Should You Buy Palantir Stock In 2024?

Table of Contents

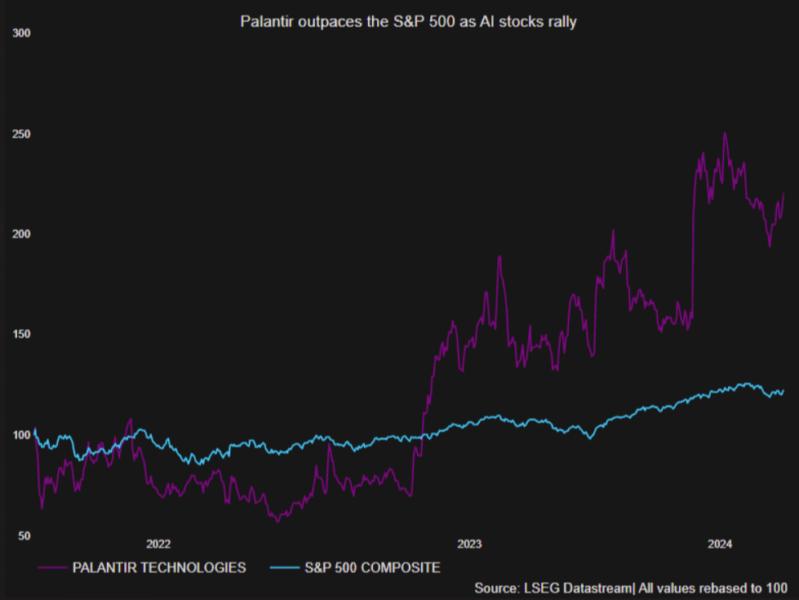

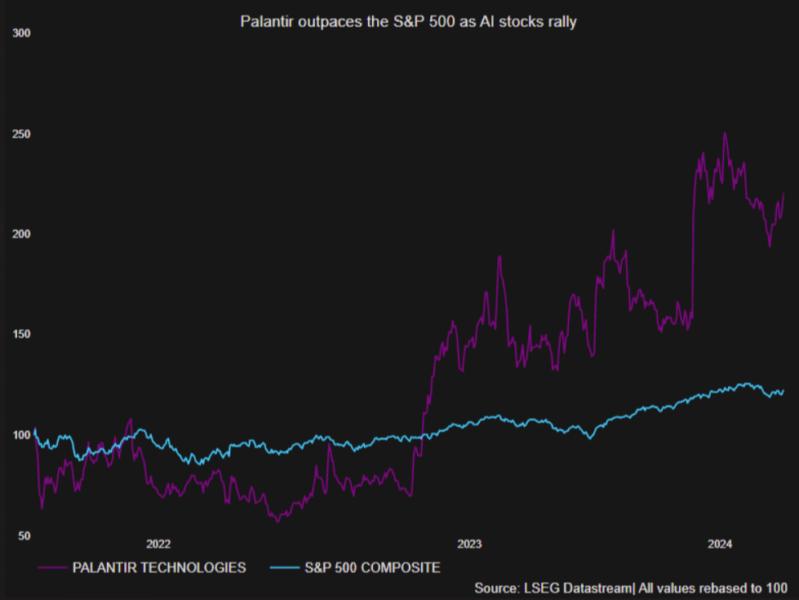

Palantir Technologies (PLTR), a prominent player in the big data analytics and artificial intelligence (AI) market, has experienced significant volatility in recent years. Its stock price has fluctuated dramatically, making investors question whether Palantir stock is a smart investment in 2024. This article aims to analyze the potential of Palantir stock, examining its financial performance, competitive landscape, and inherent risks to help you make an informed decision. We'll explore key factors influencing Palantir stock and provide a balanced perspective on its future prospects. Understanding the intricacies of Palantir stock is crucial before considering any investment.

H2: Palantir's Financial Performance and Growth Prospects

H3: Revenue Growth and Profitability: Palantir's recent financial reports reveal a mixed picture. While the company has demonstrated consistent revenue growth, profitability remains a challenge. Analyzing key metrics like year-over-year revenue growth, operating margins, and net income is vital for assessing Palantir's financial health.

- Bullet points:

- Year-over-year revenue growth consistently above [insert percentage from recent reports] for the past [number] years.

- Operating margins are [insert current margin], showing improvement/stagnation/decline compared to [previous period].

- Net income is [positive/negative], indicating [profitability/loss] and requiring further analysis of its cost structure.

- Comparison to competitors such as [competitor A] and [competitor B] reveals Palantir's relative performance.

H3: Government Contracts and Commercial Revenue: Palantir's revenue streams are significantly diversified between government and commercial sectors. While government contracts historically formed a large part of its revenue, the company is actively expanding its commercial presence.

- Bullet points:

- Approximately [percentage]% of revenue comes from government contracts, [percentage]% from commercial clients.

- Key government contracts include [mention examples, e.g., contracts with US intelligence agencies].

- Successful commercial partnerships with [mention examples, e.g., large corporations in finance or healthcare]. This diversification reduces dependence on any single revenue source.

H3: Future Projections and Analyst Opinions: Financial analysts hold varying views on Palantir's future performance. While some express optimism regarding its growth potential in the AI and big data markets, others express concerns about its profitability and valuation.

- Bullet points:

- Average price target from leading analysts: $[insert average price target].

- Distribution of buy/sell/hold ratings: [insert percentages].

- Potential catalysts for growth include: successful expansion into new markets, successful product launches, and increased profitability.

- Potential risks include: increased competition, slower than expected growth in commercial revenue, and changes in government spending.

H2: Competitive Landscape and Market Position

H3: Key Competitors and Market Share: Palantir faces stiff competition from established players and emerging companies in the big data analytics and AI market. Analyzing its market share and competitive advantages is crucial.

- Bullet points:

- Key competitors include Databricks, Snowflake, and [list other major competitors].

- Palantir's market share in [specific market segment] is estimated at [percentage]%.

- Palantir's competitive advantages include its strong government relationships, its advanced data integration capabilities, and its specialized expertise in complex data analysis.

H3: Technological Innovation and Future Developments: Palantir's continued investment in R&D is vital for its long-term success. Its ability to adapt to evolving market conditions and technological advancements will significantly influence its future prospects.

- Bullet points:

- Recent technological advancements: [mention specific advancements in AI, data integration, etc.].

- Planned future product releases: [mention any upcoming products or services].

- Number of patents held: [insert number of patents], demonstrating its commitment to innovation.

H2: Risks and Potential Downsides of Investing in Palantir Stock

H3: Valuation and Stock Price Volatility: Palantir's stock price has historically been quite volatile. Assessing its current valuation, whether overvalued or undervalued, is essential.

- Bullet points:

- Current P/E ratio: [insert current P/E ratio].

- Current P/S ratio: [insert current P/S ratio].

- Historical stock price volatility: [mention the range and frequency of fluctuations].

- Potential impact of market downturns on Palantir stock price.

H3: Dependence on Government Contracts: Palantir's substantial reliance on government contracts exposes it to risks related to changes in government policy, budget cuts, or contract renewals.

- Bullet points:

- Percentage of revenue from government contracts: [insert percentage].

- Risks associated with contract renewals and potential delays.

- Potential impact of changes in government priorities or budget allocations.

H3: Competition and Market Saturation: The big data analytics market is increasingly competitive. Market saturation poses a risk to Palantir's future growth.

- Bullet points:

- Emerging competitors and their potential market impact.

- Potential disruptive technologies and their impact on Palantir's offerings.

- Factors contributing to market saturation and their potential impact on Palantir's growth.

Conclusion: Should You Invest in Palantir Stock in 2024?

Investing in Palantir stock in 2024 presents both opportunities and risks. While Palantir demonstrates strong revenue growth and boasts innovative technology, concerns remain about its profitability and dependence on government contracts. The competitive landscape is intense, and market volatility adds another layer of uncertainty. This analysis suggests that Palantir stock could be a suitable investment for risk-tolerant investors with a long-term perspective, but thorough due diligence is crucial. Before investing in Palantir stock, carefully consider your personal financial goals and risk tolerance. Consult with a qualified financial advisor and conduct your own comprehensive research using resources like Palantir's investor relations page and reputable financial news sources. Remember, this analysis is not financial advice; the ultimate decision regarding Palantir stock rests solely with you.

Featured Posts

-

Gpb Capital Founders Conviction David Gentile Gets 7 Years For Fraud

May 10, 2025

Gpb Capital Founders Conviction David Gentile Gets 7 Years For Fraud

May 10, 2025 -

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solutions

May 10, 2025

Nyt Strands Today April 9 2025 Clues Theme Hints And Spangram Solutions

May 10, 2025 -

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025

Nhl Kucherovs Lightning Shut Out Oilers 4 1

May 10, 2025 -

Don De Cheveux A Dijon Trouver Un Centre De Collecte

May 10, 2025

Don De Cheveux A Dijon Trouver Un Centre De Collecte

May 10, 2025 -

Ras Barakas Arrest A Closer Look At The Ice Detention Center Protest

May 10, 2025

Ras Barakas Arrest A Closer Look At The Ice Detention Center Protest

May 10, 2025