Should You Buy Palantir Stock Now?

Table of Contents

Palantir's Current Financial Performance and Future Growth Prospects

Palantir, a leading provider of big data analytics platforms, operates primarily in two sectors: government and commercial. Understanding the performance of these segments is crucial to assessing the viability of a Palantir investment.

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth, although profitability remains a key focus. Analyzing recent quarterly and annual reports reveals important trends.

- Key Financial Metrics: Examine revenue growth rates, earnings per share (EPS), and free cash flow (FCF) to gauge the financial health of the company. Look for consistent increases in these metrics, indicating strong financial performance.

- Industry Comparison: Benchmark Palantir's financial performance against its competitors in the big data analytics space. This provides context for understanding its relative success and potential for future growth.

- Growth Drivers: Identify the factors driving Palantir's revenue growth. This may include successful contract wins, expansion into new markets, or the successful launch of new products and services. Strong growth drivers point to a positive future for Palantir stock.

Government vs. Commercial Contracts

Palantir's revenue is derived from both government and commercial contracts. The balance between these streams significantly impacts its risk profile and future growth potential.

- Government Contract Dependence: A high reliance on government contracts can expose Palantir to geopolitical risks and potential budget cuts. A diversified revenue stream, with a stronger commercial presence, reduces this risk.

- Commercial Market Penetration: Palantir's success in penetrating the commercial market is vital for long-term sustainable growth. Increased commercial adoption indicates a broader and more stable customer base.

- Long-Term Growth Potential: Assess the growth prospects of each sector. The commercial sector often offers higher growth potential but may require greater investment in sales and marketing.

Competition and Market Share

The big data analytics market is highly competitive, with major players like AWS, Microsoft, and Google vying for market share.

- Key Competitors: Understanding Palantir's main competitors and their strengths is crucial. Identify where Palantir has a competitive advantage.

- Competitive Advantages: Palantir's proprietary technology, strong government relationships, and focus on complex data analytics provide certain competitive advantages. However, the competitive landscape is dynamic.

- Market Share Analysis: Tracking Palantir's market share and its trajectory over time provides insight into its ability to compete effectively and gain market dominance.

Evaluating Palantir's Valuation and Stock Price

Determining whether Palantir stock is currently undervalued or overvalued is essential for making an informed investment decision.

Price-to-Sales Ratio (P/S) and Other Valuation Metrics

Several valuation metrics can help assess Palantir's attractiveness as an investment.

- Current P/S Ratio: Compare Palantir's current price-to-sales ratio to its historical average and to the P/S ratios of its competitors. A lower P/S ratio may suggest undervaluation.

- Historical P/S Ratio: Analyzing the historical P/S ratio helps determine whether the current valuation is unusually high or low compared to its past performance.

- Industry Average: Compare Palantir's P/S ratio to the average P/S ratio for companies in the big data analytics industry. This offers a broader perspective on its relative valuation.

Stock Price Volatility and Risk Assessment

Palantir's stock price has historically been volatile. Understanding the sources of this volatility is critical for risk assessment.

- Historical Price Volatility: Analyze the historical volatility of Palantir's stock price to gauge the potential for significant price swings in the future.

- Risk Factors: Identify key risk factors, such as dependence on government contracts, intense competition, and macroeconomic conditions, that could impact the stock price.

- Future Price Fluctuations: Consider the potential for future price fluctuations based on the identified risk factors and market sentiment.

Long-Term Investment Considerations for Palantir Stock

Investing in Palantir requires considering its long-term growth potential, driven by innovation and leadership.

Technological Innovation and Future Products

Palantir's ongoing investment in research and development (R&D) is crucial for its long-term success.

- Key Technological Innovations: Identify Palantir's key technological innovations and their potential impact on its future growth.

- New Products and Services: Analyze the company's pipeline of new products and services, assessing their potential market appeal and revenue generation capabilities.

- Market Disruption: Evaluate Palantir's potential to disrupt the big data analytics market with innovative solutions and technologies.

Management Team and Corporate Governance

The quality of Palantir's management team and corporate governance practices is an essential factor to consider.

- Key Executives: Assess the experience and expertise of Palantir's key executives and their ability to lead the company through challenges and opportunities.

- Corporate Governance Structure: Examine the company's corporate governance structure and identify any potential concerns regarding transparency, accountability, or ethical conduct.

Conclusion: Should You Buy Palantir Stock Now? A Final Verdict

Based on our analysis of Palantir's financial performance, valuation, and long-term prospects, investing in Palantir stock presents both significant opportunities and considerable risks. The company's growth trajectory in the commercial sector, coupled with its established presence in the government space, is promising. However, the high volatility of its stock price and intense competition in the big data analytics market should be carefully considered. Whether or not to buy Palantir stock now depends heavily on your risk tolerance and investment horizon. A long-term perspective, factoring in the potential for technological leadership and market expansion, might favor a "buy" decision for some investors. Others might prefer a "wait and see" approach, monitoring the company's performance and valuation before making an investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Before making any decisions about buying Palantir stock, conduct thorough due diligence and consult with a financial advisor.

Featured Posts

-

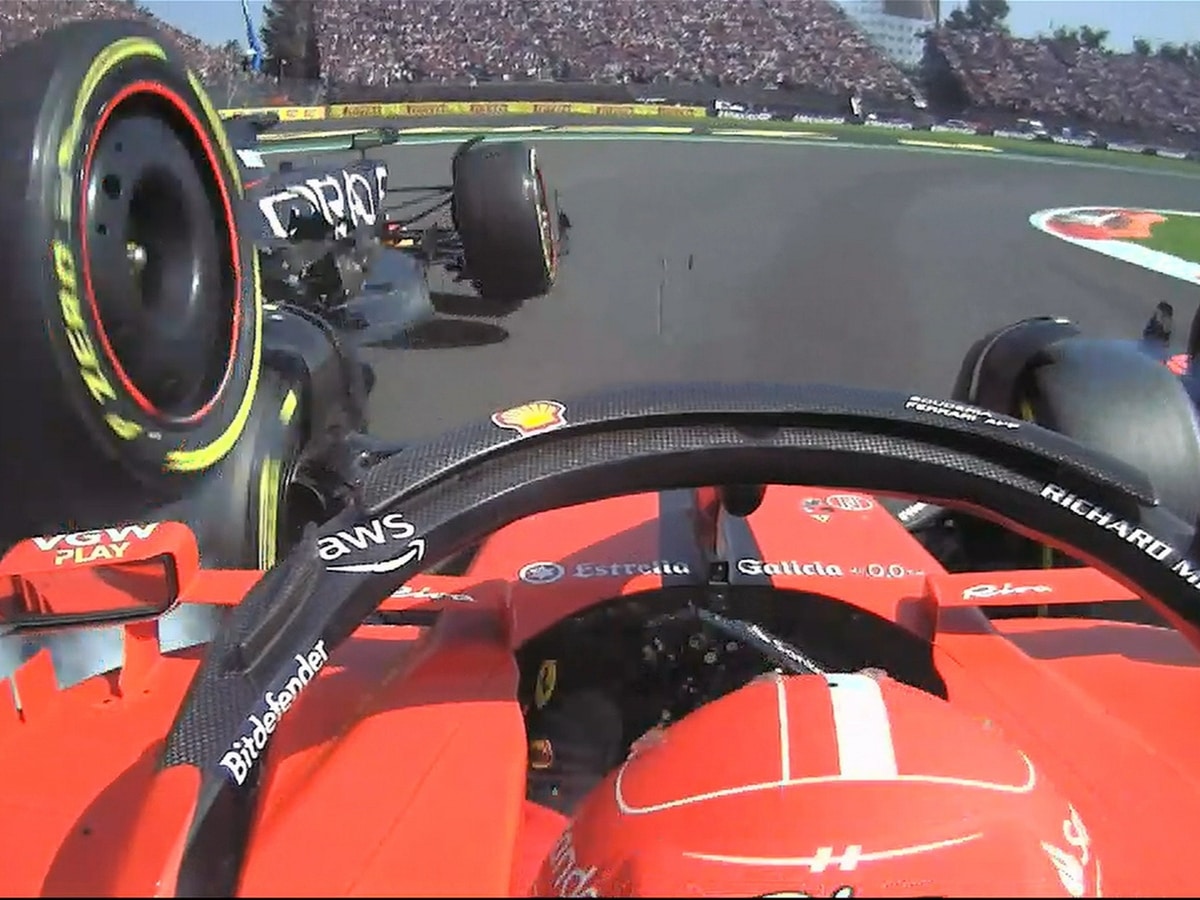

Sergio Perez And Franco Colapinto Pay Respects Following F1 Loss

May 09, 2025

Sergio Perez And Franco Colapinto Pay Respects Following F1 Loss

May 09, 2025 -

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025

So Very Fragile A Parenting Expert Explains The Risks Of Early Daycare

May 09, 2025 -

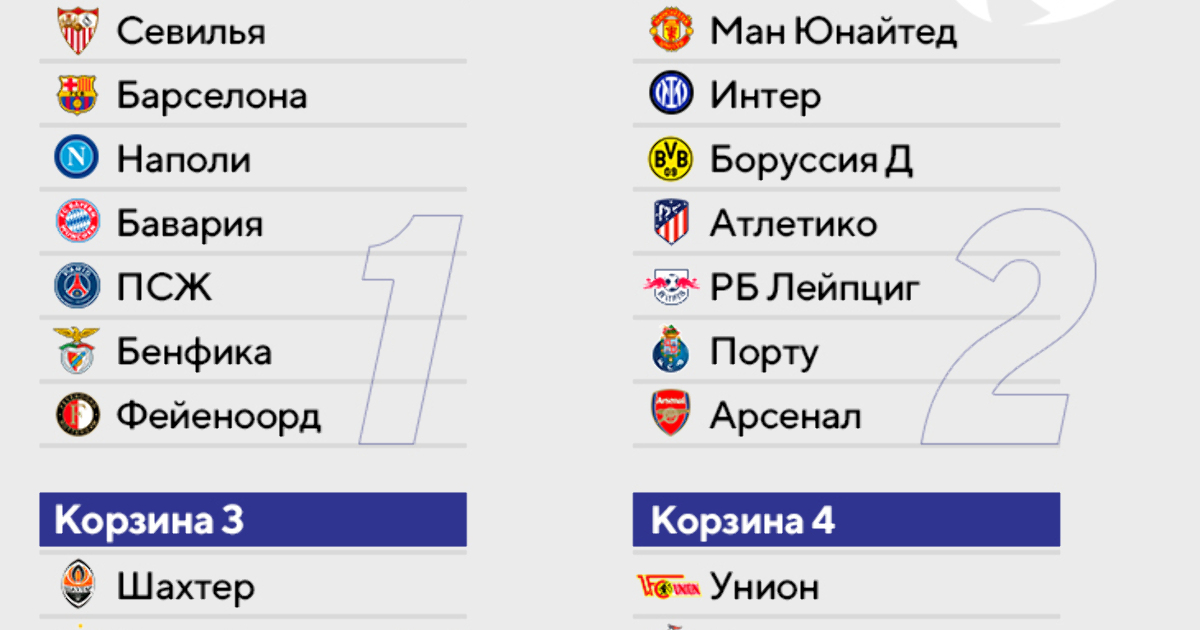

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025 -

Return Of High Potential Season 2 Renewal Information And Episode Details

May 09, 2025

Return Of High Potential Season 2 Renewal Information And Episode Details

May 09, 2025 -

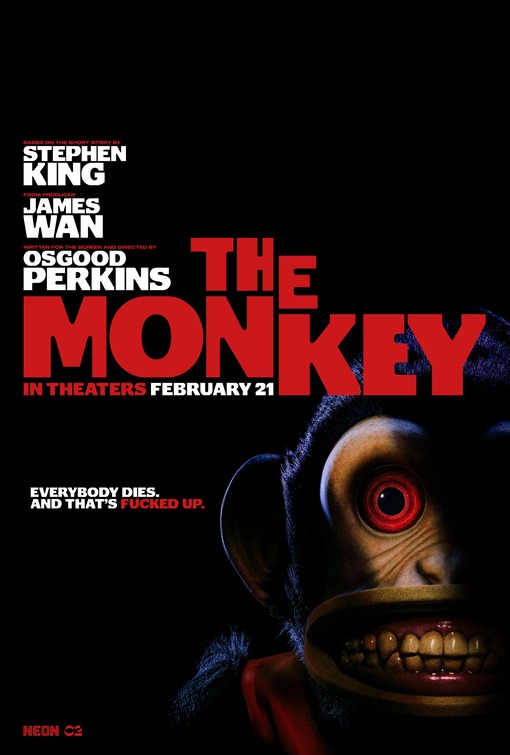

A Look At The Monkey Will It Define Stephen Kings 2025 Film Output

May 09, 2025

A Look At The Monkey Will It Define Stephen Kings 2025 Film Output

May 09, 2025