Singapore's DBS Bank: A Breathing Space For Top Polluters

Table of Contents

DBS Bank's Extensive Portfolio in High-Emission Sectors

DBS Bank's financial involvement in high-emission sectors is substantial and raises serious concerns about its commitment to combating climate change. This extensive portfolio significantly undermines its public image as a sustainable financial institution.

Fossil Fuel Financing

DBS Bank's investments in fossil fuel projects are a major point of contention. The bank's financing of oil, gas, and coal extraction and processing operations contributes significantly to global greenhouse gas emissions.

- Specific Companies Financed: While precise figures are often difficult to obtain due to a lack of complete transparency, reports indicate DBS's involvement with several companies engaged in fossil fuel extraction in Southeast Asia and beyond. Further investigation is needed to fully expose the extent of these investments.

- Financial Support Provided: The scale of financial support provided by DBS to fossil fuel companies is substantial, encompassing both loans and equity investments running into billions of dollars. The exact figures remain largely undisclosed, further fueling concerns about the lack of transparency in the bank's operations.

- Carbon Emissions: The carbon emissions resulting from DBS's fossil fuel financing contribute significantly to climate change, jeopardizing global efforts to limit global warming. Independent analyses are needed to fully quantify the carbon footprint associated with these investments.

Financing Other High-Emission Industries

Beyond fossil fuels, DBS Bank's portfolio includes investments in other high-emission industries, further contributing to environmental degradation.

- Examples of Companies: The bank has been linked to financing companies involved in palm oil production, leading to deforestation, and cement production, a significant source of carbon emissions. Again, a lack of transparency hinders accurate assessment.

- Environmental Impacts: These industries are responsible for widespread deforestation, biodiversity loss, water pollution, and significant greenhouse gas emissions. The consequences are far-reaching and deeply damaging to the planet.

- Lack of Transparency: The lack of detailed information regarding DBS Bank's investments in these high-emission sectors makes it challenging to accurately assess the full environmental impact of its lending practices. This opacity is a significant cause for concern.

DBS Bank's ESG Commitments and Their Apparent Discrepancy

DBS Bank actively promotes its commitment to ESG principles through public statements and sustainability reports. However, the bank's actual financing practices appear to contradict these stated goals.

Public Statements and Sustainability Reports

DBS Bank's sustainability reports and press releases frequently highlight its commitment to a low-carbon future and its ambitious ESG targets. However, these commitments are significantly undermined by its continued investment in high-emission industries.

- Examples from Reports: While DBS publicly states goals to reduce carbon emissions and support sustainable businesses, these statements are often vague and lack specific targets or timelines for phasing out financing of polluting industries.

- Inconsistencies: The stark contrast between DBS's public pronouncements and its continued financing of fossil fuels and other environmentally damaging industries reveals a significant gap between stated intentions and actual actions.

Criticism and Scrutiny from Activists and NGOs

DBS Bank has faced increasing criticism from environmental groups and activists for its financing of polluting industries.

- Campaigns and Reports: Several NGOs have published reports detailing DBS Bank's investments in high-emission sectors and calling for greater transparency and accountability.

- Criticisms: These groups have highlighted the inconsistency between DBS's sustainability commitments and its continued financing of environmentally damaging businesses, urging the bank to align its actions with its stated goals.

The Implications of DBS Bank's Actions on Environmental Goals

DBS Bank's financing of polluting industries has significant implications for global environmental goals and the fight against climate change.

Impact on Climate Change

The bank's continued support for high-emission sectors directly contributes to global greenhouse gas emissions, hindering efforts to meet the targets of the Paris Agreement.

- Quantifying the Carbon Footprint: A comprehensive assessment of the carbon footprint resulting from DBS's investments in polluting industries is crucial to understand the full extent of its impact on climate change.

- Consequences of Failure: Failing to meet climate goals will lead to catastrophic consequences, including more frequent and intense extreme weather events, sea-level rise, and biodiversity loss.

Wider Environmental Consequences

The environmental consequences extend beyond climate change, encompassing deforestation, biodiversity loss, and pollution.

- Examples of Environmental Damage: Deforestation driven by palm oil production financed by DBS, pollution from cement factories, and the depletion of natural resources due to fossil fuel extraction all contribute to environmental degradation.

- Social and Economic Impacts: These environmental harms have significant social and economic consequences, affecting livelihoods, food security, and overall well-being.

Conclusion

In conclusion, despite its public commitment to ESG principles, DBS Bank continues to heavily finance environmentally damaging industries. This apparent discrepancy between stated goals and actual actions raises serious concerns about the bank's true dedication to sustainability. The bank's extensive portfolio in high-emission sectors, including fossil fuels and deforestation-linked industries, significantly contributes to climate change and wider environmental damage. The lack of transparency surrounding these investments further exacerbates the issue. We must demand greater accountability from DBS Bank and other financial institutions regarding their role in funding polluting industries. It's time for DBS Bank to move beyond rhetoric and genuinely align its financing practices with its professed commitment to a sustainable future. Only through increased transparency and stricter regulation of financing for high-emission sectors can we hope to curb the destructive impact of these practices. Investigate DBS Bank's environmental record further and demand change – the future of our planet depends on it.

Featured Posts

-

Veteran Wide Receiver Joins Browns Report Confirms Signing And Return Specialist Role

May 08, 2025

Veteran Wide Receiver Joins Browns Report Confirms Signing And Return Specialist Role

May 08, 2025 -

Cash Only Understanding Ubers Auto Service Policy Change

May 08, 2025

Cash Only Understanding Ubers Auto Service Policy Change

May 08, 2025 -

Arsenals Path To The Final Psg Presents A Stiffer Challenge Than Real Madrid

May 08, 2025

Arsenals Path To The Final Psg Presents A Stiffer Challenge Than Real Madrid

May 08, 2025 -

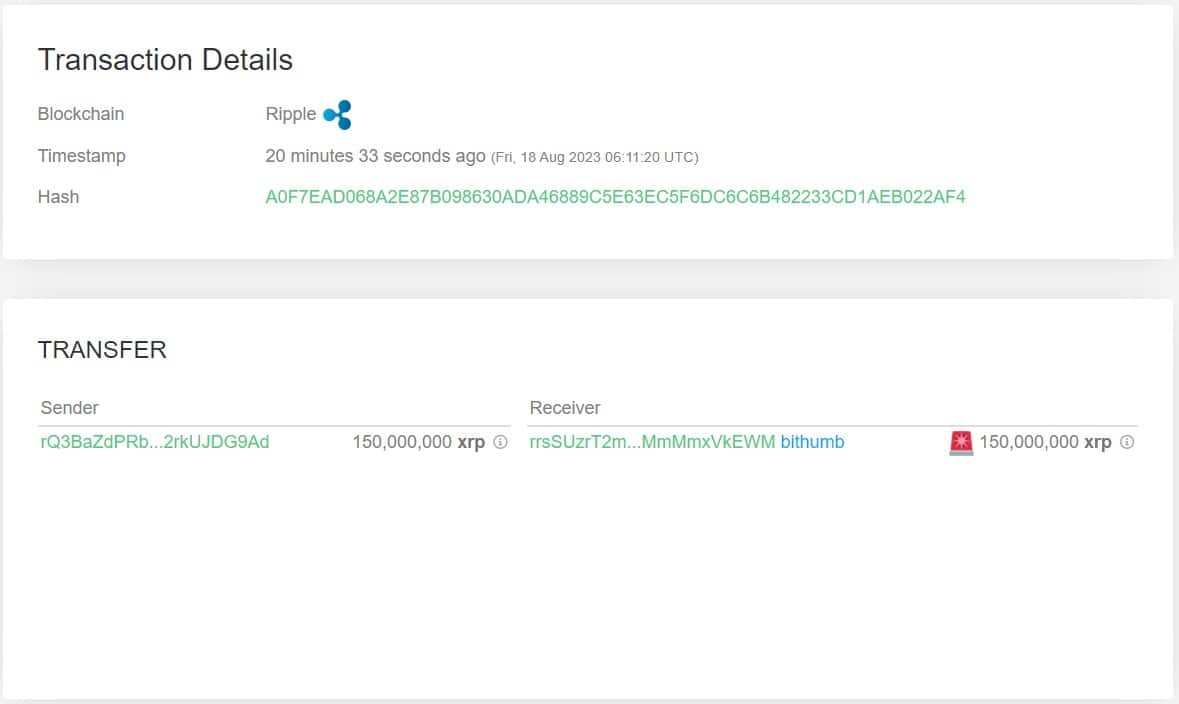

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 08, 2025

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 08, 2025 -

Will Trumps Xrp Backing Drive Institutional Investment

May 08, 2025

Will Trumps Xrp Backing Drive Institutional Investment

May 08, 2025