Shein's IPO In London: Delayed Due To US Tariffs

Table of Contents

The Planned London IPO and its Significance

Shein's aspirations for a London listing were significant. A successful IPO on the London Stock Exchange would have provided several key benefits, solidifying its position as a global player and fueling further expansion. The advantages of a London IPO included:

- Increased brand visibility and legitimacy: A London listing would have significantly enhanced Shein's brand credibility and international recognition, attracting a broader customer base and strengthening its market position.

- Significant capital for expansion: The IPO would have generated substantial capital, crucial for fueling Shein's rapid growth, expanding its operations, and investing in technology and infrastructure.

- Strategic partnerships and collaborations: A successful IPO often attracts strategic partnerships and collaborations with other established businesses, opening doors to new markets and opportunities.

- Improved access to European investors and financial markets: Listing in London would provide Shein with direct access to the sophisticated European financial markets and a vast pool of investors.

The Impact of US Tariffs on Shein's IPO Decision

The imposition of US tariffs on Shein's products has directly impacted the company's IPO plans. These tariffs, targeting various garments and accessories, significantly increase Shein's production costs and negatively affect its profitability. The financial implications are considerable:

- Increased production costs: The tariffs add a substantial amount to Shein's already low production costs, squeezing profit margins and impacting the overall financial attractiveness of the company to potential investors.

- Reduced profit margins: The decreased profitability directly affects the valuation of the company, potentially discouraging investors looking for a strong return on their investment.

- Negative investor sentiment: Uncertainty surrounding the tariffs and their potential long-term effects creates a climate of uncertainty, impacting investor confidence and potentially reducing the demand for Shein's shares.

- Shein's mitigation strategies: While specific details of Shein's response remain undisclosed, the company is likely exploring various strategies to mitigate the impact of the tariffs, including lobbying efforts and potential supply chain restructuring.

Alternative Strategies and Future IPO Prospects

Given the current situation, Shein is likely considering several alternatives to navigate this challenge. These strategies might include:

- Delaying the IPO further: Postponing the IPO allows Shein to wait for a more favorable market environment or resolve the tariff issue before seeking public listing.

- Exploring different listing locations: Shein may consider alternative stock exchanges in other regions, less affected by US tariffs.

- Restructuring supply chains: This involves diversifying manufacturing locations and sourcing materials from countries not subject to the same tariffs.

- Focusing on internal improvements and cost-cutting: Shein might prioritize internal efficiencies and cost-reduction measures to improve its financial performance before pursuing an IPO.

The Broader Context of Global Trade and Fast Fashion

Shein's predicament highlights the complexities facing the fast-fashion industry in the context of global trade. The situation underscores several critical challenges:

- Increasing scrutiny of fast fashion's environmental and social impact: The industry faces increasing pressure to address concerns about its environmental sustainability and ethical labor practices.

- Geopolitical factors influencing business decisions: Geopolitical tensions and trade disputes significantly impact business strategies and decision-making processes.

- Navigating international trade regulations and tariffs: Businesses operating internationally must contend with a complex web of regulations and tariffs, requiring strategic planning and adaptability.

- Competitive landscape of the fast-fashion market: The highly competitive nature of the fast-fashion market necessitates constant innovation, efficiency, and resilience to external shocks.

Conclusion

The Shein IPO delay, primarily driven by the impact of US tariffs, reveals the challenges faced by global businesses navigating the complexities of international trade and the fast-fashion landscape. The tariffs significantly impact Shein's profitability, investor confidence, and ultimately, its ability to proceed with its London IPO. The company is likely exploring alternative strategies, including supply chain diversification and exploring different listing locations to overcome these hurdles. The long-term impact on Shein's growth and market positioning remains to be seen. Stay tuned for updates on the Shein IPO and its potential future developments. Follow us for the latest news on Shein's London listing and the impact of US tariffs on its strategic decisions. Keep an eye out for a Shein IPO update in the coming months.

Featured Posts

-

Eviter Les Catastrophes La Methode De L Affutage De La Guillotine

May 04, 2025

Eviter Les Catastrophes La Methode De L Affutage De La Guillotine

May 04, 2025 -

Dispelling The Myth Buffetts Stance On Trumps Tariffs

May 04, 2025

Dispelling The Myth Buffetts Stance On Trumps Tariffs

May 04, 2025 -

Russell Westbrook New Placement In Nbas All Time Scoring Top 20

May 04, 2025

Russell Westbrook New Placement In Nbas All Time Scoring Top 20

May 04, 2025 -

Canelo Vs Crawford Upset Brewing

May 04, 2025

Canelo Vs Crawford Upset Brewing

May 04, 2025 -

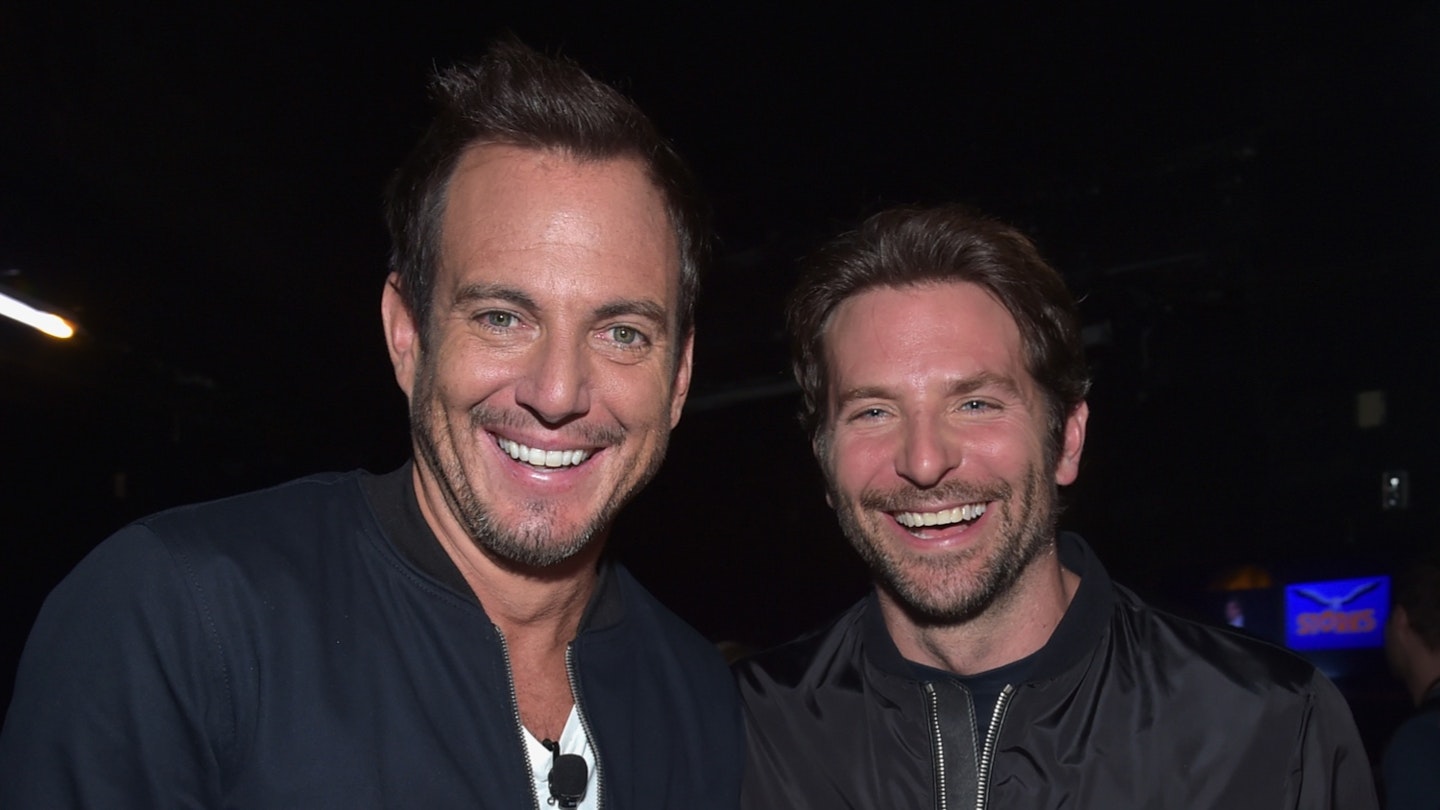

Is This Thing On Behind The Scenes Look At Bradley Cooper And Will Arnetts Nyc Production

May 04, 2025

Is This Thing On Behind The Scenes Look At Bradley Cooper And Will Arnetts Nyc Production

May 04, 2025