Shein's London IPO: The US Tariff Roadblock

Table of Contents

Shein's Business Model and its Vulnerability to US Tariffs

Shein's success is built on an ultra-fast fashion business model. This model relies heavily on low production costs, achieved primarily through its extensive supply chains based largely in China. The US market represents a significant portion of Shein's revenue and is vital for its continued growth. However, existing US tariffs on clothing and accessories directly impact Shein's profit margins, making it less competitive against established brands in the American market.

- Shein's reliance on Chinese manufacturing: The majority of Shein's products are manufactured in China, making it highly susceptible to trade tensions between the US and China.

- Specific tariffs impacting Shein's products: Tariffs imposed on clothing and textile imports directly increase the cost of Shein's products in the US, squeezing profit margins.

- Increased prices for US consumers: To offset the impact of these tariffs, Shein may be forced to increase prices, potentially impacting consumer demand and its competitive advantage.

The Strategic Implications of a London IPO for Shein

Shein's decision to pursue a London IPO, rather than a New York or Hong Kong listing, is a strategic move with both advantages and disadvantages. London offers access to a large pool of European and global investors, a relatively favorable regulatory environment, and a strong financial infrastructure. However, choosing London might not fully mitigate the US tariff issue.

- Access to European and global investors: A London listing opens doors to a broader range of investors beyond the US market, potentially reducing reliance on US consumer spending.

- Potential regulatory hurdles in London: While generally considered favorable, the UK regulatory environment still presents its own set of compliance requirements for listed companies.

- Impact on Shein's brand image and investor confidence: The US tariff challenge could negatively impact investor perception of Shein's long-term stability and profitability, potentially affecting the IPO valuation.

Potential Solutions and Mitigation Strategies for Shein

Shein faces a critical need to address the US tariff issue proactively. Several strategies could potentially mitigate the negative impact:

- Shifting production to other countries: Diversifying its manufacturing base to countries with more favorable trade relationships with the US could lessen its vulnerability to tariffs. This, however, would require significant investment and time.

- Negotiating trade agreements with the US government: Shein could lobby for more favorable trade terms or exemptions from specific tariffs, although this is a complex and uncertain path.

- Absorbing tariff costs to maintain competitiveness: Shein could choose to absorb the increased costs associated with tariffs, protecting its market share in the US but sacrificing profit margins.

- Increasing prices to offset tariff costs: While this is the simplest solution, it risks alienating price-sensitive customers who are a key part of Shein's target market.

The Future of Shein and the Impact of the US Tariff Roadblock on the Fast Fashion Industry

Shein's struggle with US tariffs has broader implications for the fast fashion industry. Other companies relying on low-cost manufacturing in China could face similar challenges, leading to industry-wide adjustments. The long-term sustainability of ultra-fast fashion business models is being questioned amidst increasing regulatory scrutiny and geopolitical uncertainty.

- Impact on competitor strategies: Competitors may also explore alternative sourcing or pricing strategies in response to the challenges posed by US tariffs.

- Changes in consumer behavior: Increased prices due to tariffs could impact consumer purchasing habits, potentially leading to a shift towards more sustainable or ethically sourced fashion.

- The evolving landscape of global trade: The current situation highlights the risks of over-reliance on single manufacturing locations and the increasing importance of diversified supply chains in a globalized market.

Conclusion: Navigating the Shein London IPO and the US Tariff Obstacle

Shein's London IPO presents a significant opportunity, but the US tariff roadblock casts a long shadow. The company's success hinges on its ability to strategically navigate this challenge, whether through diversification, negotiation, or price adjustments. The outcome will not only determine Shein's future but also influence the broader fast-fashion industry's response to evolving global trade dynamics. Stay tuned for updates on Shein's London IPO and how they navigate this US tariff roadblock.

Featured Posts

-

Reluctant Berlanga Secures Impressive Ko

May 04, 2025

Reluctant Berlanga Secures Impressive Ko

May 04, 2025 -

Snl 50th Anniversary Emma Stones Daring Fashion Choice

May 04, 2025

Snl 50th Anniversary Emma Stones Daring Fashion Choice

May 04, 2025 -

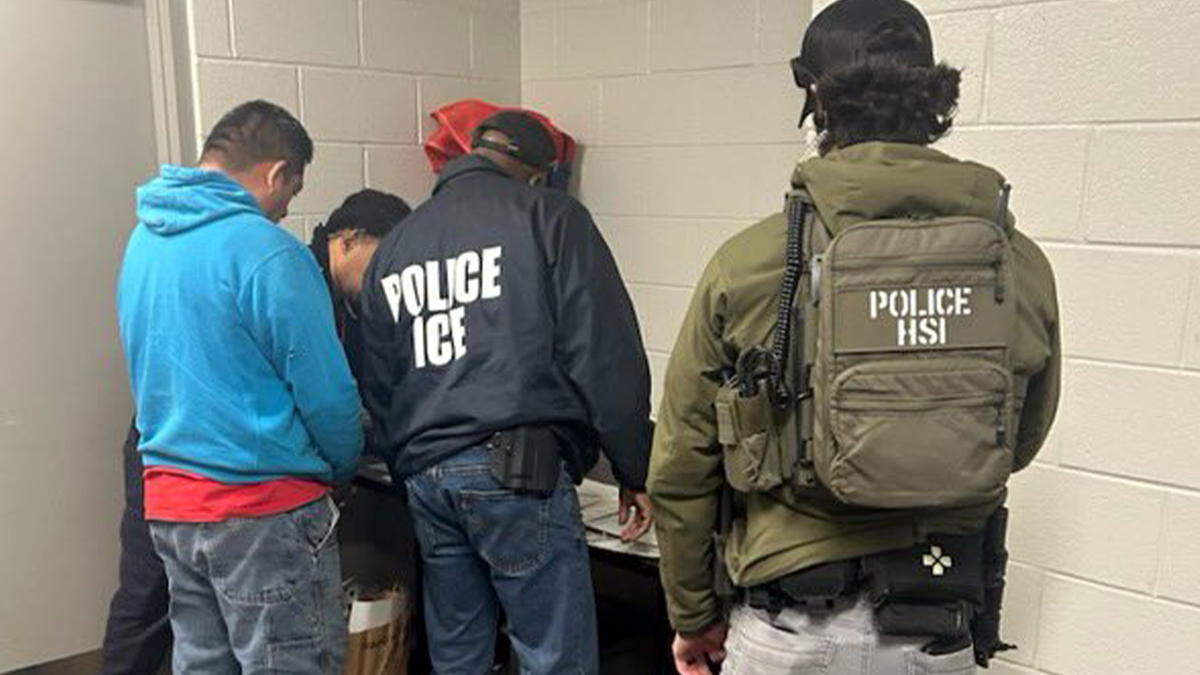

Migrant Spends Eight Hours In Tree To Evade Ice Arrest A Desperate Act Of Survival

May 04, 2025

Migrant Spends Eight Hours In Tree To Evade Ice Arrest A Desperate Act Of Survival

May 04, 2025 -

Sydney Sweeneys Difficult Breakup Understanding Her Reported Struggle With Jonathan Davino

May 04, 2025

Sydney Sweeneys Difficult Breakup Understanding Her Reported Struggle With Jonathan Davino

May 04, 2025 -

Canelo Ggg Iv Nyc Press Conference Previews Undisputed Title Fight

May 04, 2025

Canelo Ggg Iv Nyc Press Conference Previews Undisputed Title Fight

May 04, 2025