Significant Increase: Dubai Holding's REIT IPO Targets $584 Million

Table of Contents

The Scale of Dubai Holding's REIT IPO and its Implications

The $584 million target for Dubai Holding's REIT IPO is substantial, marking one of the largest REIT offerings in the region recently. This figure underscores the confidence Dubai Holding has in its portfolio and the attractive nature of Dubai's real estate market to both domestic and international investors. The offering details, including the exact number of shares and pricing per share, will be crucial factors in determining the ultimate success of the IPO. However, the sheer scale of the target already positions this as a significant event for Dubai's economy and its real estate sector. The anticipated influx of capital could stimulate further development and bolster investor confidence in the long-term prospects of the Emirate.

- Comparison with previous IPOs in Dubai: This IPO is expected to surpass several recent IPOs in terms of size and scale, highlighting the growing attractiveness of Dubai's real estate market.

- Expected investor interest (local and international): Given Dubai's reputation as a global investment hub and the strength of its real estate market, significant interest from both local and international investors is anticipated.

- Potential market capitalization post-IPO: The success of the IPO could significantly boost the market capitalization of Dubai Holding and further enhance its profile on the global stage.

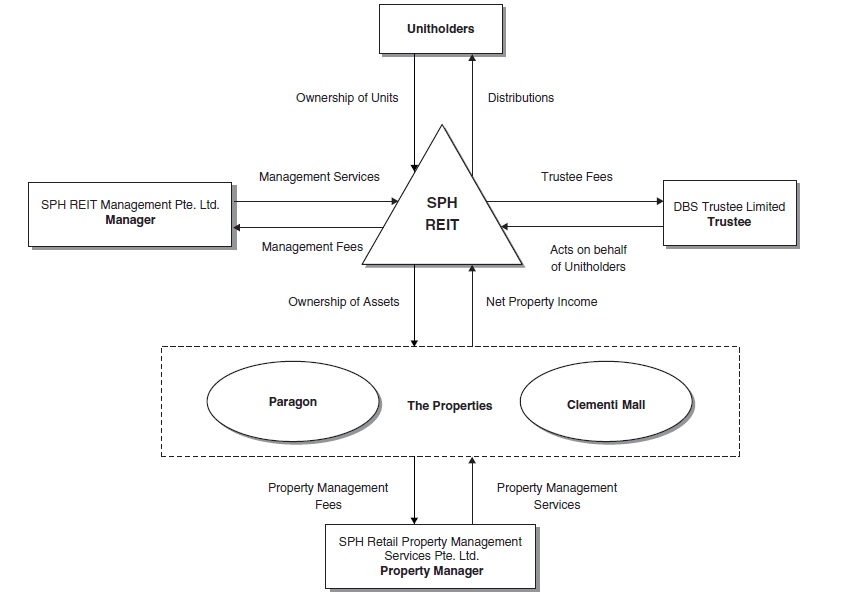

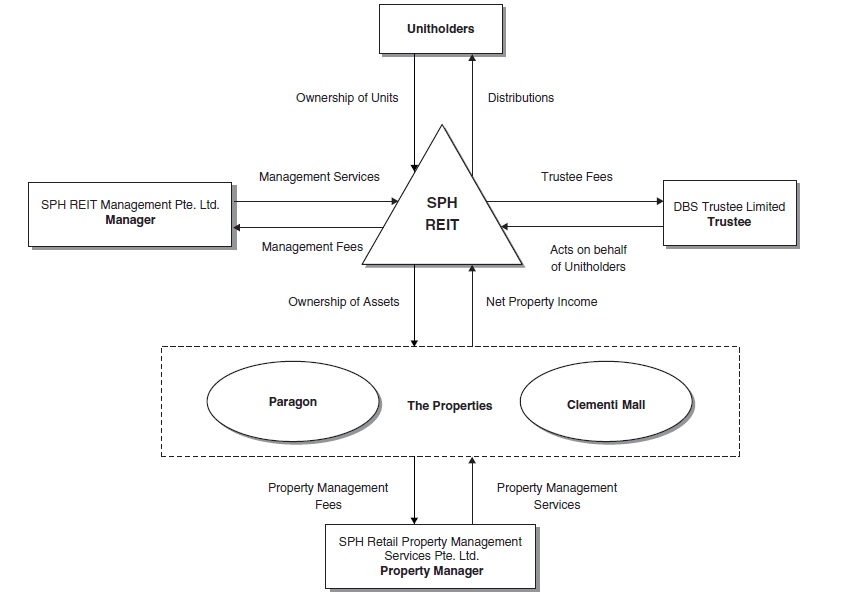

Dubai Holding's Assets and Investment Strategy

The REIT portfolio will comprise a diverse range of high-quality assets strategically located across Dubai. These include prime commercial properties such as office towers in central business districts, upscale residential buildings in sought-after neighborhoods, and potentially even significant land parcels earmarked for future development. The inclusion of such a diverse portfolio aims to mitigate risk and provide a stable stream of income for investors. Dubai Holding's long-term investment strategy for this REIT involves continuous portfolio optimization, aiming for consistent growth and attractive returns for shareholders.

- List of key properties within the REIT portfolio: (Specific details would be included here once publicly released by Dubai Holding). This section would list key properties with addresses and details on their size and value.

- Geographical distribution of assets: The geographical diversification of assets across various prime locations in Dubai further reduces risk and enhances the attractiveness of the investment.

- Rental income projections and occupancy rates: Strong rental income projections and high occupancy rates are key factors contributing to the positive outlook for the REIT's performance.

Market Conditions and Investor Sentiment

Current market conditions in Dubai's real estate sector are largely positive. The Emirate continues to attract significant foreign investment, driven by its strategic location, robust infrastructure, and favorable government policies. Investor sentiment toward Dubai's real estate market remains largely optimistic, with strong demand for high-quality properties. While there are always inherent risks associated with any investment, including potential market volatility and interest rate fluctuations, the underlying fundamentals of Dubai's economy suggest a favorable environment for this REIT.

- Current interest rates and their impact: Current interest rates will influence the cost of borrowing and, consequently, the returns on investment. A detailed analysis would be needed here, factoring in prevailing conditions.

- Overall economic outlook for Dubai: The strong economic outlook for Dubai strengthens the investment case for the REIT.

- Competitive landscape for REITs in the region: The IPO will face competition from other REITs operating in the region; a competitive analysis assessing its strengths and market positioning is crucial.

Potential Benefits and Risks for Investors

Investing in Dubai Holding's REIT IPO presents both potential benefits and risks. Potential benefits include attractive dividend yields, opportunities for capital appreciation as property values rise, and portfolio diversification for investors seeking exposure to the thriving Dubai real estate market. However, investors should also be aware of potential risks, such as market volatility, fluctuations in interest rates, and the inherent uncertainties associated with the property market. A thorough risk assessment is crucial before making any investment decision.

- Expected dividend payout ratio: The projected dividend payout ratio will be a key factor influencing investor decisions.

- Historical performance of similar REITs: Analyzing the performance of comparable REITs in the region can provide insights into potential returns and risk profiles.

- Risk mitigation strategies for investors: Understanding and implementing appropriate risk mitigation strategies is essential for investors to protect their capital.

Conclusion: Investing in Dubai Holding's REIT IPO: A Promising Opportunity?

Dubai Holding's $584 million REIT IPO represents a significant development in Dubai's real estate market. The scale of the offering, the quality of the underlying assets, and the generally positive market conditions suggest a promising investment opportunity. However, potential investors should carefully assess the associated risks before committing their capital. The anticipated dividend yields, potential for capital appreciation, and the diversification benefits offered by this REIT make it an attractive proposition for investors seeking exposure to Dubai's thriving real estate sector. Learn more about the Dubai Holding REIT IPO today and consider investing in Dubai's dynamic real estate market. Don't miss this significant investment opportunity.

Featured Posts

-

Guilty Verdict Four Bribery Charges Against Retired Admiral

May 21, 2025

Guilty Verdict Four Bribery Charges Against Retired Admiral

May 21, 2025 -

Understanding The Aimscap World Trading Tournament Wtt

May 21, 2025

Understanding The Aimscap World Trading Tournament Wtt

May 21, 2025 -

Uk Luxury Sector Brexit Hinders Eu Market Growth

May 21, 2025

Uk Luxury Sector Brexit Hinders Eu Market Growth

May 21, 2025 -

The Amazing World Of Gumball Streaming Now On Hulu And Disney

May 21, 2025

The Amazing World Of Gumball Streaming Now On Hulu And Disney

May 21, 2025 -

D Waves Quantum Breakthrough Ai Powered Drug Discovery

May 21, 2025

D Waves Quantum Breakthrough Ai Powered Drug Discovery

May 21, 2025