South Asian Capital Markets: Pakistan, Sri Lanka, And Bangladesh Forge Closer Links

Table of Contents

Economic Rationale for Integration of South Asian Capital Markets

The integration of South Asian capital markets offers compelling economic advantages for Pakistan, Sri Lanka, and Bangladesh. This synergy promises enhanced efficiency, reduced risk, and ultimately, greater prosperity.

Diversification and Risk Reduction

Integrated markets dramatically reduce over-reliance on domestic savings and investment. By accessing a larger pool of capital, each nation can attract foreign investment, bolstering economic growth. For investors, diversification becomes a powerful tool:

- Reduced Volatility: Spreading investments across multiple markets mitigates the impact of shocks affecting any single economy.

- Access to a Wider Range of Assets: Investors gain access to a broader array of investment opportunities, tailoring portfolios to specific risk tolerances and return expectations.

- Improved Portfolio Performance: Diversification leads to a more stable and potentially higher-performing investment portfolio over the long term. This improved performance, in turn, can stimulate further investment within the interconnected South Asian capital markets.

Enhanced Capital Allocation Efficiency

An integrated market ensures that capital flows more efficiently to its most productive uses. This improved allocation leads to tangible economic benefits:

- Increased Investment in Productive Sectors: Capital gravitates towards ventures with the highest potential returns, fostering growth in key sectors of the economy.

- Improved Resource Allocation: Efficient capital allocation optimizes resource utilization, minimizing waste and maximizing output.

- Higher GDP Growth: The cumulative effect of increased investment and improved resource allocation translates into significantly higher Gross Domestic Product (GDP) growth for the region.

Promoting Regional Trade and Investment

Capital market integration and regional trade are intrinsically linked. Easier access to capital fosters cross-border investment, stimulating economic activity:

- Increased Foreign Direct Investment (FDI): Integrated markets attract more FDI, fueling economic expansion and job creation.

- Growth in Regional Trade: Improved capital flows facilitate increased trade between nations, strengthening economic ties.

- Stronger Economic Ties: The interconnectedness of capital markets strengthens regional economic partnerships, leading to greater stability and shared prosperity.

Challenges to Integrating South Asian Capital Markets

Despite the clear advantages, several obstacles hinder the seamless integration of South Asian capital markets. Addressing these challenges is crucial for realizing the full potential of regional cooperation.

Regulatory Differences and Harmonization

Differing regulatory frameworks and accounting standards pose significant hurdles to cross-border investment:

- Varying Listing Requirements: Companies face varying rules and regulations when seeking listings across different markets.

- Different Disclosure Standards: Inconsistent disclosure requirements create uncertainty and complicate cross-border transactions.

- Inconsistent Investor Protection: Variations in investor protection laws create risks and deter cross-border investment. Harmonizing these regulations is paramount for fostering trust and attracting foreign investors to the South Asian capital markets.

Political and Geopolitical Risks

Political instability and regional tensions significantly impact investor confidence:

- Political Instability: Political uncertainty deters investment and disrupts market activity.

- Cross-border Disputes: Regional conflicts undermine investor confidence and hinder economic cooperation.

- Security Concerns: Security issues can create risks and deter investment in the region. Addressing these concerns is vital for encouraging foreign participation in the South Asian capital markets.

Infrastructure Deficiencies

Inadequate financial infrastructure in some countries impedes integration:

- Limited Access to Technology: Lack of access to modern technology hinders efficient trading and settlement.

- Underdeveloped Payment Systems: Inefficient payment systems increase transaction costs and delays.

- Lack of Efficient Clearing and Settlement Mechanisms: Inefficient clearing and settlement mechanisms increase risk and hinder market liquidity. Upgrading this infrastructure is crucial for the development of efficient South Asian capital markets.

Opportunities and Strategies for Closer Collaboration in South Asian Capital Markets

Overcoming the challenges requires concerted efforts to strengthen regional cooperation and enhance market infrastructure.

Strengthening Regional Regulatory Cooperation

Regional organizations play a critical role in promoting regulatory harmonization:

- Joint Working Groups: Establishing joint working groups to harmonize regulations and share best practices.

- Information Sharing: Facilitating the exchange of information and data among regulatory bodies.

- Harmonized Standards: Developing and implementing harmonized accounting, disclosure, and investor protection standards. This will be essential in building trust in the South Asian capital markets.

Developing Regional Market Infrastructure

Investing in modern financial infrastructure is crucial for facilitating efficient cross-border transactions:

- Modernized Trading Platforms: Developing state-of-the-art trading platforms to enhance market efficiency.

- Efficient Clearing and Settlement Systems: Implementing robust clearing and settlement systems to reduce risk and improve liquidity.

- Improved Data Infrastructure: Investing in reliable and efficient data infrastructure to support market transparency and information dissemination.

Promoting Investor Education and Awareness

Building investor confidence requires targeted education and awareness campaigns:

- Investor Education Programs: Developing and implementing investor education programs to promote understanding of cross-border investments.

- Increased Transparency: Enhancing transparency and disclosure to build trust and confidence in regional markets.

- Improved Communication: Improving communication channels to keep investors informed about market developments and opportunities.

Conclusion: The Future of South Asian Capital Markets

The integration of South Asian capital markets offers immense potential for economic growth and shared prosperity. While challenges remain, the opportunities for development are significant. By addressing the obstacles and embracing the strategies outlined above, policymakers, regulators, and market participants can unlock the full potential of these markets. The future prosperity of South Asia hinges on the successful integration of its capital markets. By fostering collaboration and addressing the issues discussed, we can create a more dynamic and interconnected region, paving the way for sustainable economic growth and shared prosperity. We encourage further reading and research into South Asian capital markets to better understand the complexities and opportunities within this dynamic region.

Featured Posts

-

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025 -

Impact Of Trumps Policies On The Rights And Well Being Of Transgender People

May 10, 2025

Impact Of Trumps Policies On The Rights And Well Being Of Transgender People

May 10, 2025 -

Full List Famous People Affected By The La Palisades Fires

May 10, 2025

Full List Famous People Affected By The La Palisades Fires

May 10, 2025 -

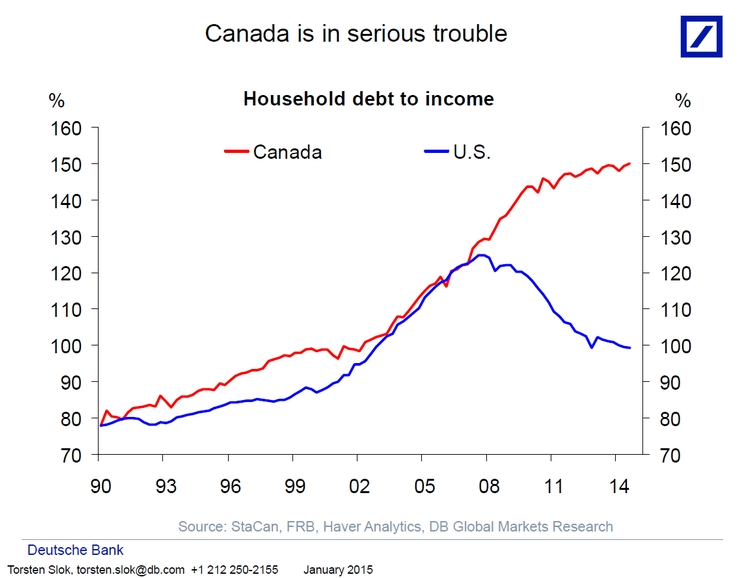

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025

The Impact Of Large Down Payments On Canadian Homebuyers

May 10, 2025 -

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025

Elon Musk Net Worth 2024 Analyzing The Impact Of Us Economic Shifts

May 10, 2025