Should Investors Worry About Current Stock Market Valuations? BofA's Answer.

Table of Contents

The current stock market presents a complex picture for investors. High valuations are a common concern, leading many to question whether a correction or bear market is imminent. Bank of America (BofA), a leading financial institution, offers valuable insights into this crucial question: should investors worry about current stock market valuations? This article examines BofA's perspective and explores the factors informing their assessment.

BofA's Stance on Current Valuations

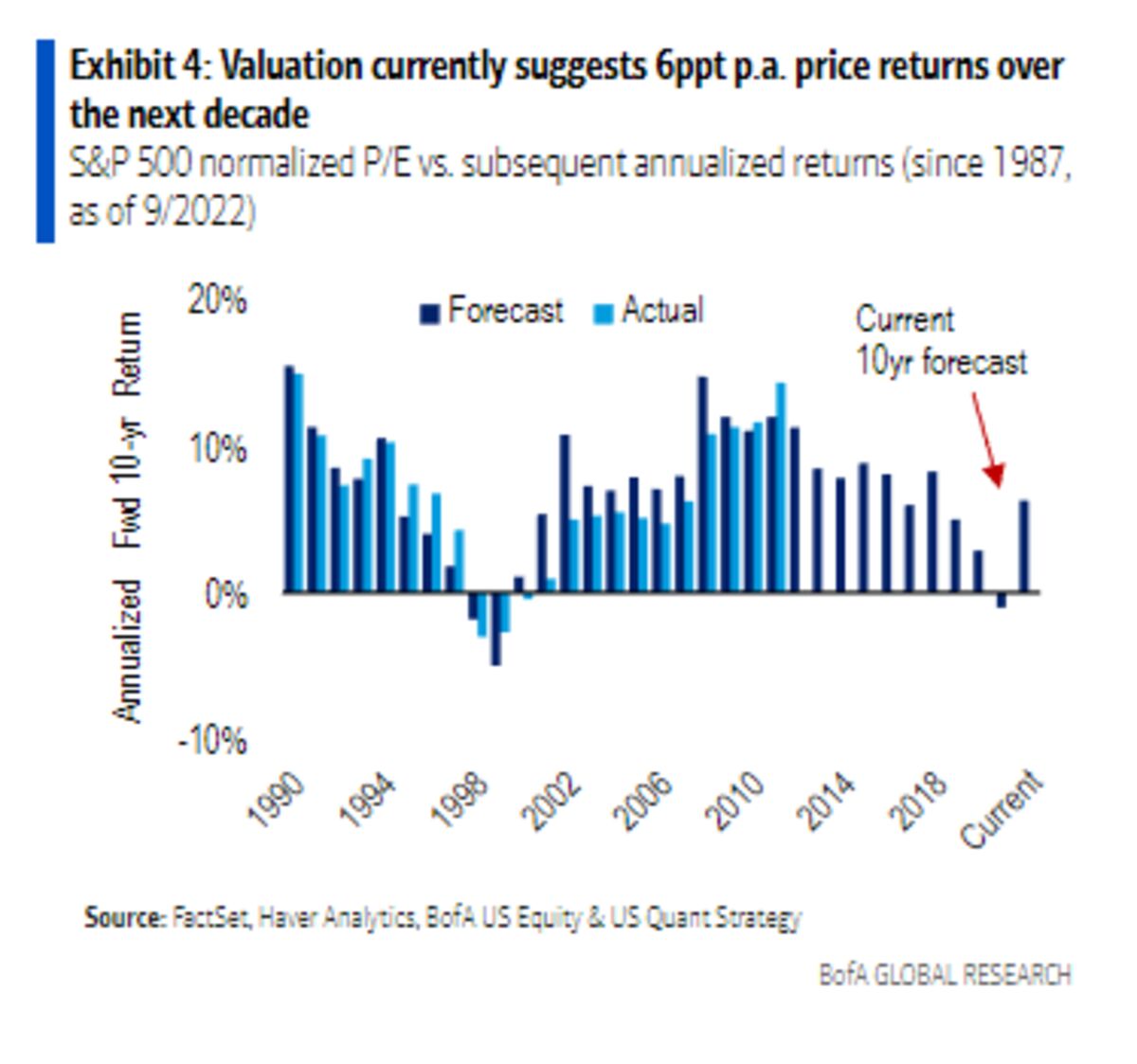

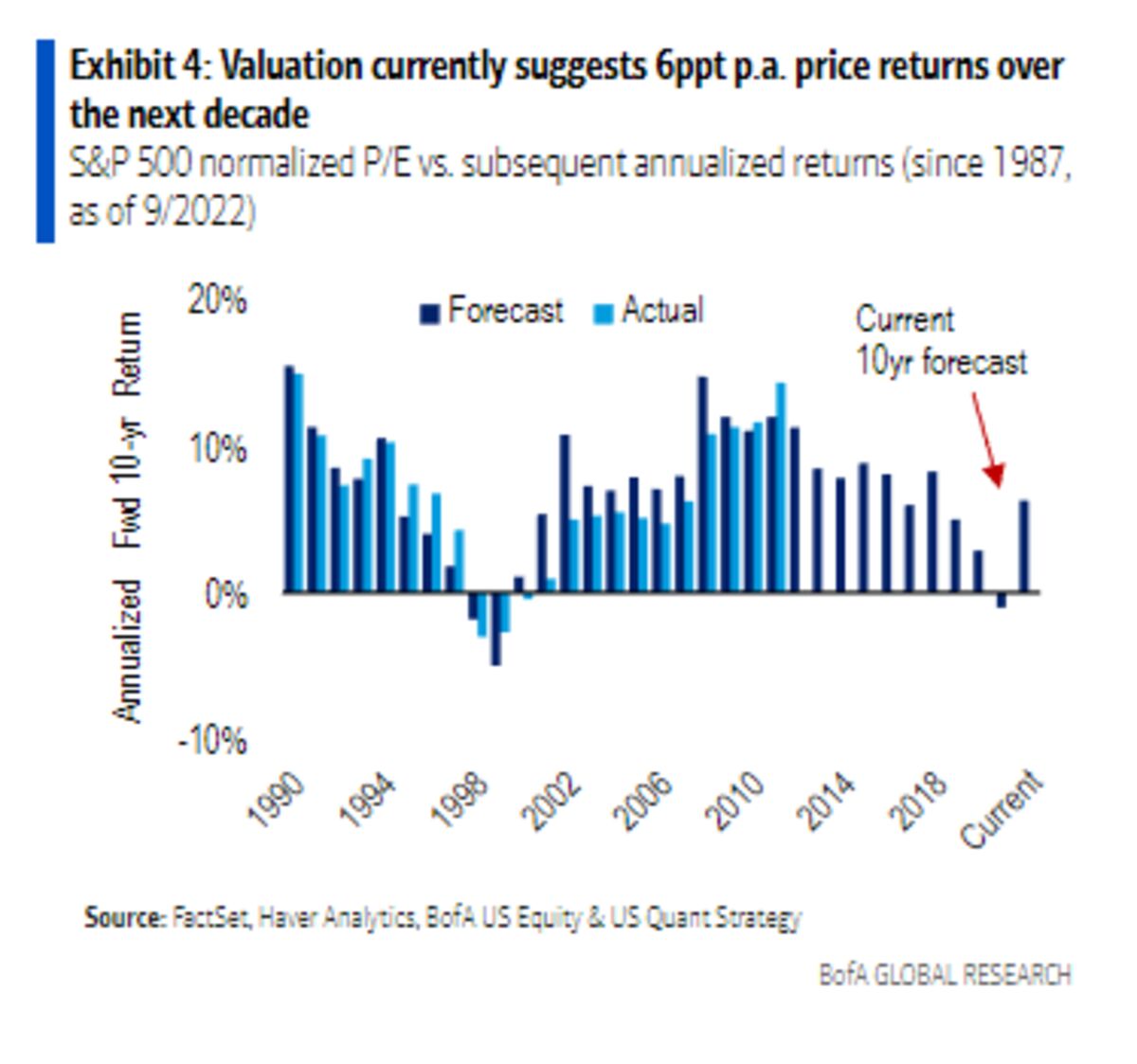

BofA's stance on current market valuations is generally cautious, leaning towards optimism tempered by significant caveats. While acknowledging elevated valuations in certain sectors, they haven't outright declared a market crash imminent. Their analysis often incorporates metrics like the price-to-earnings (P/E) ratio and market cap-to-GDP ratio to gauge overall market valuation. However, the specific data points and their interpretations can fluctuate depending on the report and timeframe.

- Overvalued Sectors: BofA frequently identifies specific technology sectors and certain consumer discretionary stocks as potentially overvalued, given their recent growth and current P/E ratios.

- Undervalued Sectors: Conversely, they may highlight sectors like energy or certain financials as potentially undervalued based on their projections for future earnings and market conditions. This can vary considerably depending on economic forecasts.

- Concerns and Risks: BofA's analysis usually includes concerns about persistent inflation, the impact of further interest rate hikes by the Federal Reserve, and ongoing geopolitical uncertainties, all of which can significantly influence stock market performance and valuations. Their recommended investment approach often emphasizes selectivity and diversification.

Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis is multifaceted, considering a range of intertwined economic and market indicators. Their conclusions are rarely based on a single factor but rather on the interplay of several key elements.

- Inflation Rates: High inflation erodes purchasing power and can lead to higher interest rates, negatively impacting corporate profitability and stock valuations. BofA carefully monitors inflation data to assess its potential impact.

- Interest Rate Hikes: Increased interest rates raise borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings, thereby influencing stock prices. BofA considers the Federal Reserve's monetary policy decisions as a key factor.

- Economic Growth Projections: Strong economic growth generally supports higher stock valuations, while slowing growth or recessionary fears can lead to lower valuations. BofA's economic forecasts significantly shape their valuation assessments.

- Geopolitical Risks: Geopolitical events, such as wars or trade disputes, can introduce significant uncertainty into the market, impacting investor sentiment and causing volatility in stock prices. BofA incorporates geopolitical risk assessments into its valuation models.

The Role of Earnings Growth in Valuation

BofA's valuation analysis heavily relies on projected earnings growth. Understanding the relationship between earnings growth and valuation is crucial.

- Earnings Growth and P/E Ratios: Higher projected earnings growth can justify higher P/E ratios, as investors are willing to pay more for companies expected to deliver strong future profits. BofA analyzes individual company earnings forecasts and industry-wide growth projections.

- High-Growth Sectors: Sectors projected to experience significant earnings growth, such as certain technology sub-sectors or innovative healthcare companies, might command higher valuations despite seemingly high P/E ratios.

- Earnings Justification: Sustained earnings growth is a key factor in validating higher stock valuations. BofA analyzes the underlying drivers of earnings growth to ensure valuations are justifiable and not simply based on speculation.

Alternative Perspectives and Diversification Strategies

While BofA's analysis provides valuable insight, it's essential to consider alternative perspectives and diversify your investment portfolio to mitigate risk.

- Alternative Valuation Metrics: Other metrics like the Shiller PE ratio (CAPE ratio) and Tobin's Q offer different perspectives on market valuations, potentially revealing discrepancies or inconsistencies compared to traditional P/E ratios.

- Portfolio Diversification: Diversifying across different asset classes is crucial to reducing risk. Holding a mix of stocks, bonds, real estate, and commodities can help cushion against market downturns.

- Asset Allocation: Determining the appropriate asset allocation strategy depends on your individual risk tolerance, investment timeline, and financial goals. A financial advisor can assist in developing a personalized strategy.

Conclusion

BofA's assessment of current stock market valuations emphasizes a cautious optimism, highlighting the need for selective investment and careful consideration of various economic indicators. While they might identify overvalued sectors, they also acknowledge the potential for future growth in others. Factors like inflation, interest rates, economic growth projections, and geopolitical events significantly influence their analysis. Remember that while BofA's analysis provides valuable insights, it doesn't provide a definitive answer on whether to worry about current stock market valuations. Investment decisions should always be based on your own thorough research and risk tolerance. Consider consulting with a financial advisor before making any significant investment changes based on current stock market valuations. Stay informed on market trends and continually reassess your investment strategy concerning stock market valuations.

Featured Posts

-

Mariah The Scientists Burning Blue Track By Track Analysis

May 10, 2025

Mariah The Scientists Burning Blue Track By Track Analysis

May 10, 2025 -

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025

Elon Musks Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025 -

Oilers Fall To Lightning 4 1 Kucherov Leads The Charge

May 10, 2025

Oilers Fall To Lightning 4 1 Kucherov Leads The Charge

May 10, 2025 -

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025 -

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025

Court Dismisses Part Of Lawsuit Against Nicolas Cage Son Weston Remains Defendant

May 10, 2025