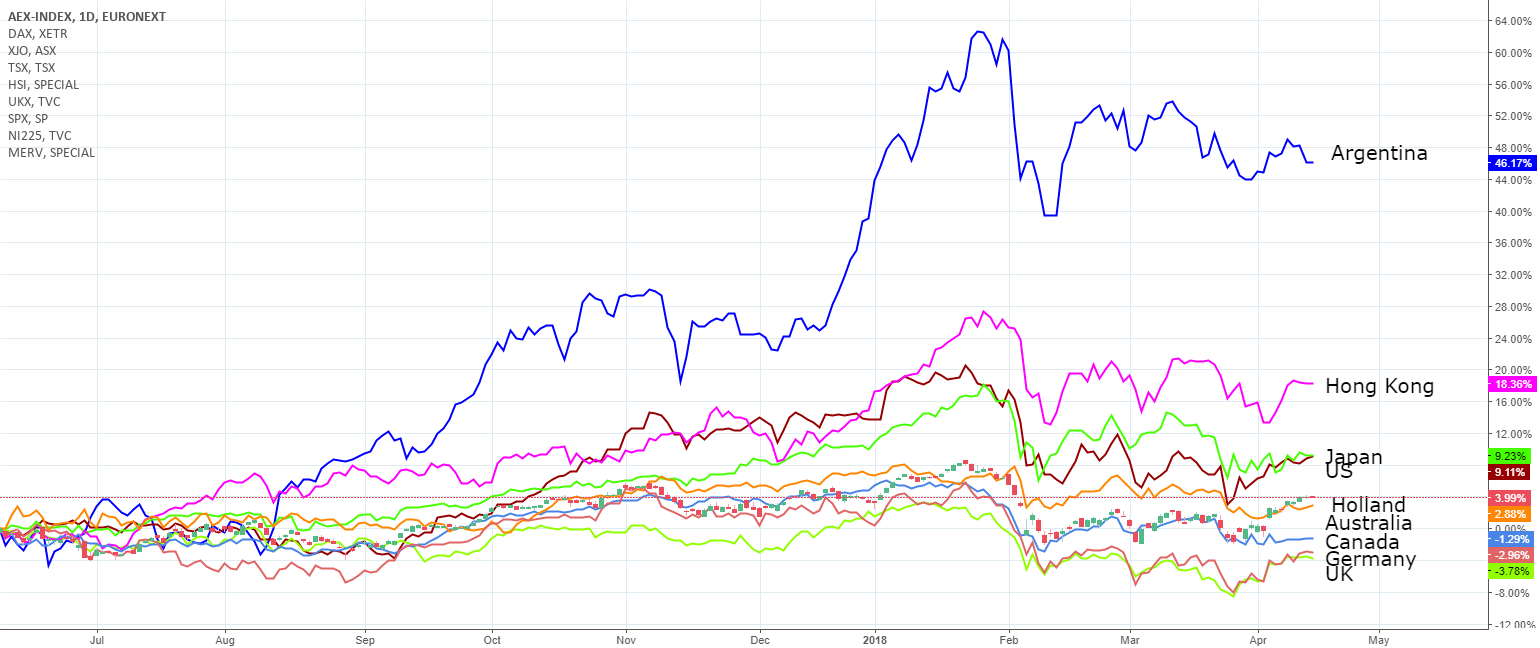

The correlation between global economic downturn and AEX Index performance is undeniable. Data shows a strong negative correlation between the AEX and global indices like the S&P 500 and the FTSE 100, reflecting the interconnected nature of global financial markets.

Performance of Specific Sectors

The decline in the AEX Index is not uniform across all sectors. Certain sectors are experiencing more significant drops than others.

- Energy: While energy companies initially benefited from high energy prices, the recent price volatility and concerns about future demand have led to a correction in the energy sector's performance within the AEX.

- Technology: The technology sector, sensitive to interest rate hikes and reduced investor risk appetite, has seen a notable decline in valuations. Many tech companies within the AEX have experienced significant share price drops.

- Financials: Banks and financial institutions within the AEX are also impacted by rising interest rates, affecting their profitability and valuations.

For example, [Insert example of a specific company in a struggling sector within the AEX and explain the reason for its poor performance]. This illustrates the sector-specific challenges contributing to the overall AEX Index decline.

Impact of Geopolitical Events

Geopolitical events significantly influence investor confidence and contribute to market volatility.

- War in Ukraine: The ongoing war in Ukraine creates significant uncertainty, impacting energy markets, supply chains, and investor sentiment globally, thereby affecting the AEX.

- Tensions with China: Growing geopolitical tensions between the West and China also add to market uncertainty, creating risk aversion among investors.

These events contribute to market instability and increased volatility, further depressing the AEX Index. [Insert data or statistics showcasing the impact of specific geopolitical events on the AEX].

Implications of the AEX Index Decline for Investors

The decline in the AEX Index has significant implications for investors, requiring careful consideration of both short-term and long-term strategies.

Short-Term Investment Strategies

For investors with short-term investment strategies, the current market conditions necessitate cautious decision-making.

- Hedging: Consider hedging strategies to mitigate potential losses in a volatile market.

- Diversification: Diversifying investments across different asset classes and geographies can help reduce overall portfolio risk.

Adjusting short-term portfolios based on current market sentiment is crucial for minimizing losses. However, short-term market timing is inherently risky and not always successful.

Long-Term Investment Strategies

Long-term investors should maintain a long-term perspective and avoid making rash decisions based on short-term market fluctuations.

- Diversified Portfolio: Maintain a well-diversified portfolio across different asset classes to reduce exposure to specific sectors or market risks.

- Long-Term Plan: Stick to a well-defined long-term investment plan, avoiding impulsive reactions to market volatility.

Despite the current decline, maintaining a long-term investment plan remains crucial, as market cycles inevitably involve periods of both growth and decline.

Potential for Recovery

While the current outlook is challenging, several factors could contribute to a potential recovery in the AEX Index.

- Positive Economic Indicators: Positive shifts in global economic indicators, such as easing inflation or improved consumer confidence, could boost investor sentiment.

- Policy Changes: Government policies aimed at stimulating economic growth could also contribute to a market rebound.

- Future Growth Potential: The long-term growth potential of Dutch companies remains a key factor to consider.

The potential for recovery hinges on a combination of global and domestic economic factors, creating uncertainty in predicting the precise timing of a market rebound.

Conclusion

The sharp decline in the AEX Index reflects the complex interplay of global economic uncertainty, specific sector performance challenges, and the impact of significant geopolitical events. This downturn presents both challenges and opportunities for investors. Short-term investors need to adopt cautious strategies, while long-term investors should maintain a steady course, focusing on diversification and their long-term investment plans. Understanding the dynamics of the AEX Index and the Amsterdam Stock Market is critical for navigating the current volatility and making informed investment decisions. Stay informed about the fluctuations of the AEX Index and consult with financial advisors to make informed decisions about your investments. Monitoring economic news and understanding the complexities of the AEX Index are crucial for navigating this period of market volatility.

Featured Posts

-

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025 -

Deconstructing The Hells Angels

May 25, 2025

Deconstructing The Hells Angels

May 25, 2025 -

Ralph Fiennes Eyed For Coriolanus Snow Role Fan Campaign Pushes For Kiefer Sutherland

May 25, 2025

Ralph Fiennes Eyed For Coriolanus Snow Role Fan Campaign Pushes For Kiefer Sutherland

May 25, 2025 -

Global Trade And Tariffs A G7 Perspective

May 25, 2025

Global Trade And Tariffs A G7 Perspective

May 25, 2025 -

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Monegasca

May 25, 2025

Charlene De Monaco Y Roc Agel Un Refugio En La Costa Monegasca

May 25, 2025