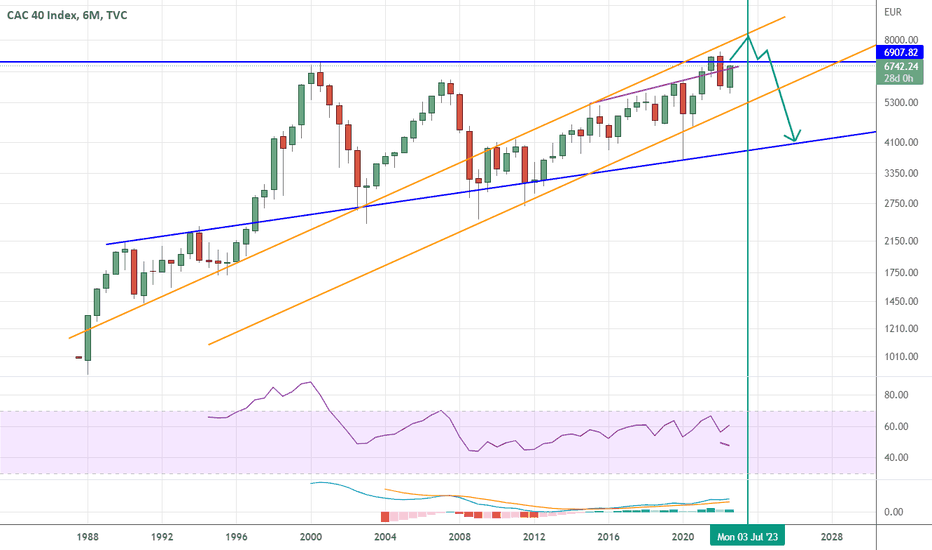

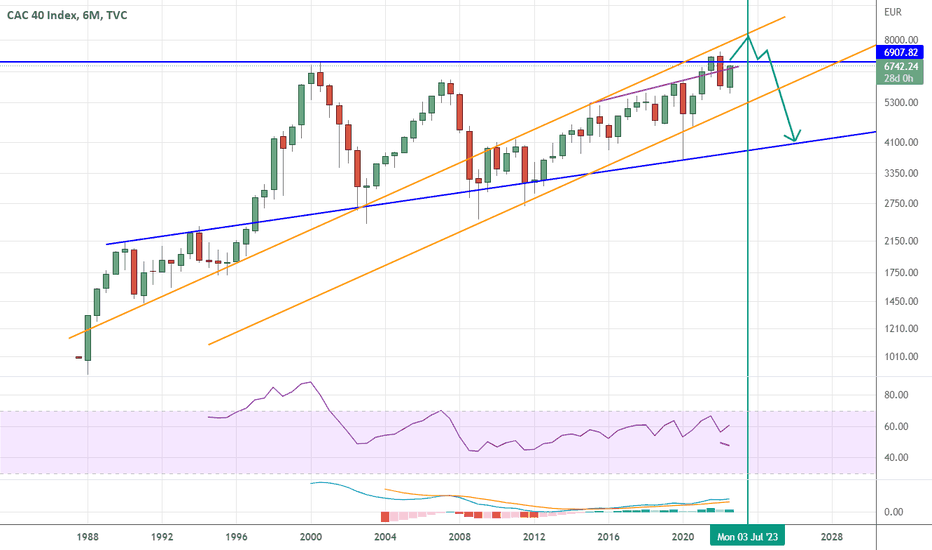

Slight CAC 40 Dip At Week's End; Remains Steady Overall (March 7, 2025)

Table of Contents

Factors Contributing to the CAC 40 Dip

Several factors contributed to the slight dip in the CAC 40 at the close of the week. While the overall trend remains positive, understanding these contributing elements is crucial for investors.

Global Market Sentiment

Global economic news significantly influences the CAC 40's performance. The interconnected nature of global markets means events outside France can ripple through the French Stock Market.

- Interest Rate Hikes: Concerns about further interest rate hikes by major central banks, aimed at combating inflation, created a sense of uncertainty and risk aversion among investors, impacting global market sentiment and consequently, the CAC 40.

- Geopolitical Tensions: Ongoing geopolitical instability in various regions continues to fuel market volatility. Concerns about escalating conflicts and their potential economic consequences can lead to sell-offs.

- Economic Data Releases: Disappointing economic data releases from key global economies can negatively impact investor confidence, triggering a decline in stock markets, including the CAC 40. For example, weaker-than-expected manufacturing data from Germany could directly affect French export-oriented companies listed on the CAC 40.

While precise correlations require in-depth statistical analysis, anecdotal evidence suggests a clear link between these global events and the slight CAC 40 decline.

Sector-Specific Performance

The dip wasn't uniform across all sectors within the CAC 40. Specific sectors underperformed, contributing disproportionately to the overall decline.

- Technology Sector Underperformance: The technology sector experienced a slight downturn, potentially due to profit-taking after a period of strong growth and concerns about future regulatory changes. Companies like [Example Tech Company listed on CAC 40] saw their stock prices decline slightly.

- Energy Sector Volatility: Fluctuations in global energy prices impacted the performance of energy companies listed on the CAC 40, contributing to the overall index dip. This is linked to global supply chain issues and geopolitical factors.

- Financial Sector Cautiousness: Concerns about potential credit tightening and economic slowdown led to a degree of caution in the financial sector, influencing the overall performance of the CAC 40.

Impact of Investor Sentiment

Investor behavior and market sentiment play a critical role in shaping market trends. Profit-taking, risk aversion, and market analyst predictions all influence the CAC 40's movements.

- Profit-Taking: Investors may have taken profits after a period of strong gains, leading to selling pressure and contributing to the downward pressure on the CAC 40.

- Risk Aversion: Global uncertainty led some investors to adopt a more risk-averse approach, shifting their investments towards safer assets, resulting in selling of CAC 40 stocks.

- Analyst Predictions: Negative or cautious predictions from market analysts can influence investor sentiment and contribute to sell-offs. The collective effect of these factors contributed to the observed dip. Increased trading volume in options markets around the close of the week suggests heightened investor activity and possibly some degree of speculation.

Overall CAC 40 Stability and Long-Term Outlook

Despite the Friday dip, the CAC 40 demonstrated remarkable resilience throughout the week. The overall positive performance underscores its underlying strength and stability.

Resilience Despite Dip

The week's performance showcases the CAC 40's strength.

- Weekly Gains: Even with the Friday dip, the CAC 40 still recorded positive gains for the week.

- Year-to-Date Performance: The year-to-date performance of the CAC 40 remains positive, demonstrating its long-term growth potential.

- Market Capitalization: The overall market capitalization of the CAC 40 remains strong, indicating continued investor confidence in the long term.

The Friday dip should be viewed within the context of this broader positive trend.

Future Predictions and Investment Strategies

The outlook for the CAC 40 remains cautiously optimistic. While short-term volatility is expected, several factors suggest continued growth potential.

- Economic Growth: Continued economic growth in France and the Eurozone will likely support the CAC 40's upward trajectory.

- Corporate Earnings: Strong corporate earnings reports from CAC 40 companies will bolster investor confidence.

- Global Market Recovery: A potential recovery in global markets could lead to further gains for the CAC 40.

Investors should consider portfolio diversification strategies to mitigate risk, and closely monitor global economic developments and sector-specific performance to make informed investment decisions. Keywords: investment strategies, portfolio diversification.

Analyzing the CAC 40's Transient Dip

In conclusion, the slight dip in the CAC 40 at the end of the week, while notable, was ultimately a minor correction within a largely positive trend. Factors such as global market sentiment, sector-specific performance, and investor behavior all played a role. However, the CAC 40's overall strength and resilience remain evident. The long-term outlook remains cautiously optimistic, though investors should remain vigilant and adapt their strategies based on evolving market conditions. Stay updated on CAC 40 movements by following our market analysis, and monitor your CAC 40 investments for informed decision-making. Follow the CAC 40 index for future insights and subscribe to our newsletter for regular updates!

Featured Posts

-

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025

Glastonbury 2025 Headliners Disappointment And Controversy

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Your Guide To Getting Tickets

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Your Guide To Getting Tickets

May 24, 2025 -

Best Of Bangladesh In Europes 2nd Edition Driving Collaboration And Economic Growth

May 24, 2025

Best Of Bangladesh In Europes 2nd Edition Driving Collaboration And Economic Growth

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025 -

Financial Considerations For Your Escape To The Country

May 24, 2025

Financial Considerations For Your Escape To The Country

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025