Should I Buy Palantir Stock Before Its May 5th Earnings Report?

Table of Contents

Analyzing Palantir's Recent Performance and Future Prospects

Palantir Technologies (PLTR) operates in the big data analytics and software space, providing powerful solutions for government and commercial clients. Its platform is known for its ability to analyze vast amounts of data to solve complex problems. Understanding its recent performance is crucial to deciding whether to buy Palantir stock before the May 5th earnings report.

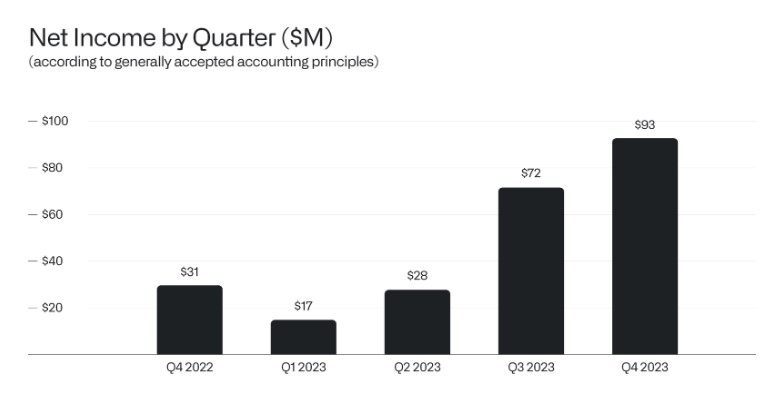

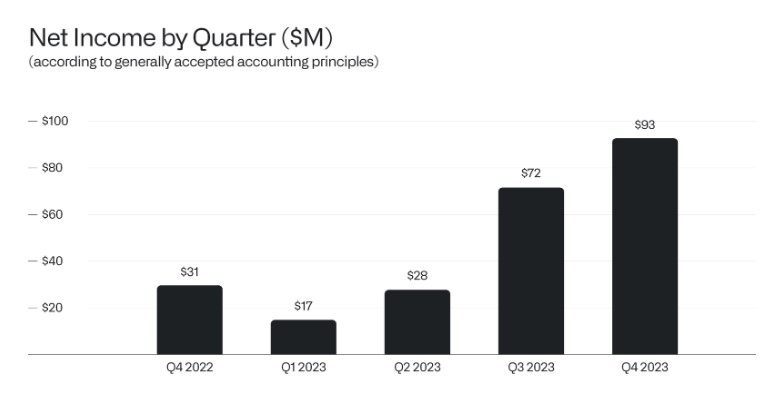

Revenue Growth and Profitability

Examining Palantir's financial health is paramount. We need to look beyond headline numbers and delve into the details.

- Revenue Growth Rate: Analyze the quarterly and yearly revenue growth rates. A consistently increasing rate suggests a healthy, expanding business. However, a slowing growth rate might signal potential concerns.

- Profitability Margins: Gross margin, operating margin, and net margin all provide insights into Palantir's profitability. High margins indicate efficiency and pricing power, while shrinking margins may be a cause for concern.

- Revenue Stream Diversification: Palantir's revenue comes from both government and commercial sectors. A balanced distribution across these sectors reduces reliance on any single source and decreases overall risk. A shift in the balance might impact future projections. Understanding this dynamic is crucial for evaluating PLTR stock.

Government Contracts and Commercial Growth

Palantir's substantial government contracts have historically been a major revenue driver. However, its foray into the commercial sector is vital for long-term growth and diversification.

- Government Contract Pipeline: The pipeline of future government contracts is a key factor impacting future revenue. A robust pipeline suggests continued stability, while a lack thereof increases uncertainty.

- Commercial Partnership Success: Palantir's success in forging and maintaining partnerships with commercial entities is a critical indicator of its ability to penetrate and grow within this sector.

- Revenue Diversification: A balanced mix of government and commercial revenue minimizes the risk associated with relying heavily on any single revenue source. This is a key element for assessing the future of PLTR stock.

Competition and Market Share

Palantir operates in a competitive landscape. Understanding its position is crucial for a well-informed investment decision.

- Key Competitors: Companies like AWS, Microsoft, and Google Cloud Platform offer competing data analytics solutions. Understanding these competitors' strengths and weaknesses is crucial.

- Competitive Advantages: Palantir's proprietary technology, its extensive data sets, and strategic partnerships are key advantages that differentiate it in the market.

- Market Share Threats: Analyzing potential threats to Palantir's market share—such as increased competition or changing market dynamics—is essential for forecasting the future performance of PLTR stock.

Evaluating the Market Sentiment and Analyst Predictions

Market sentiment and analyst predictions offer valuable insights into investor expectations and future price movements.

Stock Price Trends and Volatility

Examining recent stock price performance provides a visual representation of investor confidence and market reaction.

- Stock Price Highs and Lows: Analyzing recent highs and lows helps identify significant trends and volatility.

- Valuation Metrics: The price-to-earnings ratio (P/E) and other valuation metrics provide context for determining whether the stock is overvalued or undervalued.

- News Impact: Major news events and announcements can significantly affect Palantir's stock price.

Analyst Ratings and Price Targets

Analyst opinions offer a diverse perspective on Palantir's prospects.

- Buy/Hold/Sell Recommendations: A summary of analyst ratings provides a gauge of overall market sentiment toward PLTR stock.

- Price Targets: Analyst price targets reflect their expectations for future stock price performance.

- Divergence of Opinions: Analyzing any significant differences in analyst opinions helps understand the uncertainty surrounding Palantir's stock.

Assessing the Risks and Rewards of Investing in Palantir Before Earnings

Investing in Palantir before the earnings report involves both significant risks and potential rewards.

Earnings Surprise Potential

Palantir's earnings could beat or miss analyst expectations, significantly impacting the stock price.

- Accuracy of Earnings Guidance: Past performance in meeting earnings guidance provides insight into the company's forecasting ability.

- Factors Influencing Earnings: Identifying potential positive or negative factors influencing earnings helps predict possible scenarios.

- Price Movement Estimates: Estimating potential price movements based on different earnings scenarios provides context for the level of risk involved.

Overall Investment Risk

Investing in Palantir involves several risks to consider.

- Economic Downturn Impact: Economic downturns could negatively affect both government and commercial spending on data analytics solutions.

- Government Contract Dependency: Heavy reliance on government contracts exposes Palantir to changes in government spending priorities.

- Regulatory and Legal Risks: Potential regulatory or legal issues could significantly impact Palantir's operations and stock price.

Conclusion: Should You Buy Palantir Stock Before the May 5th Earnings Report?

The decision of whether to buy Palantir stock before its May 5th earnings report is complex. While Palantir boasts promising technology and a growing commercial sector, it also faces competitive pressures and significant reliance on government contracts. Analyst opinions are varied, and the potential for an earnings surprise—positive or negative—is considerable. The stock's price volatility adds another layer of risk.

Ultimately, the decision of whether to buy Palantir stock before its May 5th earnings report rests with you. Remember to conduct thorough due diligence and seek professional advice before investing in PLTR stock or any other investment. Consider your own risk tolerance and investment goals before making any decisions. Understanding the nuances of Palantir's business model, market position, and the risks involved is paramount before deciding whether to invest in Palantir stock before the May 5th earnings report.

Featured Posts

-

Ai Driven Podcast Creation Transforming Mundane Documents Into Engaging Content

May 10, 2025

Ai Driven Podcast Creation Transforming Mundane Documents Into Engaging Content

May 10, 2025 -

Pam Bondi On Epstein Diddy Jfk Mlk Documents Release Imminent

May 10, 2025

Pam Bondi On Epstein Diddy Jfk Mlk Documents Release Imminent

May 10, 2025 -

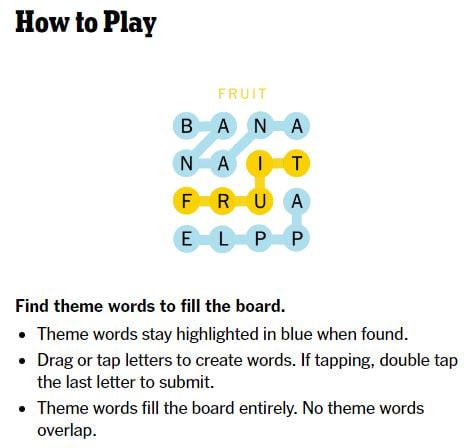

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025 -

Psgs Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025

Psgs Winning Formula Luis Enriques Impact On The French Champions

May 10, 2025 -

Unlocking Nyt Strands April 9 2025 Puzzle Walkthrough

May 10, 2025

Unlocking Nyt Strands April 9 2025 Puzzle Walkthrough

May 10, 2025