Sharp Decline In Toronto Home Sales: 23% Year-Over-Year, 4% Price Decrease

Table of Contents

Factors Contributing to the Decline in Toronto Home Sales

Several interconnected factors have contributed to the sharp decline in Toronto home sales. Understanding these elements is crucial for grasping the current market dynamics.

Rising Interest Rates and Mortgage Costs

The most significant factor driving the slowdown is the substantial increase in interest rates. Higher interest rates directly translate to increased mortgage costs, making homeownership less affordable for many potential buyers.

- A 1% increase in interest rates can significantly increase monthly mortgage payments, particularly for those with larger mortgages.

- Average mortgage rates in Toronto have increased by X% in the past year, impacting affordability for a large segment of the population.

- First-time homebuyers are especially vulnerable, as they often rely on maximum borrowing capacity and are particularly sensitive to interest rate fluctuations.

Economic Uncertainty and Inflation

Beyond interest rates, broader economic uncertainty and persistent inflation are dampening consumer confidence and reducing purchasing power. This impacts the real estate market significantly, as home purchases are often considered major investments.

- High inflation rates erode purchasing power, reducing the amount buyers can comfortably spend on a home.

- Rising unemployment rates and decreased consumer sentiment further reduce demand for real estate.

- Economic uncertainty makes potential buyers hesitant to commit to large financial investments like purchasing a home in the Toronto housing market.

Increased Inventory Levels

The increased number of properties available on the market has also contributed to the decline in sales. Higher inventory levels reduce buyer competition, giving buyers more leverage to negotiate lower prices.

- Inventory levels in Toronto are currently X% higher than they were a year ago, increasing buyer choice.

- This increased competition benefits buyers but reduces the negotiation power of sellers in the Toronto real estate market.

- Specific property types, such as condos in certain neighborhoods, are experiencing even higher inventory levels.

Impact on Different Segments of the Toronto Real Estate Market

The decline in Toronto home sales is affecting different market segments in varying ways.

Condo Market Trends

The Toronto condo market, typically more sensitive to interest rate changes, has also seen a significant slowdown in sales. Prices have softened, reflecting the broader market trend.

- Condo sales volume has decreased by Y% year-over-year.

- Average condo prices have experienced a Z% decrease, slightly less than the overall market decline.

- Increased inventory in certain condo submarkets has intensified competition amongst sellers.

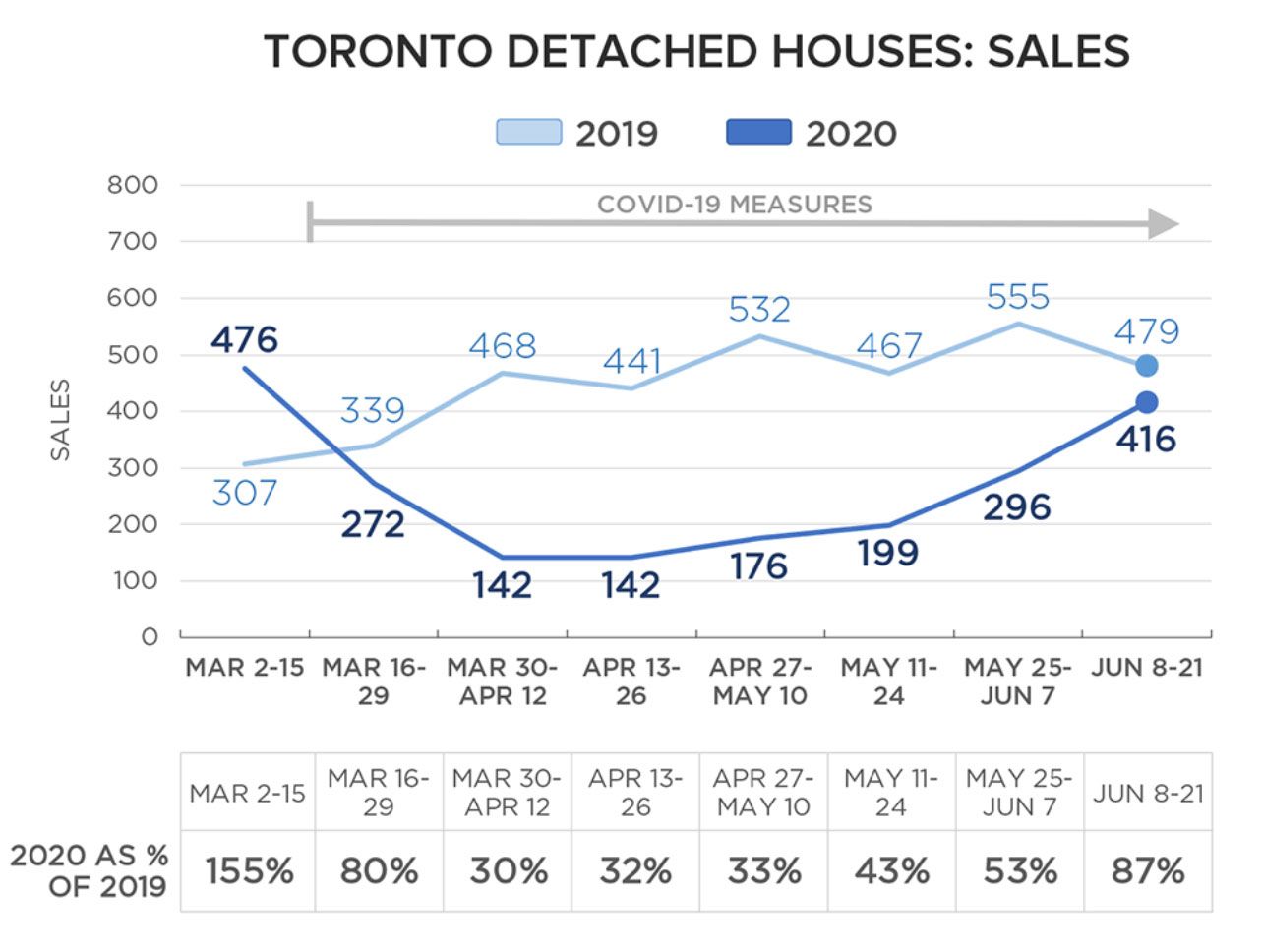

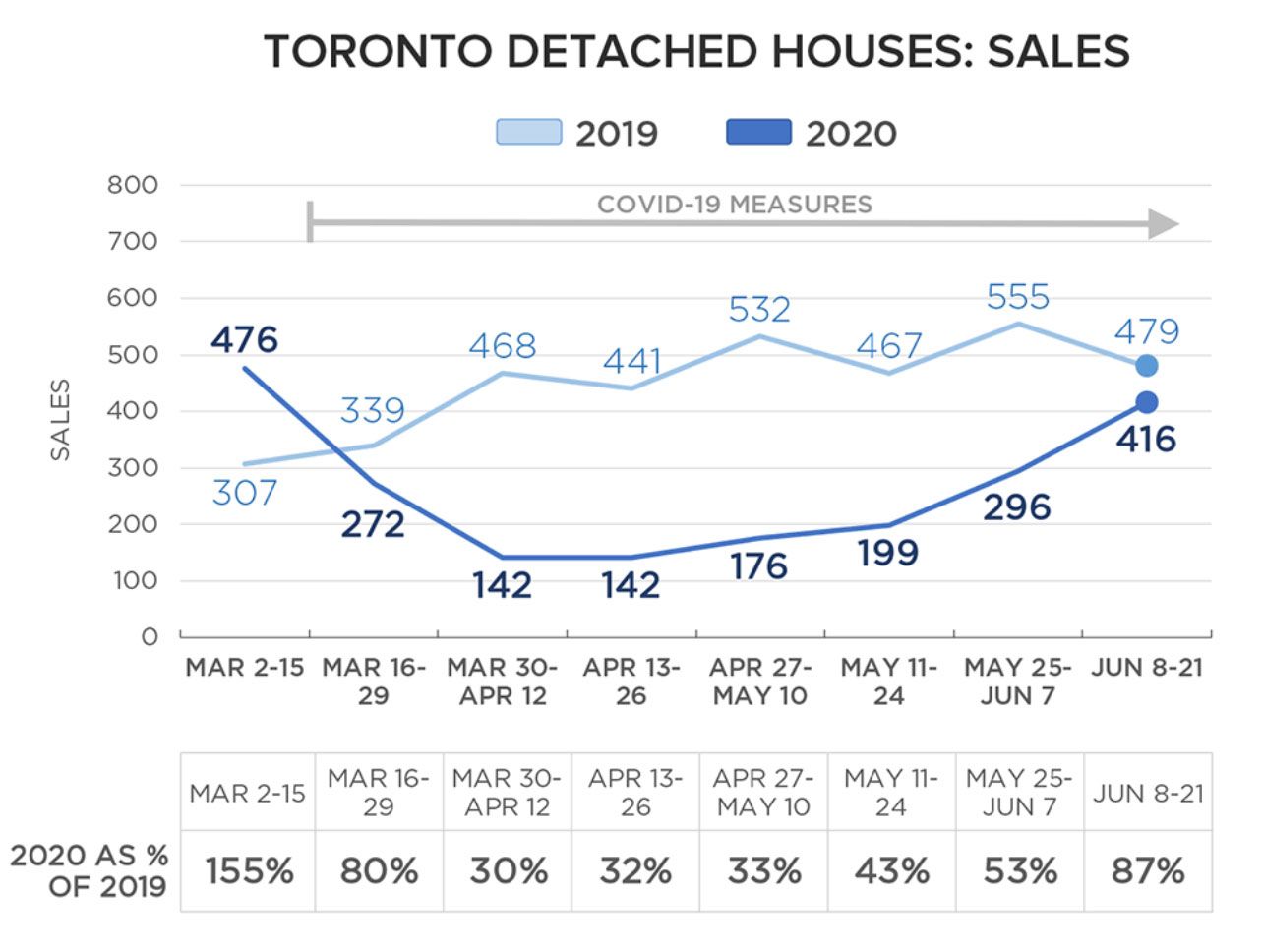

Detached Home Market Trends

The detached home market, while traditionally more resilient, is not immune to the current market slowdown. Sales volume is down, and price growth has slowed considerably.

- Sales volume for detached homes has dropped by A% year-over-year.

- Price growth for detached homes has slowed significantly, with some areas even seeing slight price declines.

- The disparity between the condo and detached home markets is narrowing as both segments respond to similar economic pressures.

Impact on First-Time Homebuyers

The current market presents significant challenges for first-time homebuyers in Toronto. Increased mortgage costs and reduced affordability make it harder to enter the market.

- Many first-time homebuyers find themselves priced out of the market due to higher interest rates and increased competition.

- Government support programs aimed at assisting first-time homebuyers are proving increasingly less effective in the face of rising costs.

- The current market emphasizes the critical need for improved financial planning and responsible budgeting for aspiring homeowners in the Toronto area.

Predictions for the Future of Toronto Real Estate

Forecasting the future of Toronto real estate requires considering both short-term and long-term factors.

Short-Term Outlook (Next 6-12 Months)

The short-term outlook for the Toronto real estate market remains uncertain, with potential for continued decline or stabilization depending on several factors.

- If interest rates remain elevated, we may see a continuation of the sales decline and further price adjustments.

- A potential stabilization could occur if interest rates plateau and consumer confidence improves.

- Increased government intervention or unexpected shifts in economic conditions could also significantly influence market trends.

Long-Term Outlook (Next 2-5 Years)

The long-term outlook for Toronto real estate remains positive due to factors such as continued population growth and ongoing infrastructure development.

- Despite short-term challenges, Toronto's long-term prospects are fueled by strong population growth and ongoing infrastructure improvements.

- Government policies and regulations will play a role in shaping the long-term trajectory of the market.

- However, continued economic uncertainty and potential shifts in global markets could influence the pace of growth.

Conclusion: Navigating the Changing Toronto Real Estate Landscape

The significant decline in Toronto home sales, driven by rising interest rates, economic uncertainty, and increased inventory, has created a challenging but potentially opportune environment for buyers and sellers. Understanding these trends is paramount for making informed decisions in the Toronto housing market. Both buyers and sellers need to adjust their strategies to navigate the current conditions effectively. Stay informed about Toronto real estate market trends and consult with experienced real estate professionals for personalized guidance in buying or selling in this dynamic market. The Toronto real estate market is constantly evolving; therefore, seeking professional advice tailored to your specific needs is crucial for success in navigating this changing landscape.

Featured Posts

-

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025 -

Analyzing Ripple Xrp The Path To 3 40

May 08, 2025

Analyzing Ripple Xrp The Path To 3 40

May 08, 2025 -

Zhurnalist Raskryvaet Detali Kontrakta Zenita S Zhersonom E500 000

May 08, 2025

Zhurnalist Raskryvaet Detali Kontrakta Zenita S Zhersonom E500 000

May 08, 2025