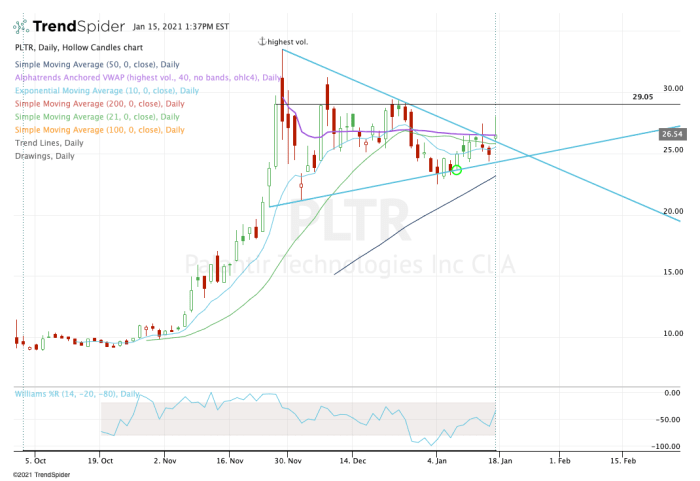

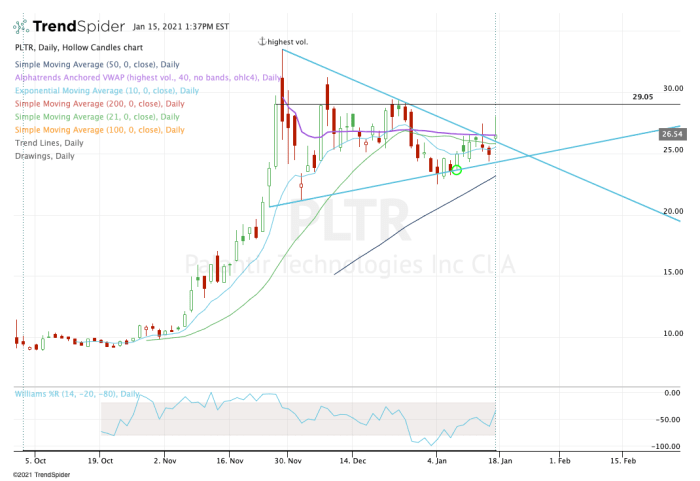

Should You Invest In Palantir Stock Now? A 40% Gain By 2025: Analysis And Outlook.

Table of Contents

Palantir's Current Financial Performance and Growth Trajectory

Analyzing Palantir's recent financial reports reveals a mixed bag. While revenue growth is impressive, profitability remains a challenge. Understanding the key performance indicators (KPIs) is crucial for assessing the long-term viability of Palantir stock.

-

Revenue Growth: Palantir has shown consistent revenue growth, particularly within the government sector, demonstrating strong demand for its advanced analytics capabilities. This consistent revenue stream is a positive sign for potential investors in Palantir stock.

-

Foundry Platform Adoption: The increasing adoption of Palantir's Foundry platform in the commercial sector represents a significant growth opportunity. This expansion beyond government contracts diversifies Palantir's revenue streams and reduces reliance on a single customer base. This is a key factor when considering whether to buy Palantir stock.

-

Profitability and Margins: Palantir is still working toward consistent profitability, with operating margins remaining a concern. Investors should carefully analyze the company's path to profitability before investing in Palantir stock.

-

Debt Levels: Palantir carries a level of debt which needs to be considered. While not alarmingly high, it's a factor that could impact future growth and needs careful monitoring by those considering Palantir stock as an investment.

Market Analysis and Competitive Landscape

Palantir operates in a fiercely competitive big data analytics market. While it enjoys a strong position, understanding its competitive advantages and disadvantages is vital before investing in Palantir stock. Major competitors include Databricks, Snowflake, and even the cloud services of AWS.

-

Market Share and Growth Potential: Palantir holds a significant market share, particularly in government and defense, but faces increasing competition from established players and agile startups. The growth potential for Palantir stock depends heavily on its ability to maintain and expand its market share.

-

Technological Edge: Palantir's proprietary technology, particularly its Gotham and Foundry platforms, provides a significant competitive advantage. These platforms offer unique capabilities that differentiate Palantir from its competitors.

-

Threats from Competitors and Disruptive Technologies: The rapid pace of innovation in the data analytics market presents a constant threat. New technologies and emerging competitors could erode Palantir's market share, impacting the value of Palantir stock.

Future Outlook and Potential for a 40% Gain by 2025

The prediction of a 40% increase in Palantir stock price by 2025 is ambitious but not entirely unrealistic. Several factors could contribute to such growth, but significant risks also exist.

-

Expanding Government Contracts and Commercial Adoption: Continued success in securing lucrative government contracts and expanding its reach into the commercial sector are essential for driving Palantir's growth. This is a key factor to consider when evaluating Palantir stock.

-

Product Innovation and Market Expansion: Successful product innovation and expansion into new markets are crucial for maintaining growth momentum. Palantir's ability to adapt to changing market demands will directly influence the future value of Palantir stock.

-

Economic Downturn: An economic downturn could significantly impact government spending and corporate investment in data analytics, potentially hindering Palantir's growth. This is a critical risk factor for Palantir stock.

-

Geopolitical Risks: Geopolitical instability and shifts in government priorities could affect Palantir's government contracts, impacting the overall performance and value of Palantir stock.

Risks and Considerations for Investing in Palantir Stock

Investing in Palantir stock involves significant risks. Understanding these risks and implementing appropriate risk management strategies is crucial for any investor.

-

High Stock Price Volatility: Palantir's stock price has historically been quite volatile, making it a higher-risk investment.

-

Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or spending could negatively impact the company's financial performance.

-

Competition from Tech Giants: Competition from established tech giants poses a significant threat to Palantir's market share and future growth.

-

Potential for Regulatory Scrutiny: Palantir operates in a heavily regulated industry, and increased regulatory scrutiny could impact its operations and profitability.

Conclusion

Investing in Palantir stock presents a compelling opportunity for growth, with the potential for a substantial return. However, the analysis reveals significant risks associated with this investment. The prediction of a 40% gain by 2025 is ambitious and hinges on several factors, including continued revenue growth, successful expansion into new markets, and navigating a competitive landscape. While the potential for growth is exciting, the volatility and inherent risks associated with Palantir stock demand careful consideration. Before investing in Palantir stock, conducting thorough due diligence, diversifying your portfolio, and understanding your risk tolerance are crucial steps. Do your own due diligence before investing in Palantir stock. Consider your personal financial goals and risk tolerance before making any investment decisions regarding Palantir investment. Should you buy Palantir stock? The answer depends entirely on your individual circumstances and risk appetite.

Featured Posts

-

Kimbal Musk Beyond Elons Shadow A Look At His Life And Career

May 09, 2025

Kimbal Musk Beyond Elons Shadow A Look At His Life And Career

May 09, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025 -

Deutsche Bank Expands Into Defense Finance With New Team

May 09, 2025

Deutsche Bank Expands Into Defense Finance With New Team

May 09, 2025 -

The Daily Fox News Briefings Is The Us Attorney Generals Presence Justified

May 09, 2025

The Daily Fox News Briefings Is The Us Attorney Generals Presence Justified

May 09, 2025 -

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025