Should You Buy Palantir Stock Before May 5? A Prudent Investor's Guide

Table of Contents

Palantir's Recent Performance and Future Outlook

Analyzing Recent Financial Results

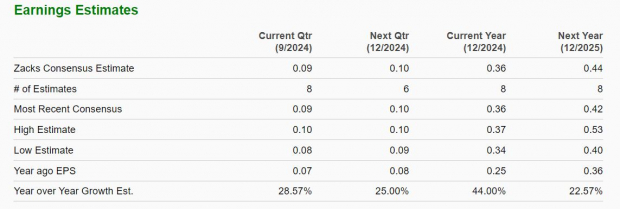

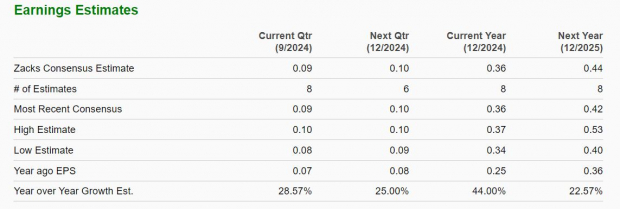

Palantir's recent financial results provide crucial insights into its current standing and potential for future growth. Analyzing recent earnings reports is paramount for any prospective Palantir stock buyer. Let's delve into some key metrics:

- Revenue: Examining the trend of Palantir's revenue growth over the past few quarters and years helps assess its financial health and market traction. A consistent upward trend suggests strong demand for its products and services.

- Earnings Per Share (EPS): Analyzing EPS reveals the profitability of Palantir on a per-share basis. Positive and growing EPS is a generally positive sign for investors.

- Debt: Understanding Palantir's debt levels is crucial. High debt levels can be a significant risk factor, impacting future growth and profitability.

Compared to its competitors in the big data analytics sector, Palantir's performance needs careful consideration. While it holds a strong position in government contracts, its commercial sector expansion is a key factor influencing its overall competitive standing and future Palantir stock price.

Growth Potential and Market Position

Palantir's growth potential hinges on several factors, notably its expansion in both the government and commercial sectors.

- New Contracts & Partnerships: Securing new contracts, especially large-scale government contracts and strategic partnerships with major corporations, will be vital in driving future revenue growth. These partnerships and contracts directly influence Palantir's future.

- Market Expansion Plans: Palantir's strategic initiatives to penetrate new markets and expand its product offerings are key drivers for future growth. The success of these expansions is crucial for long-term Palantir stock performance.

- Competitive Advantages: Palantir's proprietary technology and data analytics capabilities provide a strong competitive advantage. Maintaining this technological edge is essential for sustaining its market position.

However, potential risks exist. Increased competition, the need for continuous innovation, and the possibility of economic downturns could hinder its growth trajectory. Any prudent Palantir investment strategy needs to account for these possibilities.

Evaluating Key Risk Factors Before Investing in Palantir Stock

Investing in Palantir PLTR stock, like any stock investment, involves inherent risks. A prudent investor must carefully consider these before buying Palantir stock.

Market Volatility and Economic Uncertainty

Macroeconomic factors significantly influence Palantir's stock price.

- Interest Rate Hikes: Rising interest rates can negatively impact investor sentiment and potentially decrease valuations across the market, including Palantir.

- Inflation: High inflation erodes purchasing power and can affect consumer spending, potentially impacting Palantir's commercial sector growth.

- Recessions: Economic downturns often lead to reduced government spending and corporate investment, posing a risk to Palantir's revenue streams.

Competition and Technological Disruption

The big data analytics sector is highly competitive.

- Key Competitors: Companies offering similar data analytics solutions pose a constant threat. Staying ahead of the competition in terms of innovation and technological advancements is crucial for Palantir's continued success.

- Technological Disruption: The rapid pace of technological change could render Palantir's current technologies obsolete, requiring significant investment in R&D to maintain its competitive edge.

Dependence on Government Contracts

Palantir's revenue is significantly dependent on government contracts. This dependence creates specific risks.

- Government Spending Changes: Changes in government priorities or budget cuts could significantly impact Palantir's revenue.

- Policy Changes: Shifts in government policies or regulations could also affect Palantir's ability to secure future contracts. Diversification of its revenue streams is crucial to mitigate this risk.

Alternative Investment Strategies and Diversification

Before committing to a Palantir investment, consider these points:

Considering Other Investment Options

A diversified investment portfolio is crucial for mitigating risk.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces the overall risk of your portfolio. Don't put all your eggs in one basket!

- Alternative Investments: Explore other investment opportunities in the technology sector or beyond to balance your portfolio.

The Importance of Due Diligence

Thorough research is paramount before investing in any stock, including Palantir.

- Consult Financial Advisors: Seek advice from qualified financial professionals to assess your risk tolerance and investment goals.

- Utilize Reputable Resources: Use reliable financial news sources and company filings to make informed investment decisions.

Conclusion

Deciding whether to buy Palantir stock before May 5th requires a thorough evaluation of its recent performance, future growth prospects, and inherent risks. While Palantir holds a strong position in the big data analytics market, potential risks associated with market volatility, competition, and dependence on government contracts must be carefully weighed. Consider alternative investment options and diversify your portfolio to mitigate risk. Remember, this is not financial advice. Conduct thorough research, understand the risks involved, and consult with a qualified financial advisor before making any investment decisions regarding Palantir stock or any other security. Only invest in Palantir stock if it aligns with your risk tolerance and investment goals. Make a prudent investment decision based on your own research.

Featured Posts

-

Apples Ai Innovation Or Imitation

May 09, 2025

Apples Ai Innovation Or Imitation

May 09, 2025 -

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025

February 23 Nyt Strands Solutions Game 357 Hints And Answers Guide

May 09, 2025 -

Tragedi Putra Heights 10 Agensi Pas Selangor Beri Bantuan Kepada Mangsa

May 09, 2025

Tragedi Putra Heights 10 Agensi Pas Selangor Beri Bantuan Kepada Mangsa

May 09, 2025 -

Investigacao Mulher Alega Ser Madeleine Mc Cann E E Presa

May 09, 2025

Investigacao Mulher Alega Ser Madeleine Mc Cann E E Presa

May 09, 2025 -

Solve The Nyt Spelling Bee April 12 2025 Hints And Solutions

May 09, 2025

Solve The Nyt Spelling Bee April 12 2025 Hints And Solutions

May 09, 2025