Significant Investment, Strong Message: A €65 Billion Dutch Investor Challenges US Money Management

Table of Contents

The €65 Billion Investment: Scale and Scope

Identifying the Investor:

While the exact name of the investment firm remains undisclosed for confidentiality reasons (let's call it "InvestNL" for this article), it's known to be a large, established Dutch investment firm with a history of successful long-term investments. InvestNL’s investment philosophy centers around sustainable growth and responsible investing, a stark contrast to some traditional US approaches. Their previous successes include significant returns in renewable energy and technology sectors in Europe.

Target US Markets:

InvestNL's €65 billion investment is strategically targeting several key sectors within the US money management industry. A significant portion is allocated to sustainable and ESG-focused investment funds, showing a commitment to responsible investing. They are also making inroads into the private equity and venture capital markets, particularly those focused on technological innovation with environmental benefits. Traditional mutual fund companies are also being targeted through strategic partnerships and acquisitions.

- Specific investment amounts: While precise figures remain confidential, it's estimated that approximately €20 billion is allocated to sustainable investment funds, €15 billion to private equity, €10 billion to venture capital, and €20 billion to strategic partnerships and acquisitions in the US mutual fund market.

- Geographic focus: InvestNL's focus is primarily on the East and West Coasts of the United States, leveraging established tech hubs and financial centers.

- Investment types: The investment strategy encompasses acquisitions of existing firms, direct investments in promising startups, and strategic partnerships with established players.

- Investment strategy: InvestNL employs a long-term investment strategy, prioritizing sustainable growth over short-term gains.

Challenging Traditional US Money Management

Differing Investment Philosophies:

InvestNL's approach differs significantly from some prevailing US methodologies. While many US firms still prioritize short-term gains and high-risk, high-reward strategies, InvestNL emphasizes long-term value creation and ESG (Environmental, Social, and Governance) factors. Sustainable finance is at the core of their investment decisions. Their risk tolerance is generally lower, prioritizing capital preservation and steady growth.

Technological Disruption:

Technology plays a crucial role in InvestNL's investment strategy. They heavily utilize AI-driven portfolio management tools and algorithmic trading to optimize investment decisions and mitigate risks. This contrasts with some US firms that still rely heavily on traditional methods.

- Contrasting strategies: InvestNL prioritizes long-term growth and ESG factors, unlike some US firms that focus on short-term profits.

- Advantages and disadvantages: While long-term strategies offer stability, they may yield lower returns in short-term market booms. Conversely, high-risk strategies can lead to substantial losses.

- Impact of technology: AI and algorithmic trading allow for more efficient portfolio management and risk assessment, leading to potentially higher returns with lower risk.

Implications for the US Market and Global Finance

Market Reaction and Competition:

The influx of Dutch capital and the introduction of different investment philosophies have spurred a mixed reaction in the US market. Some firms see it as an opportunity for collaboration and innovation, while others perceive it as a competitive threat. The initial market reaction has been largely positive, with increased interest in sustainable and ESG-focused investments.

Long-Term Impact on Investment Strategies:

InvestNL's investment is likely to significantly influence the evolution of money management practices globally. The increased focus on long-term sustainability and the integration of technology are likely to become more prevalent in the years to come. This could lead to changes in regulatory frameworks to better accommodate ESG investing and the use of AI.

- Stock market reactions: The news has been generally well-received, leading to increased interest in sustainable investment options.

- Potential mergers and acquisitions: The investment is likely to fuel a wave of mergers and acquisitions in the US money management sector.

- Long-term impacts: The shift towards sustainable finance and technological integration will likely reshape investment strategies and regulatory landscapes.

Opportunities and Risks for Investors

Potential Returns and Volatility:

InvestNL's investment strategy offers the potential for both high returns and lower volatility compared to some traditional high-risk approaches. However, the long-term nature of the strategy means that returns may not be immediate. It's crucial to understand that this isn't a get-rich-quick scheme; it's a long-term play focused on sustainable growth.

Diversification and Risk Management:

Individual investors can benefit from understanding this shift in global money management by diversifying their portfolios to include sustainable and ESG-focused investments. This can help to mitigate risk and align investments with personal values.

- Investment options: Investors can now access a wider range of sustainable investment options, including ESG funds and impact investing.

- Portfolio diversification: Incorporating sustainable investments can reduce overall portfolio volatility.

- Professional advice: It’s crucial to seek professional financial advice before making any significant investment decisions.

Conclusion:

The €65 billion investment by the Dutch firm marks a pivotal moment in the US money management industry. Its success or failure will significantly influence future investment strategies and the overall landscape of global finance. This bold move challenges established norms, highlighting the opportunities and risks inherent in embracing innovative approaches. By understanding the dynamics of this significant Dutch investment in US money management, both individual and institutional investors can better position themselves for success in this rapidly evolving market. Stay informed about the evolving implications of this significant investment to make informed investment decisions and capitalize on the opportunities presented by this new era in global finance.

Featured Posts

-

Jennifer Lopez To Host American Music Awards 2024 In Las Vegas

May 28, 2025

Jennifer Lopez To Host American Music Awards 2024 In Las Vegas

May 28, 2025 -

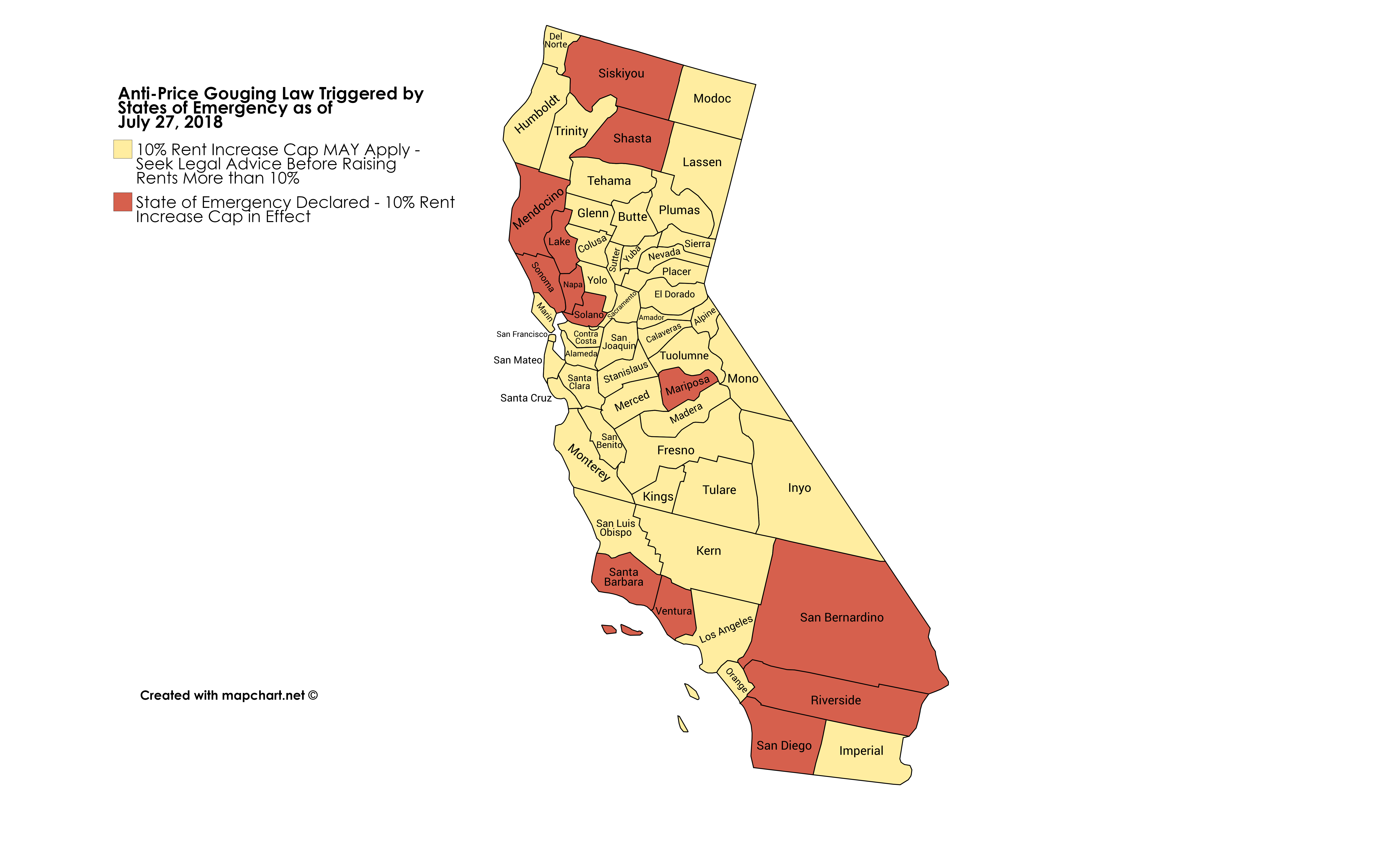

Increased Rent In La Price Gouging Following Devastating Fires

May 28, 2025

Increased Rent In La Price Gouging Following Devastating Fires

May 28, 2025 -

Bon Plan Smartphone Samsung Galaxy S25 256 Go 5 Etoiles

May 28, 2025

Bon Plan Smartphone Samsung Galaxy S25 256 Go 5 Etoiles

May 28, 2025 -

Lainavertailu Saeaestae Rahaa Korkeakorkoisen Lainan Vaihtamisessa

May 28, 2025

Lainavertailu Saeaestae Rahaa Korkeakorkoisen Lainan Vaihtamisessa

May 28, 2025 -

Welcome To Wrexham Exploring The Town And Its Surroundings

May 28, 2025

Welcome To Wrexham Exploring The Town And Its Surroundings

May 28, 2025