Sharp Decline In Indonesia's Reserves: Two-Year Low Amid Rupiah Volatility

Table of Contents

Factors Contributing to the Decline in Indonesia's Reserves

Several intertwined factors have contributed to the alarming decline in Indonesia's foreign exchange reserves.

Increased Import Demand

The rising cost of imports has significantly drained Indonesia's reserves. This surge in import costs is multifaceted:

- Increased energy import costs: Indonesia's reliance on energy imports makes it vulnerable to global price fluctuations. The ongoing global energy crisis has exacerbated this, leading to a substantial increase in expenditure on imported fuel.

- Rising global commodity prices: The global surge in commodity prices, impacting everything from raw materials to manufactured goods, has pushed up the cost of imports across the board.

- Impact of supply chain disruptions: Lingering supply chain disruptions, stemming from the pandemic and geopolitical events, have further amplified the cost of imported goods, adding pressure on Indonesia's foreign exchange reserves.

Data from [Insert Source: e.g., Bank Indonesia, Trading Economics] shows a [Insert Percentage]% increase in import costs over the past [Insert Time Period], resulting in a widening trade deficit of [Insert Figures]. This illustrates the significant strain on Indonesia's foreign exchange reserves.

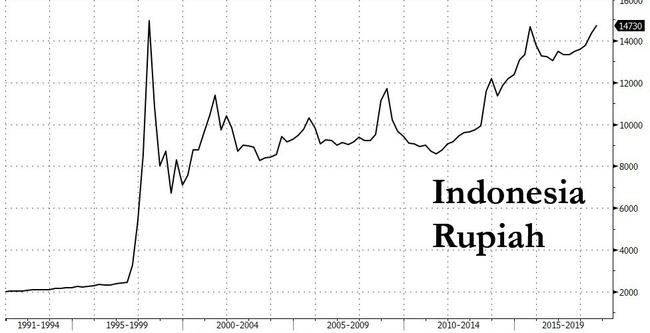

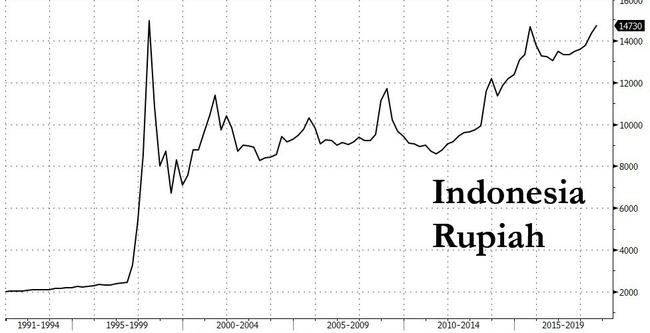

Rupiah Depreciation

The weakening of the Rupiah against major currencies, particularly the US dollar, has also contributed significantly to the reserve decline. A weaker Rupiah requires Indonesia to spend more of its foreign exchange reserves to purchase the same amount of imported goods.

- Mechanics of Rupiah depreciation: When the Rupiah depreciates, Indonesian importers need more Rupiah to buy foreign currency, increasing the demand for foreign exchange and putting downward pressure on reserves.

- Influencing factors: Several factors contribute to Rupiah volatility, including interest rate differentials between Indonesia and other countries, global economic uncertainty, and investor sentiment towards emerging markets.

[Insert Chart: Showing Rupiah/USD exchange rate over the relevant period. Source should be cited.] This chart clearly demonstrates the Rupiah's weakening trend against the US dollar, exacerbating the pressure on Indonesia's foreign exchange reserves.

Capital Outflows

Capital flight, the movement of funds out of the country, has further depleted Indonesia's reserves. Several reasons contribute to this outflow:

- Global risk aversion: Global economic uncertainty and geopolitical risks often lead to investors moving their funds from emerging markets like Indonesia to perceived safer havens.

- Investor sentiment: Negative investor sentiment towards the Indonesian economy, driven by factors like policy uncertainty or economic slowdown, can trigger capital outflows.

Data on foreign investment flows [Insert Source and data showing capital outflows] reveals a significant outflow of capital in recent months, adding to the pressure on Indonesia's foreign exchange reserves.

Impact of the Reserve Decline on the Indonesian Economy

The decline in Indonesia's foreign exchange reserves has far-reaching implications for the Indonesian economy.

Implications for Economic Stability

Lower reserves increase Indonesia's vulnerability to external shocks.

- Increased vulnerability to external shocks: A smaller reserve cushion leaves Indonesia less able to weather economic storms like global financial crises or sudden shifts in commodity prices.

- Potential pressure on the Rupiah: Further pressure on the Rupiah could lead to higher inflation and reduced purchasing power for consumers.

- Impact on inflation: A weaker Rupiah raises import costs, potentially fueling inflation.

- Effect on government borrowing costs: A weaker currency can increase government borrowing costs, as the government needs to pay more in foreign currency to service its debts.

Impact on Government Policy

The Indonesian government is likely to respond with various policy measures to mitigate the situation.

- Potential interest rate hikes: Raising interest rates can attract foreign investment and strengthen the Rupiah, but it might also slow economic growth.

- Foreign exchange interventions: The government may intervene in the foreign exchange market to support the Rupiah, but this can deplete reserves further.

- Fiscal policy adjustments: The government might adjust its fiscal policy, such as reducing spending or increasing taxes, to improve the budget balance and stabilize the economy. [Mention any actual government actions taken].

Risks and Challenges

Several risks and challenges remain for Indonesia's foreign exchange reserves.

- Global economic slowdown: A global recession could further reduce demand for Indonesian exports and increase capital outflows.

- Geopolitical risks: Geopolitical instability can disrupt trade, investment, and capital flows, negatively impacting reserves.

- Domestic policy uncertainties: Uncertainty around domestic policies can undermine investor confidence and lead to capital flight.

Potential Solutions and Outlook

Addressing the decline in Indonesia's foreign exchange reserves requires a multi-pronged approach.

Diversification of Export Earnings

Reducing reliance on a few key export commodities and diversifying into new markets and products can boost export revenue and strengthen reserves.

Attracting Foreign Direct Investment (FDI)

Implementing policies to improve the investment climate, reduce bureaucratic hurdles, and enhance infrastructure can attract more FDI, counteracting capital outflows.

Improving Macroeconomic Fundamentals

Strengthening macroeconomic fundamentals, such as controlling inflation, improving fiscal discipline, and promoting structural reforms, will enhance investor confidence and attract investment.

Conclusion

The sharp decline in Indonesia's foreign exchange reserves to a two-year low, driven by Rupiah volatility, increased import demand, and capital outflows, presents significant challenges for the Indonesian economy. The implications for economic stability, government policy, and future growth are substantial. Proactive policy measures, focusing on diversifying export earnings, attracting FDI, and strengthening macroeconomic fundamentals are crucial to addressing these challenges and ensuring sustainable economic growth. Continued monitoring of Indonesia's foreign exchange reserves and further analysis of Rupiah volatility are vital for understanding the evolving economic landscape and informing effective policy decisions. Further research into "Indonesia's foreign exchange reserves," "Rupiah volatility analysis," and the "Indonesian economic outlook" is recommended.

Featured Posts

-

Update Arrest Made In Connection With Elizabeth City Shooting

May 09, 2025

Update Arrest Made In Connection With Elizabeth City Shooting

May 09, 2025 -

Mc Cann Family Granted Police Protection Amid Stalking Concerns At Vigil

May 09, 2025

Mc Cann Family Granted Police Protection Amid Stalking Concerns At Vigil

May 09, 2025 -

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 09, 2025

Dijon 2026 Le Projet Ecologiste Pour Les Municipales

May 09, 2025 -

Melanie Griffith And Dakota Johnsons Matching Spring Outfits

May 09, 2025

Melanie Griffith And Dakota Johnsons Matching Spring Outfits

May 09, 2025 -

Planning A Trip Understanding Real Id Compliance For Air Travel

May 09, 2025

Planning A Trip Understanding Real Id Compliance For Air Travel

May 09, 2025