Shein's Stalled London IPO: US Tariffs Cast A Long Shadow

Table of Contents

H2: The Allure of a London IPO for Shein

Shein's meteoric rise to become a global fast fashion powerhouse has been nothing short of remarkable. Its ultra-low prices and rapid-fire trend cycles have disrupted the industry, creating a massive global following. However, to continue this trajectory and fuel further expansion, Shein requires substantial capital injection beyond its current funding rounds. This is where the allure of a London IPO comes into play.

-

Shein's global ambition: Shein's ambition extends far beyond its current market share. An IPO would provide the significant capital infusion needed to expand its global footprint, invest in technology, and enhance its supply chain infrastructure. This includes further penetration of existing markets and expansion into new, lucrative territories. The potential for increased market capitalization makes a successful IPO highly attractive.

-

London's attractiveness: London offers several compelling advantages as an IPO location. Its established financial infrastructure, access to a vast pool of international investors, and proximity to key European markets make it an ideal launching pad for a global brand like Shein. The UK's relatively favorable regulatory environment for IPOs also adds to its appeal.

-

Potential benefits of an IPO: A successful Shein IPO would bring multiple benefits. Increased brand visibility and credibility are key, attracting both new customers and high-profile collaborations. The influx of capital allows for aggressive expansion, technology upgrades, and potentially acquisitions of smaller competitors. Finally, improved investor relations through increased transparency will solidify Shein's position in the market.

H2: The Impact of US Tariffs on Shein's IPO Prospects

The shadow looming over Shein's IPO plans is the ongoing investigation into its business practices by US authorities and the potential imposition of substantial tariffs. These investigations center around concerns about intellectual property rights, labor practices, and potential violations of US trade laws.

-

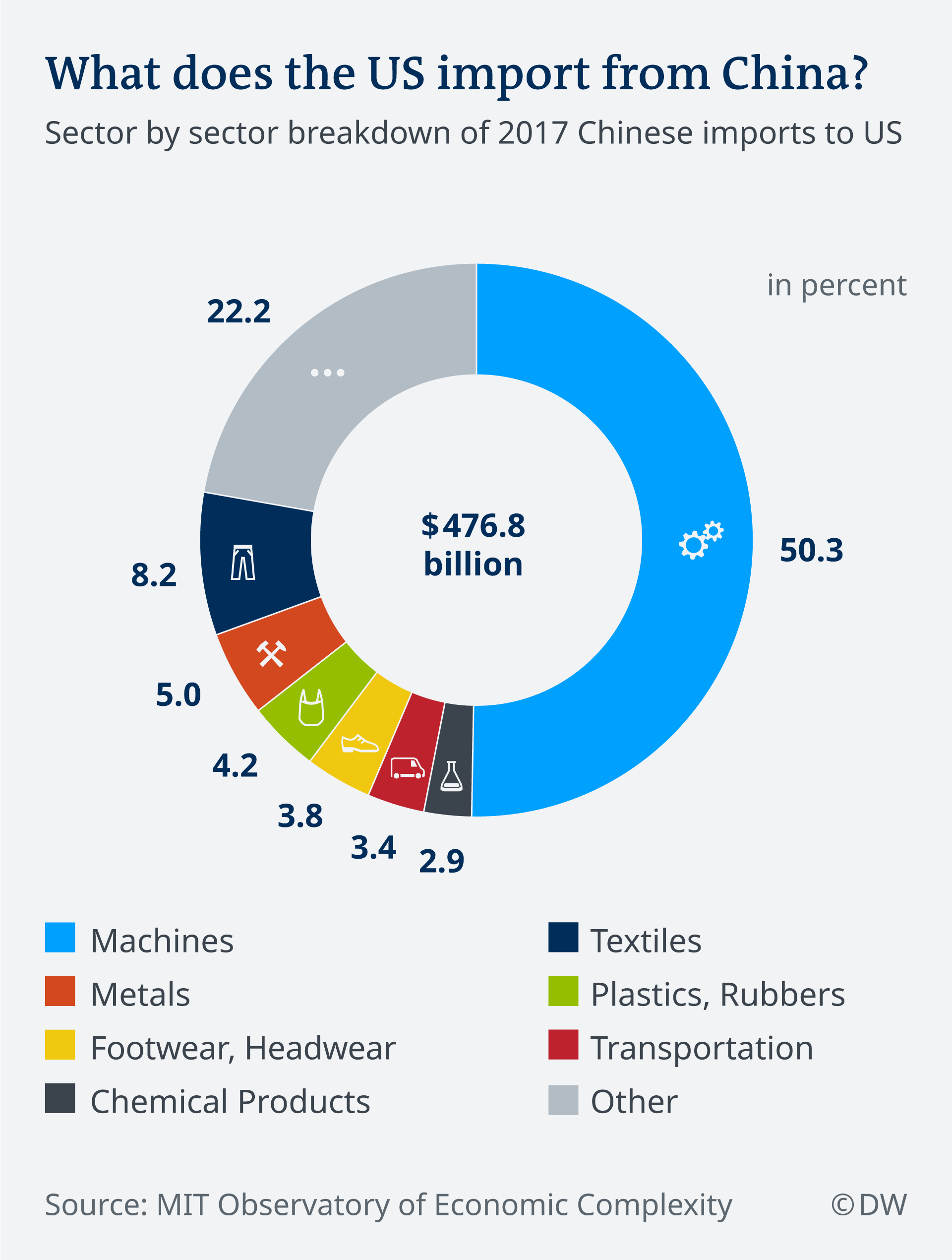

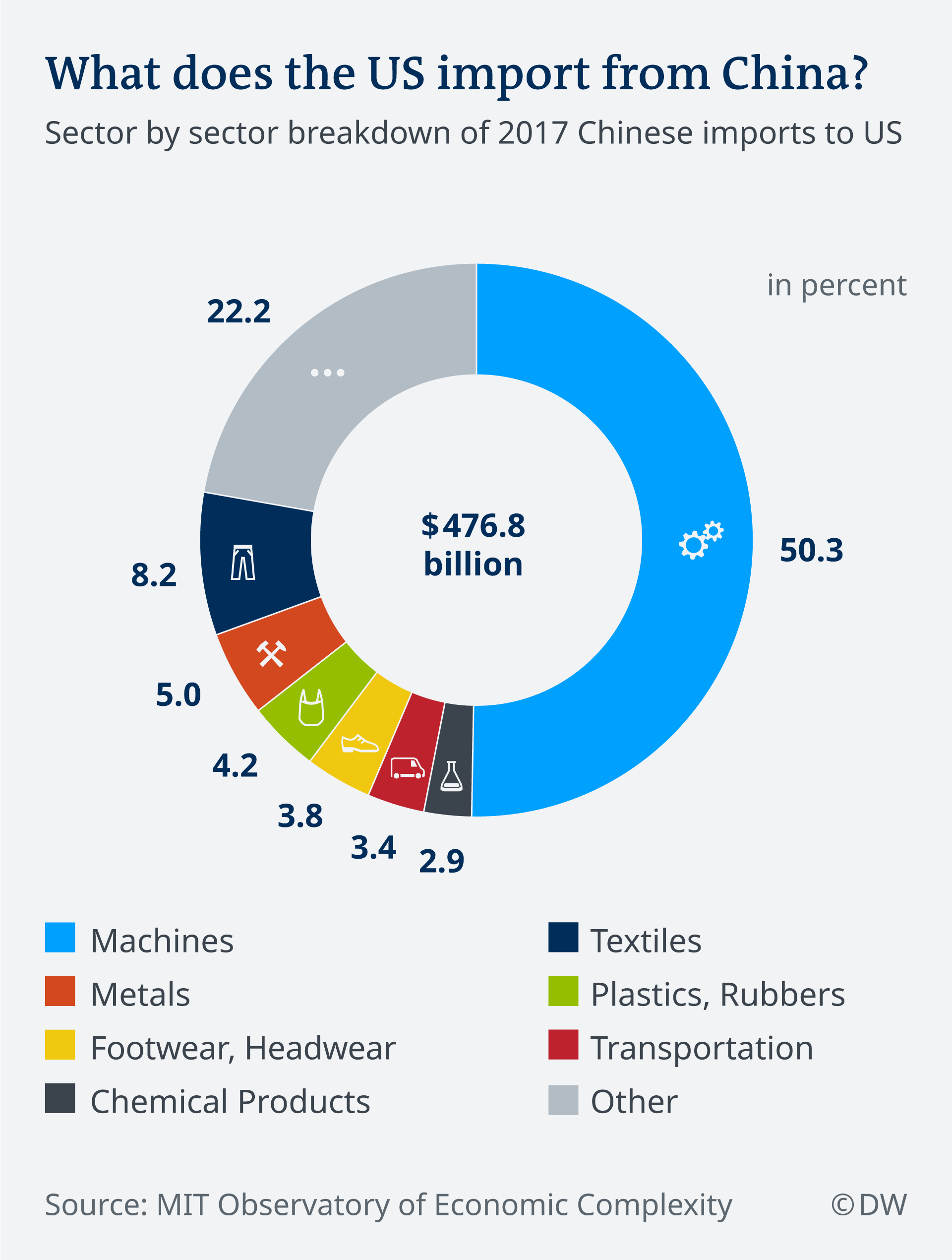

US tariff investigations: The potential for significant tariffs on Shein's goods imported into the US poses a substantial threat to its profitability. These tariffs could significantly increase the cost of its products, impacting competitiveness and potentially eroding its market share in a key region.

-

Potential tariff implications: Substantial US tariffs would dramatically increase Shein's production costs and reduce profit margins. This would directly impact its financial outlook, potentially making it less attractive to investors concerned about the long-term sustainability of its business model.

-

Investor concerns: The uncertainty surrounding US tariffs has undoubtedly discouraged potential investors. Investors are risk-averse and prefer predictable financial outlooks. The potential for significant unforeseen costs associated with tariffs increases the perceived risk of investing in Shein, impacting the price of its shares.

-

Bullet points: The potential negative impacts of US tariffs on Shein include:

- Increased production costs, squeezing profit margins

- Reduced profit margins, impacting investor returns

- Damage to brand reputation due to negative press coverage

- Negative impact on investor confidence, deterring participation in the IPO

H2: Alternative Strategies for Shein's Future Growth

Despite the setbacks caused by the potential US tariffs, Shein still has several avenues to pursue for continued growth. Delaying the IPO allows the company to strategically address these challenges and reassess its approach.

-

Exploring other funding options: Shein could explore further rounds of private investment to secure the capital needed for expansion. This might involve attracting new investors or securing larger investments from existing stakeholders.

-

Addressing US tariff concerns: Shein can actively engage in lobbying efforts to influence trade policy and mitigate the impact of potential tariffs. This may involve negotiating trade agreements, diversifying its sourcing to lessen dependence on Chinese manufacturing, and investing in more ethically sourced production.

-

Focusing on other markets: Shein can strategically focus on expanding its presence in markets less susceptible to US trade policies. This may involve investing heavily in marketing and distribution networks in regions like Europe, Latin America, and Asia.

-

Bullet points: Shein's alternative growth strategies could include:

- Securing further private equity funding

- Forming strategic alliances with other companies

- Diversifying its market presence geographically

- Restructuring its supply chain for greater flexibility and ethical sourcing

Conclusion:

Shein's delayed London IPO highlights the intricate challenges faced by fast-fashion companies in today's complex global trade environment. The threat of substantial US tariffs has undeniably cast a long shadow, raising serious concerns among potential investors and prompting a re-evaluation of the company's expansion strategies. While alternative funding avenues exist, resolving the US tariff issue remains crucial for Shein's long-term success. Understanding the implications of the Shein IPO delay is crucial for anyone following the fast fashion industry or interested in the intricacies of international trade. Staying informed on developments regarding the Shein IPO and the impact of US tariffs is essential for navigating this dynamic market. Keep watching for updates on the future of the Shein IPO and its impact on the global fashion industry.

Featured Posts

-

Canelo Alvarezs One Word Take On Jake Paul And Other Boxers

May 04, 2025

Canelo Alvarezs One Word Take On Jake Paul And Other Boxers

May 04, 2025 -

Marvel Cinematic Universe A Call For Higher Standards

May 04, 2025

Marvel Cinematic Universe A Call For Higher Standards

May 04, 2025 -

Anna Kendrick And Rebel Wilsons Friendship From Pitch Perfect To Real Life

May 04, 2025

Anna Kendrick And Rebel Wilsons Friendship From Pitch Perfect To Real Life

May 04, 2025 -

Onde Assistir Corinthians X Sao Bernardo Horario E Informacoes Da Partida

May 04, 2025

Onde Assistir Corinthians X Sao Bernardo Horario E Informacoes Da Partida

May 04, 2025 -

Oni Byli Kak Bratya Kuper I Di Kaprio Pravda O Rasstavanii Druzey

May 04, 2025

Oni Byli Kak Bratya Kuper I Di Kaprio Pravda O Rasstavanii Druzey

May 04, 2025