Significant HMRC Tax Return Rule Changes: Impact And Implications

Table of Contents

Key Changes to the Self-Assessment Tax Return Process

The HMRC has implemented several key changes to the self-assessment tax return process, impacting how you file your UK tax return. These changes aim to improve efficiency and accuracy but also require taxpayers to adapt to new procedures and requirements.

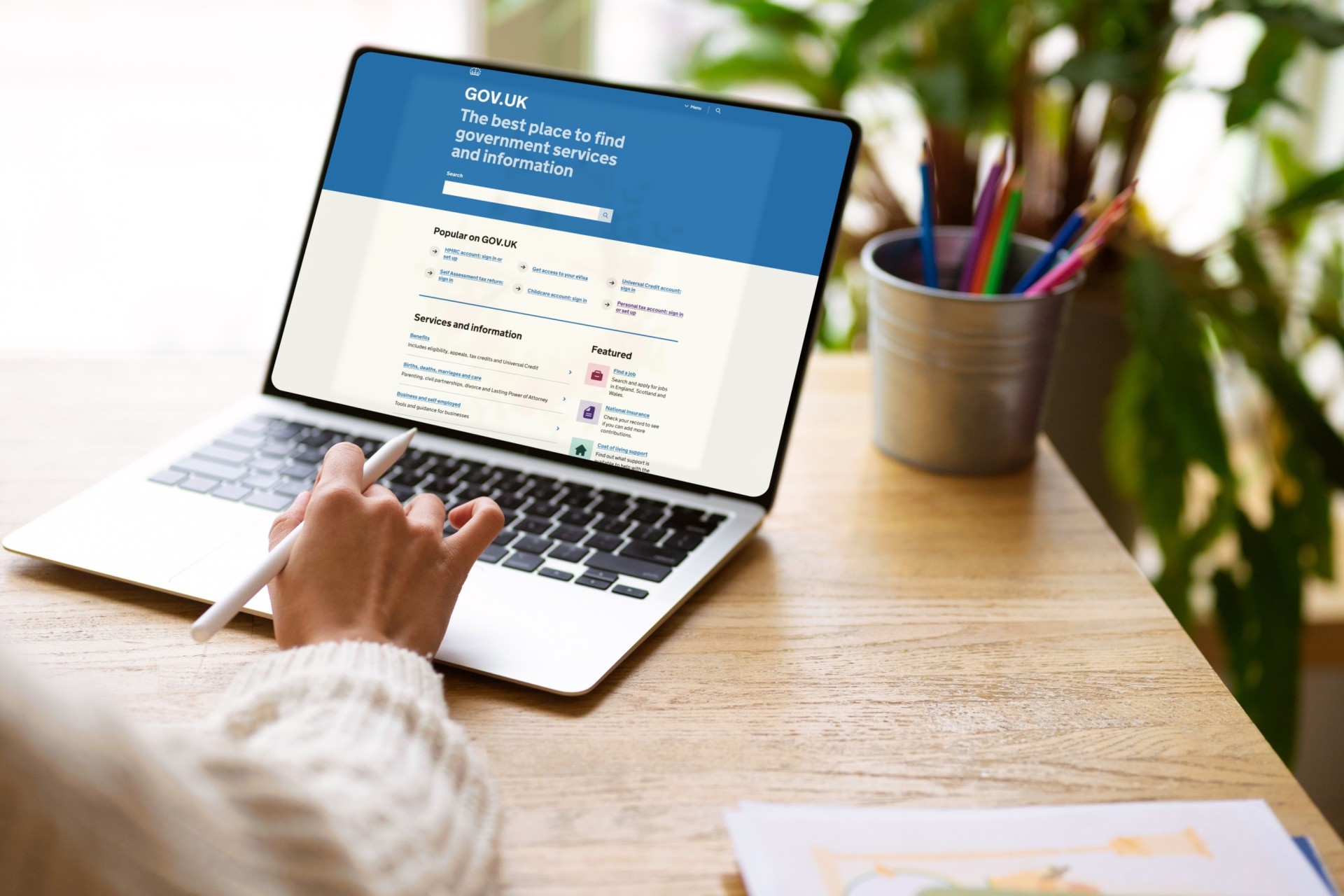

New Online Filing Requirements

The HMRC is increasingly moving towards a fully digital tax system. This means significant changes to online filing requirements for your HMRC tax return:

- Mandatory Digital Submissions: Paper tax returns are largely phased out, requiring nearly all taxpayers to file online through the HMRC portal.

- Enhanced Security Measures: New security protocols, including improved password protection and verification methods, are in place to protect taxpayer data.

- Updated Forms and Navigation: The online portal itself has been updated, with new forms and a potentially altered navigation system. Familiarising yourself with the new interface is vital.

- Digital Authentication Requirements: You may need to use government-approved methods for confirming your identity before accessing your account and submitting your return.

These changes can present challenges for those less comfortable with online systems. However, the HMRC provides extensive support, including online guides, help pages, and telephone assistance, to help navigate the new digital filing process.

Modified Reporting Requirements for Specific Income Types

Several income types now have modified reporting requirements within your HMRC tax return. These changes impact the detail needed and potentially the tax implications:

- Dividends: More detailed information on dividend payments may be required, including specific identifiers from the paying company.

- Rental Income: Updated reporting requirements could involve more comprehensive details of rental properties and associated expenses.

- Capital Gains: New rules may specify additional information needed for calculating capital gains tax, potentially requiring more meticulous record-keeping.

- Cryptocurrency Income: HMRC has clarified its stance on reporting cryptocurrency transactions and gains within the tax return.

Failing to accurately report these income types according to the updated guidelines could lead to penalties. It's crucial to understand these changes and ensure your tax return reflects the new requirements. For example, failing to accurately report rental income under the updated guidelines could lead to a significant underpayment of tax.

Updated Penalties for Late or Inaccurate Filing

The penalties for late or inaccurate self-assessment tax returns have been increased. This reinforces the importance of timely and accurate filing:

- Late Filing Penalties: Penalties are calculated based on the length of the delay, with increasing charges for each month the return is overdue.

- Incorrect Information Penalties: Penalties are imposed for knowingly providing inaccurate information or for careless mistakes that result in underpayment of tax.

- Interest Charges: In addition to penalties, interest may be charged on any unpaid tax.

To avoid these penalties, maintain meticulous records, file your return on time, and ensure all information is accurate. Consider using tax software or seeking professional guidance to reduce the risk of errors.

Impact of the Changes on Different Taxpayer Groups

The HMRC tax return rule changes have varying impacts on different taxpayer groups. Understanding these specific implications is crucial for ensuring compliance.

Implications for Self-Employed Individuals

Self-employed individuals must adapt to several specific changes:

- Expenses: Stricter rules on allowable expenses may require more detailed record-keeping to support claims.

- Record-Keeping: Meticulous record-keeping is essential to avoid penalties for inaccurate reporting.

- Deadlines: Understanding and meeting the new deadlines is crucial to avoid late-filing penalties. These changes necessitate better organisation and potentially professional assistance.

Implications for Businesses (Sole Traders, Partnerships, Limited Companies)

Businesses face specific changes affecting their tax returns:

- Corporation Tax: Changes in corporation tax rates or allowances directly impact the profits reported and taxes owed.

- Business Records: Maintaining comprehensive business records is more critical than ever to ensure accurate reporting.

- VAT Returns: Changes to VAT reporting requirements may also be implemented, impacting compliance for businesses registered for VAT.

Navigating these changes often requires specialised knowledge, and businesses may benefit from consulting a tax professional for assistance with their company's tax return.

Implications for Landlords and Property Investors

Landlords and property investors face changes specifically impacting their rental properties:

- Rental Income: More stringent reporting of rental income is required, including details of all properties and tenants.

- Property Expenses: Changes in allowable expenses related to rental properties could affect the calculation of taxable income.

- Capital Gains Tax: New rules might influence the calculation of capital gains tax when selling investment properties. Understanding these changes is crucial for accurate tax reporting.

Navigating the New HMRC Tax Return Rules

Successfully navigating the new HMRC tax return rules requires proactive measures.

Importance of Accurate Record Keeping

Maintaining accurate and detailed financial records is paramount:

- Digital Records: Utilise digital accounting software to track income and expenses efficiently.

- Organized Filing: Implement a robust filing system to easily access necessary documents.

- Expense Tracking: Utilise apps or spreadsheets to track expenses accurately, ensuring you meet the requirements for evidence of expenses.

Accurate record-keeping minimises the risk of errors and penalties, making the tax filing process smoother and less stressful.

Seeking Professional Tax Advice

Considering professional tax advice is often beneficial:

- Complex Situations: If your tax affairs are complex, professional advice can help ensure accuracy and compliance.

- Tax Planning: Tax professionals can help you plan strategically to minimise your tax liabilities.

- Peace of Mind: Knowing you have accurate and compliant filings provides peace of mind.

Choosing a reputable and qualified tax advisor is key to receiving accurate and reliable guidance.

Utilizing HMRC Resources

The HMRC website provides valuable resources to assist taxpayers:

- Online Guides: Comprehensive online guides explain the changes and provide detailed instructions.

- Helpline Support: The HMRC helpline provides support for those needing assistance with specific queries.

- Forms and Publications: The website offers downloadable forms and publications for additional guidance.

Remember to use official HMRC resources to avoid misinformation.

Conclusion

The significant changes to HMRC tax return rules require proactive adaptation. Understanding the updated online filing requirements, modified reporting guidelines for various income types, and increased penalties for inaccuracies is critical for all taxpayers. Different groups – self-employed individuals, businesses, and landlords – face specific challenges. Accurate record-keeping, potentially seeking professional tax advice, and utilising HMRC resources are crucial steps to ensure compliant tax filing. Don't delay! Prepare your HMRC tax return by reviewing these changes and take action today to ensure compliant filing. Understanding the new HMRC tax return rules is essential for avoiding penalties and maintaining a healthy tax position.

Featured Posts

-

Biarritz Celebre Le 8 Mars Parcours De Femmes

May 20, 2025

Biarritz Celebre Le 8 Mars Parcours De Femmes

May 20, 2025 -

Todays Nyt Mini Crossword Solutions March 27

May 20, 2025

Todays Nyt Mini Crossword Solutions March 27

May 20, 2025 -

Abidjan Le Guide Complet De La Numerotation Des Batiments Du District

May 20, 2025

Abidjan Le Guide Complet De La Numerotation Des Batiments Du District

May 20, 2025 -

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025 -

New Hmrc Tax Codes For 2024 What Savers Need To Know

May 20, 2025

New Hmrc Tax Codes For 2024 What Savers Need To Know

May 20, 2025