Sharp Decline In Amsterdam: Stock Market Plunges 7% On Trade War Worries

Table of Contents

Understanding the 7% Plunge: Depth of the Amsterdam Stock Market Crisis

The 7% drop represents a substantial and rapid decline in the Amsterdam stock market, marking one of the worst single-day losses in recent history. The AEX index, a key indicator of the Amsterdam Stock Exchange's performance, plummeted sharply, reflecting the widespread panic and uncertainty. This market volatility affected various sectors, with some experiencing far greater losses than others.

- Most significantly impacted sectors: The technology, export-oriented manufacturing, and financial sectors bore the brunt of the decline.

- Leading companies affected: Several prominent Dutch companies saw their share prices fall drastically, highlighting the widespread nature of the crisis. (Specific company examples would be added here with real-time data, if available).

- Speed of the decline: The speed at which the market fell exacerbated the impact, leaving many investors with little time to react and causing significant losses. This rapid drop significantly eroded investor confidence, leading to further selling pressure.

Trade War Fears as the Primary Catalyst: Global Uncertainty Impacts Amsterdam

The primary catalyst for this sharp decline in Amsterdam is the escalating global trade war. New tariffs imposed (or the threat of new tariffs), particularly those affecting Dutch exports, are creating significant uncertainty for businesses. The Netherlands, as a heavily export-oriented economy, is particularly vulnerable to disruptions in international trade. The interconnectedness of the global market means that escalating tensions between major economic powers inevitably impact even smaller, highly integrated economies like the Netherlands.

- Specific trade war concerns: (This section needs to be updated with current events – for example, specific new tariffs or escalating tensions between the US and the EU that would directly impact the Dutch economy).

- Potential future scenarios: Depending on the resolution (or lack thereof) of the trade disputes, the Amsterdam market could face further declines or a period of prolonged uncertainty, hindering business investment and economic growth.

Investor Reaction and Market Sentiment: A Wave of Selling in Amsterdam

The immediate investor reaction was a wave of selling, driven by fear and uncertainty. Panic selling amplified the initial decline, creating a vicious cycle of falling prices and further selling pressure. Market sentiment shifted dramatically, characterized by widespread pessimism and risk aversion.

- Selling pressure: The volume of selling significantly exceeded the volume of buying, contributing to the steep decline.

- Market sentiment: Analysts describe the mood as one of fear and uncertainty, with many investors adopting a wait-and-see approach.

- Expert opinions: [Insert quotes from financial analysts or economists assessing the situation and predicting potential future market behavior]. For example: "The current situation points to a high degree of risk aversion among investors," commented [Name of Analyst], "[Quote about the market’s potential recovery or further decline]".

Potential Long-Term Consequences: The Economic Fallout in Amsterdam

The sharp decline in the Amsterdam stock market has significant potential long-term consequences for the Dutch economy. A prolonged period of uncertainty could negatively impact employment, consumer confidence, and business investment. The government will likely need to implement measures to mitigate the economic fallout and stimulate growth.

- Economic consequences: Reduced investment, job losses in affected sectors, and a potential slowdown in economic growth are all possible outcomes.

- Government intervention: The Dutch government may announce fiscal stimulus packages or other measures to support businesses and boost the economy.

- Recession risk: While not inevitable, the severity of the decline raises concerns about the potential for a recession in the Netherlands.

Conclusion: Navigating the Sharp Decline in Amsterdam: A Look Ahead

The 7% plunge in the Amsterdam stock market represents a significant event, driven largely by escalating trade war anxieties. The speed and depth of the decline, coupled with the negative investor sentiment, point to substantial challenges ahead. Understanding the long-term economic consequences, including potential impacts on employment and business investment, is crucial. While the potential for recovery exists, navigating this period of uncertainty requires careful monitoring of market trends and a proactive approach to investment management.

Stay updated on the latest developments in the Amsterdam stock market to manage your investments wisely. Monitor the Amsterdam stock market for any further declines related to trade war concerns. Consult with your financial advisor to develop a strategy that mitigates risk and capitalizes on potential opportunities during periods of market volatility.

Featured Posts

-

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

Is Apple Stock A Buy Before Q2 Earnings Analysis Of Key Levels

May 24, 2025

Is Apple Stock A Buy Before Q2 Earnings Analysis Of Key Levels

May 24, 2025 -

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 24, 2025

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 24, 2025 -

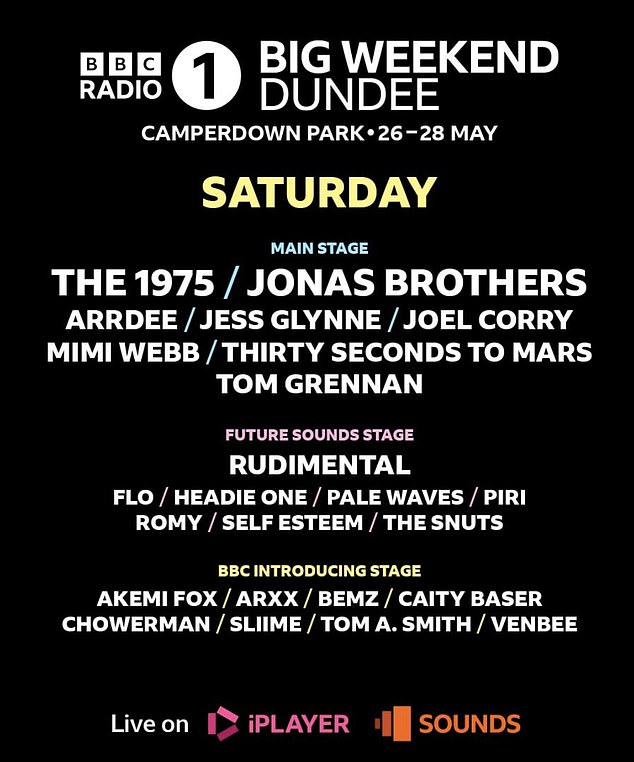

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets Complete Guide

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025