Shifting The Balance: Addressing Overreliance On U.S. Investment In Canada

Table of Contents

The Current State of U.S. Investment in Canada

The dominance of U.S. investment in Canada is undeniable. Analyzing the landscape of US investment sectors in Canada reveals a concerning concentration. Foreign direct investment (FDI) from the U.S. significantly shapes key sectors of the Canadian economy.

H3: Sectoral Concentration:

The energy sector, for instance, heavily relies on U.S. investment, with numerous American energy companies holding significant stakes in Canadian oil sands and natural gas projects. Similarly, the technology and finance sectors see substantial U.S. involvement, creating a situation of sectoral dependence. This concentration creates vulnerabilities within these critical industries.

- Percentage breakdown: While precise figures fluctuate, estimates consistently place U.S. investment at a significantly high percentage across key sectors like energy (over 50%), technology (around 40%), and finance (over 30%).

- Major U.S. players: Companies like ExxonMobil, Microsoft, and Goldman Sachs have massive operations in Canada, highlighting the influence of U.S. capital.

- Vulnerability: This concentrated investment makes the Canadian economy susceptible to shocks originating in the U.S., such as policy shifts or economic downturns.

Risks Associated with Overreliance on U.S. Investment

The current imbalance presents considerable economic risks. Overdependence on a single major investor leaves Canada vulnerable to external economic pressures.

H3: Economic Vulnerability:

A major recession in the U.S. would directly and severely impact Canadian businesses heavily reliant on American investment. Changes in U.S. trade policies or regulatory frameworks can also significantly affect the Canadian economy. This trade dependency necessitates a more resilient approach.

- Past events: The 2008 financial crisis demonstrated how interconnected the economies are, with Canada experiencing a slowdown due to the U.S. downturn.

- Future policy changes: Shifts in U.S. environmental regulations or energy policies could significantly impact Canadian industries reliant on U.S. investment.

- Resilience: Reducing reliance on a single source of investment is essential for navigating future economic uncertainties.

Strategies for Diversifying Investment Sources

To mitigate the risks, Canada needs to actively pursue strategies to attract investment from a wider range of global partners. Diversifying investment sources is paramount.

H3: Attracting Investment from Other Countries:

This requires a multi-pronged approach, focusing on improving Canada's business climate, promoting its strengths to international investors, and actively targeting specific regions.

- Government initiatives: The Canadian government needs to continue and strengthen initiatives designed to attract foreign investment, particularly from Asia and Europe, showcasing Canada's stable political environment, skilled workforce, and abundant natural resources.

- Business climate: Streamlining regulations, reducing bureaucratic hurdles, and improving infrastructure are crucial to creating a more attractive investment environment.

- Targeted outreach: Focusing on specific regions, such as the European Union and rapidly growing Asian markets, will help diversify investment sources and reduce dependence on the U.S.

Promoting Domestic Investment and Entrepreneurship

Alongside attracting foreign capital, fostering domestic investment and entrepreneurship is essential for long-term economic stability.

H3: Fostering Innovation and Growth:

Strengthening Canadian businesses and encouraging innovation will reduce reliance on external investment and drive sustainable economic growth.

- Supporting startups: Providing grants, tax incentives, and mentorship programs for Canadian startups and small businesses will stimulate innovation and job creation.

- Government policies: Government policies that encourage domestic investment, such as tax credits for R&D and infrastructure development, are crucial.

- Venture capital: Encouraging the growth of domestic venture capital and private equity firms will provide crucial funding for Canadian businesses.

Conclusion:

Canada's overreliance on U.S. investment presents significant economic risks. A balanced investment strategy is crucial for long-term stability and prosperity. Diversifying foreign investment sources, coupled with a strong focus on domestic investment and entrepreneurship, is not merely desirable but essential. We must actively pursue policies that attract investment from diverse global partners and foster a vibrant domestic entrepreneurial ecosystem. Only by reducing reliance on US investment and diversifying foreign investment can we truly strengthen the Canadian economy and ensure its long-term success.

Featured Posts

-

Oranjegekte Naar Liverpool Titelstrijd Trekt Nederlandse Supporters

May 29, 2025

Oranjegekte Naar Liverpool Titelstrijd Trekt Nederlandse Supporters

May 29, 2025 -

Upcoming Louisiana Horror Film Sinners Theater Release Details

May 29, 2025

Upcoming Louisiana Horror Film Sinners Theater Release Details

May 29, 2025 -

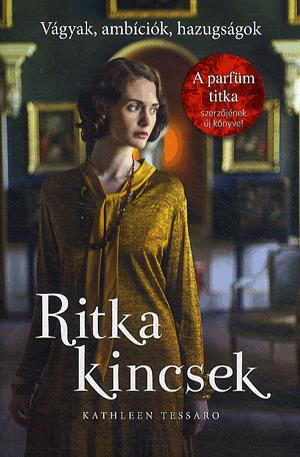

Ritka Kincsek A Vateran Rekordarak A Legkeresettebb Termekekert

May 29, 2025

Ritka Kincsek A Vateran Rekordarak A Legkeresettebb Termekekert

May 29, 2025 -

Nba Injury Report Pacers Vs Kings March 31st Matchup

May 29, 2025

Nba Injury Report Pacers Vs Kings March 31st Matchup

May 29, 2025 -

Robbie Williams Malaga Concert Cruise Ship Christening Spectacle

May 29, 2025

Robbie Williams Malaga Concert Cruise Ship Christening Spectacle

May 29, 2025