Should You Invest In Palantir Stock Before May 5th? A Comprehensive Overview

Table of Contents

Palantir's Recent Financial Performance and Growth Prospects

Analyzing Palantir's recent performance is crucial before considering investment. Understanding its revenue growth, profitability, and future projections will give you valuable insights into the company's health and potential.

Palantir Revenue, Earnings, and Profitability

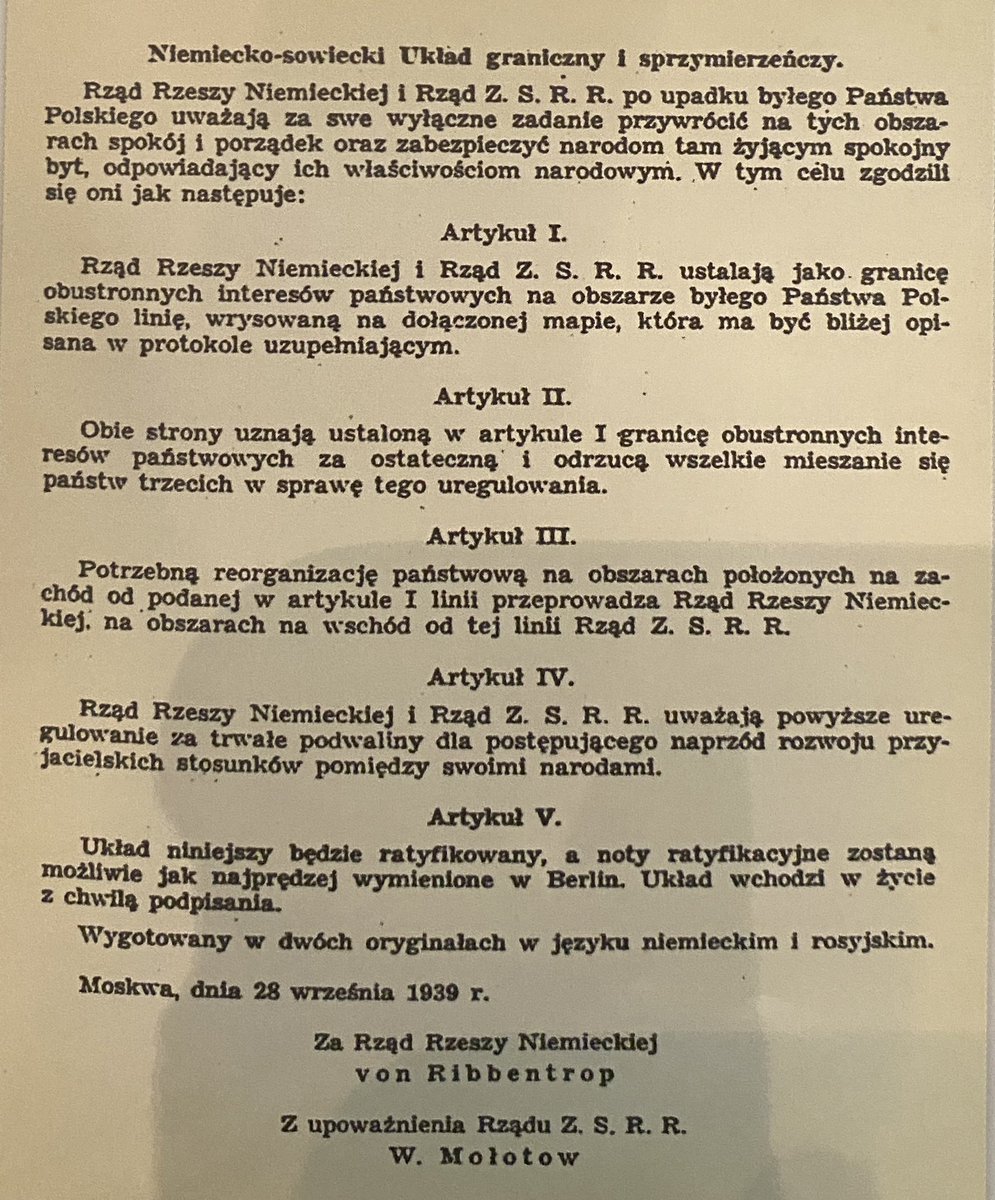

Palantir's recent financial reports reveal a mixed bag. While revenue has shown consistent growth, profitability remains a key focus for the company. Examining key metrics such as revenue growth rate, operating margins, and earnings per share (EPS) is vital. (Insert chart or graph showing Palantir's revenue and profit trends here). For example, while Q4 2022 showed strong revenue growth, the company's net income might not reflect immediate profitability. This trend needs careful observation alongside the company's projected future performance. Understanding the reasons behind the profitability picture— whether it's due to strategic investments or underlying business challenges—is crucial. Analyzing the company's cash flow and debt levels is another important aspect of evaluating Palantir Financials.

Key Palantir Contracts, Partnerships, and Government Contracts

Palantir's success hinges on securing large contracts, particularly within the government and commercial sectors. Recent partnerships and contract wins significantly influence its future revenue streams and overall growth trajectory. For example, the continued expansion of contracts with US government agencies remains a crucial driver of growth, while commercial partnerships indicate progress in diversifying their customer base.

- Specific examples: Mention specific large contracts secured recently, such as those with major government agencies or Fortune 500 companies. Quantify their value and expected impact.

- Customer base diversification: Discuss the progress Palantir is making in diversifying its client base beyond government contracts. The shift toward commercial clients signifies a broader market reach and reduced reliance on a single revenue source.

- Market expansion: Analyze Palantir's expansion into new markets or sectors. This might include new geographical regions or exploring new applications for its technology.

Market Analysis and Industry Trends

Understanding the broader market context is essential when evaluating Palantir stock. This includes analyzing the big data and analytics market, the competitive landscape, and Palantir's unique selling propositions.

Big Data Analytics Market and AI Market Growth

Palantir operates within the rapidly expanding big data and analytics market, a sector expected to experience significant growth in the coming years. The increasing adoption of artificial intelligence (AI) and machine learning further fuels this growth. Analyzing the overall market size, growth forecasts, and key industry trends provides valuable context for Palantir's potential. The demand for data analytics solutions across various sectors, such as healthcare, finance, and government, contributes significantly to this market's positive outlook.

Palantir Competitors and Competitive Advantage

Palantir faces competition from established players like Databricks and Snowflake, among others. Identifying these key Palantir Competitors and assessing their strengths and weaknesses is crucial. However, Palantir boasts a unique competitive advantage stemming from its proprietary technology, extensive data sets, and strong foothold in the government sector. Its ability to integrate and analyze complex data sets makes it a valuable partner for organizations facing data-intensive challenges. Analyzing this competitive advantage within the context of the ever-evolving Data Analytics Industry is vital for a holistic understanding.

- Key Competitors: List and briefly describe Palantir's main competitors, highlighting their market share and strategic focuses.

- Unique Selling Propositions (USPs): Discuss Palantir's core strengths, such as its advanced data analytics platform, strong government relationships, and its ability to handle highly sensitive data.

- Competitive Threats and Opportunities: Analyze potential threats such as increased competition and technological disruptions, as well as emerging opportunities from expanding markets and new technologies.

Risk Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, it's crucial to understand the inherent risks. These risks can be categorized into valuation, market volatility, and geopolitical/regulatory factors.

Palantir Stock Price, Stock Volatility, and Valuation

Palantir's stock price has historically shown significant volatility. This high degree of Market Risk is a key consideration for investors. Analyzing the company's current valuation and comparing it to its peers and historical performance is crucial. The relatively young age of the company and its still-developing profitability contribute to this volatility. Understanding your risk tolerance concerning Palantir Stock Price fluctuations is vital.

Geopolitical and Regulatory Risks for Palantir

Geopolitical events and regulatory changes can significantly impact Palantir's business, particularly its government contracts. Changes in government policies or international relations could affect its revenue streams and overall stability. Similarly, cybersecurity threats and data privacy regulations pose significant risks to the company's operations. Government Regulation changes could alter the competitive landscape significantly.

- Economic Downturns: Analyze how potential economic slowdowns could affect Palantir's business and its ability to secure contracts.

- Legal and Regulatory Hurdles: Discuss potential legal challenges or regulatory changes that could impact the company’s operations.

- Cybersecurity Threats: Assess the risks associated with cybersecurity breaches and their potential impact on the company's reputation and financial performance.

Should You Invest in Palantir Stock Before May 5th? A Preliminary Assessment

Based on the analysis above, deciding whether to invest in Palantir stock before May 5th requires careful consideration of your investment strategy and risk tolerance. While Palantir shows growth potential in the expanding big data and analytics market, it also carries considerable risk due to its stock volatility and dependence on government contracts. The long-term outlook might be positive, but the short-term performance could be unpredictable. A long-term investment might be suitable for those comfortable with higher risk, but a short-term investment carries significant uncertainty.

Conclusion

Investing in Palantir stock involves weighing its potential for growth against significant risks. Factors like its revenue growth, the competitive big data analytics market, its unique selling propositions, and inherent volatility all play crucial roles in your decision-making process. While the company's prospects might look promising long-term, short-term performance remains uncertain. Remember, this analysis does not constitute financial advice. Before making any investment decisions regarding Palantir stock, conduct your own thorough research, understand your personal risk tolerance, and consider seeking advice from a qualified financial advisor. Only then can you decide if investing in Palantir stock aligns with your investment strategy and financial goals.

Featured Posts

-

F1 News Alpine Team Principals Strong Statement To Doohan

May 09, 2025

F1 News Alpine Team Principals Strong Statement To Doohan

May 09, 2025 -

France And Poland A New Chapter In Friendship Treaty To Be Signed

May 09, 2025

France And Poland A New Chapter In Friendship Treaty To Be Signed

May 09, 2025 -

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025 -

Nyt Strands April 9th 2024 Solutions Game 402

May 09, 2025

Nyt Strands April 9th 2024 Solutions Game 402

May 09, 2025 -

Closing West Hams 25 Million Financial Hole

May 09, 2025

Closing West Hams 25 Million Financial Hole

May 09, 2025